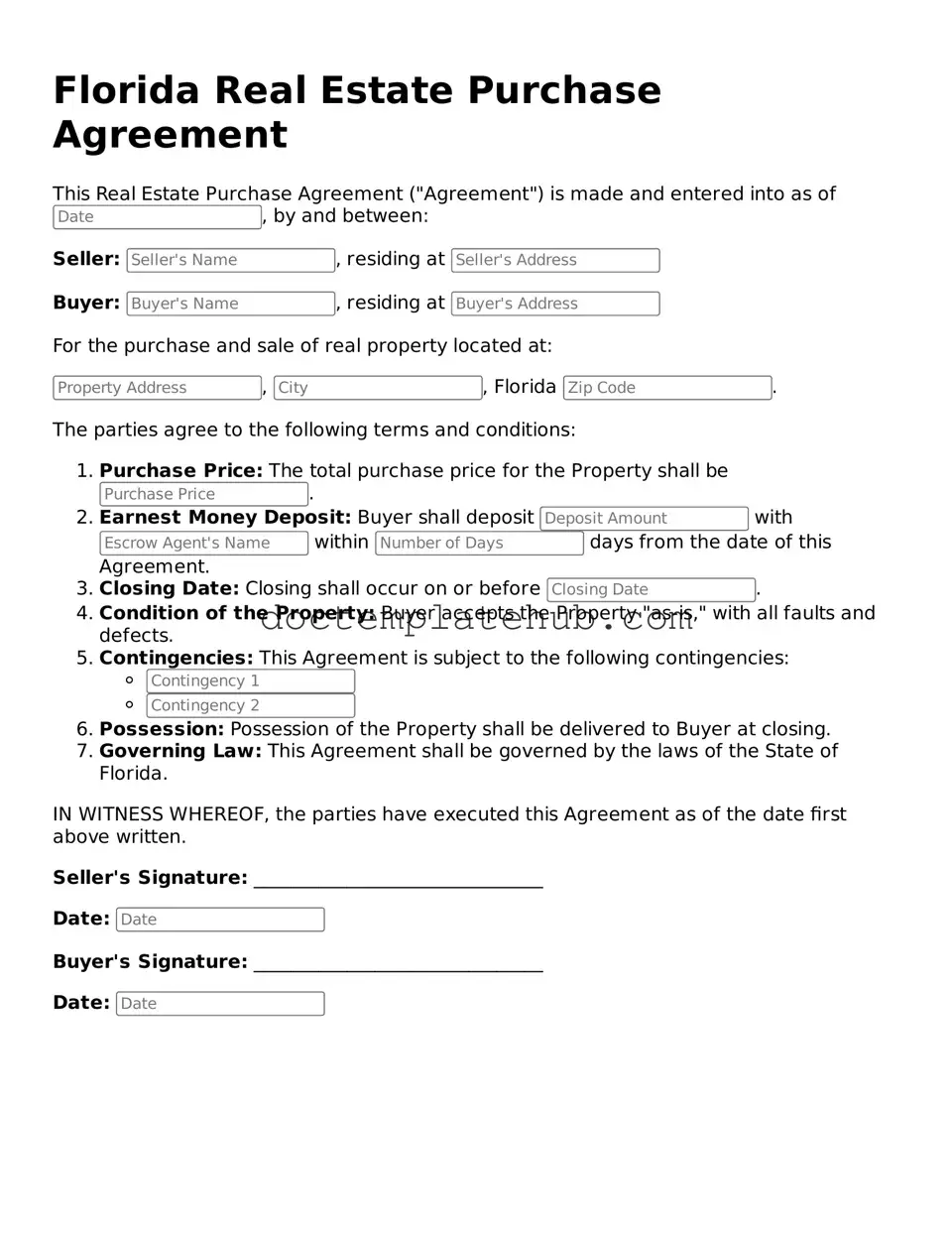

Fillable Real Estate Purchase Agreement Template for Florida State

In the vibrant real estate market of Florida, the Real Estate Purchase Agreement form serves as a crucial document for buyers and sellers alike, ensuring that all parties are on the same page throughout the transaction process. This form outlines essential details such as the purchase price, property description, and financing terms, providing clarity and structure to the agreement. Additionally, it addresses contingencies that may arise, including inspections, appraisals, and financing approvals, which protect the interests of both the buyer and seller. The agreement also specifies the closing date and any included fixtures or personal property, helping to avoid misunderstandings. By thoroughly detailing the responsibilities and rights of each party, this form fosters transparency and trust, ultimately guiding the transaction to a successful conclusion.

