Fillable Transfer-on-Death Deed Template for Georgia State

The Georgia Transfer-on-Death Deed (TOD) form is a powerful tool for property owners who wish to ensure a smooth transfer of their real estate upon death, without the need for probate. This legal document allows individuals to designate one or more beneficiaries who will automatically receive the property title when the owner passes away. By utilizing the TOD deed, property owners can maintain full control over their property during their lifetime, while also simplifying the transfer process for their heirs. The form must be properly executed and recorded to be effective, ensuring that the intended beneficiaries are legally recognized. It is crucial to understand the implications of this deed, including how it affects property ownership and the rights of the beneficiaries. Additionally, property owners should be aware of any potential tax consequences and how the TOD deed interacts with other estate planning tools. Overall, the Georgia Transfer-on-Death Deed serves as a practical solution for those looking to streamline the transfer of their real estate assets while minimizing complications for their loved ones.

Similar forms

The Georgia Transfer-on-Death Deed is similar to a Will in that both documents are used to transfer property upon the death of the owner. A Will outlines how a person's assets should be distributed after their passing. However, unlike a Will, which must go through probate, a Transfer-on-Death Deed allows property to pass directly to the designated beneficiary without the need for probate court involvement. This makes the Transfer-on-Death Deed a quicker and often less expensive option for transferring property after death.

An Affidavit of Heirship is another document that shares similarities with the Transfer-on-Death Deed. This affidavit is used to establish the identity of heirs when someone dies without a Will. While the Transfer-on-Death Deed clearly designates who will receive the property, the Affidavit of Heirship serves to clarify and confirm the rightful heirs, especially in cases where the deceased did not leave behind a legal document outlining their wishes. Both documents aim to facilitate the transfer of property but approach it from different angles.

The Quitclaim Deed is another document that functions similarly to the Transfer-on-Death Deed. A Quitclaim Deed is used to transfer ownership of property without guaranteeing that the title is clear or free of claims. This document can be useful for transferring property between family members or in divorce settlements. While a Quitclaim Deed can transfer property rights, the Transfer-on-Death Deed specifically addresses the transfer of property upon death and ensures that the beneficiary receives the property without the complications of probate.

A Revocable Living Trust is another document that provides a way to manage and transfer assets, similar to the Transfer-on-Death Deed. With a Revocable Living Trust, a person can place their assets into the trust while retaining control over them during their lifetime. Upon their death, the assets in the trust can be distributed according to the terms outlined in the trust document, avoiding probate. Both the Revocable Living Trust and the Transfer-on-Death Deed aim to streamline the process of transferring property, but they operate under different frameworks.

The General Power of Attorney can also be considered similar in some respects. This document allows an individual to appoint someone else to make decisions on their behalf, including decisions related to property. While it does not directly transfer property upon death, it can be used to manage a person's assets while they are alive. The Transfer-on-Death Deed, in contrast, specifically focuses on the transfer of property after death, providing clarity and direction for beneficiaries.

The Beneficiary Designation form is another document that shares a purpose with the Transfer-on-Death Deed. This form is often used for financial accounts, insurance policies, and retirement plans to designate who will receive the assets upon the account holder's death. Like the Transfer-on-Death Deed, it allows for a direct transfer of assets without going through probate. Both documents simplify the process of transferring ownership and ensure that the intended beneficiaries receive their inheritance smoothly.

The Joint Tenancy with Right of Survivorship is another method of property ownership that is similar to the Transfer-on-Death Deed. In a joint tenancy arrangement, two or more individuals own property together, and when one owner dies, their share automatically passes to the surviving owner(s). This method avoids probate, much like the Transfer-on-Death Deed. However, the key difference lies in the fact that joint tenancy requires multiple owners from the outset, while the Transfer-on-Death Deed can be executed by a single property owner who wishes to designate a beneficiary.

In understanding the various estate planning tools available, it's important to recognize that a Hold Harmless Agreement form, like the ones used in Texas, serves to protect parties involved in transactions that may carry inherent risks. This form ensures that one party will not hold the other liable for any inadvertent injuries or damages sustained during certain activities, echoing the importance of legal security that many estate planning documents attempt to provide. For further insights on related legal forms, you can visit smarttemplates.net.

