Fillable Quitclaim Deed Template for Georgia State

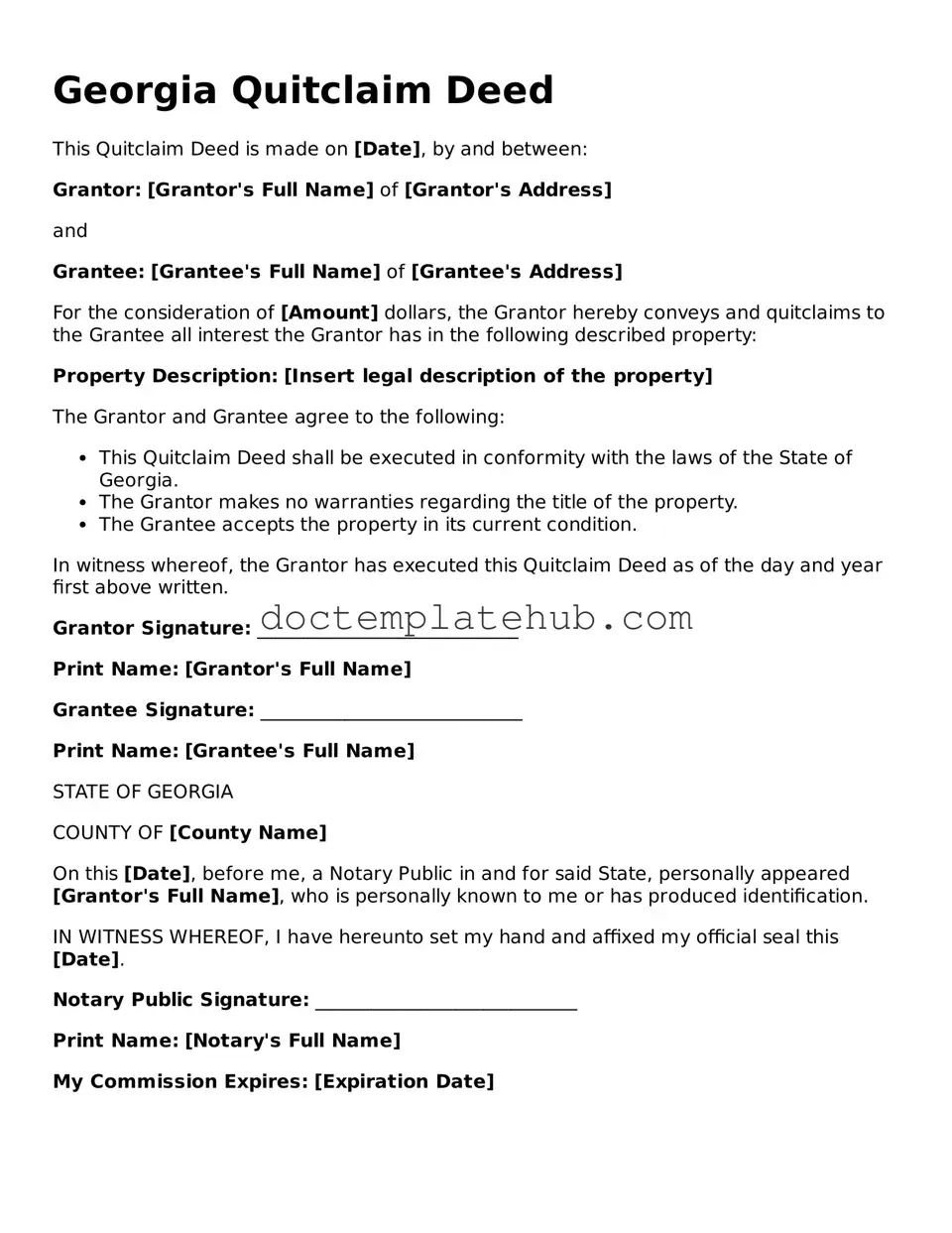

The Georgia Quitclaim Deed form serves as a crucial legal instrument for property owners wishing to transfer their interest in real estate without making any guarantees regarding the title. This form is particularly useful in situations where the parties involved are familiar with each other, such as family members or friends, as it simplifies the transfer process by relinquishing any claim the grantor may have on the property. Key elements of the form include the identification of the parties involved, a clear description of the property being transferred, and the signature of the grantor. Additionally, the Quitclaim Deed must be properly notarized to ensure its validity and to provide a public record of the transaction. While this form does not offer the protections that a warranty deed provides, it remains a popular choice for quick and uncomplicated property transfers in Georgia. Understanding its purpose and requirements can help individuals navigate the complexities of real estate transactions with greater ease.

