Fill Your Gift Letter Form

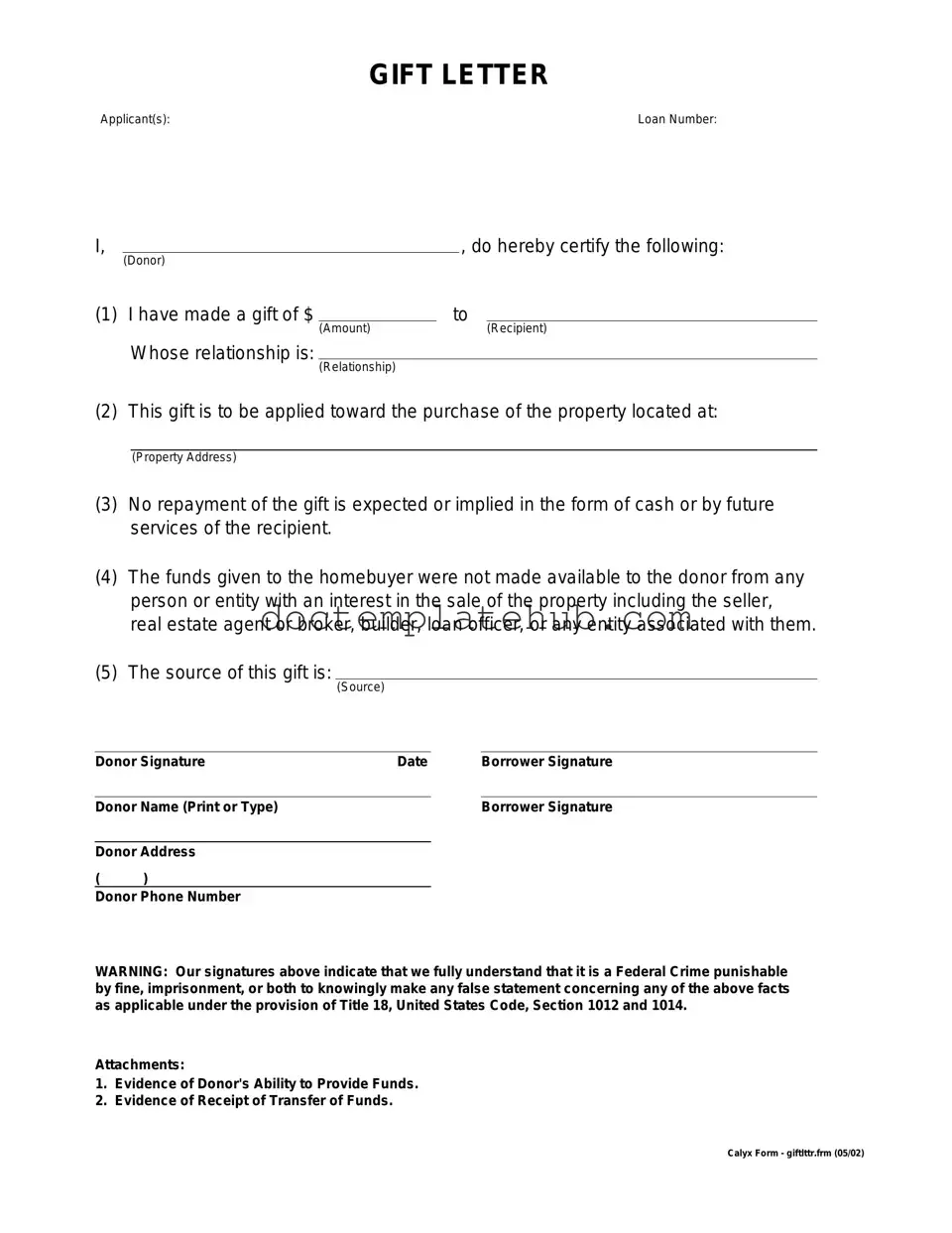

The Gift Letter form serves as an essential document in various financial transactions, particularly in real estate and mortgage processes. This form is used to formally declare that a monetary gift has been provided to an individual, often a homebuyer, without any expectation of repayment. By outlining the relationship between the giver and the recipient, the form helps clarify the nature of the funds, ensuring that lenders can verify the legitimacy of the financial support. It typically includes details such as the amount of the gift, the date it was given, and the purpose of the funds. Lenders often require this documentation to assess the borrower’s financial situation accurately. Utilizing a Gift Letter can help streamline the mortgage approval process, as it provides transparency and reassurance to all parties involved. Understanding the components and significance of this form is crucial for anyone considering a gift in the context of home financing.

Similar forms

The Gift Letter form serves as a declaration that funds given to a recipient are indeed a gift, not a loan. A similar document is the Affidavit of Support. This affidavit is often used in immigration cases to demonstrate that a sponsor has sufficient financial resources to support an immigrant. Like the Gift Letter, it requires the sponsor to affirm their financial commitment, ensuring that the immigrant will not become a public charge. Both documents aim to clarify the nature of financial support, providing assurance to relevant parties, whether they are lenders or immigration officials.