Lastly, a Warranty Deed is a document that conveys property ownership and guarantees that the title is clear. While it is primarily used for transferring property during a person's lifetime, it shares the goal of transferring property rights. However, the Warranty Deed does not address what happens after the owner’s death, unlike the Transfer-on-Death Deed, which is specifically designed to facilitate the transfer of property upon death without the complications of probate.

Other Common State-specific Transfer-on-Death Deed Templates

What Are the Disadvantages of a Transfer on Death Deed? - It is important for all named beneficiaries to be aware of the deed and their future rights to the property.

The EDD DE 2501 form is not only vital for securing temporary disability benefits in California, but it's also important to familiarize yourself with the specific details involved in its completion. For more information, you can visit https://documentonline.org/blank-edd-de-2501, which provides resources that clarify the requirements and help streamline the application process.

Tod in California - Make sure to properly identify the property in the deed to avoid confusion later.

More About Georgia Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Georgia to transfer their real estate to designated beneficiaries upon their death. This deed does not take effect until the owner passes away, allowing the owner to retain full control of the property during their lifetime.

Who can use a Transfer-on-Death Deed?

Any property owner in Georgia can use a TOD Deed, provided they are of sound mind and legal age. This includes individuals who own real estate solely or as joint tenants with rights of survivorship.

What types of property can be transferred using a TOD Deed?

In Georgia, a TOD Deed can be used to transfer real estate, including residential homes, commercial properties, and vacant land. However, it cannot be used for personal property, such as vehicles or bank accounts.

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, the property owner must complete the appropriate form, which includes information about the property and the designated beneficiaries. The deed must then be signed by the owner in the presence of a notary public and recorded with the county's clerk of court where the property is located.

Is there a fee to record a Transfer-on-Death Deed?

Yes, there is typically a fee for recording a TOD Deed. The fee may vary by county, so it is advisable to check with the local clerk of court's office for the exact amount. This fee is usually a small percentage of the property’s value.

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, the property owner can change or revoke a TOD Deed at any time before their death. To do this, the owner must create a new deed or file a revocation document with the same county clerk where the original deed was recorded.

What happens if the beneficiary predeceases the property owner?

If a designated beneficiary dies before the property owner, the TOD Deed does not automatically transfer the property to that beneficiary’s heirs. Instead, the property will remain part of the owner's estate and can be transferred according to the owner’s will or state intestacy laws.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a TOD Deed. However, the property may be subject to estate taxes upon the owner's death, depending on the total value of the estate. It is advisable to consult a tax professional for specific guidance.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney to create a TOD Deed, consulting one is recommended. An attorney can help ensure that the deed is correctly completed and complies with Georgia laws, reducing the risk of future disputes.

Can a Transfer-on-Death Deed be contested?

Yes, a TOD Deed can be contested, just like any other estate planning document. Disputes may arise if there are claims of undue influence, lack of capacity, or if the deed was not properly executed. In such cases, legal action may be necessary to resolve the issues.

Dos and Don'ts

When filling out the Georgia Transfer-on-Death Deed form, it’s important to follow specific guidelines to ensure everything is completed correctly. Here’s a helpful list of what to do and what to avoid.

- Do: Provide accurate information about the property, including the full legal description.

- Do: Include the names and addresses of all beneficiaries clearly.

- Do: Sign the deed in front of a notary public to validate it.

- Do: Ensure the deed is recorded in the appropriate county office where the property is located.

- Do: Keep a copy of the completed deed for your records.

- Do: Consult with a legal professional if you have questions about the process.

- Don't: Leave any blank spaces on the form; it could lead to complications.

- Don't: Forget to double-check the spelling of names and addresses.

- Don't: Use outdated forms; always use the most current version available.

- Don't: Attempt to fill out the form without understanding the implications of a Transfer-on-Death Deed.

- Don't: Neglect to inform your beneficiaries about the deed and its contents.

- Don't: Assume that verbal agreements about the property will suffice; everything must be in writing.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed properly and serves its intended purpose. Remember, taking the time to do it right can save you and your loved ones from potential issues down the road.