Similar forms

A Warranty Deed is a document that guarantees the grantor holds clear title to a property and has the right to sell it. Unlike a Quitclaim Deed, which transfers whatever interest the grantor has without any warranties, a Warranty Deed provides assurances to the buyer that there are no hidden claims against the property. This makes it a more secure option for buyers, as it protects them from potential disputes regarding ownership or liens that may arise after the sale. The presence of warranties can offer peace of mind, ensuring that the buyer can fully enjoy their new property without unexpected legal issues.

A Grant Deed is another document that shares similarities with the Quitclaim Deed. It conveys property ownership from one party to another but typically includes certain implied warranties. These warranties assure the buyer that the property has not been sold to anyone else and that it is free from undisclosed encumbrances. While a Quitclaim Deed simply transfers whatever interest the grantor has, a Grant Deed provides a bit more security for the buyer, making it a preferred choice in many real estate transactions.

An Affidavit of Title is a document used to confirm the ownership of a property and the absence of any liens or claims against it. Although it serves a different purpose than a Quitclaim Deed, it can be used in conjunction with it. When a seller provides an Affidavit of Title, they affirm that they have the right to transfer the property and that there are no pending legal issues. This added layer of assurance can be beneficial for buyers, as it complements the transfer of ownership that occurs with a Quitclaim Deed.

Other Common State-specific Quitclaim Deed Templates

Quit Claim Deed Form Arizona - Can be used to change the name on a property title.

Texas Quit Claim Deed Pdf - This deed can quickly change property ownership between parties.

More About Georgia Quitclaim Deed

What is a Quitclaim Deed in Georgia?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property’s title. In Georgia, this means that the person transferring the property (the grantor) relinquishes any claim they may have to the property, but does not guarantee that they actually own it or that there are no other claims against it. This type of deed is often used between family members or in situations where the parties know each other well, as it offers a simpler process for transferring property rights.

How do I complete a Quitclaim Deed in Georgia?

To complete a Quitclaim Deed in Georgia, you will need to gather some essential information. This includes the names and addresses of both the grantor (the person giving up the property) and the grantee (the person receiving the property). You will also need to provide a legal description of the property, which can typically be found in the property's current deed or tax records. After filling out the form, both parties must sign it in the presence of a notary public. It’s crucial to ensure that the deed is properly executed, as any mistakes can lead to complications later on.

Do I need to file the Quitclaim Deed with the county?

Yes, in Georgia, it is important to file the Quitclaim Deed with the appropriate county clerk’s office where the property is located. This step is necessary to make the transfer of ownership official and to protect the rights of the new owner. After filing, you should request a copy of the recorded deed for your records. This documentation serves as proof of the transfer and may be needed for future transactions or legal matters related to the property.

Are there any tax implications when using a Quitclaim Deed in Georgia?

Using a Quitclaim Deed may have tax implications, particularly in terms of property taxes and potential capital gains taxes. In Georgia, the transfer of property through a Quitclaim Deed typically does not trigger a transfer tax, but it’s wise to consult with a tax professional to understand any potential liabilities. Additionally, if the property is sold later, the new owner may be responsible for capital gains taxes based on the property's appreciated value. Being informed about these aspects can help you make better decisions regarding property transfers.

Dos and Don'ts

When filling out the Georgia Quitclaim Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are six things to do and not do:

- Do provide accurate property information, including the legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the form in front of a notary public.

- Do double-check for any spelling errors in names and addresses.

- Don't leave any sections of the form blank.

- Don't forget to file the completed deed with the county clerk’s office.

Georgia Quitclaim Deed - Usage Steps

Once you have the Georgia Quitclaim Deed form in hand, it's important to fill it out accurately to ensure a smooth transfer of property. After completing the form, you will need to have it signed in front of a notary public. This step is crucial, as it adds a layer of authenticity to the document. Following notarization, you will file the deed with the appropriate county office to finalize the transfer.

- Begin by writing the date at the top of the form.

- In the section labeled "Grantor," enter the full name of the person transferring the property.

- Next, in the "Grantee" section, fill in the full name of the person receiving the property.

- Provide the property address in the designated area, including the city, state, and ZIP code.

- Include a legal description of the property. This can often be found on the original deed or property tax records.

- Indicate the consideration amount, which is the value exchanged for the property, typically written in both words and numbers.

- Sign the form in the presence of a notary public. Make sure all signatures are clear and legible.

- After notarization, make copies of the completed deed for your records.

- Finally, file the original Quitclaim Deed with the county clerk's office where the property is located.