Fillable Loan Agreement Template for Georgia State

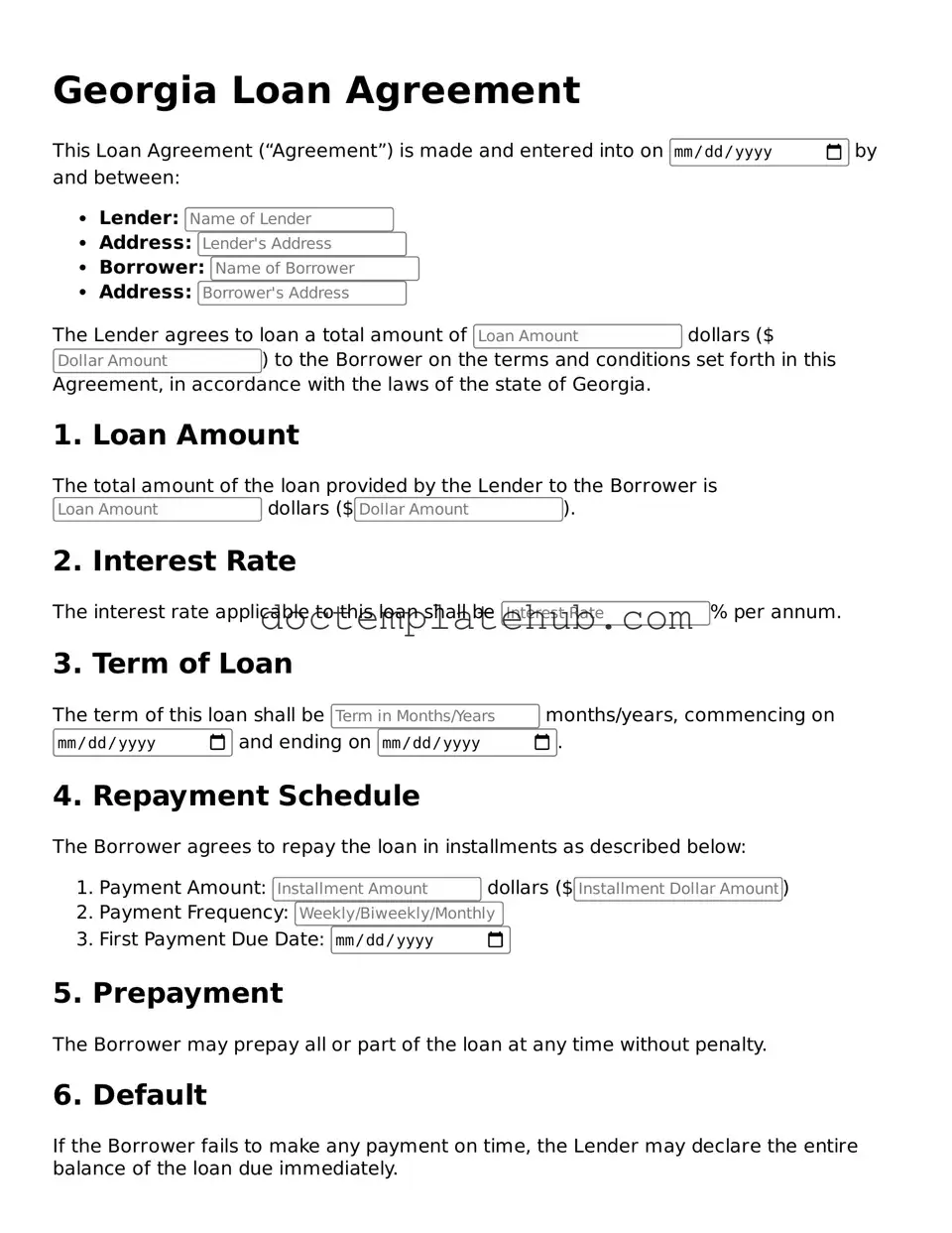

The Georgia Loan Agreement form serves as a crucial document for individuals and businesses seeking to formalize a loan arrangement in the state of Georgia. This form outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It also specifies the rights and responsibilities of both the lender and the borrower, ensuring that both parties have a clear understanding of their obligations. Key elements such as default terms and collateral requirements are also included, providing a comprehensive framework for the loan transaction. By using this form, borrowers can protect their interests while lenders can secure their investment, making it an essential tool for financial agreements in Georgia.

