Fill Your Geico Supplement Request Form

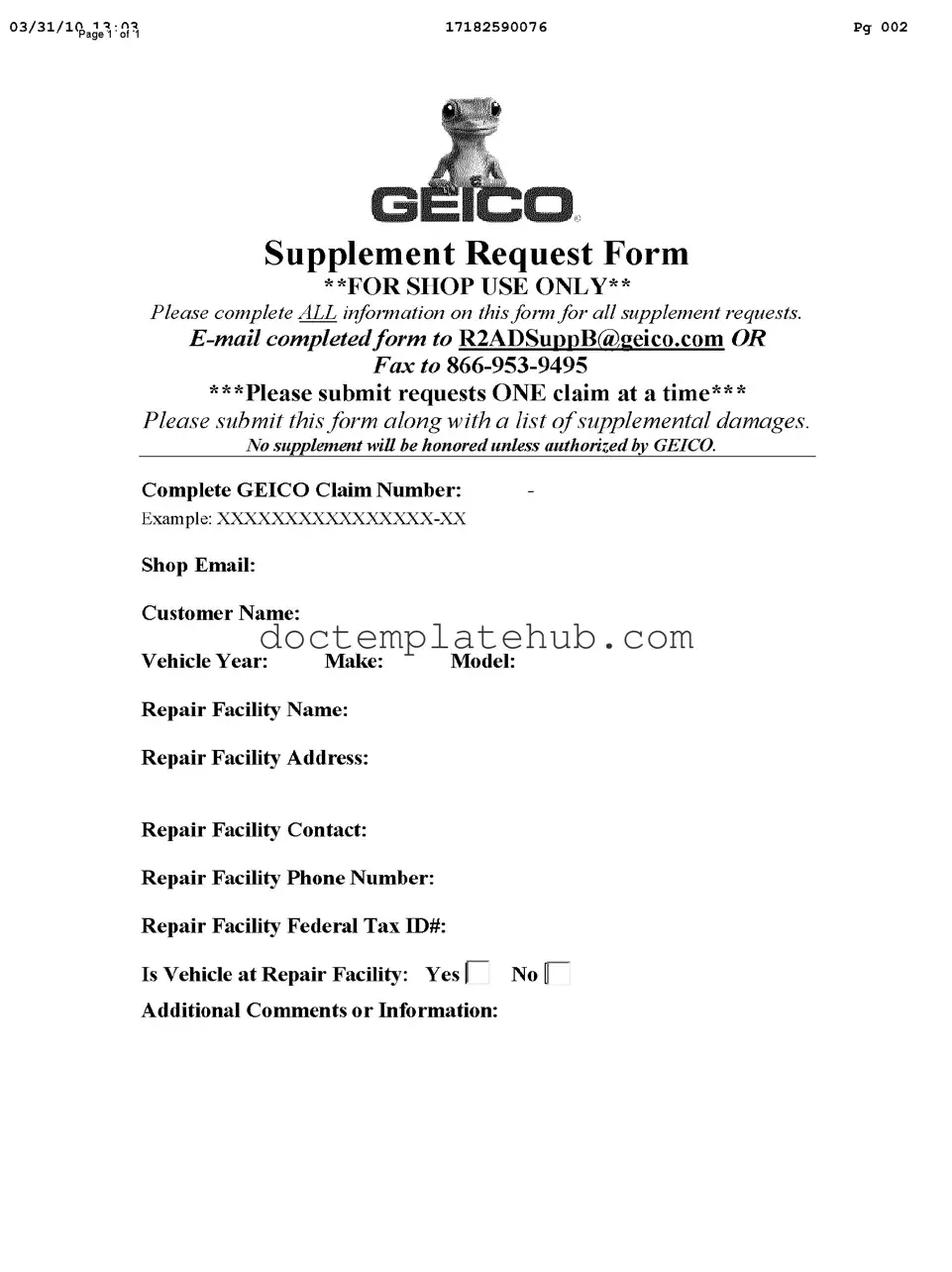

The GEICO Supplement Request Form is an essential tool for repair shops seeking reimbursement for additional damages discovered during vehicle repairs. This form is designed specifically for shop use, ensuring that all necessary information is collected for a smooth processing of supplement requests. When completing the form, it is crucial to fill out every section accurately, including the GEICO claim number, customer details, and vehicle information such as year, make, and model. Additionally, the form requires the repair facility's contact information and federal tax ID number, which helps streamline communication and verification processes. Submitting the request involves emailing the completed form along with a detailed list of supplemental damages. Remember, each claim must be submitted individually, and no supplement will be honored without prior authorization from GEICO. Providing any additional comments or information can also be helpful in clarifying the situation and expediting the approval process.

Similar forms

The GEICO Supplement Request Form is similar to the Insurance Claim Form used by various insurance companies. Both documents require detailed information about the claim, including the policyholder's name, contact information, and specifics about the incident. The Insurance Claim Form typically asks for documentation of damages and supporting evidence, much like the supplemental damages list requested by GEICO. Each form serves to streamline the claims process, ensuring that all necessary information is collected efficiently.

Another document that resembles the GEICO Supplement Request Form is the Auto Repair Authorization Form. This form is used by repair facilities to obtain permission from the insurance company before proceeding with repairs. Similar to the GEICO form, it requires the repair facility's details, customer information, and vehicle specifics. Both forms emphasize the importance of authorization before any additional work can be done, ensuring compliance with insurance policies.

The Damage Assessment Form is also comparable to the GEICO Supplement Request Form. This document is often used by repair shops to provide an initial evaluation of damages before repairs begin. Like the GEICO form, it requires a detailed description of the vehicle’s condition and the extent of damages. Both forms aim to facilitate communication between the repair facility and the insurance provider, promoting a clear understanding of the necessary repairs.

