Fillable Mobile Home Bill of Sale Template for Georgia State

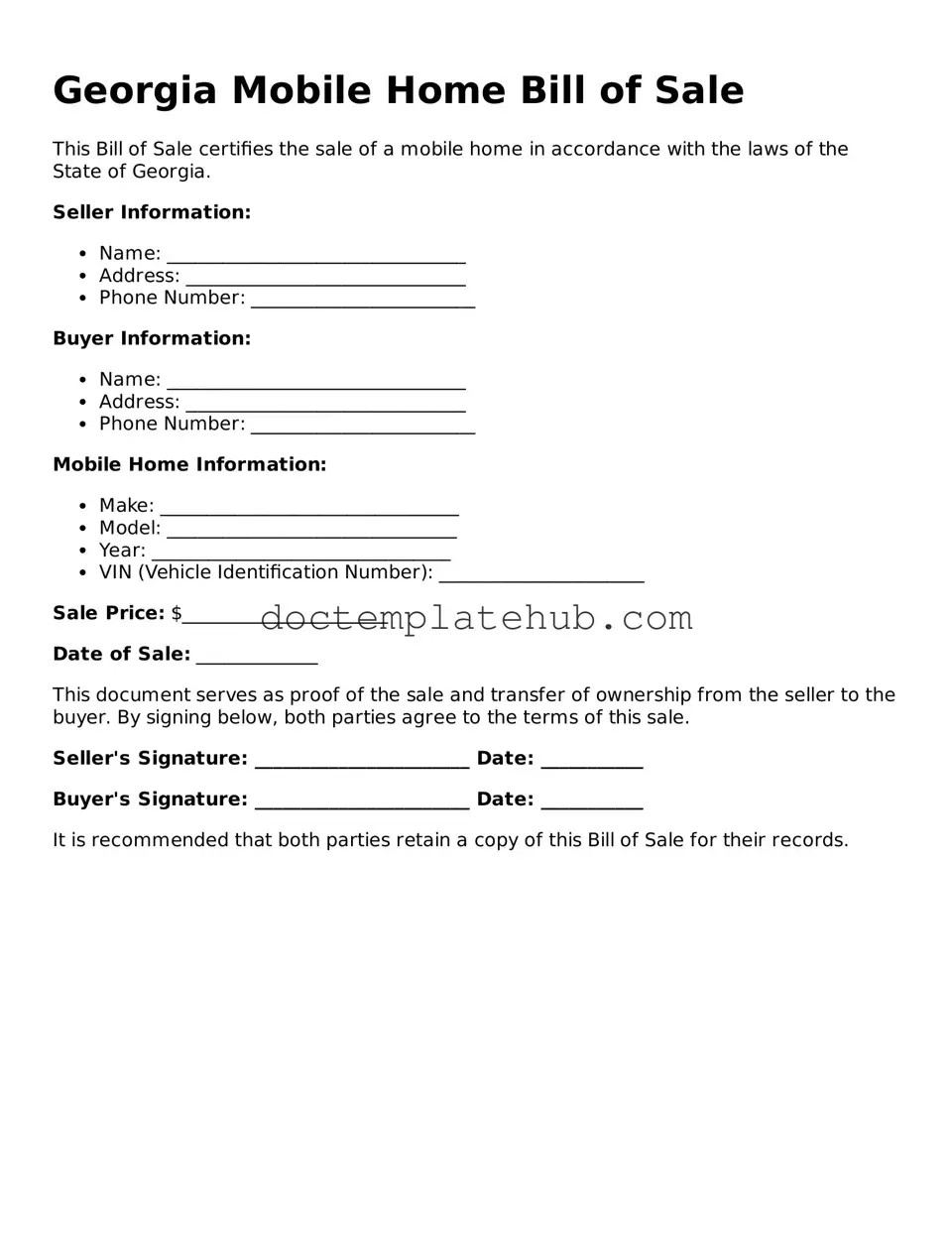

When it comes to buying or selling a mobile home in Georgia, having the right documentation is crucial. The Georgia Mobile Home Bill of Sale form serves as a vital tool in this process, ensuring that both parties are protected and that the transaction is conducted smoothly. This form typically includes essential details such as the names and addresses of the buyer and seller, a description of the mobile home, including its make, model, and identification number, and the sale price. Additionally, it may outline any warranties or representations made by the seller regarding the condition of the mobile home. By completing this form, both parties can establish clear terms of the sale, which helps prevent misunderstandings and disputes down the line. It's not just a piece of paper; it's a safeguard for both the buyer and the seller, making it a fundamental part of any mobile home transaction in Georgia.

Similar forms

The Georgia Mobile Home Bill of Sale form is similar to a standard Vehicle Bill of Sale. Both documents serve to transfer ownership from one party to another. They include essential details such as the buyer and seller's names, contact information, and a description of the item being sold. Just like the Mobile Home Bill of Sale, the Vehicle Bill of Sale also often requires signatures from both parties to validate the transaction, ensuring that both understand the terms of the sale.

Understanding the purpose of a comprehensive Promissory Note form is essential for anyone involved in lending or borrowing money. This document ensures clarity in the repayment process and outlines critical agreements between the parties involved, fostering trust and accountability.

