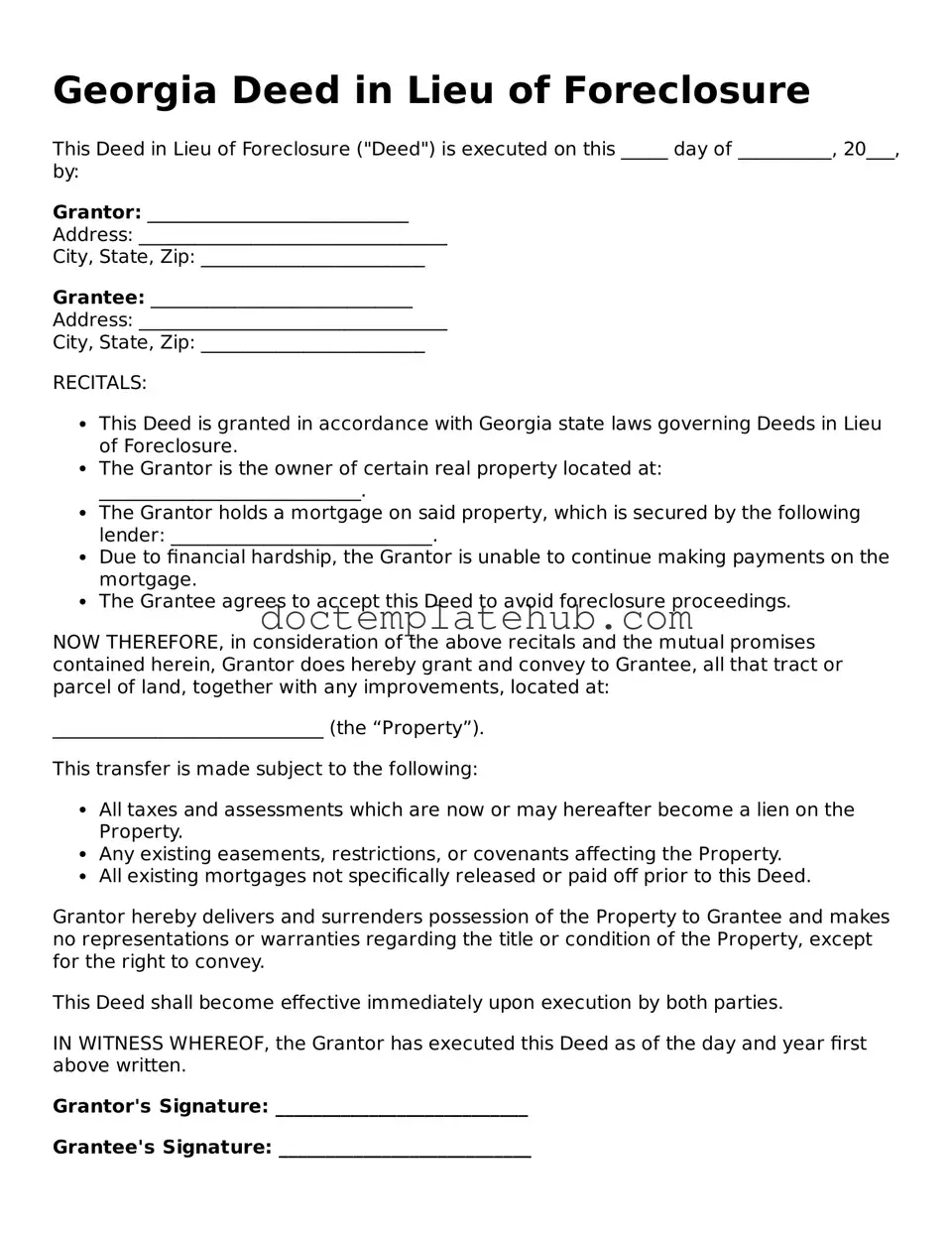

Fillable Deed in Lieu of Foreclosure Template for Georgia State

In the state of Georgia, homeowners facing the possibility of foreclosure may find a valuable alternative in the Deed in Lieu of Foreclosure form. This legal document allows property owners to voluntarily transfer the title of their home back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By opting for this route, homeowners can mitigate the negative impact on their credit scores, while also relieving themselves of the financial burden associated with mortgage payments. The Deed in Lieu of Foreclosure form includes essential details such as the names of the parties involved, a description of the property, and any relevant terms and conditions agreed upon by both the homeowner and the lender. Additionally, it is crucial for homeowners to understand the implications of this decision, including potential tax consequences and the necessity of obtaining lender approval before proceeding. As this option can provide a fresh start for those in financial distress, understanding the intricacies of the form and the overall process is vital for making informed decisions.

Similar forms

A Short Sale Agreement is similar to a Deed in Lieu of Foreclosure in that both processes aim to avoid foreclosure. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with lender approval. This allows the homeowner to settle their debt and move on, while the lender recoups some of their losses. Both options require cooperation from the lender and can provide a more amicable solution than foreclosure.

A Loan Modification Agreement shares similarities with a Deed in Lieu of Foreclosure by addressing financial hardship. In this case, the lender agrees to change the terms of the mortgage to make payments more manageable for the homeowner. This might involve lowering the interest rate or extending the loan term. Like a deed in lieu, this approach aims to keep the homeowner in their property while avoiding the negative consequences of foreclosure.

A Forebearance Agreement also relates closely to a Deed in Lieu of Foreclosure. This document allows a homeowner to temporarily pause mortgage payments during financial difficulties. The lender agrees to postpone the payments for a specified period, enabling the homeowner to recover financially. Both agreements focus on providing relief to the homeowner while maintaining the lender's interests.

A Bankruptcy Filing can be compared to a Deed in Lieu of Foreclosure, as both may provide relief from overwhelming debt. In bankruptcy, individuals can discharge certain debts or create a repayment plan. This legal process can halt foreclosure proceedings and offer a fresh start. While the outcomes differ, both methods aim to address severe financial distress.

