Fillable Gift Deed Template for Georgia State

The Georgia Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property ownership without monetary exchange. This document outlines the donor's intent to give a gift of real estate to a recipient, known as the grantee. Essential components of the form include the names and addresses of both parties, a clear description of the property being gifted, and the donor's signature. Additionally, the form may require witnesses or notarization to ensure its validity and to safeguard against future disputes. By executing a Gift Deed, the donor relinquishes all rights to the property, while the grantee accepts ownership, making it a straightforward yet powerful means of conveying property. Understanding the nuances of this form is vital for anyone considering a property transfer in Georgia, as it ensures compliance with state laws and protects the interests of both parties involved.

Similar forms

The Georgia Gift Deed form shares similarities with a Warranty Deed. Both documents are used to transfer property ownership, but they serve different purposes. A Warranty Deed guarantees that the seller has clear title to the property and provides protection against any future claims. In contrast, a Gift Deed does not offer such warranties; it simply conveys property as a gift without any exchange of money. Both documents require signatures and must be notarized, ensuring that the transfer is legally binding.

Another document akin to the Gift Deed is the Quitclaim Deed. This type of deed is often used to transfer property between family members or in situations where the granter is unsure of the title's validity. Like the Gift Deed, a Quitclaim Deed does not provide any guarantees about the property’s title. Instead, it transfers whatever interest the granter may have, if any. Both documents are relatively straightforward and can be completed without extensive legal formalities, making them popular for informal property transfers.

Understanding the variety of deed types is essential for anyone involved in real estate transactions, as it helps clarify ownership rights and responsibilities. Each deed serves a distinct purpose in the transfer process, ensuring that parties are aware of their legal obligations. This is akin to the importance of forms in immigration processes, such as the USCIS I-134 form, which can be explored further at https://smarttemplates.net/.

The Special Warranty Deed also bears resemblance to the Gift Deed. This document conveys property while providing limited warranties from the granter. The granter guarantees that they have not encumbered the property during their ownership, but they do not make any promises about previous owners. While the Gift Deed offers no warranties, both documents require a formal transfer process and can be used to convey property to a new owner, albeit with different levels of protection for the recipient.

Lastly, the Bargain and Sale Deed is another document that can be compared to the Gift Deed. This type of deed indicates that the seller has the right to sell the property but does not guarantee that the title is clear. It’s often used in real estate transactions where the buyer is willing to accept some risk. While the Gift Deed is typically used for transfers without monetary exchange, both documents facilitate the transfer of property ownership and require a formal execution process to be valid.

Other Common State-specific Gift Deed Templates

California Gift Deed - There is no limit to the value of property that can be gifted through a Gift Deed, though tax regulations may apply.

Acquiring a reliable Notary Acknowledgement form template is vital for verifying signatory identities, especially in legal contexts where authenticity is paramount. This document facilitates smoother transactions and reinforces trust in the signing process.

More About Georgia Gift Deed

What is a Georgia Gift Deed?

A Georgia Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. The giver, known as the grantor, voluntarily gives the property to the recipient, known as the grantee, as a gift. This deed must be properly executed and recorded to be legally effective.

Who can use a Gift Deed in Georgia?

Any individual who owns property in Georgia can use a Gift Deed to transfer that property to another person. This can include family members, friends, or any other individual. However, it is essential that the grantor has the legal capacity to transfer the property and that the gift is made voluntarily.

