Fill Your Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form serves as a crucial document for both independent contractors and the businesses that hire them. This form provides a clear breakdown of earnings, ensuring transparency in compensation. It typically includes essential information such as the contractor's name, the pay period, and the total amount earned. Additionally, it outlines any deductions or taxes withheld, giving contractors a comprehensive view of their net pay. By using this form, businesses can maintain accurate records and comply with financial regulations, while contractors benefit from having a detailed account of their earnings for personal finance management or tax purposes. Overall, the Independent Contractor Pay Stub form is an important tool that fosters trust and clarity in the contractor-client relationship.

Similar forms

The Independent Contractor Pay Stub form shares similarities with the W-2 form, which employers use to report wages paid to employees. Both documents provide a summary of earnings over a specific period. The W-2 outlines federal, state, and local taxes withheld, while the Independent Contractor Pay Stub may detail payments made to contractors without tax withholding. This distinction highlights the different tax obligations for employees versus independent contractors.

For those seeking a rental property, understanding the important Rental Application process can streamline the leasing experience. This form serves as a key step in ensuring that the landlord receives the necessary background information, which aids in making informed decisions regarding potential tenants.

Another document that resembles the Independent Contractor Pay Stub is the 1099 form. This form is specifically designed for reporting income earned by independent contractors. Like the pay stub, the 1099 provides a record of earnings but is typically issued at the end of the year. Both documents serve to inform the contractor about their income, which is essential for tax reporting purposes.

The paycheck stub, commonly provided to employees, also shares features with the Independent Contractor Pay Stub. Both stubs detail the amount earned during a pay period and may include deductions. However, paycheck stubs include information about employee benefits and taxes withheld, while the Independent Contractor Pay Stub focuses on gross earnings without deductions for taxes or benefits.

The invoice is another document that bears similarity to the Independent Contractor Pay Stub. An invoice outlines services rendered and the corresponding payment due. Both documents serve as financial records for the contractor. However, while the pay stub reflects payments received, the invoice represents a request for payment and may include payment terms and due dates.

A commission statement is comparable to the Independent Contractor Pay Stub, particularly for contractors who earn commissions. Both documents summarize earnings over a specific period. The commission statement breaks down earnings based on sales performance, while the pay stub may reflect hourly wages or project fees, depending on the contractor's arrangement.

