Fillable Quitclaim Deed Template for Florida State

In Florida, the Quitclaim Deed serves as a practical tool for transferring property rights from one party to another, often without the complexities associated with traditional property sales. This straightforward form allows an individual, known as the grantor, to relinquish any claim they may have on a property to another individual or entity, referred to as the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property, nor does it provide any warranties regarding the property's condition or legal status. This makes it particularly useful in specific situations, such as when transferring property between family members, settling divorce agreements, or clearing up title issues. The process of executing a Quitclaim Deed involves completing the form with accurate details about the property and the parties involved, signing it in the presence of a notary public, and then filing it with the appropriate county clerk's office. Understanding the nuances of this form can empower individuals to navigate property transactions more confidently, ensuring that their rights and intentions are clearly communicated and legally recognized.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, a Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding the title, the seller is responsible for resolving them. In contrast, a Quitclaim Deed offers no such assurances, making it a less secure option for buyers.

A Bargain and Sale Deed resembles a Quitclaim Deed in that it transfers ownership without warranties. However, it typically implies that the seller has some ownership interest in the property, even if they do not guarantee clear title. This type of deed is often used in foreclosure sales or tax lien sales, where the seller may not have full knowledge of the property's title status.

A Special Purpose Deed is often used for specific transactions, such as transferring property into a trust or between family members. Like a Quitclaim Deed, it does not provide warranties about the title. However, it serves a distinct purpose and may include specific language tailored to the transaction's nature, making it more specialized than a Quitclaim Deed.

A Deed of Trust is similar in that it involves property transfer but serves a different function. It is used primarily in financing transactions, where the property acts as collateral for a loan. The borrower conveys the property to a trustee, who holds it until the loan is paid off. Unlike a Quitclaim Deed, a Deed of Trust involves a lender and a borrower and includes terms for repayment.

An Executor’s Deed is used when a property owner passes away, and their estate is being settled. This deed allows an executor to transfer property from the deceased's estate to heirs or buyers. Similar to a Quitclaim Deed, it does not guarantee clear title, but it is specifically tied to the process of estate administration.

A Personal Representative's Deed is another document related to estate matters. It is used by a personal representative to convey property from a deceased person's estate. Like the Quitclaim Deed, it does not provide warranties about the title. This deed is essential for settling estates and transferring property to rightful heirs.

A Leasehold Deed is used to transfer leasehold interests in a property rather than ownership. While it operates differently from a Quitclaim Deed, both documents facilitate the transfer of rights associated with real estate. A Leasehold Deed grants the lessee certain rights for a specified period, but it does not convey ownership of the property itself.

A Tax Deed is issued when a property is sold at a tax lien auction due to unpaid property taxes. This deed transfers ownership to the new buyer but often comes with risks regarding the title. Similar to a Quitclaim Deed, a Tax Deed does not guarantee clear title and may come with existing liens or claims against the property.

A Mineral Deed is used to transfer rights to minerals or resources beneath the surface of a property. While it is focused on specific rights rather than the property itself, it shares similarities with a Quitclaim Deed in that it may not provide warranties about those rights. This type of deed is crucial for transactions involving oil, gas, or mineral extraction.

Other Common State-specific Quitclaim Deed Templates

Texas Quit Claim Deed Pdf - Used often in family transfers, a Quitclaim Deed offers a simplified process.

Ohio Quit Claim Deed Form - This document provides a clear and simple way to relinquish property rights.

Georgia Deed Transfer Forms - Clearly stating the intent in the Quitclaim Deed can help avoid future disputes.

More About Florida Quitclaim Deed

What is a Quitclaim Deed in Florida?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another in Florida. Unlike a warranty deed, a Quitclaim Deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any. This type of deed is often used between family members or in situations where the parties know each other well and trust that the transfer is valid.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in several scenarios. For instance, if you are transferring property to a family member, such as a spouse or child, this deed can simplify the process. It’s also useful for clearing up title issues, such as when a person’s name needs to be removed from a deed after a divorce. However, it’s important to note that if you are buying property, a Quitclaim Deed may not provide the protection you need, as it does not ensure a clear title.

How do I complete a Quitclaim Deed in Florida?

Completing a Quitclaim Deed in Florida involves a few straightforward steps. First, you need to gather the necessary information, including the names of the grantor (the person giving up the property) and the grantee (the person receiving the property), as well as a legal description of the property. Next, fill out the Quitclaim Deed form accurately. Once completed, both parties should sign the document in the presence of a notary public. Finally, to make the deed official, you must file it with the county clerk’s office where the property is located.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees involved when filing a Quitclaim Deed in Florida. These fees can vary by county, but you should expect to pay a recording fee when you submit the deed to the county clerk’s office. Additionally, if you choose to have the document prepared by a professional, there may be associated service fees. It’s wise to check with your local county office for the most accurate fee structure.

Dos and Don'ts

When filling out the Florida Quitclaim Deed form, attention to detail is crucial. This document is essential for transferring property ownership, and mistakes can lead to significant issues down the line. Here’s a helpful list of dos and don’ts to guide you through the process:

- Do ensure that all names are spelled correctly. Accuracy is vital for legal documents.

- Do include the correct legal description of the property. This can usually be found on the previous deed or property tax records.

- Do sign the document in the presence of a notary public. This step is necessary for the deed to be legally binding.

- Do provide the date of the transfer. This establishes when the ownership change takes effect.

- Don't leave any fields blank. Incomplete forms can lead to delays or rejection.