A Mortgage Release, or Satisfaction of Mortgage, is another document that resembles a Deed in Lieu of Foreclosure. This document indicates that a mortgage has been paid off or forgiven. In a deed in lieu situation, the homeowner relinquishes the property to the lender, effectively satisfying the mortgage without the foreclosure process. Both documents signify the end of a mortgage obligation.

A Property Settlement Agreement may also be similar to a Deed in Lieu of Foreclosure in certain contexts, especially during divorce proceedings. This agreement outlines how marital property will be divided, which may include the family home. If one party cannot afford the mortgage, they might agree to transfer their interest in the property, similar to a deed in lieu. Both documents facilitate the transfer of property ownership to resolve financial or personal disputes.

In addition to the interactions around foreclosures and mortgage agreements, entities looking to safeguard their confidential dealings may also consider utilizing a New York Non-disclosure Agreement. This legal instrument ensures that sensitive information remains protected during negotiations, preventing unauthorized disclosure of proprietary details. For those interested in drafting such agreements, resources like smarttemplates.net offer valuable templates tailored to specific needs.

An Assignment of Mortgage can be compared to a Deed in Lieu of Foreclosure in that both involve the transfer of ownership rights. In an assignment, the lender transfers the mortgage to another entity. This can occur for various reasons, including selling the loan. While the motivations differ, both documents reflect changes in ownership and responsibility regarding the mortgage.

Finally, a Quitclaim Deed has similarities with a Deed in Lieu of Foreclosure in terms of property transfer. A quitclaim deed allows one party to transfer their interest in a property to another without guaranteeing the title's validity. In a deed in lieu situation, the homeowner transfers their interest to the lender, often without the lengthy foreclosure process. Both documents facilitate the transfer of property rights, albeit under different circumstances.

Other Common State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu of Mortgage - The transaction can be beneficial for lenders as it allows them to quickly take possession of the property with fewer costs.

To further clarify the process of buying a vehicle, it's important to reference the California Vehicle Purchase Agreement, which ensures that both the buyer and seller are on the same page regarding the transaction. You can find a reliable version of this form at documentonline.org/blank-california-vehicle-purchase-agreement, helping to navigate the complexities of the vehicle purchase process effectively.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Borrowers may negotiate with lenders for additional terms when executing a Deed in Lieu.

