Fill Your Goodwill donation receipt Form

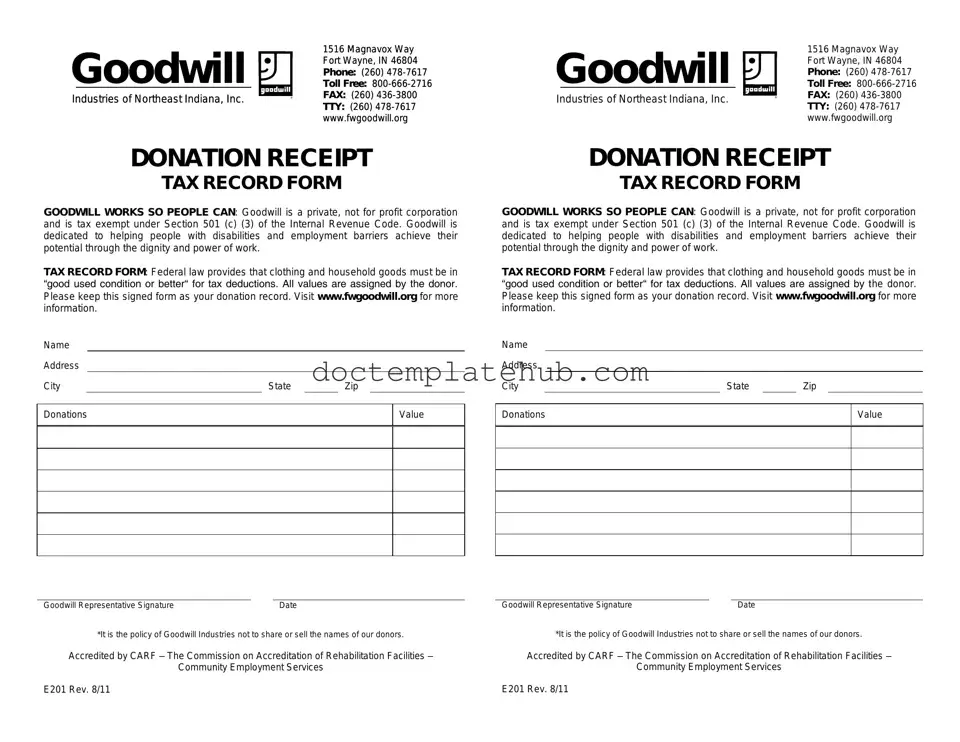

When you decide to donate items to Goodwill, you not only contribute to a worthy cause but also create an opportunity for potential tax deductions. The Goodwill donation receipt form plays a crucial role in this process. It serves as proof of your charitable contribution, detailing the items you donated and their estimated value. This form typically includes your name, address, the date of the donation, and a description of the items given. It’s important to keep this receipt for your records, especially during tax season, as it can substantiate your claims for deductions. Additionally, the form may also provide information about Goodwill's mission and how your donations help support local communities. By understanding the significance of this receipt, donors can ensure they are fully prepared to take advantage of any tax benefits while supporting a meaningful cause.

Similar forms

The first document that is similar to a Goodwill donation receipt form is a charitable contribution receipt. This receipt is issued by various nonprofit organizations to acknowledge donations made by individuals or businesses. Like the Goodwill receipt, it typically includes the donor's name, the date of the donation, and a description of the donated items or cash. Both documents serve as proof of the donation for tax purposes, allowing donors to claim deductions when filing their income taxes.

Another comparable document is the IRS Form 8283, which is used for reporting noncash charitable contributions. This form is required when the total value of noncash donations exceeds $500. Similar to the Goodwill donation receipt, Form 8283 requires detailed information about the items donated, including their fair market value. Both documents help substantiate the donor's claims and ensure compliance with tax regulations.

A Hold Harmless Agreement form is a legal document used in Utah to protect one party from liability for any injuries or damages incurred by another party during various activities. It essentially shifts the risk of legal claims from one party to another, ensuring that the party hosting or responsible for the activity is not held financially responsible for incidents that occur. This agreement is commonly used in construction, real estate transactions, and special events. For more resources regarding this form, you can visit smarttemplates.net.