In navigating these various financial documents, it is important to understand the nuances each serves, especially when considering immigration cases that require the USCIS I-134 form, which can be explored further at smarttemplates.net. This form, while distinct from others like the Gift Letter, plays a crucial role in affirming a sponsor's commitment to support a visitor financially while in the United States.

Another document akin to the Gift Letter is the Loan Agreement. While a Gift Letter confirms that money is a gift, a Loan Agreement outlines the terms under which money is borrowed. It includes details such as repayment schedules and interest rates. Despite their differences, both documents serve to formalize financial transactions and clarify the intentions of the parties involved. They help prevent misunderstandings by clearly stating the nature of the funds being exchanged, whether as a gift or a loan.

The Promissory Note is also comparable to the Gift Letter. This document is a written promise to pay a specified amount of money to a designated party at a certain time. Unlike the Gift Letter, which confirms a gift, the Promissory Note establishes a debtor-creditor relationship. However, both documents require the parties to express their intentions clearly. They provide a record of the financial arrangement, which can be crucial in avoiding disputes down the line.

Lastly, the Financial Gift Agreement shares similarities with the Gift Letter. This agreement outlines the terms and conditions under which a gift is given, including any stipulations or expectations from the giver. It may cover aspects such as the purpose of the gift or any conditions that must be met. Both documents aim to clarify the nature of the financial transaction, ensuring that the recipient understands the gift's intent. By documenting these details, they help foster transparency and trust between the parties involved.

Other PDF Templates

California Short Term Disability - California residents can download the DE 2501 from the Employment Development Department’s website.

Completing the New York Rental Application process is vital for applicants, allowing them to present their qualifications to potential landlords. This form streamlines the rental evaluation by gathering critical information about one's background, credit status, and prior rental experiences to facilitate informed decisions in property leasing.

Annual Physical Exam Form - Report allergies or sensitivities to avoid complications during treatment.

More About Gift Letter

What is a Gift Letter?

A Gift Letter is a document that outlines the details of a financial gift given to a borrower. It typically includes the donor's name, the recipient's name, the amount of the gift, and a statement confirming that the funds do not need to be repaid. This letter is often required by lenders when a borrower is using gifted funds for a down payment on a home.

Why do I need a Gift Letter?

Lenders require a Gift Letter to ensure that the funds being used for a down payment are indeed a gift and not a loan. This helps the lender assess the borrower's financial situation accurately. The letter provides clarity and documentation that the borrower will not have to repay the gifted amount, which can affect loan approval.

Who can provide a Gift Letter?

A Gift Letter can be provided by anyone who is giving a financial gift to the borrower. Common donors include family members, friends, or other individuals who have a close relationship with the borrower. Some lenders may have specific requirements regarding who can be a donor, so it is advisable to check with the lender beforehand.

What information should be included in a Gift Letter?

A Gift Letter should include the following information: the donor's name and contact information, the recipient's name, the amount of the gift, the relationship between the donor and recipient, and a statement confirming that the funds are a gift and do not need to be repaid. It may also include the date of the gift and the donor's signature.

Is there a specific format for a Gift Letter?

While there is no universally required format for a Gift Letter, it should be clear and concise. Many lenders provide a template or specific guidelines to follow. It is important to ensure that all required information is included and that the letter is signed by the donor.

Do I need to provide proof of the gift?

In addition to the Gift Letter, some lenders may require proof of the transfer of funds. This could include bank statements or wire transfer receipts. It is essential to check with the lender for their specific documentation requirements regarding gifted funds.

Can I use a Gift Letter for all types of loans?

Gift Letters are commonly used for mortgage loans, particularly for first-time homebuyers. However, not all lenders or loan types may accept Gift Letters. It is important to confirm with the lender whether they accept Gift Letters for the specific loan type being applied for.

What happens if the Gift Letter is not provided?

If a Gift Letter is not provided when required, it may delay the loan approval process or result in denial of the loan application. Lenders need this documentation to verify the source of funds and ensure compliance with their lending policies.

Can I use a Gift Letter for a down payment on an investment property?

Using a Gift Letter for a down payment on an investment property may be more complicated than for a primary residence. Some lenders may not allow gifted funds for investment properties, while others may have specific guidelines. It is crucial to consult with the lender to understand their policies regarding gifted funds for investment properties.

Dos and Don'ts

When filling out a Gift Letter form, it is essential to approach the task with care. Here are some important do's and don'ts to consider:

- Do provide accurate information about the donor and recipient.

- Do clearly state the amount of the gift.

- Do mention the purpose of the gift, if applicable.

- Do ensure that the letter is signed by the donor.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to date the letter.

- Don't leave out any required details specific to your lender's guidelines.

Gift Letter - Usage Steps

Once you have the Gift Letter form in hand, you will need to fill it out accurately to ensure a smooth process. This form typically requires information about the donor and recipient, as well as details regarding the gift itself. After completing the form, it will be important to review it for any errors before submission.

- Begin by entering the date at the top of the form.

- Fill in the donor's full name and address in the designated fields.

- Provide the recipient's full name and address next.

- Clearly state the amount of the gift in the appropriate section.

- Indicate the relationship between the donor and the recipient.

- Include a brief statement confirming that the gift is given without expectation of repayment.

- Sign and date the form at the bottom, ensuring the donor's signature is included.

- Make a copy of the completed form for your records.