Fillable Promissory Note Template for Georgia State

In the state of Georgia, a Promissory Note serves as a vital financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This document establishes a clear understanding of the amount borrowed, the interest rate applicable, and the repayment schedule, ensuring that both parties are aware of their obligations. It includes essential details such as the names of the parties involved, the date of the agreement, and any collateral that may secure the loan. Furthermore, the Promissory Note may specify conditions for default and the rights of the lender in such an event, providing a layer of protection for the lender while also offering transparency for the borrower. By clearly defining these terms, the Promissory Note helps to foster trust and accountability in financial transactions, making it a crucial tool for anyone engaging in lending or borrowing activities in Georgia.

Similar forms

The Georgia Promissory Note is similar to a Loan Agreement, which outlines the terms of a loan between a lender and a borrower. Both documents specify the amount borrowed, interest rates, repayment schedules, and consequences of default. A Loan Agreement, however, often includes additional clauses regarding collateral and conditions for disbursement, making it more comprehensive in nature.

Another document closely related to the Promissory Note is the Mortgage Agreement. While a Promissory Note serves as a promise to repay a loan, a Mortgage Agreement secures that loan with real property. In essence, the Mortgage Agreement gives the lender a claim to the property if the borrower fails to repay, adding a layer of security that the Promissory Note alone does not provide.

A Secured Note is also similar to a Promissory Note, as it represents a borrower's promise to repay a loan. The key difference lies in the security interest; a Secured Note is backed by collateral, such as a vehicle or property, which can be claimed by the lender if the borrower defaults. This added security can make it easier for borrowers to obtain loans, as lenders feel more protected.

The Installment Agreement shares similarities with the Promissory Note, particularly in its structure and purpose. Both documents outline a borrower's commitment to repay a debt over time. However, an Installment Agreement often includes specific terms about the frequency and amount of payments, providing a clearer framework for repayment that can benefit both parties.

In addition, the Personal Guarantee is akin to a Promissory Note in that it represents a commitment to repay a debt. However, a Personal Guarantee is typically signed by a third party, often a business owner, who agrees to be responsible for the debt if the primary borrower defaults. This document adds an extra layer of security for lenders, as it broadens the potential for recovery in case of non-payment.

The Chick-fil-A job application form is a fundamental document used by individuals seeking employment at the popular fast-food chain. This form collects essential information about applicants, including their work history and availability. Completing it accurately is the first step toward joining a team known for its commitment to customer service and community involvement. For those interested in applying, you can access the application form at documentonline.org/blank-chick-fil-a-job-application/.

The Demand Note is another document that bears resemblance to the Promissory Note. Both serve as written promises to repay a loan, but a Demand Note allows the lender to request repayment at any time. This flexibility can be advantageous for lenders, but it may create uncertainty for borrowers regarding when they need to repay the loan.

A Business Loan Agreement is similar to a Promissory Note, especially when it comes to financing for businesses. Both documents outline the terms of borrowing and repayment. However, a Business Loan Agreement typically includes more detailed terms and conditions, such as covenants that the business must adhere to during the loan period, which can protect the lender's interests more effectively.

The Credit Agreement is also akin to a Promissory Note, as it establishes the terms under which credit is extended. However, a Credit Agreement is often broader in scope, covering various aspects of the credit relationship, including fees, interest rates, and repayment terms. This comprehensive nature allows lenders to manage risks more effectively while providing borrowers with a clearer understanding of their obligations.

Finally, the Loan Modification Agreement shares similarities with a Promissory Note in that it addresses the terms of a loan. However, this document is specifically used to alter the original terms of a loan, such as interest rates or repayment schedules. This can be crucial for borrowers facing financial difficulties, allowing them to renegotiate terms while still honoring their original debt commitment.

Other Common State-specific Promissory Note Templates

Ohio Promissory Note Requirements - Every promissory note should be dated and signed to make it valid.

To further clarify the implications of the New York Room Rental Agreement, it is highly advisable for both landlords and tenants to consult resources that provide comprehensive insights about this document. One such resource can be found at smarttemplates.net, where users can access a fillable template that simplifies the agreement process and ensures all critical elements are included.

Promissory Note Template Arizona - Promissory notes can be secured or unsecured, depending on the agreement.

More About Georgia Promissory Note

What is a Georgia Promissory Note?

