Fillable Prenuptial Agreement Template for Florida State

In the realm of marriage, planning for the future is an essential step that many couples choose to take. A Florida Prenuptial Agreement serves as a vital tool for individuals entering into a marital union, providing clarity and security regarding financial matters and property rights. This agreement outlines the distribution of assets and liabilities in the event of divorce or separation, thus helping to prevent misunderstandings and potential disputes down the line. Couples can specify how they wish to handle their individual and joint property, ensuring that each party's interests are protected. Additionally, the form may address issues such as spousal support and the management of debts, allowing both partners to enter the marriage with a shared understanding of their financial landscape. By thoughtfully considering these aspects, individuals can foster a sense of trust and transparency, laying a solid foundation for their relationship. Understanding the intricacies of the Florida Prenuptial Agreement form is crucial for those who wish to safeguard their financial future while nurturing their bond.

Similar forms

The Florida Prenuptial Agreement form shares similarities with a Cohabitation Agreement. Both documents serve to outline the rights and responsibilities of partners, whether they are married or living together. A Cohabitation Agreement typically addresses issues like property division, financial responsibilities, and what happens if the relationship ends. Just as a prenuptial agreement prepares couples for marriage, a cohabitation agreement prepares partners for a shared life without the legal status of marriage, making both essential for relationship clarity.

Another document that aligns closely with the Florida Prenuptial Agreement is the Postnuptial Agreement. While a prenuptial agreement is created before marriage, a postnuptial agreement is executed after the wedding. Both documents aim to clarify financial arrangements and property rights. They can address similar topics, such as asset division and spousal support, allowing couples to establish expectations and reduce conflict in the event of a separation or divorce.

A Georgia Hold Harmless Agreement is a critical legal tool utilized by parties engaged in various activities, as it ensures that one party is protected from any liabilities or losses that may arise from the actions of another. This agreement is vital in contexts such as property use, business dealings, and service-related arrangements, providing both clarity and security. For more information and templates, you can visit toptemplates.info/.

A Separation Agreement is also comparable to a prenuptial agreement, as both seek to define financial and property arrangements. However, a separation agreement is specifically designed for couples who are separating, whether temporarily or permanently. It lays out how assets and debts will be handled during the separation period and can include child custody and support arrangements. Like a prenuptial agreement, it helps to minimize disputes by clearly stating each party's rights and responsibilities.

The Florida Prenuptial Agreement form is similar to a Marital Settlement Agreement, which is often used during divorce proceedings. Both documents detail how property and debts will be divided, but a marital settlement agreement is created when a marriage is ending, while a prenuptial agreement is established before marriage. Each agreement aims to provide clarity and prevent misunderstandings, ultimately facilitating a smoother transition, whether entering or exiting a marriage.

An Estate Plan can also bear resemblance to a prenuptial agreement in that both involve planning for the future. While a prenuptial agreement focuses on asset division in the event of divorce, an estate plan outlines how a person's assets will be distributed after their death. Both documents require careful consideration of individual and shared assets, ensuring that the intentions of the individuals involved are clearly documented and respected.

The concept of a Trust Agreement is similar to that of a prenuptial agreement in terms of asset protection. A trust can hold assets for the benefit of specific individuals, providing a level of security and control over how those assets are managed and distributed. Like a prenuptial agreement, a trust can help protect assets from being claimed by unintended parties, ensuring that the creator's wishes are honored in both marriage and after death.

Lastly, a Business Partnership Agreement shares some characteristics with a prenuptial agreement, particularly when it comes to asset protection and clarity. Both documents are designed to protect the interests of the parties involved, whether in a marriage or a business partnership. They outline how assets will be managed, how profits will be shared, and what happens if one partner wants to exit the arrangement. This parallel emphasizes the importance of clear agreements in various types of relationships.

Other Common State-specific Prenuptial Agreement Templates

Ohio Premarital Contract - A prenuptial agreement can help avoid lengthy disputes and misunderstandings during separation.

Georgia Premarital Contract - This document can outline how shared assets will be managed during the marriage.

Texas Premarital Contract - This agreement is not a sign of distrust, but rather a practical step toward financial clarity and mutual understanding.

For anyone considering a boat purchase, understanding the utility of a reliable document is crucial. A vital resource to consider is the trusted Boat Bill of Sale template, which simplifies the transfer process and ensures all necessary information is captured.

Arizona Premarital Contract - Can encompass all forms of property, including real estate and investments.

More About Florida Prenuptial Agreement

What is a prenuptial agreement in Florida?

