Fill Your Generic Direct Deposit Form

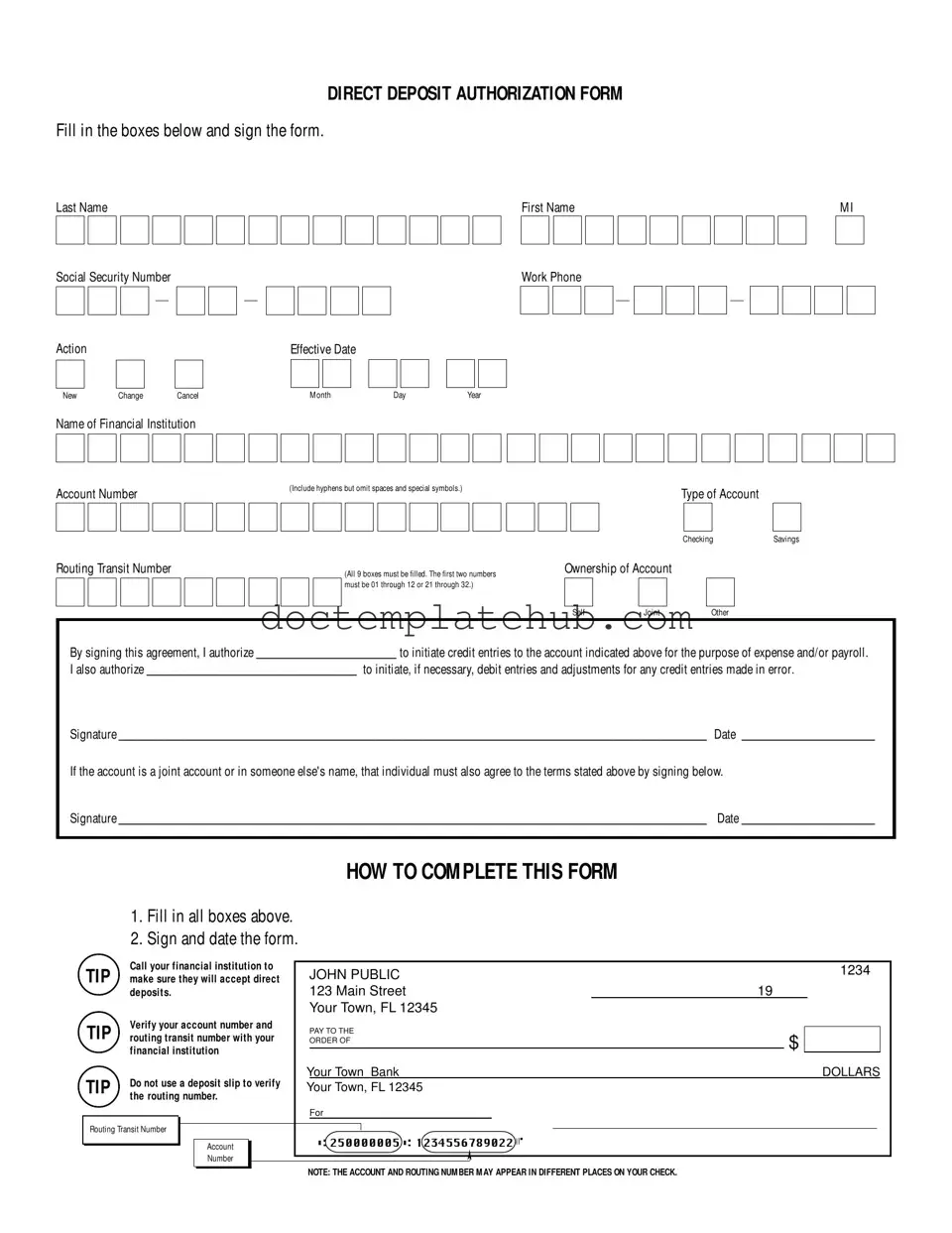

The Generic Direct Deposit form is an essential document for individuals looking to streamline their payment processes. This form facilitates the electronic transfer of funds directly into a bank account, enhancing efficiency for both employers and employees. Key components of the form include personal identification details such as the individual's name and Social Security number, which are critical for verifying identity and ensuring accurate payments. Additionally, it requires the individual to specify the type of account—either checking or savings—along with the account number and routing transit number, which are necessary for directing the funds correctly. The form also includes options for initiating a new direct deposit, making changes to an existing arrangement, or canceling a previous authorization. Importantly, the form must be signed and dated by the individual, and if applicable, a joint account holder must also provide their signature to validate the authorization. Clear instructions guide users through the completion process, emphasizing the need to verify account details with their financial institution to avoid errors. This form not only simplifies the payment process but also ensures that individuals receive their funds in a timely manner.

