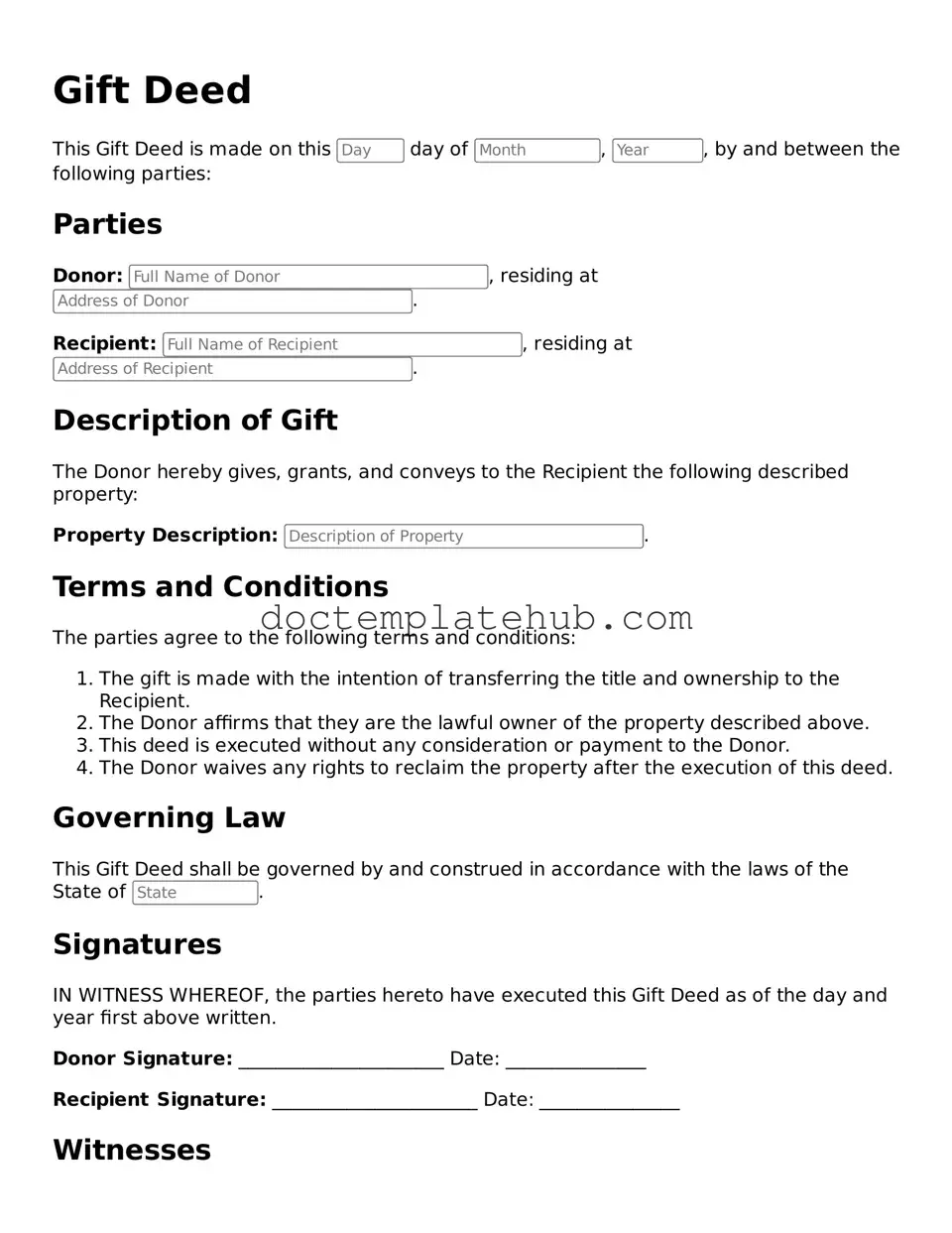

Official Gift Deed Form

The Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property or assets without any exchange of monetary compensation. This document formalizes the intent of the donor, who voluntarily offers a gift to the recipient, often referred to as the donee. Essential elements of a Gift Deed include the identification of both parties, a clear description of the property being gifted, and the explicit intention to make a gift. In many jurisdictions, the form must be executed with certain formalities, such as signatures and, in some cases, notarization, to ensure its validity. Additionally, the Gift Deed may outline any conditions or restrictions associated with the gift, which can affect how the recipient may use or transfer the property in the future. Understanding the implications of a Gift Deed is vital, as it not only affects the immediate parties involved but can also have tax consequences and impact estate planning. By grasping the nuances of this form, individuals can navigate the complexities of property transfer more effectively.

Similar forms

A Gift Deed is often compared to a Quitclaim Deed, as both documents transfer ownership of property. A Quitclaim Deed is typically used to relinquish any claim to a property without guaranteeing that the title is clear. In contrast, a Gift Deed specifically conveys property as a gift, meaning there is no exchange of money involved. Both documents require the signature of the grantor, but a Gift Deed may include additional language to confirm that the transfer is indeed a gift, highlighting the intention behind the transaction.

Another document similar to a Gift Deed is a Warranty Deed. Like a Gift Deed, a Warranty Deed transfers ownership of property. However, a Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. This type of deed offers more protection to the grantee because it assures them that they will not face legal issues related to the title. While both deeds accomplish the transfer of property, the Warranty Deed includes warranties that the Gift Deed does not.