Similar forms

The Florida Real Estate Purchase Agreement is similar to the Residential Purchase Agreement used in many states. Both documents outline the terms and conditions of a real estate transaction, including the purchase price, financing details, and contingencies. They serve to protect the interests of both buyers and sellers, ensuring that all parties are clear on their obligations and rights throughout the process.

Another comparable document is the Commercial Purchase Agreement. While this agreement is tailored for commercial properties, it shares many similarities with the residential version. Both documents detail the terms of sale, including the purchase price and closing date. However, the Commercial Purchase Agreement often includes additional clauses specific to business operations, zoning laws, and lease agreements.

The Lease Agreement also bears resemblance to the Florida Real Estate Purchase Agreement. While primarily used for rental situations, it outlines terms related to the use of property, payment obligations, and duration of the agreement. Both documents aim to protect the rights of the parties involved, ensuring that expectations are clearly defined and legally enforceable.

The Option to Purchase Agreement is another related document. This agreement grants a potential buyer the right to purchase a property within a specified time frame. Like the Real Estate Purchase Agreement, it includes essential terms such as the purchase price and duration. However, it focuses more on the buyer's right to decide rather than an immediate obligation to purchase.

The Seller Financing Agreement is also similar in that it outlines the terms under which a seller provides financing to the buyer. This document details the purchase price, interest rate, and payment schedule. It serves as a bridge for buyers who may not qualify for traditional financing, just as the Real Estate Purchase Agreement facilitates the overall transaction.

The Short Sale Agreement shares some characteristics with the Florida Real Estate Purchase Agreement. In a short sale, the seller seeks to sell the property for less than the amount owed on the mortgage. Both agreements detail the terms of the sale, but the Short Sale Agreement also includes provisions for lender approval, adding complexity to the transaction.

The Land Contract, or Contract for Deed, is another document that resembles the Real Estate Purchase Agreement. This agreement allows a buyer to make payments directly to the seller over time, with the seller retaining the title until the purchase price is fully paid. Both documents outline the sale terms, but the Land Contract emphasizes installment payments and ownership transfer over time.

In the realm of real estate transactions, a clear understanding of legal documents is essential for all parties involved. One such important document is the Hold Harmless Agreement, which serves to protect individuals from liability during various activities. For those looking for templates or examples of these agreements, resources are available online, including at https://smarttemplates.net/.

The Purchase and Sale Agreement is a broader term that encompasses various types of real estate transactions. It includes details similar to those found in the Florida Real Estate Purchase Agreement, such as the sale price, contingencies, and closing procedures. This document is often used interchangeably with the Real Estate Purchase Agreement, depending on the jurisdiction.

Lastly, the Real Estate Investment Purchase Agreement is tailored for investors looking to buy properties for rental or resale. While it shares essential elements with the Florida Real Estate Purchase Agreement, it may also include specific investment-related clauses, such as projected cash flow and return on investment. Both documents aim to secure the interests of the buyer while detailing the transaction's terms.

Other Common State-specific Real Estate Purchase Agreement Templates

Property Purchase Agreement Format - Outlines responsibilities for repairs before closing.

Arizona Purchase Contract - This agreement is essential for a smooth property transaction.

Real Estate Contract Template - Details any seller concessions or credits provided to the buyer.