Similar forms

A Promissory Note is a legal document that outlines a borrower's promise to repay a loan. Like a Loan Agreement, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a Promissory Note is often simpler and focuses primarily on the borrower's commitment, without detailing the terms of the loan as thoroughly as a Loan Agreement might.

A Mortgage Agreement is another document that shares similarities with a Loan Agreement. This document secures a loan with real property as collateral. Both agreements outline the terms of the loan, including the amount and repayment plan. However, a Mortgage Agreement specifically addresses the rights and responsibilities regarding the property being used to secure the loan.

In California, when engaging in a vehicle purchase, it is imperative to utilize the California Vehicle Purchase Agreement which not only delineates the terms between buyer and seller but also serves to protect both parties throughout the transaction. For anyone looking to understand this form better, you can find it at documentonline.org/blank-california-vehicle-purchase-agreement, ensuring a smoother and more secure vehicle acquisition process.

A Security Agreement is also comparable to a Loan Agreement. This document grants a lender a security interest in personal property, such as equipment or inventory. Like a Loan Agreement, it specifies terms of repayment and the consequences of default. The key difference lies in the type of collateral involved; a Security Agreement typically deals with personal property rather than real estate.

An Installment Sale Agreement is similar in that it outlines the terms for purchasing property over time. It includes details about payments, interest rates, and the consequences of non-payment. While a Loan Agreement focuses on borrowing money, an Installment Sale Agreement emphasizes the sale of an asset, with the buyer making payments over time.

A Lease Agreement bears similarities to a Loan Agreement as well, particularly when it comes to the payment terms. Both documents outline obligations and rights of the parties involved. However, a Lease Agreement pertains to the rental of property, while a Loan Agreement is focused on borrowing funds with the expectation of repayment.

A Credit Agreement is another document that resembles a Loan Agreement. It outlines the terms under which a lender extends credit to a borrower. Both documents detail interest rates and repayment schedules. However, a Credit Agreement may cover a broader range of financial products, such as lines of credit or revolving credit, rather than a specific loan amount.

A Line of Credit Agreement is similar to a Loan Agreement, as it establishes the terms for borrowing funds. Both documents outline repayment terms and interest rates. The primary distinction is that a Line of Credit allows borrowers to withdraw funds as needed, up to a certain limit, rather than receiving a lump sum upfront.

A Personal Loan Agreement is akin to a Loan Agreement in that it sets forth the terms for borrowing money for personal use. This document specifies the loan amount, interest rate, and repayment schedule. The main difference is that Personal Loan Agreements are often less formal and may not require collateral, unlike many Loan Agreements.

A Business Loan Agreement is comparable to a Loan Agreement but is specifically tailored for business purposes. It outlines the terms of borrowing funds for business operations, including repayment terms and interest rates. Both documents serve to protect the lender's interests while ensuring that the borrower understands their obligations.

A Debt Settlement Agreement shares some similarities with a Loan Agreement, particularly in terms of outlining payment terms. However, this document is used when a borrower negotiates a reduced amount to settle a debt. While a Loan Agreement focuses on the original loan terms, a Debt Settlement Agreement addresses the resolution of outstanding debts.

Other Common State-specific Loan Agreement Templates

Texas Promissory Note Requirements - Important for clarifying interest rates and any applicable fees.

Sample Promissory Note California - May outline borrower’s obligation to keep the lender informed of contact changes.

In addition to clearly outlining the responsibilities of each party, utilizing a Hold Harmless Agreement form can significantly reduce potential disputes and provide peace of mind for those involved. For those interested in accessing a reliable template for such agreements, smarttemplates.net offers easy-to-use resources that can help in drafting customized agreements tailored to specific needs.