Another document that shares similarities is the Boat Bill of Sale. This form is used to document the sale of a boat, much like the Mobile Home Bill of Sale does for mobile homes. It includes information about the seller and buyer, a detailed description of the boat, and the sale price. Both documents protect the interests of both parties by providing a written record of the transaction, which can be important for future reference or disputes.

The Real Estate Purchase Agreement is another related document. While it typically involves immovable property, its purpose is similar: to outline the terms of a sale. This agreement specifies the parties involved, the property details, and the purchase price. Like the Mobile Home Bill of Sale, it serves as a legal record of the transaction, protecting the rights of both the buyer and seller and detailing any conditions that must be met before the sale is finalized.

Lastly, the Equipment Bill of Sale is akin to the Mobile Home Bill of Sale in that it facilitates the sale of specific items, often machinery or tools. This document outlines the terms of the sale, including the item’s condition, purchase price, and warranties, if any. Both forms ensure that the transaction is documented and that both parties are aware of their rights and responsibilities regarding the sale.

Other Common State-specific Mobile Home Bill of Sale Templates

Ohio Bill of Sale Template - The Mobile Home Bill of Sale may include space for inspection dates and results.

An Operating Agreement form is a crucial document for any Texas-based limited liability company (LLC). This legal document outlines the operating procedures, financial decisions, and various roles within the company. It serves as a foundational guide for the business, ensuring clarity and order in its operations. For more information, you can visit smarttemplates.net.

Mobile Home Bill of Sale - This form can facilitate a smooth transaction, especially for first-time buyers.

More About Georgia Mobile Home Bill of Sale

What is a Georgia Mobile Home Bill of Sale?

A Georgia Mobile Home Bill of Sale is a legal document that records the transfer of ownership of a mobile home from one party to another. This form includes essential details such as the names of the buyer and seller, the mobile home’s identification number, and the purchase price. It serves as proof of the transaction and can be used for registration purposes with the state.

Why do I need a Bill of Sale for a mobile home?

A Bill of Sale is crucial for several reasons. First, it provides a clear record of the transaction, helping to protect both the buyer and seller in case of disputes. Second, it is often required by the state when transferring ownership, as it helps ensure that the mobile home is registered under the new owner’s name. Lastly, it can serve as a reference for tax purposes.

What information is required on the form?

The form typically requires several key pieces of information. You will need to include the names and addresses of both the buyer and seller, the mobile home’s make, model, year, and identification number (often referred to as the VIN). Additionally, the purchase price and the date of the sale should be clearly stated. It’s also advisable to include any terms or conditions related to the sale.

Do I need to have the Bill of Sale notarized?

While notarization is not a strict requirement for a Bill of Sale in Georgia, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent potential disputes in the future. If you choose to notarize the document, both parties should sign it in the presence of the notary.

Can I use a generic Bill of Sale for my mobile home?

While you can use a generic Bill of Sale, it is advisable to use a form specifically designed for mobile homes. A specialized form will include all the necessary details relevant to mobile home transactions, ensuring compliance with state laws. Using the appropriate form can help avoid issues during the transfer process.

What should I do after completing the Bill of Sale?

Once you have completed the Bill of Sale, both the buyer and seller should keep a copy for their records. The seller should provide the original document to the buyer, who will then need to take it to the local county tax office or Department of Revenue to register the mobile home in their name. This step is crucial to ensure that the new owner is recognized legally as the owner of the mobile home.

Are there any fees associated with registering the mobile home?

Yes, there may be fees associated with registering a mobile home in Georgia. These fees can vary by county and may include title fees, registration fees, and taxes. It’s a good idea to check with your local county office for specific amounts and any additional requirements that may apply.

What if I have more questions about the Bill of Sale?

If you have further questions about the Georgia Mobile Home Bill of Sale or the process of transferring ownership, consider reaching out to your local county tax office or a legal professional. They can provide tailored advice and ensure that you have all the necessary information to complete your transaction smoothly.

Dos and Don'ts

When filling out the Georgia Mobile Home Bill of Sale form, attention to detail is crucial. Here are some essential dos and don'ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and identification numbers.

- Do include the correct vehicle identification number (VIN) for the mobile home. This is vital for registration and future transactions.

- Do sign and date the form. Both the seller and buyer should provide their signatures to validate the transaction.

- Do keep a copy of the completed form for your records. This will serve as proof of the sale.

- Don't leave any sections blank. Incomplete forms can lead to delays or complications in the sale process.

- Don't use outdated forms. Always ensure you are using the most current version of the Bill of Sale.

- Don't rush through the process. Take your time to review each section carefully before submission.

- Don't forget to check local regulations. Some counties may have additional requirements for mobile home sales.

Georgia Mobile Home Bill of Sale - Usage Steps

Once you have the Georgia Mobile Home Bill of Sale form ready, you will need to complete it accurately to ensure a smooth transaction. This document will be important for both the seller and the buyer, as it serves as proof of the sale and transfer of ownership. Follow these steps to fill out the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Make sure to include the street address, city, state, and zip code.

- Next, enter the full name and address of the buyer, using the same format as for the seller.

- In the designated section, describe the mobile home being sold. Include details such as the make, model, year, and identification number (VIN).

- Specify the purchase price of the mobile home. Clearly indicate whether this amount is in dollars.

- If applicable, note any terms of the sale, such as payment methods or conditions.

- Both the seller and the buyer must sign and date the form at the bottom. Ensure that both parties have a copy of the completed document for their records.