Fillable Promissory Note Template for Florida State

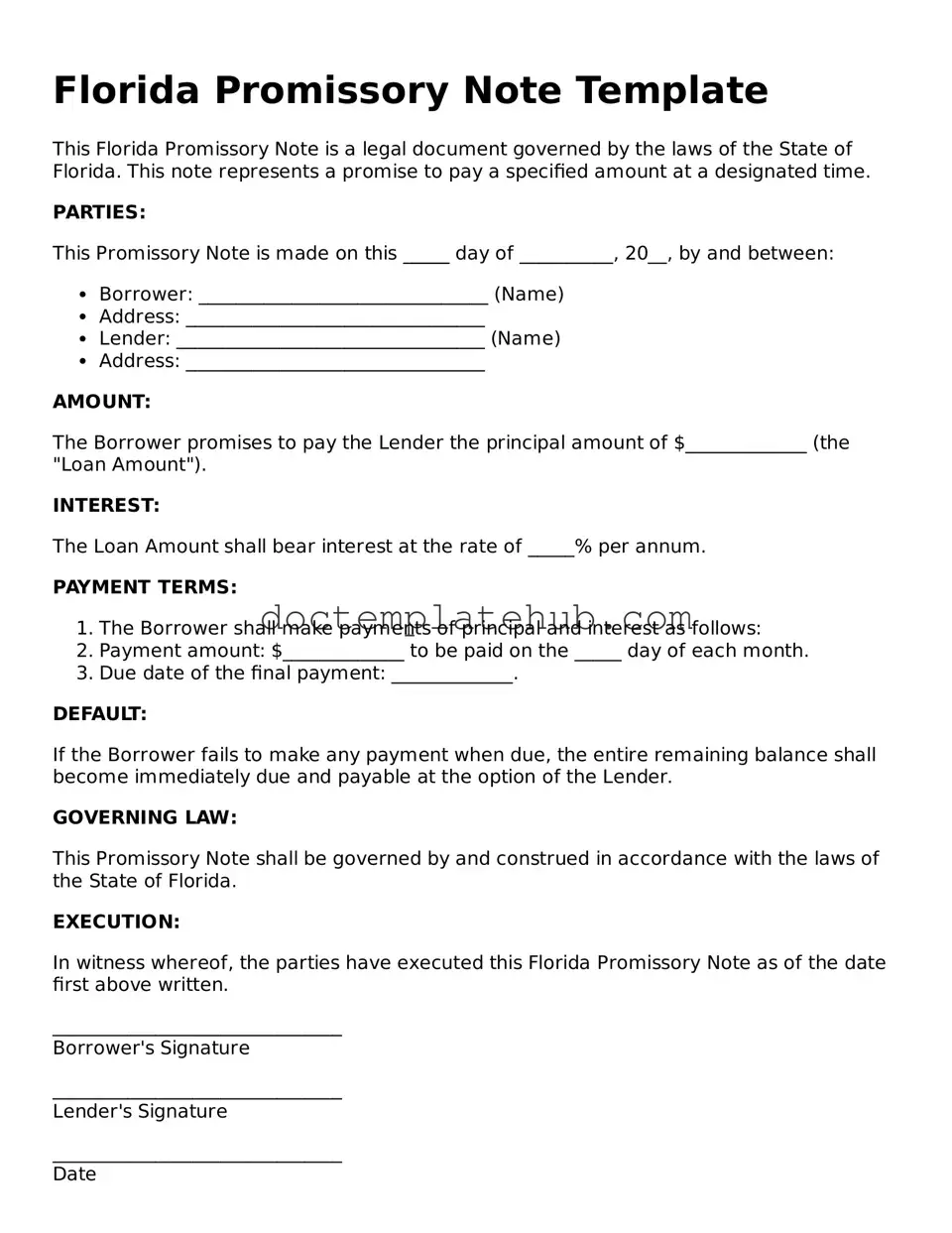

The Florida Promissory Note form serves as a crucial document in financial transactions, specifically when one party borrows money from another. This form outlines the borrower's promise to repay the borrowed amount, typically accompanied by interest, within a specified timeframe. Key elements of the note include the principal amount, the interest rate, and the repayment schedule, which details how and when payments will be made. Additionally, the document often specifies the consequences of default, providing clarity on what actions may be taken if the borrower fails to meet their obligations. Understanding the nuances of this form is essential for both lenders and borrowers, as it establishes the legal framework for the loan agreement and ensures that both parties are aware of their rights and responsibilities. By using this standardized form, individuals can navigate their financial agreements with greater confidence and security.

Similar forms

A Loan Agreement is similar to a Florida Promissory Note because it outlines the terms of a loan between a borrower and a lender. This document typically details the amount borrowed, interest rates, repayment schedules, and any collateral involved. While a Promissory Note focuses primarily on the borrower's promise to repay, a Loan Agreement provides a more comprehensive framework that includes additional terms and conditions governing the loan relationship.

A Mortgage is another document that shares similarities with a Promissory Note. While the Promissory Note represents the borrower's promise to repay the loan, the Mortgage serves as security for that loan. It allows the lender to claim the property if the borrower defaults. Both documents work together to protect the lender's interests while outlining the borrower's obligations.

An Installment Agreement is akin to a Florida Promissory Note in that it specifies a series of payments over time. This type of agreement is often used for the purchase of goods or services, where the buyer agrees to pay in installments. Like a Promissory Note, it includes details such as payment amounts and due dates, making it clear when and how payments should be made.