- Don't use informal names or nicknames. Always use the full legal names of all parties involved.

- Don't forget to check for any local requirements. Some counties may have specific rules regarding property transfers.

- Don't overlook the need for additional documentation. Depending on the situation, you may need to provide supporting documents.

By following these guidelines, you can help ensure a smoother process when completing the Florida Quitclaim Deed form. Remember, clarity and precision are your best allies in legal matters.

Florida Quitclaim Deed - Usage Steps

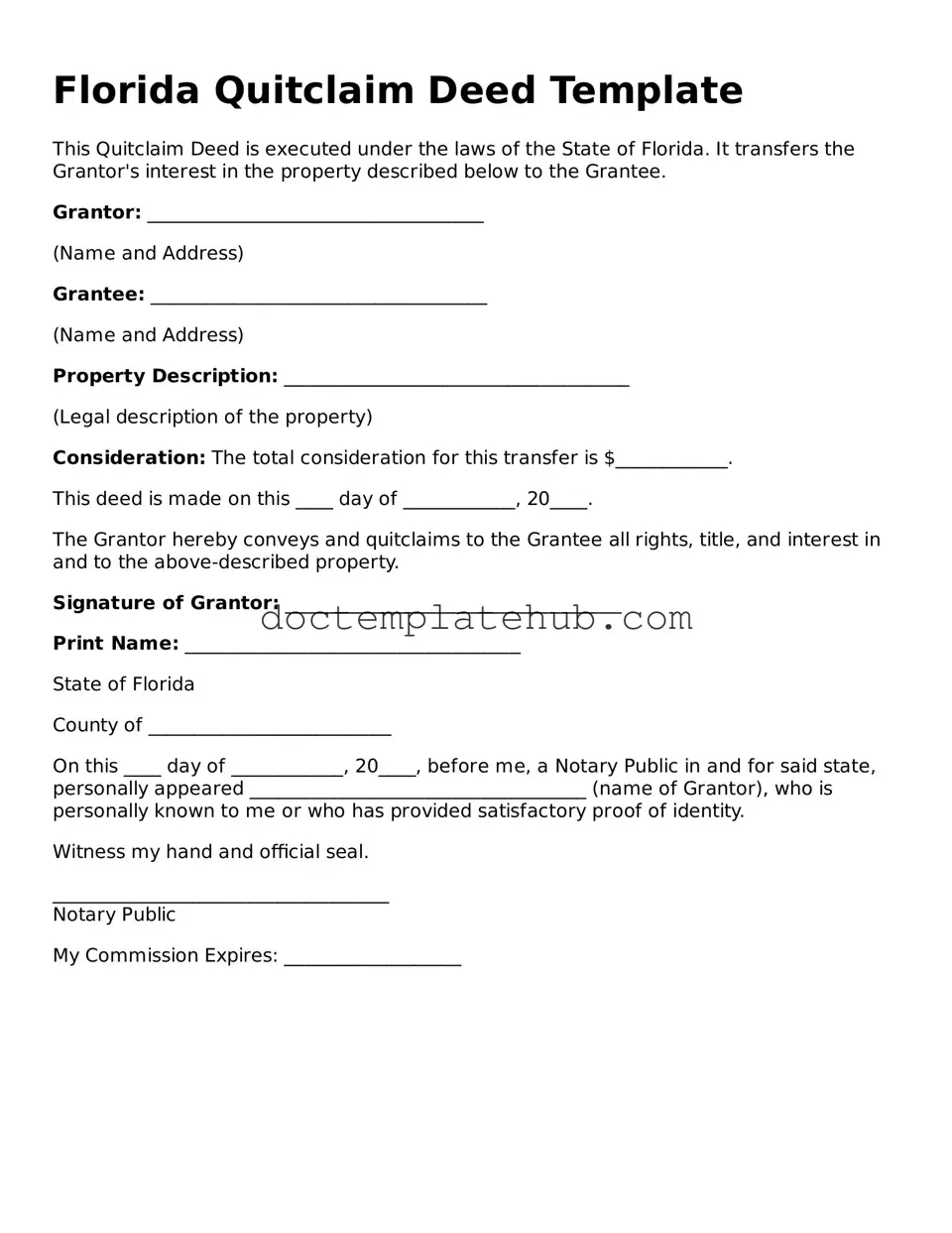

Once you have the Florida Quitclaim Deed form, it's time to fill it out carefully. This document will need to be completed accurately to ensure the transfer of property is valid. Follow the steps below to fill out the form correctly.

- Obtain the Form: Start by downloading or acquiring the Florida Quitclaim Deed form from a reliable source.

- Identify the Grantor: In the first section, write the full name of the person transferring the property. This is known as the grantor.

- Identify the Grantee: Next, enter the full name of the person receiving the property. This is the grantee.

- Property Description: Provide a detailed description of the property being transferred. This should include the address and any legal description that applies.

- Consideration: State the amount of money or value being exchanged for the property. If no money is involved, you can indicate “$0” or “love and affection.”

- Sign the Document: The grantor must sign the deed in the presence of a notary public. This signature is crucial for the validity of the document.

- Notarization: Have the notary public complete their section, which includes their signature and seal, confirming the identity of the grantor.

- Record the Deed: Finally, take the completed and notarized deed to the local county clerk’s office to record it. This step is essential for making the transfer official.

After completing these steps, the Quitclaim Deed will be ready for submission. Ensure that you keep copies of the document for your records. It is also wise to consult with a professional if you have any questions during the process.