Similar forms

The W-4 form, officially known as the Employee's Withholding Certificate, is similar to the Generic Direct Deposit form in that both documents are essential for payroll processing. The W-4 allows employees to specify their tax withholding preferences, which directly affects their take-home pay. Like the direct deposit form, it requires personal information such as name and Social Security number, and it must be signed and dated to be valid. Both forms ensure that employees receive their earnings correctly and efficiently, highlighting their importance in the payroll system.

The I-9 form, or Employment Eligibility Verification, serves a different purpose but shares similarities with the Generic Direct Deposit form in its requirement for personal information and signatures. The I-9 confirms an employee's eligibility to work in the United States, necessitating the collection of identification documents. While the focus of the I-9 is on verifying identity and work authorization, both forms are integral to the employment process and must be accurately completed and submitted to ensure compliance with federal regulations.

For individuals looking to transfer property ownership in Alabama, understanding related legal documents is crucial. A common document used in real estate transactions is the Quitclaim Deed form, which allows for the transfer of ownership without warranties, often in scenarios where the seller cannot guarantee clear title to the property. Filling out this form accurately is essential to ensure smooth ownership transfer and minimize any potential future disputes.

The 1099 form, specifically the 1099-MISC or 1099-NEC, is used for reporting income received by independent contractors. Like the Generic Direct Deposit form, it requires accurate financial information, including the recipient's name and Tax Identification Number. Both documents play a role in the financial transactions between employers and workers, ensuring that payments are tracked and reported correctly for tax purposes. The 1099 form, however, is used post-payment, whereas the direct deposit form is used to facilitate the payment process.

The ACH Authorization form is closely related to the Generic Direct Deposit form as both facilitate electronic payments. The ACH Authorization form allows individuals or businesses to authorize recurring payments or transfers directly from their bank accounts. Similar to the direct deposit form, it requires banking information, including account and routing numbers. Both forms streamline the payment process, reducing the need for paper checks and enhancing efficiency in financial transactions.

The Payroll Deduction Authorization form allows employees to authorize deductions from their paychecks for various purposes, such as retirement savings or health insurance premiums. Like the Generic Direct Deposit form, it requires employees to provide personal information and must be signed to be effective. Both forms are crucial in managing employee compensation and benefits, ensuring that the correct amounts are deducted and deposited as intended.

The Health Savings Account (HSA) Contribution form is similar to the Generic Direct Deposit form in that it allows employees to direct funds into a specific account. This form enables employees to specify the amount they wish to contribute to their HSA from their paycheck. Both forms require personal and banking information, and both facilitate the management of funds for specific purposes, ensuring that employees can effectively save for healthcare expenses.

The Direct Deposit Authorization for Benefits form is used by individuals receiving government benefits, such as Social Security. It is similar to the Generic Direct Deposit form because it authorizes the direct deposit of benefit payments into a bank account. Both forms require the recipient's personal information and banking details, ensuring that payments are made accurately and efficiently to support individuals' financial needs.

The Vendor Payment Authorization form is used by businesses to set up direct deposit for payments to vendors. This document resembles the Generic Direct Deposit form as it requires banking information and authorization for electronic payments. Both forms streamline the payment process, enabling businesses to manage their cash flow effectively while ensuring that vendors receive their payments promptly and securely.

The Automatic Bill Payment Authorization form allows individuals to set up automatic payments for recurring bills, such as utilities or subscriptions. Like the Generic Direct Deposit form, it requires banking details and a signature to authorize the payments. Both forms facilitate financial transactions, providing convenience and ensuring that obligations are met on time without the need for manual intervention.

Other PDF Templates

Prescription Paper for Controlled Substances - The Prescription Pad can also highlight dosage adjustments for patients with special considerations.