A Personal Guarantee can be compared to a Promissory Note as it involves a commitment to repay a debt. In this case, a third party agrees to take responsibility for the debt if the primary borrower defaults. Both documents establish a financial obligation, but a Personal Guarantee often adds an extra layer of security for the lender, especially in business transactions.

A Secured Note is similar to a Florida Promissory Note in that it involves a promise to repay a loan, but it is backed by collateral. This means that if the borrower fails to meet their obligations, the lender can seize the collateral to recover their losses. Both documents clearly outline the terms of repayment, but a Secured Note provides additional protection for the lender through the use of collateral.

When establishing a business, it is essential to have well-documented agreements to prevent confusion and ensure smooth operations. An Operating Agreement form is particularly important for Texas-based limited liability companies (LLCs), as it delineates the roles, responsibilities, and financial arrangements within the company. By outlining these key elements, it acts as a foundational framework that can help streamline business interactions. For further resources on creating such an agreement, you can visit smarttemplates.net.

An IOU, or "I owe you," is a more informal document that indicates a debt owed. While it lacks the detailed structure of a Florida Promissory Note, it serves a similar purpose by acknowledging that one party owes money to another. Both documents express a financial obligation, but an IOU is typically less formal and may not include specific repayment terms or interest rates.

A Credit Agreement is also comparable to a Florida Promissory Note. This document outlines the terms under which credit is extended, including repayment terms, interest rates, and fees. While a Promissory Note is a promise to repay a specific loan, a Credit Agreement can cover multiple transactions and establish a broader relationship between the borrower and lender. Both documents aim to clarify the expectations and responsibilities of each party involved.

Other Common State-specific Promissory Note Templates

Promissory Note Template Arizona - As a legal instrument, it must be clear and unambiguous.

For anyone looking to formalize a lending agreement, our guide explains the significance of a well-structured Promissory Note in financial transactions and its role in safeguarding the interests of both the borrower and lender. Explore further by visiting our page on the Promissory Note form requirements for clarity and guidance.

Texas Promissory Note Form - A clear repayment schedule benefits both parties and minimizes misunderstandings.

More About Florida Promissory Note

What is a Florida Promissory Note?

A Florida Promissory Note is a written promise to pay a specific amount of money to a designated person or entity. This document outlines the terms of the loan, including the amount borrowed, interest rate, payment schedule, and any penalties for late payments. It serves as a legal agreement between the borrower and the lender.

Who can use a Promissory Note in Florida?

Anyone can use a Promissory Note in Florida, whether you are an individual lending money to a friend or a business providing a loan to a customer. It’s important for both parties to understand the terms and conditions outlined in the note before signing.

What are the key components of a Florida Promissory Note?

A typical Promissory Note includes the following key components: the names of the borrower and lender, the principal amount, the interest rate, the repayment schedule, and any late fees or default terms. It may also include provisions for prepayment and any collateral securing the loan.

Is a Promissory Note legally binding in Florida?

Yes, a Promissory Note is legally binding in Florida, provided it meets certain requirements. Both parties must agree to the terms, and the note must be signed and dated. If the borrower fails to repay the loan as agreed, the lender can take legal action to recover the amount owed.

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer draft a Promissory Note, consulting one can help ensure that all legal requirements are met and that the document protects your interests. Many people choose to use templates or online resources to create a basic note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the updated agreement to avoid confusion later on.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They can demand full payment, charge late fees, or take legal action to recover the debt. The specific actions available depend on the terms outlined in the Promissory Note.

Are there any tax implications for using a Promissory Note?

Yes, there may be tax implications for both the lender and borrower. Interest income earned by the lender may be taxable, while the borrower may be able to deduct interest payments if the loan is used for certain purposes. It’s advisable to consult a tax professional for specific guidance.

Dos and Don'ts

When filling out the Florida Promissory Note form, it’s essential to be thorough and accurate. Here’s a list of important dos and don’ts to guide you through the process:

- Do ensure that all parties involved are clearly identified, including full names and addresses.

- Do specify the loan amount in both numerical and written form to avoid any confusion.

- Do include a clear repayment schedule, detailing when payments are due and the total number of payments.

- Do state the interest rate, if applicable, and clarify whether it is fixed or variable.

- Don't leave any fields blank; incomplete information can lead to disputes later on.

- Don't use vague language; be precise in your terms to ensure everyone understands their obligations.

- Don't forget to sign and date the document; without signatures, the note may not be enforceable.

Florida Promissory Note - Usage Steps

Once you have the Florida Promissory Note form in front of you, it is essential to fill it out accurately. This form will require specific information about the loan and the parties involved. Follow these steps carefully to ensure that all necessary details are included.

- Enter the date: Start by writing the date on which the note is being created at the top of the form.

- Identify the borrower: Fill in the full name and address of the borrower. This person is responsible for repaying the loan.

- Identify the lender: Next, provide the full name and address of the lender. This individual or entity is providing the loan.

- State the loan amount: Clearly write the total amount of money being loaned. Be specific and use numbers and words for clarity.

- Set the interest rate: If applicable, indicate the interest rate on the loan. Include whether it is fixed or variable.

- Define the payment terms: Specify how and when the borrower will make payments. Include the payment frequency and due dates.

- Include any late fees: If there are penalties for late payments, state the amount of the late fee and when it applies.

- Signatures: Both the borrower and lender must sign the form. Ensure that the signatures are dated.

- Witnesses or notarization: Depending on your needs, consider having the document witnessed or notarized for added legal validity.

After completing the form, review it for accuracy. Make copies for both the borrower and lender. Keep a copy for your records as well. This will ensure that all parties have the necessary documentation regarding the loan agreement.