Loan Agreement Template Florida - This agreement can prevent misunderstandings between lender and borrower.

More About Georgia Loan Agreement

What is a Georgia Loan Agreement?

A Georgia Loan Agreement is a legal document that outlines the terms and conditions under which one party lends money to another. It includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This agreement helps protect both the lender and the borrower by clearly stating their rights and responsibilities.

Who can use a Georgia Loan Agreement?

Anyone in Georgia who is involved in lending or borrowing money can use this agreement. This includes individuals, businesses, and financial institutions. Whether you are lending to a friend or entering into a business loan, having a written agreement is crucial.

What information should be included in the agreement?

The agreement should include the names and addresses of both parties, the loan amount, the interest rate, the repayment terms, and any fees or penalties for late payments. Additionally, it should specify the purpose of the loan and any collateral that secures the loan.

Is a Georgia Loan Agreement legally binding?

Yes, when properly executed, a Georgia Loan Agreement is legally binding. This means both parties must adhere to the terms outlined in the document. If one party fails to comply, the other party may take legal action to enforce the agreement.

Do I need a lawyer to create a Georgia Loan Agreement?

No, you do not necessarily need a lawyer to create a Georgia Loan Agreement. Many people choose to use templates or online services to draft their agreements. However, if your loan involves a significant amount of money or complex terms, consulting with a lawyer may be beneficial.

Can the terms of the agreement be changed after it is signed?

Yes, the terms can be changed, but both parties must agree to the changes. It is best to document any amendments in writing and have both parties sign the revised agreement to avoid misunderstandings in the future.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing the collateral specified in the agreement. It is essential to understand the consequences of defaulting before entering into a loan agreement.

How is interest calculated in a Georgia Loan Agreement?

Interest can be calculated in various ways, such as simple interest or compound interest. The agreement should clearly state how interest will be calculated and when it will be applied. Understanding this can help both parties manage their financial expectations.

Can I use a Georgia Loan Agreement for personal loans?

Absolutely! A Georgia Loan Agreement can be used for personal loans between friends, family members, or even for personal loans from financial institutions. Having a written agreement helps clarify the terms and protects both parties.

Where can I find a Georgia Loan Agreement template?

You can find templates for Georgia Loan Agreements online. Many legal websites offer free or paid templates that you can customize to fit your needs. Ensure that any template you use complies with Georgia laws and is suitable for your specific situation.

Dos and Don'ts

When filling out the Georgia Loan Agreement form, there are several important steps to follow. Here’s a simple guide to help you navigate the process smoothly.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all numbers and figures for accuracy.

- Do sign and date the form where required.

- Don't leave any fields blank unless specified.

- Don't use abbreviations or shorthand in your answers.

- Don't rush through the process; take your time.

- Don't forget to keep a copy for your records.

By following these guidelines, you can ensure that your Loan Agreement form is completed correctly and efficiently.

Georgia Loan Agreement - Usage Steps

After obtaining the Georgia Loan Agreement form, it is essential to complete it accurately to ensure all parties involved understand their rights and obligations. Following the steps outlined below will help facilitate this process.

- Begin by entering the date at the top of the form. This is the date when the agreement is being executed.

- Provide the names and addresses of both the lender and the borrower. Ensure that all information is spelled correctly.

- Clearly state the loan amount. This should be the total sum being borrowed.

- Specify the interest rate applicable to the loan. This may be a fixed or variable rate.

- Indicate the repayment terms, including the duration of the loan and the frequency of payments (e.g., monthly, quarterly).

- Include any collateral or security being offered for the loan, if applicable. Describe the collateral in detail.

- Outline the consequences of default. This should explain what happens if the borrower fails to make payments.

- Both parties should sign and date the form at the bottom. Signatures should be accompanied by printed names for clarity.

Completing these steps will ensure that the Georgia Loan Agreement form is filled out properly. Once finalized, both parties should retain copies for their records.