Fillable Transfer-on-Death Deed Template for Florida State

The Florida Transfer-on-Death Deed is a valuable estate planning tool that allows property owners to transfer their real estate to designated beneficiaries upon their passing, without the need for probate. This form streamlines the transfer process, enabling a seamless transition of property ownership. By utilizing this deed, individuals can maintain control over their property during their lifetime while ensuring that their wishes are honored after death. The form requires specific information, such as the names of the property owners, the beneficiaries, and a legal description of the property. Importantly, the deed must be signed and notarized to be valid, and it is recommended to file it with the county clerk to ensure proper record-keeping. Understanding the implications and requirements of this deed can help individuals make informed decisions about their estate planning needs, ultimately providing peace of mind for both the property owner and their beneficiaries.

Similar forms

The Florida Transfer-on-Death Deed (TOD) is similar to a Last Will and Testament. Both documents allow individuals to express their wishes regarding the distribution of their assets after they pass away. However, a key difference lies in the timing of the transfer. A will takes effect only after the individual’s death and must go through probate, while a TOD deed allows for the direct transfer of property to the designated beneficiary without the need for probate, making the process quicker and often less costly.

Another document that shares similarities with the TOD deed is the Living Trust. Like the TOD deed, a living trust allows for the direct transfer of assets upon death. However, a living trust is a more comprehensive estate planning tool that can manage not only real estate but also other assets while the individual is still alive. The trust can help avoid probate and provide for management of assets in case of incapacity, which the TOD deed does not address.

The Beneficiary Designation form is also akin to the TOD deed. This form is commonly used for financial accounts, such as bank accounts or retirement plans, allowing individuals to designate beneficiaries who will receive the assets upon their death. Similar to the TOD deed, the transfer of assets occurs outside of probate, ensuring a faster and more straightforward process for the beneficiaries.

A Payable-on-Death (POD) account functions in a similar manner to the TOD deed. With a POD account, the account holder designates a beneficiary who will receive the funds in the account upon the account holder's death. This arrangement bypasses probate, allowing for immediate access to funds for the beneficiary, just like a TOD deed allows for the direct transfer of property.

The Joint Tenancy with Right of Survivorship is another document that bears resemblance to the TOD deed. In this arrangement, two or more individuals hold title to a property together. When one owner passes away, their share automatically transfers to the surviving owner(s) without going through probate. This automatic transfer feature mirrors the intent of the TOD deed, which is to facilitate a smooth transfer of property upon death.

A Life Estate deed is similar as well. This deed allows an individual to retain the right to use and benefit from a property during their lifetime, while designating another person to receive full ownership upon their death. Like the TOD deed, it ensures a seamless transition of property, although it involves a more complex arrangement regarding the rights of the life tenant versus the remainderman.

The Florida Employment Verification form serves as an essential tool in the hiring process, allowing employers to confirm the employment status and eligibility of potential employees. This form not only helps organizations comply with legal requirements but also protects them from potential liability. By utilizing resources like TopTemplates.info, employers can access accurate templates and information that streamline the verification process, ensuring a smooth transition for both employers and employees.

The Family Limited Partnership (FLP) can also be compared to the TOD deed. An FLP allows family members to pool their assets into a partnership, which can facilitate the transfer of ownership interests upon death. While the TOD deed specifically pertains to real estate, an FLP can encompass a broader range of assets and can provide tax benefits and asset protection, while still allowing for a smooth transition of ownership.

Lastly, the Declaration of Trust is similar to the TOD deed in that it allows for the management and distribution of assets. This document outlines how a trustee will manage the assets for the benefit of the beneficiaries. While the TOD deed specifically addresses the transfer of real property, a Declaration of Trust can encompass various types of assets and provides a structured approach to asset management and distribution.

Other Common State-specific Transfer-on-Death Deed Templates

What Are the Disadvantages of a Transfer on Death Deed? - Various estate planning resources are available to help property owners navigate this option.

Texas Transfer on Death Deed Form 2023 - It ensures that your property goes to someone specific, preventing potential disputes among heirs.

Tod in California - Such a deed can include specific conditions for the transfer of property.

In order to effectively manage one’s estate, using the Texas Last Will and Testament form is essential as it provides clear directives regarding asset distribution. For those looking for templates to create such a document, resources like smarttemplates.net can be invaluable, helping to ensure that all legal requirements are met and that the testator's wishes are clearly articulated.

Transfer on Death Affidavit - This method of transferring property can be beneficial for those who want to avoid family disputes in the future.

More About Florida Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Florida to designate a beneficiary who will receive the property upon the owner's death. This deed does not require the property to go through probate, making the transfer process more straightforward and efficient for the beneficiary.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, the property owner must fill out the appropriate form, which includes details about the property and the designated beneficiary. The deed must be signed by the property owner in the presence of a notary public and recorded with the county clerk's office where the property is located. It is important to ensure that all information is accurate to avoid complications later.

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, a Transfer-on-Death Deed can be changed or revoked. The property owner can create a new TOD Deed that supersedes the previous one or file a formal revocation with the county clerk's office. It is essential to follow the proper legal procedures to ensure the changes are valid and recognized.

What happens if the beneficiary dies before the property owner?

If the designated beneficiary passes away before the property owner, the TOD Deed becomes void. In this case, the property will not automatically transfer to the beneficiary's heirs. The property owner should consider naming an alternate beneficiary to avoid complications and ensure the property is transferred according to their wishes.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. The transfer of property occurs upon the owner's death, at which point the beneficiary may be responsible for any applicable estate taxes. It is advisable to consult a tax professional for specific guidance related to individual circumstances and potential tax liabilities.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure the process goes smoothly. Below is a list of things you should and shouldn't do.