When engaging in vehicle transactions, it’s beneficial to utilize a well-structured contract, such as the California Vehicle Purchase Agreement, which delineates essential aspects of the sale between buyer and seller. This document ensures clarity regarding terms and conditions, contributing to a smooth transaction process. For further information and access to this form, you can visit https://documentonline.org/blank-california-vehicle-purchase-agreement/.

A Trust Deed also shares similarities with a Gift Deed. A Trust Deed is used in real estate transactions to secure a loan, where the property serves as collateral. In some cases, property can be placed into a trust as a gift, where the grantor retains certain rights while transferring ownership to the trust. The key difference lies in the purpose: a Gift Deed is for transferring property outright without compensation, while a Trust Deed involves securing a financial obligation. Both documents require careful consideration of the grantor's intentions and the rights of the grantee.

Finally, a Bill of Sale is another document that resembles a Gift Deed in its purpose of transferring ownership. While a Gift Deed pertains specifically to real estate, a Bill of Sale is used for personal property, such as vehicles or furniture. Both documents can be used to document a gift, but a Bill of Sale is typically simpler and may not require the same level of detail or formalities as a Gift Deed. Regardless of the type of property involved, both documents serve to clarify the transfer of ownership and the intentions of the parties involved.

State-specific Guides for Gift Deed Forms

Fill out Common Types of Gift Deed Templates

Printable Quitclaim Deed - This deed does not involve a sales transaction.

A Hold Harmless Agreement form in New York is a legal document that one party uses to protect themselves from any liability or harm caused by another party during their interaction. This form is frequently utilized in various types of business dealings, property use, and service provision to ensure that potential legal and financial responsibilities are clearly outlined and assigned. For those looking to draft such a document, resources like smarttemplates.net can be invaluable in managing risk and ensuring compliance.

Does California Have a Transfer on Death Deed - This deed may provide peace of mind regarding your estate.

More About Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. It is a way to give a gift formally and ensures that the transfer is recognized by law.

Who can create a Gift Deed?

Any individual who is the legal owner of a property or asset can create a Gift Deed. The person giving the gift is known as the donor, while the person receiving the gift is referred to as the donee.

What types of property can be transferred using a Gift Deed?

A Gift Deed can be used to transfer various types of property, including real estate, vehicles, bank accounts, and personal belongings. However, certain restrictions may apply depending on local laws.

Is a Gift Deed legally binding?

Yes, a Gift Deed is legally binding once it is properly executed and signed by both the donor and donee. It is important to follow the legal requirements specific to your state to ensure the deed is enforceable.

Do I need to pay taxes on a Gift Deed?

Gift taxes may apply depending on the value of the gift and the relationship between the donor and donee. It is advisable to consult with a tax professional to understand any potential tax implications.

What are the requirements for a valid Gift Deed?

To create a valid Gift Deed, it must be in writing, signed by the donor, and delivered to the donee. In some cases, witnesses or notarization may also be required to ensure validity.

Can a Gift Deed be revoked?

Generally, once a Gift Deed is executed and delivered, it cannot be revoked. However, certain conditions or circumstances may allow for revocation. It is essential to consult legal advice if revocation is being considered.

How do I create a Gift Deed?

Creating a Gift Deed typically involves drafting the document, including details about the donor, donee, property being gifted, and any conditions of the gift. After drafting, both parties should sign the deed, and it may need to be notarized or witnessed depending on state requirements.

Can a Gift Deed include conditions?

Yes, a Gift Deed can include specific conditions or terms that the donee must fulfill. However, these conditions must be clear and lawful to be enforceable.

What happens if the donee refuses the gift?

If the donee refuses the gift, the Gift Deed may be considered void. The donor may then retain ownership of the property or asset. It's recommended to document any refusal in writing to avoid future disputes.

Dos and Don'ts

When filling out a Gift Deed form, attention to detail is crucial. Here are five things to do and five things to avoid.

Things You Should Do:

- Provide accurate information about the donor and recipient.

- Clearly describe the property being gifted.

- Include the date of the gift to establish a clear timeline.

- Have the form signed by both the donor and recipient.

- Consider having the document notarized for added legal validity.

Things You Shouldn't Do:

- Do not leave any sections blank; incomplete forms can lead to issues.

- Avoid using vague language that could create confusion about the gift.

- Do not forget to check local laws that may affect the Gift Deed.

- Refrain from altering the form after it has been signed.

- Do not neglect to keep a copy of the completed Gift Deed for your records.

Gift Deed - Usage Steps

Filling out a Gift Deed form is a straightforward process. Once you complete the form, you will need to have it signed and possibly notarized, depending on your state’s requirements. Here are the steps to guide you through the process.

- Obtain the Gift Deed form: You can find this form online or at your local government office.

- Fill in the date: Write the date on which the gift is being made.

- Identify the donor: Provide the full name and address of the person giving the gift.

- Identify the recipient: Include the full name and address of the person receiving the gift.

- Describe the gift: Clearly describe the item or property being gifted, including any relevant details like location or identification numbers.

- Include any conditions: If there are any conditions attached to the gift, state them clearly in this section.

- Sign the form: The donor must sign the form to validate the gift.

- Notarize if necessary: Check your state’s requirements to see if a notary public needs to witness the signing.

- Make copies: After completing the form, make copies for both the donor and recipient for their records.