It is essential for landlords to properly utilize the Notice to Quit form, as it not only outlines the lease violation but also provides tenants with a clear directive to resolve the issue or face potential eviction. For those looking for detailed information on this process, you can open the pdf that offers a comprehensive overview and guidance on filling out this important document correctly.

Georgia Purchase and Sale Agreement 2023 - The agreement can state whether the sale is “as-is” or contingent.

More About Florida Real Estate Purchase Agreement

What is the Florida Real Estate Purchase Agreement form?

The Florida Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This form includes important details such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized. It serves as a binding contract once both parties have signed it.

Who typically uses the Florida Real Estate Purchase Agreement?

This agreement is commonly used by buyers and sellers of residential real estate in Florida. Real estate agents, brokers, and attorneys may also be involved in the process to ensure that the agreement is properly completed and that both parties understand their rights and obligations.

What are the key components of the agreement?

Key components of the Florida Real Estate Purchase Agreement include the names of the buyer and seller, a description of the property, the purchase price, the deposit amount, financing details, and any contingencies, such as home inspections or appraisals. Additionally, the agreement outlines the closing process and any seller disclosures that may be required.

Can the agreement be modified after it is signed?

Yes, the Florida Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure that they are enforceable.

What happens if either party fails to fulfill their obligations?

If either party fails to fulfill their obligations as outlined in the agreement, it may be considered a breach of contract. The non-breaching party may have the right to seek legal remedies, which could include enforcing the agreement, seeking damages, or terminating the contract. It is advisable to consult with a legal professional in such situations.

Is the Florida Real Estate Purchase Agreement standard for all transactions?

While there are standard forms available, the Florida Real Estate Purchase Agreement can be customized to fit the specific needs of the transaction. Buyers and sellers may negotiate certain terms, and it is important to ensure that all agreed-upon changes are clearly documented in the agreement.

Are there any contingencies that are commonly included?

Yes, common contingencies in a Florida Real Estate Purchase Agreement may include financing contingencies, inspection contingencies, and appraisal contingencies. These provisions allow the buyer to back out of the agreement or renegotiate terms if certain conditions are not met.

Where can I obtain a Florida Real Estate Purchase Agreement form?

Florida Real Estate Purchase Agreement forms can be obtained through various sources, including real estate agents, brokers, and online legal form providers. It is important to ensure that the form used is up-to-date and compliant with Florida real estate laws.

Dos and Don'ts

When filling out the Florida Real Estate Purchase Agreement form, it's essential to be careful and thorough. Here are some important dos and don’ts to keep in mind:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property and the parties involved.

- Do ensure that all necessary signatures are included.

- Do consult with a real estate professional or attorney if you have questions.

- Don’t leave any blank spaces in the form; fill in all required fields.

- Don’t rush through the process; take your time to avoid mistakes.

Following these guidelines will help ensure that your purchase agreement is complete and valid. Taking the time to do it right can save you from potential issues down the road.

Florida Real Estate Purchase Agreement - Usage Steps

Once you have the Florida Real Estate Purchase Agreement form in hand, you will need to fill it out carefully. This form is essential for documenting the terms of the sale between the buyer and seller. Follow these steps to ensure that all necessary information is provided accurately.

- Identify the Parties: Enter the full legal names of the buyer(s) and seller(s) at the top of the form.

- Property Description: Clearly describe the property being sold, including the address and any specific details that distinguish it.

- Purchase Price: State the total purchase price for the property. Be specific and ensure it reflects the agreed amount.

- Earnest Money Deposit: Indicate the amount of earnest money the buyer will provide and the terms regarding its handling.

- Financing Terms: Specify how the buyer intends to finance the purchase, whether through a mortgage, cash, or other means.

- Closing Date: Provide a proposed closing date for the transaction. Make sure it is realistic and agreed upon by both parties.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or financing approvals.

- Signatures: Ensure all parties sign and date the agreement. This includes both the buyer and the seller.

After completing the form, review it for accuracy and completeness. Both parties should retain a copy for their records. Ensure that any necessary actions, such as deposits or inspections, are scheduled promptly following the agreement.