Convalescent Leave - The form must be filled in triplicate for official processing.

A Utah Non-disclosure Agreement form is essential for maintaining confidentiality and protecting sensitive information in various business dealings. For those who require assistance in creating such documents, resources like smarttemplates.net can be invaluable in ensuring that all legal requirements are met effectively.

Affidavit of Death of Joint Tenant California - It serves as a legal document confirming the death of one joint tenant to facilitate property transfer.

More About Generic Direct Deposit

What is the Generic Direct Deposit form used for?

The Generic Direct Deposit form is used to authorize the automatic deposit of funds into your bank account. This could be for payroll, expense reimbursements, or other payments. By completing this form, you are giving permission for your employer or another entity to deposit money directly into your chosen financial institution, making the process more convenient and efficient.

How do I fill out the Generic Direct Deposit form?

Filling out the form is straightforward. Start by entering your last name, first name, and middle initial. Then, provide your Social Security number. You will need to indicate whether you are setting up a new direct deposit, changing an existing one, or canceling a previous authorization. Include your work phone number, the name of your financial institution, and your account number, ensuring to include any hyphens but omit spaces or special symbols. Select whether your account is a savings or checking account, and fill in the routing transit number, making sure all nine boxes are filled correctly. Finally, sign and date the form to authorize the transactions.

What should I do if I’m unsure about my account or routing number?

If you are uncertain about your account or routing number, it’s best to contact your financial institution directly. They can provide you with the correct information to ensure your direct deposit is set up accurately. Avoid using a deposit slip for verification, as this can sometimes lead to errors. Double-checking with your bank will help prevent any issues with your deposits.

What if my account is a joint account?

If you have a joint account, both account holders must agree to the terms of the direct deposit. This means that the other person listed on the account will need to sign the form as well. This requirement ensures that both parties are aware of and consent to the direct deposit arrangements.

Can I change my direct deposit information after it has been set up?

Yes, you can change your direct deposit information at any time by completing the Generic Direct Deposit form again. Just indicate that you are making a change and fill out the necessary details for your new account or routing number. Be sure to submit the updated form to your employer or the relevant entity to ensure that your future payments are directed to the correct account.

How long does it take for the direct deposit to take effect?

The time it takes for your direct deposit to take effect can vary. Generally, it may take one to two pay cycles for the new deposit information to be processed. It’s a good idea to check with your employer or the organization handling your payments to get a more accurate timeline. During this transition, it’s wise to monitor your account to ensure that deposits are being made correctly.

Dos and Don'ts

When filling out the Generic Direct Deposit form, it's important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do fill in all required boxes completely.

- Do sign and date the form where indicated.

- Do verify your account number with your financial institution.

- Do confirm the routing transit number is correct.

- Do call your financial institution to ensure they accept direct deposits.

- Don't use a deposit slip to verify the routing number.

- Don't leave any boxes blank; all fields must be filled.

- Don't forget to include hyphens in your account number.

- Don't submit the form without the necessary signatures.

- Don't assume your information is correct without double-checking.

Generic Direct Deposit - Usage Steps

Once you have your Generic Direct Deposit form in hand, it's time to fill it out carefully. This form is essential for setting up your direct deposit, ensuring that your funds go directly into your bank account. Follow the steps below to complete the form accurately.

- Write your Last Name, First Name, and Middle Initial in the designated boxes.

- Enter your Social Security Number in the specified format.

- Indicate the Action you are taking: New, Change, or Cancel.

- Fill in the Effective Date for the action you selected.

- Provide your Work Phone number.

- Write the Name of Financial Institution where your account is held.

- Enter your Account Number, making sure to include hyphens and omit any spaces or special symbols.

- Choose the type of account: Savings or Checking.

- Fill in the Routing Transit Number, ensuring all nine boxes are filled correctly. The first two digits must be between 01-12 or 21-32.

- Select the Ownership of Account: Self, Joint, or Other.

- Sign and date the form to authorize the direct deposit.

- If applicable, have the other account holder sign and date the form as well.

After completing the form, double-check all entries for accuracy. It’s advisable to contact your financial institution to confirm they accept direct deposits and verify your account and routing numbers. This step helps to prevent any delays or issues with your deposits.