A prenuptial agreement, often referred to as a prenup, is a legal document created by two individuals before they get married. In Florida, this agreement outlines how assets and debts will be divided in the event of a divorce or separation. It can also address issues like spousal support. This agreement helps provide clarity and security for both parties regarding their financial rights and responsibilities during the marriage and in the case of a divorce.

Is a prenuptial agreement legally binding in Florida?

Yes, a prenuptial agreement is legally binding in Florida, provided it meets certain requirements. Both parties must voluntarily agree to the terms of the agreement, and it must be in writing and signed by both parties. Additionally, the agreement should be executed well in advance of the wedding to ensure that there is no pressure or coercion involved.

What should be included in a Florida prenuptial agreement?

A Florida prenuptial agreement can include a variety of topics, such as the division of property, management of debts, and spousal support. It can also address how assets acquired during the marriage will be handled. However, it cannot include provisions related to child custody or child support, as these matters are determined based on the best interests of the child at the time of divorce.

Can a prenuptial agreement be modified or revoked in Florida?

Yes, a prenuptial agreement can be modified or revoked in Florida. Both parties must agree to the changes, and any modifications should be documented in writing and signed by both parties. It is important to keep records of any changes to ensure that they are enforceable in the future.

What happens if a prenuptial agreement is challenged in court?

If a prenuptial agreement is challenged in court, the judge will evaluate its validity based on several factors. This includes whether both parties entered into the agreement voluntarily, whether there was full disclosure of assets, and whether the terms are fair and reasonable. If the court finds the agreement to be valid, it will be upheld; if not, it may be deemed unenforceable.

How can one ensure a prenuptial agreement is enforceable in Florida?

To ensure that a prenuptial agreement is enforceable, both parties should have independent legal representation. This helps ensure that each party fully understands their rights and the implications of the agreement. Additionally, full financial disclosure is essential. Both parties should disclose all assets, debts, and income to avoid claims of fraud or coercion later on.

Is there a deadline for creating a prenuptial agreement in Florida?

While there is no strict deadline, it is advisable to create a prenuptial agreement well in advance of the wedding date. This allows both parties sufficient time to review the agreement, seek legal advice, and negotiate terms without any pressure. Waiting until the last minute can lead to complications and may raise questions about the agreement's validity.

Can a prenuptial agreement protect assets acquired during the marriage?

Yes, a prenuptial agreement can protect assets acquired during the marriage if it is clearly stated in the agreement. Couples can specify which assets will remain separate and which will be considered marital property. This clarity helps prevent disputes in the event of a divorce.

Are there any limitations to what can be included in a prenuptial agreement in Florida?

Yes, there are limitations. A prenuptial agreement cannot include provisions related to child custody or child support, as these matters are determined based on the best interests of the child. Additionally, the agreement cannot contain illegal terms or provisions that violate public policy.

What is the process for creating a prenuptial agreement in Florida?

The process typically begins with both parties discussing their financial situations and goals. After reaching a mutual understanding, each party should consult with their own attorney to draft the agreement. Once the terms are finalized, both parties must sign the document in the presence of a notary public. It is crucial to keep copies of the signed agreement for future reference.

Dos and Don'ts

When preparing to fill out the Florida Prenuptial Agreement form, there are several important considerations to keep in mind. Below is a list of things you should and shouldn't do to ensure the process goes smoothly.

- Do: Be transparent about your financial situation. Clearly disclose all assets, debts, and income to avoid future disputes.

- Do: Seek legal advice. Consulting with a qualified attorney can help you understand your rights and obligations.

- Do: Review the agreement carefully. Ensure that all terms are clear and that you fully understand what you are agreeing to.

- Do: Allow sufficient time for discussion. Don't rush the process; give both parties time to consider the agreement thoroughly.

- Don't: Assume verbal agreements are enough. All terms should be documented in writing to be legally binding.

- Don't: Hide assets or debts. Failing to disclose important financial information can lead to the agreement being invalidated.

- Don't: Use high-pressure tactics. Both parties should feel comfortable and willing to negotiate the terms without coercion.

- Don't: Overlook state laws. Familiarize yourself with Florida's specific requirements for prenuptial agreements to ensure compliance.