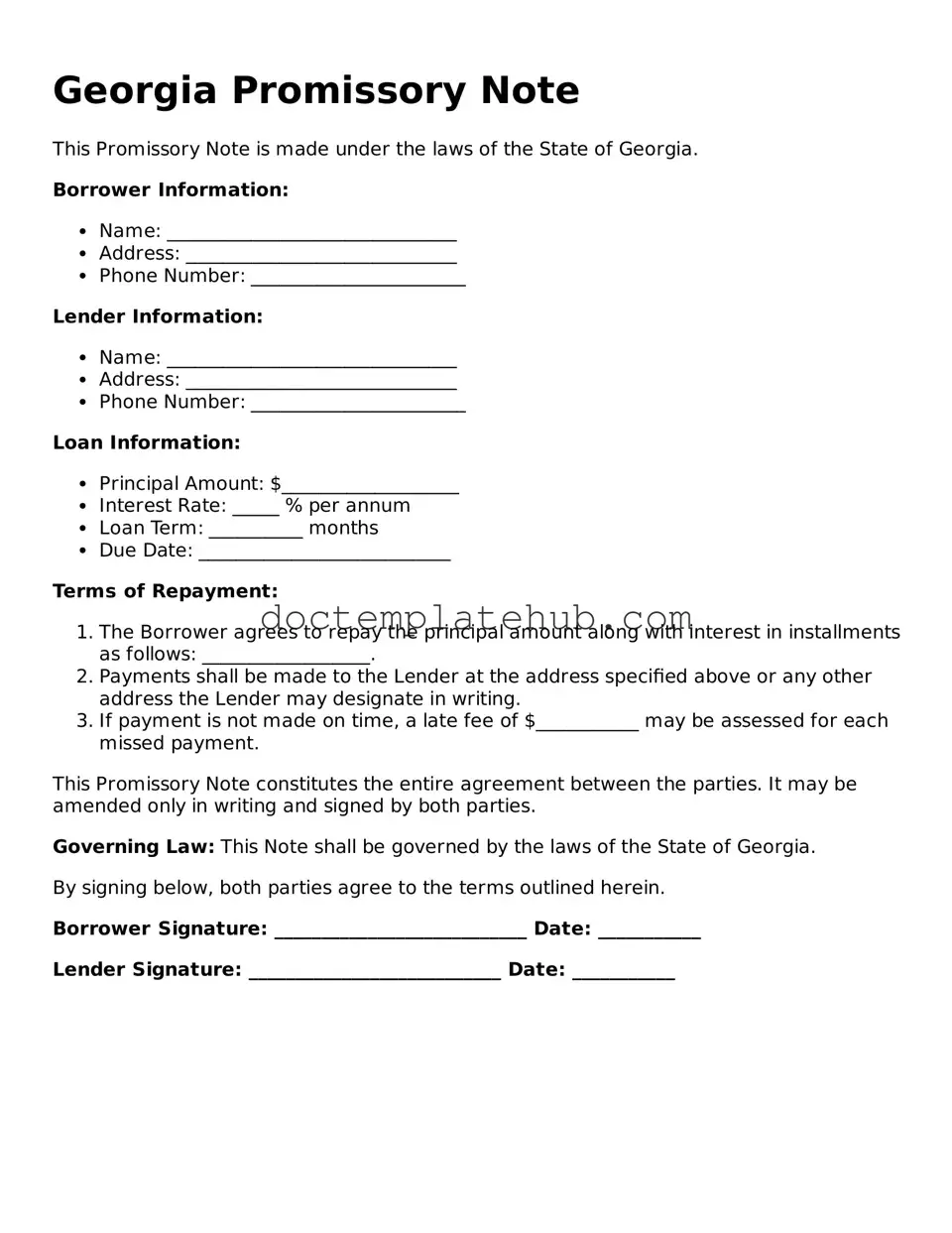

A Georgia Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It specifies the amount borrowed, the interest rate, the repayment schedule, and any other terms agreed upon by both parties. This document serves as a record of the debt and can be enforced in a court of law if necessary.

Who can use a Promissory Note in Georgia?

Any individual or business can use a Promissory Note in Georgia. This includes personal loans between friends or family, as well as formal loans from banks or financial institutions. Both the lender and borrower must agree to the terms outlined in the note for it to be valid.

What are the essential elements of a Georgia Promissory Note?

A valid Promissory Note in Georgia must include several key elements: the names of the borrower and lender, the principal amount, the interest rate (if applicable), the repayment schedule, and the maturity date. Additionally, it should outline any penalties for late payments or default. Clarity in these terms is crucial for enforcement.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. Once signed by both parties, it creates an obligation for the borrower to repay the debt under the terms specified. If the borrower fails to comply, the lender has the right to take legal action to recover the owed amount.

Do I need to have the Promissory Note notarized?

While notarization is not strictly required for a Promissory Note to be valid in Georgia, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes regarding its validity in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They can initiate legal proceedings to recover the owed amount, which may include filing a lawsuit. The terms of the Promissory Note will dictate the specific remedies available to the lender, including potential penalties or fees associated with the default.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

Dos and Don'ts

When filling out the Georgia Promissory Note form, it’s crucial to pay attention to detail. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank.

- Do include the correct date when signing the note.

- Don't use vague language; be specific about the terms.

- Do clearly state the amount being borrowed.

- Don't forget to include the interest rate, if applicable.

- Do sign the document in the designated area.

- Don't use correction fluid or erasers on the form.

- Do keep a copy of the signed note for your records.

- Don't rush through the process; take your time to ensure accuracy.

Georgia Promissory Note - Usage Steps

Once you have the Georgia Promissory Note form in hand, you can begin filling it out. This form is essential for documenting a loan agreement between a borrower and a lender. Ensure you have all necessary information ready before you start, as this will help streamline the process.

- Begin by entering the date at the top of the form. This should reflect the date when the agreement is being made.

- Next, fill in the name and address of the borrower. Make sure to include the full legal name and the complete address.

- Then, provide the lender's name and address in the designated section. Again, use the full legal name and complete address.

- Specify the principal amount of the loan in the appropriate field. This is the total amount being borrowed.

- Indicate the interest rate, if applicable. This should be clearly stated as an annual percentage rate.

- Next, outline the repayment terms. Include the payment schedule, such as monthly or bi-weekly payments, and the duration of the loan.

- If there are any late fees or penalties for missed payments, list those terms in the specified section.

- Sign and date the form at the bottom. The borrower should sign first, followed by the lender. Both parties should keep a copy of the signed document for their records.

After completing the form, ensure that both parties understand the terms outlined. It’s advisable to keep a copy of the signed document in a safe place. This will serve as a reference in case any questions arise in the future.