A third document with similarities is the donation acknowledgment letter. This letter is often sent by charities to thank donors for their contributions. Like the Goodwill receipt, it includes essential details such as the donor's name, the date of the donation, and a description of the items donated. Both documents can be used as evidence of the donation for tax deductions, reinforcing the importance of keeping accurate records for tax purposes.

Finally, a bill of sale can also be compared to the Goodwill donation receipt form. While a bill of sale is typically associated with the sale of goods, it can serve a similar purpose when items are donated. It records the transfer of ownership from the donor to the nonprofit organization. Both documents provide proof of the transaction, although the bill of sale is more common in commercial contexts. Nevertheless, both serve to document the exchange and can be important for tax records.

Other PDF Templates

Form I-9 - Often necessary for international applicants establishing their professional background.

The Chick-fil-A job application form is a fundamental document used by individuals seeking employment at the popular fast-food chain. This form collects essential information about applicants, including their work history and availability. Completing it accurately is the first step toward joining a team known for its commitment to customer service and community involvement. For those interested, the application can be found at documentonline.org/blank-chick-fil-a-job-application/.

Spanish Job Application Form - Recognizing the at-will employment nature defines mutual rights in termination.

How to File a Mechanics Lien - The form must include specific information about the claimant, the property, and the debt owed.

More About Goodwill donation receipt

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to donors when they make a contribution of goods or items to Goodwill Industries. This form serves as proof of the donation and is essential for tax purposes, allowing donors to claim deductions on their income tax returns.

How do I obtain a Goodwill donation receipt?

You can easily obtain a Goodwill donation receipt by asking for one at the time of your donation. When you drop off your items at a Goodwill location, staff members will typically provide you with a receipt. If you forget to ask, don’t worry; you can still request a receipt by contacting the specific Goodwill store where you made your donation.

What information is included on the receipt?

The receipt will generally include the name and address of the Goodwill location, the date of the donation, and a description of the items donated. However, it will not include a specific dollar value for the items. Donors are responsible for determining the fair market value of their contributions.

Can I claim a tax deduction for my donation?

Yes, you can claim a tax deduction for your donation, provided you itemize your deductions on your tax return. The Goodwill receipt is crucial for this process, as it serves as documentation of your charitable contribution. It's important to keep a record of the items you donated and their estimated values to support your deduction.

What if I lost my Goodwill donation receipt?

If you lose your Goodwill donation receipt, you may still be able to claim your deduction, but it could be more complicated. Goodwill does not keep records of individual donations, so it’s best to maintain your own records. Consider taking photos of the items you donate or keeping a written list with estimated values to help substantiate your claim.

Are there limits on how much I can deduct for my donations?

Yes, there are limits on how much you can deduct for charitable contributions. Generally, you can deduct up to 60% of your adjusted gross income (AGI) for cash donations and 30% for donations of property, like clothing or household items. Always consult the IRS guidelines or a tax professional for specific advice tailored to your situation.

What types of items can I donate to Goodwill?

Goodwill accepts a wide variety of items, including clothing, shoes, household goods, electronics, and furniture. However, certain items, such as hazardous materials, large appliances, or items in poor condition, may not be accepted. It’s best to check with your local Goodwill for a complete list of acceptable donations.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do provide a detailed description of the items donated.

- Do include your name and contact information clearly.

- Do keep a copy of the receipt for your records.

- Do check the form for any specific instructions from Goodwill.

- Don't underestimate the value of your donations; provide fair market value estimates.

- Don't forget to sign and date the receipt.

- Don't leave any sections of the form blank; fill in all required fields.

Goodwill donation receipt - Usage Steps

Once you've gathered your items for donation, it's time to complete the Goodwill donation receipt form. This form will help you keep track of your contributions, which can be useful for tax purposes. Follow these steps carefully to ensure everything is filled out correctly.

- Begin by writing the date of your donation at the top of the form.

- Next, list your name and address. Make sure to include your full name, street address, city, state, and zip code.

- In the section provided, describe the items you are donating. Be specific about each item to ensure clarity.

- Next, estimate the fair market value of each item. This is the price you believe someone would pay for the items in a thrift store.

- If applicable, indicate whether you received any goods or services in exchange for your donation. This is important for accurate record-keeping.

- Finally, sign and date the form to validate your donation.

After completing the form, keep a copy for your records. This will be essential if you decide to claim your donation on your taxes. Remember, accurate documentation is key to maximizing your benefits.