Florida Prenuptial Agreement - Usage Steps

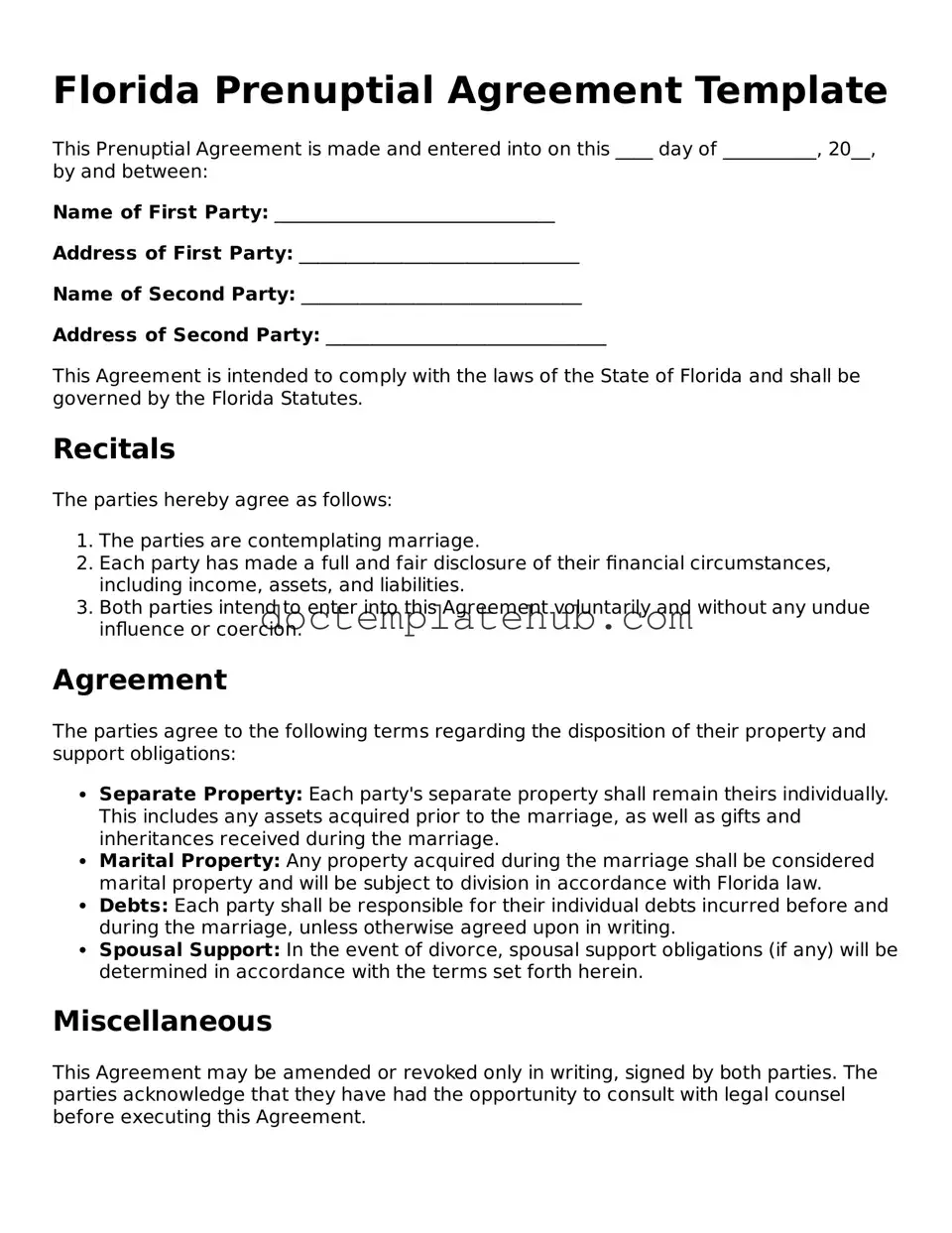

Filling out the Florida Prenuptial Agreement form is an important step in preparing for your future together. It ensures that both parties are clear about their rights and obligations. Follow these steps to complete the form accurately.

- Begin by obtaining the Florida Prenuptial Agreement form from a reliable source, such as a legal website or your attorney.

- Read through the entire form carefully to understand what information is required.

- Fill in your full legal name and the full legal name of your partner at the top of the form.

- Provide your current addresses, including city and state, ensuring they are up to date.

- List any assets you currently own, including property, bank accounts, and investments. Be as detailed as possible.

- Include your partner’s assets in the same manner, ensuring clarity and transparency.

- Discuss and outline any debts each party has, as this is crucial for financial clarity.

- Address how you wish to manage any future income or assets acquired during the marriage.

- Review any additional clauses or agreements you wish to include, such as spousal support or inheritance rights.

- Both parties should sign and date the form in the designated areas, ensuring that the signatures are witnessed if required.

- Consider having the agreement notarized for added legal validity.

After completing the form, keep a copy for your records and provide a copy to your partner. It's advisable to consult with a legal professional to ensure that everything is in order and meets Florida's legal requirements.