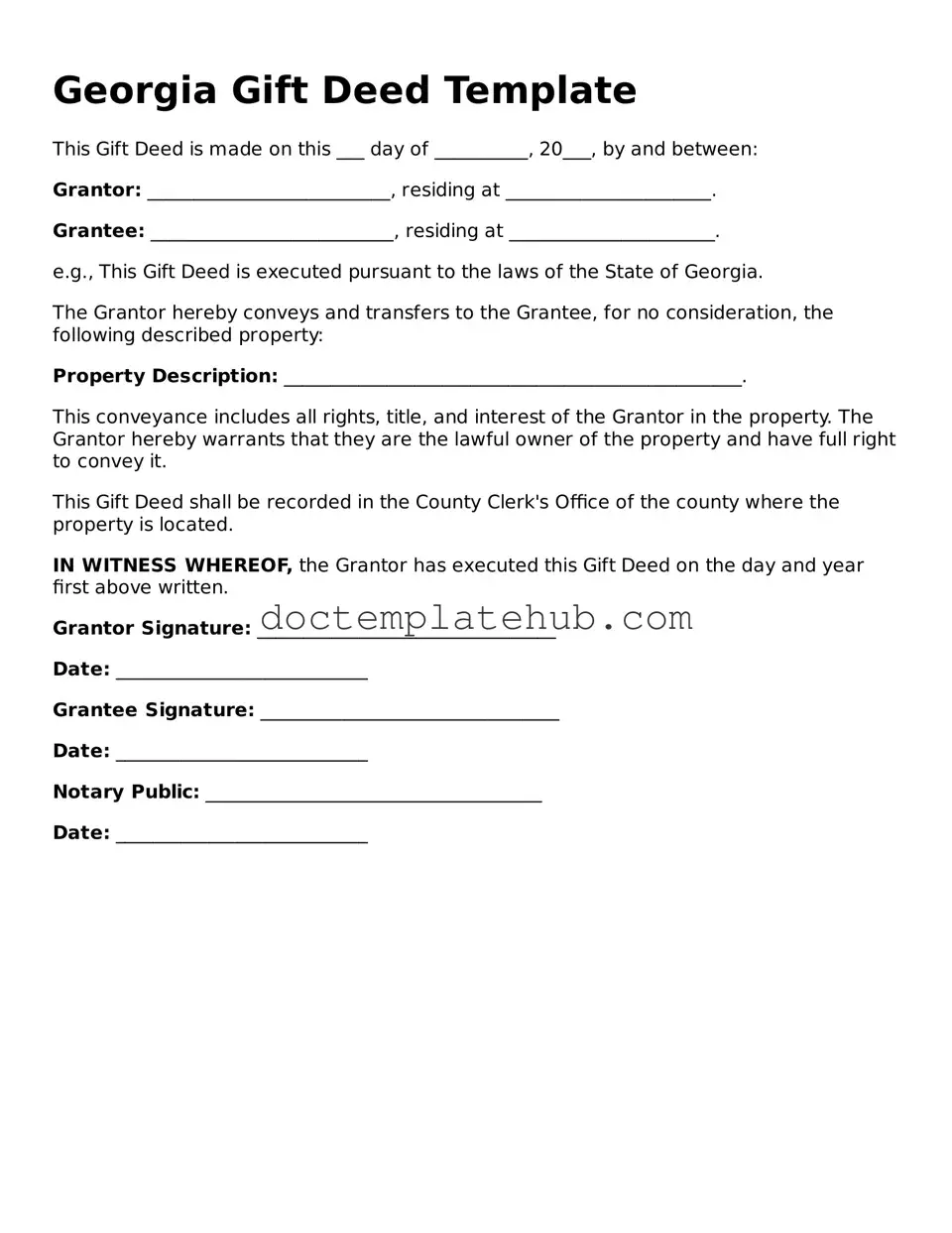

What information is required to complete a Gift Deed?

To complete a Gift Deed, you will need several key pieces of information. This includes the names and addresses of both the grantor and grantee, a legal description of the property being transferred, and the date of the transfer. It's also important to include any specific terms related to the gift, such as whether it is subject to any conditions.

Do I need to have the Gift Deed notarized?

Yes, a Gift Deed must be notarized to be valid in Georgia. The grantor must sign the document in the presence of a notary public, who will then affix their seal. This step ensures that the deed is legally recognized and can be recorded with the county clerk's office.

Are there any tax implications when using a Gift Deed?

Yes, there may be tax implications when transferring property as a gift. The donor may need to file a gift tax return if the value of the property exceeds the annual exclusion limit set by the IRS. Additionally, the recipient may have different tax responsibilities regarding the property. Consulting a tax professional is advisable to understand the specific implications.

How do I record a Gift Deed in Georgia?

To record a Gift Deed in Georgia, you must take the notarized document to the county clerk's office where the property is located. There, you will submit the deed for recording, which may require a small fee. Once recorded, the deed becomes part of the public record, providing legal proof of the transfer of ownership.

Dos and Don'ts

When filling out the Georgia Gift Deed form, it is essential to follow specific guidelines to ensure the document is valid and effective. Here are six important dos and don'ts to consider:

- Do provide accurate information about the property being gifted.

- Do include the full legal names of both the donor and the recipient.

- Do sign the form in the presence of a notary public.

- Do ensure the form is dated correctly.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't forget to record the deed with the county clerk's office after signing.

By adhering to these guidelines, you can facilitate a smoother process in transferring property as a gift in Georgia.

Georgia Gift Deed - Usage Steps

Filling out the Georgia Gift Deed form is an important step in transferring property ownership as a gift. Once the form is completed, it should be signed, notarized, and filed with the appropriate county office to make the transfer official. Below are the steps to guide you through the process of filling out the form.

- Obtain the Form: Download the Georgia Gift Deed form from a reliable source or visit your local county clerk's office to obtain a physical copy.

- Identify the Grantor: Fill in the full name and address of the person giving the gift (the grantor).

- Identify the Grantee: Enter the full name and address of the person receiving the gift (the grantee).

- Describe the Property: Provide a detailed description of the property being gifted, including the address and any relevant legal descriptions.

- State the Consideration: Indicate that the property is being transferred as a gift, specifying that no monetary consideration is involved.

- Sign the Document: The grantor must sign the form in the presence of a notary public.

- Notarization: The notary public will then complete their section, verifying the identity of the grantor and witnessing the signature.

- File the Deed: Submit the completed and notarized Gift Deed to the county clerk’s office where the property is located. Pay any applicable filing fees.

After filing, the deed will be recorded in public records, officially documenting the transfer of property. It is advisable to keep a copy for personal records as well.