The Repair Estimate Form shares similarities with the GEICO Supplement Request Form as well. This form outlines the expected costs for repairs and is submitted to the insurance company for approval. Both forms require comprehensive details about the vehicle and repairs, ensuring that the insurance company has all the information needed to process claims efficiently. They both serve as essential tools for managing repair costs and ensuring that all parties are on the same page.

The Vehicle Damage Report is another document that aligns with the GEICO Supplement Request Form. This report details the damages sustained by a vehicle and is often used in conjunction with insurance claims. Like the GEICO form, it requires specific information about the vehicle, the nature of the damages, and any additional comments. Both documents play a crucial role in assessing the extent of damages and determining the appropriate course of action for repairs.

The Proof of Loss Form is also similar to the GEICO Supplement Request Form. This document is used to formally notify the insurance company of a loss and provides details about the incident. Both forms require the claimant to provide comprehensive information, including the claim number and specifics about the loss. They serve to document the claim process and ensure that all necessary information is submitted for review.

The Claim Adjustment Request Form is another document that bears resemblance to the GEICO Supplement Request Form. This form is used to request a review or adjustment of an existing claim. Like the GEICO form, it requires detailed information about the claim, including any changes in circumstances or additional damages discovered after the initial claim submission. Both forms are designed to ensure that the insurance company has accurate and up-to-date information to make informed decisions.

Understanding the complexities of insurance documentation is crucial, and for those seeking comprehensive resources, the documentonline.org/blank-employee-handbook/ provides valuable insights that can aid in navigating the various forms necessary for efficient claims processing and repair authorization.

The Subrogation Claim Form also shares similarities with the GEICO Supplement Request Form. This document is used when one party seeks reimbursement from another party’s insurance for damages incurred. Both forms require detailed information about the incident, the parties involved, and any relevant claim numbers. They both aim to facilitate the recovery process and ensure that all necessary information is accurately documented for review.