More About Georgia Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Georgia?

A Deed in Lieu of Foreclosure is an agreement between a homeowner and a lender. In this arrangement, the homeowner voluntarily transfers ownership of the property to the lender to avoid foreclosure. This process can help both parties by simplifying the transition and potentially reducing costs associated with foreclosure proceedings.

What are the benefits of a Deed in Lieu of Foreclosure?

One significant benefit is that it allows homeowners to avoid the lengthy and stressful foreclosure process. It can also help protect your credit score compared to a foreclosure. Additionally, it may provide the lender with a quicker way to recover the property, which can be advantageous for both sides.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically depends on the lender's policies. Generally, homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify. However, the property must be free of other liens, and the homeowner must demonstrate that they have exhausted other options, like loan modifications or short sales.

How does the process work?

The process begins with the homeowner contacting the lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation and the property's status. If approved, the homeowner will sign the necessary documents to transfer ownership. After the transfer, the lender will typically forgive any remaining mortgage debt.

Are there any risks involved?

Yes, there are some risks. While a Deed in Lieu can be less damaging to your credit than foreclosure, it can still impact your credit score. Additionally, if the lender forgives a significant amount of debt, it may result in tax implications for the homeowner. Consulting a tax professional is wise to understand potential consequences.

Can I change my mind after signing the Deed in Lieu?

Once the Deed in Lieu of Foreclosure is signed and recorded, it generally cannot be undone. It’s crucial to ensure that this is the right decision for your situation before proceeding. Take the time to weigh your options and seek professional advice if needed.

What happens to my mortgage after the Deed in Lieu is executed?

After the Deed in Lieu is executed, the mortgage is considered satisfied, and the lender typically releases the homeowner from any further obligations on the loan. However, it's essential to get written confirmation of this from the lender to avoid any future misunderstandings.

Will I receive any cash or compensation for the Deed in Lieu?

In most cases, homeowners do not receive cash or compensation when executing a Deed in Lieu of Foreclosure. The primary purpose of this arrangement is to relieve the homeowner of their mortgage obligation. However, some lenders may offer relocation assistance or other incentives, so it’s worth discussing this with your lender.

How can I find legal assistance for a Deed in Lieu of Foreclosure?

Finding legal assistance is important to navigate the complexities of a Deed in Lieu of Foreclosure. You can start by contacting local legal aid organizations, real estate attorneys, or housing counselors. They can provide guidance tailored to your specific situation and help ensure that your rights are protected throughout the process.

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, it is essential to approach the process with care and attention to detail. Below is a list of actions to take and avoid during this important procedure.

- Do ensure all information is accurate and complete.

- Do consult with a legal professional if you have questions.

- Do provide the necessary documentation to support your application.

- Do keep copies of all documents for your records.

- Don't rush through the form without reviewing it thoroughly.

- Don't omit any required signatures or dates.

- Don't ignore any outstanding liens or obligations related to the property.

- Don't hesitate to seek assistance if you feel overwhelmed by the process.

Taking these steps can help ensure a smoother experience when navigating the complexities of a Deed in Lieu of Foreclosure in Georgia.

Georgia Deed in Lieu of Foreclosure - Usage Steps

After completing the Georgia Deed in Lieu of Foreclosure form, the next steps involve reviewing the document for accuracy, signing it in the presence of a notary, and then submitting it to the appropriate county office for recording. This process ensures that the transfer of property ownership is legally recognized.

- Obtain the Georgia Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the names of the grantor(s) (the property owner) and grantee(s) (the lender or bank).

- Provide the property address and legal description of the property being transferred.

- Indicate the date of the transfer.

- Include any additional terms or conditions, if applicable.

- Sign the form in the designated area. Ensure that all grantors sign if there are multiple owners.

- Have the form notarized by a licensed notary public.

- Make copies of the signed and notarized document for your records.

- Submit the original deed to the appropriate county office for recording.