- Do ensure that you are the legal owner of the property you wish to transfer.

- Do provide accurate and complete information about the property, including the legal description.

- Do have the form notarized to validate the deed.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the county clerk's office where the property is located.

- Don't fill out the form if you are not the sole owner of the property.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't forget to check for any specific local requirements that may apply.

- Don't rely on verbal agreements; all changes must be documented in writing.

- Don't assume that the deed will automatically transfer; ensure you understand the implications.

Florida Transfer-on-Death Deed - Usage Steps

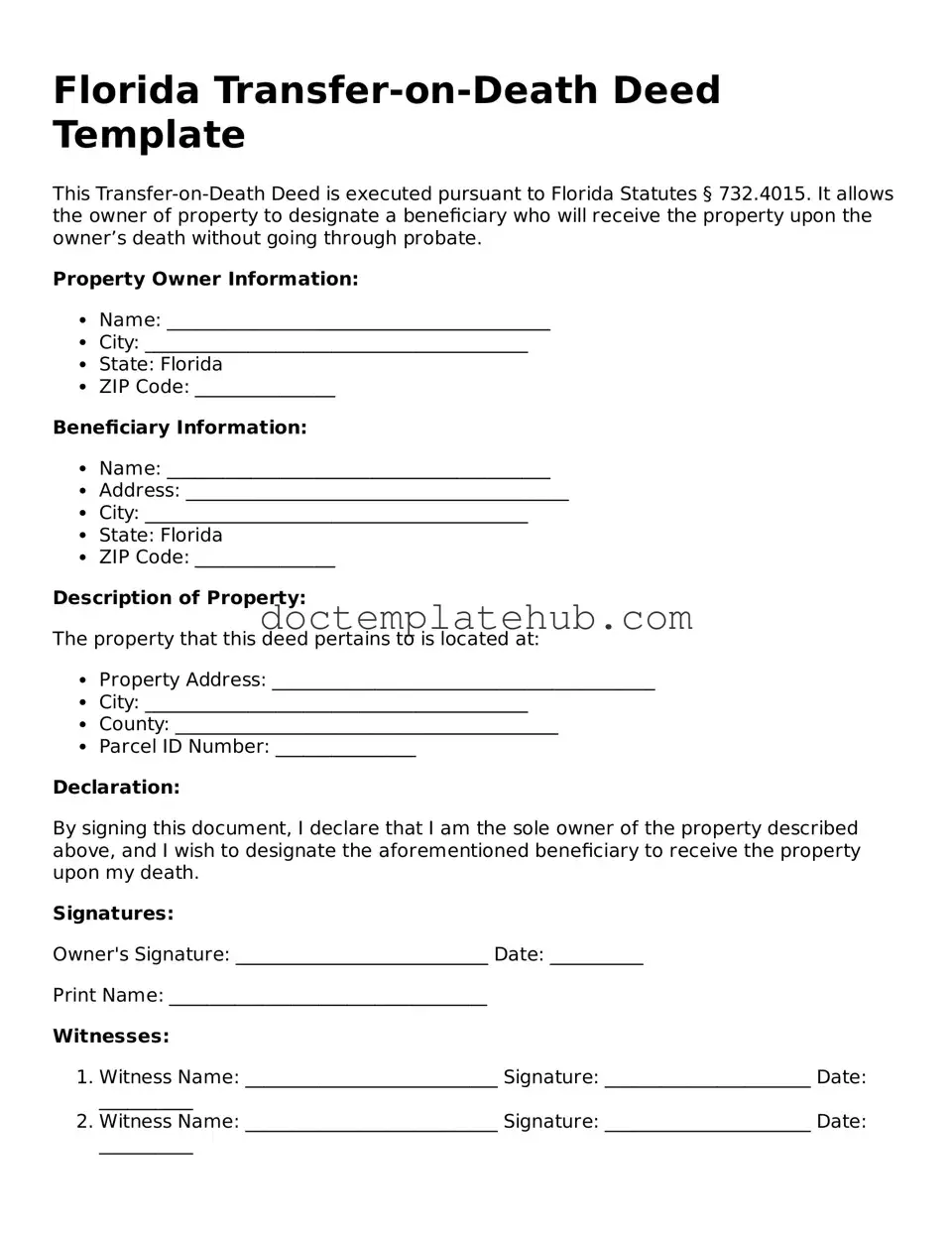

Filling out the Florida Transfer-on-Death Deed form requires careful attention to detail. After completing the form, it must be signed and recorded with the appropriate county clerk to ensure that the transfer is legally recognized. Follow these steps to accurately fill out the form.

- Begin by entering the name of the property owner(s) at the top of the form. Include full legal names as they appear on the property title.

- Provide the property address. This should include the street address, city, state, and zip code.

- Identify the legal description of the property. This information can typically be found on the current deed or property tax bill.

- Designate the beneficiary or beneficiaries. List their full names and relationship to the property owner(s).

- Include the date of execution. This is the date when the form is completed and signed.

- Sign the form in the presence of a notary public. Ensure that all property owners sign the document if there are multiple owners.

- After notarization, make copies of the signed form for your records.

- Finally, submit the original form to the county clerk’s office in the county where the property is located for recording.