Georgia Transfer-on-Death Deed - Usage Steps

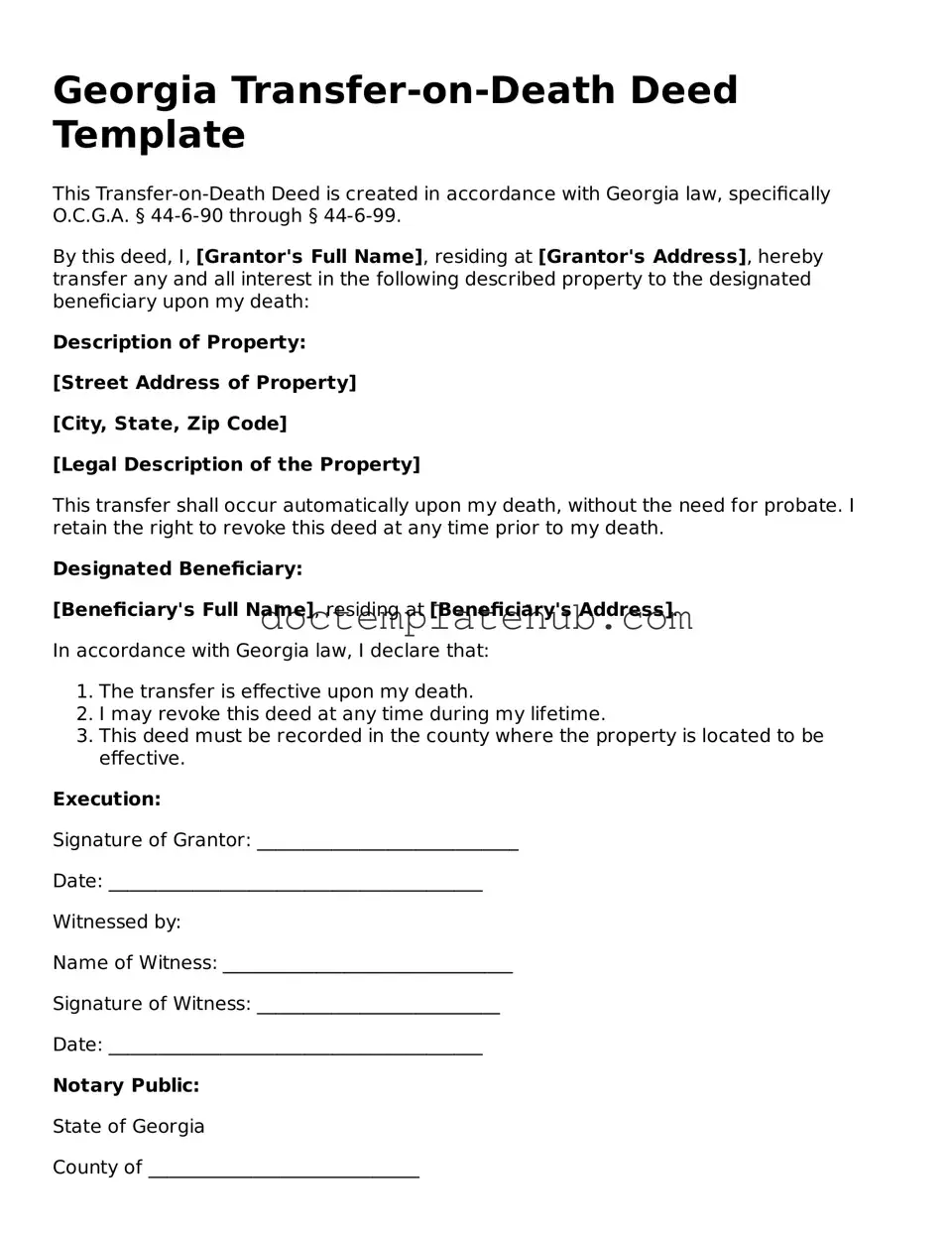

Filling out the Georgia Transfer-on-Death Deed form is a straightforward process. Once completed, this form allows you to designate a beneficiary who will receive your property upon your death, bypassing the probate process. Follow the steps below to ensure that you fill out the form accurately.

- Begin by downloading the Georgia Transfer-on-Death Deed form from a reliable source.

- Fill in your name and address in the designated section. This information identifies you as the owner of the property.

- Provide a complete legal description of the property you wish to transfer. This includes the address and any parcel number.

- Next, enter the name and address of the beneficiary. This is the person who will inherit the property.

- Indicate whether the beneficiary is a single person or multiple people. If multiple, specify how the property will be divided.

- Sign the form in front of a notary public. Your signature must be notarized to ensure its validity.

- File the completed deed with the county clerk’s office in the county where the property is located. Ensure you keep a copy for your records.

After you have filed the form, it is important to confirm that it has been recorded properly. This will help prevent any potential disputes regarding the property in the future.