Lastly, the Insurance Policy Endorsement Form is similar to the GEICO Supplement Request Form in that it modifies the terms of an existing insurance policy. This form requires detailed information about the policyholder and the changes being requested. Both forms emphasize the importance of clear communication and documentation to ensure that all parties are aware of the changes and can proceed accordingly.

Other PDF Templates

Can You Spare a Dollar Fundraiser Sheet - One dollar can be the start of something wonderful.

Understanding the process surrounding the USCIS I-589 form is essential for those in need of refuge, as this document not only initiates their asylum journey but also ensures they have access to vital resources and support. For assistance with completing the form, individuals can explore the tools available at smarttemplates.net, which can help streamline the application process and increase their chances of a successful outcome.

Da Form 31 - Be prepared to explain the reasons for your leave in the remarks section if needed.

Irs Transcripts - This document contains sensitive information about the taxpayer, such as Social Security Numbers and income details.

More About Geico Supplement Request

What is the purpose of the GEICO Supplement Request form?

The GEICO Supplement Request form is designed for repair facilities to request additional payment for unforeseen damages that were not included in the original claim. This process ensures that all necessary repairs are accounted for and that the repair shop receives the appropriate compensation for their work.

How should I submit the GEICO Supplement Request form?

To submit the form, complete all required fields accurately and email it to GEICO. Make sure to include a detailed list of the supplemental damages along with the completed form. It’s important to submit requests for only one claim at a time to avoid confusion and ensure a smoother processing experience.

What information is required on the form?

The form requires several key pieces of information, including the GEICO claim number, customer name, vehicle details (year, make, model), repair facility name and contact information, and whether the vehicle is currently at the repair facility. Providing complete and accurate information is crucial for processing the request efficiently.

Will GEICO honor every supplement request?

No, not every supplement request will be honored. GEICO requires prior authorization for any supplemental damages. This means that the repair facility must provide sufficient justification for the additional costs, and approval must be obtained before repairs are carried out.

What happens if I don’t complete the form correctly?

If the form is not completed correctly, it may lead to delays in processing the request or even denial of the supplement. It’s essential to review the form thoroughly to ensure that all required fields are filled out accurately before submission.

Can I submit multiple supplement requests at once?

No, GEICO requires that each supplement request be submitted individually. This helps streamline the review process and allows for clearer communication regarding each specific claim.

What should I do if I have additional comments or information?

If you have additional comments or information that may support your supplement request, include them in the designated section of the form. Providing context or details can help GEICO better understand the situation and may facilitate a quicker approval process.

How can I check the status of my supplement request?

Dos and Don'ts

When filling out the Geico Supplement Request form, it is important to follow specific guidelines to ensure your submission is processed smoothly. Here are four things you should and shouldn't do:

- Do complete all required information on the form.

- Do submit requests one claim at a time.

- Don't forget to include a list of supplemental damages with your request.

- Don't submit a supplement without prior authorization from GEICO.

Geico Supplement Request - Usage Steps

After gathering all necessary information, you are ready to fill out the Geico Supplement Request form. Ensure that you provide accurate details for each section to avoid delays in processing your request. Follow these steps carefully.

- Locate the Geico Supplement Request form.

- Fill in the GEICO Claim Number in the designated space. Use the format: XXXXXXXXXXXXXXXX-XX.

- Enter the Shop Email where correspondence can be sent.

- Provide the Customer Name associated with the claim.

- Indicate the Vehicle Year, Make, and Model of the car.

- Write the Repair Facility Name where the vehicle is being serviced.

- Fill in the Repair Facility Address completely.

- Provide the Repair Facility Contact person’s name.

- Enter the Repair Facility Phone Number for follow-up.

- Include the Repair Facility Federal Tax ID#.

- Indicate if the Vehicle is at Repair Facility by checking either Yes or No.

- Add any Additional Comments or Information that may assist in processing the supplement request.

Once completed, email the form along with a list of supplemental damages. Remember, submit requests one claim at a time. No supplement will be honored without prior authorization from GEICO.