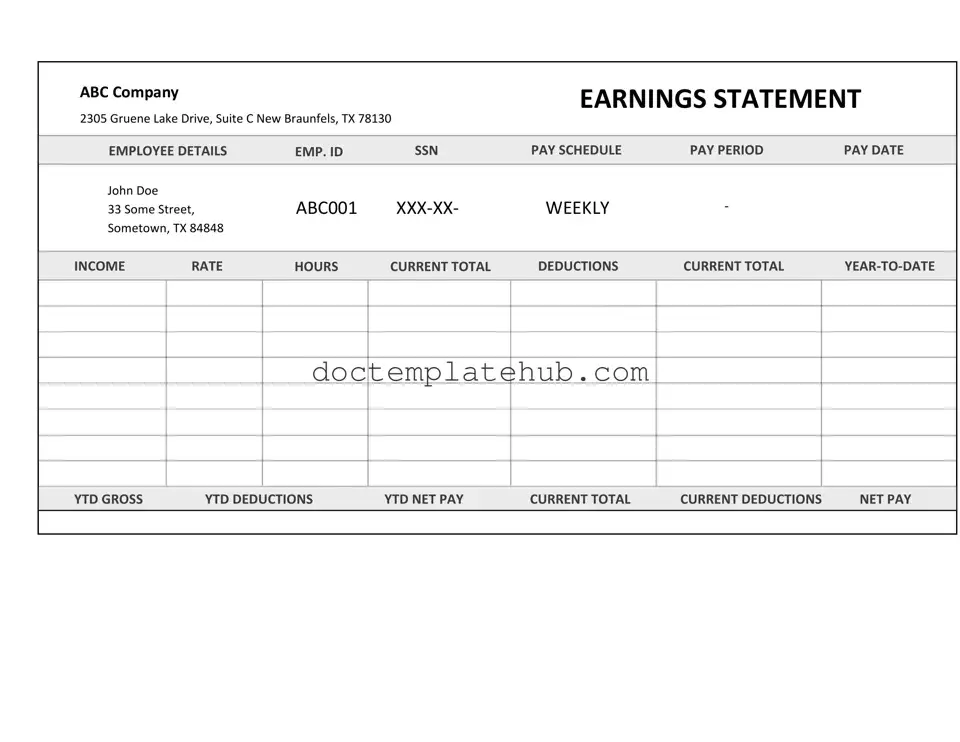

The earnings statement, often used by freelancers, closely resembles the Independent Contractor Pay Stub. Both documents provide a summary of income earned over a given timeframe. While the earnings statement may include a breakdown of hours worked and rates charged, the pay stub typically summarizes total payments received without detailing the work performed.

The payment receipt is another document that parallels the Independent Contractor Pay Stub. A payment receipt confirms that a contractor has received payment for services rendered. Both documents serve as proof of income. However, the payment receipt is generally issued after a payment is made, while the pay stub may be provided in advance or during the payment process.

Lastly, the financial statement, particularly for small businesses, shares characteristics with the Independent Contractor Pay Stub. Both documents can provide a snapshot of financial performance. While the financial statement offers a broader view of income, expenses, and profits, the Independent Contractor Pay Stub focuses specifically on payments made to the contractor, highlighting their earnings within a defined period.

Other PDF Templates

Free Horse Training Contract Template - This training contract emphasizes the importance of adhereing to agreed rules and regulations.

When preparing to support a foreign national's visit to the United States, it's essential to understand the USCIS I-134 form, which acts as a formal commitment that the individual will not rely on public assistance. This document affirms that the financial responsibility lies with the sponsor, and for further details on the completion of this crucial form, you can refer to smarttemplates.net.

Geico B2b Portal - Provide the repair facility's email for all communications.

More About Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for a contractor during a specific pay period. It serves as a record of payment and can be useful for tax purposes and personal financial tracking.

Who needs to use an Independent Contractor Pay Stub?

This form is essential for independent contractors who receive payment for their services. It helps them keep track of their income and any deductions that may apply, such as taxes or fees.

What information is included on the pay stub?

The pay stub typically includes the contractor's name, the pay period, total earnings, any deductions, and the net pay. It may also include the payer's information and a breakdown of hours worked or services rendered.

How can I obtain an Independent Contractor Pay Stub?

Is it necessary to provide a pay stub to clients?

While it is not legally required to provide a pay stub to clients, doing so can enhance professionalism and transparency. It helps clients understand the payment details and can prevent disputes regarding payment amounts.

How do I handle taxes as an independent contractor?

Independent contractors are responsible for reporting their income and paying taxes on it. The pay stub can help in tracking earnings, but contractors should also keep accurate records of all income and expenses for tax filing purposes.

Can I use a pay stub for loan applications?

Yes, many lenders accept pay stubs as proof of income for loan applications. However, it is advisable to check with the specific lender to ensure they accept independent contractor pay stubs as valid documentation.

What if I notice an error on my pay stub?

If there is an error on your pay stub, it is important to address it promptly. Contact the payer to discuss the discrepancy and request a corrected pay stub. Keeping clear records will help facilitate this process.

Are there any legal requirements for independent contractors regarding pay stubs?

There are no federal laws mandating that independent contractors receive pay stubs. However, some states may have specific regulations requiring documentation of payments. It’s important to be aware of local laws that may apply.

Can I create my own pay stub template?

Yes, you can create your own pay stub template. Ensure that it includes all necessary information, such as your name, pay period, earnings, deductions, and net pay. Various online resources provide templates that can be customized to suit your needs.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don’ts to consider:

- Do provide accurate personal information, including your name and address.

- Do include the correct payment period for the services rendered.

- Do clearly list all services provided and the corresponding rates.

- Do double-check all calculations to avoid errors in total pay.

- Don't leave any sections blank; fill out all required fields.

- Don't use vague descriptions for services; be specific.

- Don't forget to sign and date the pay stub.

- Don't submit the form without reviewing it for accuracy.

Independent Contractor Pay Stub - Usage Steps

Filling out the Independent Contractor Pay Stub form is a straightforward process. This form is essential for documenting payments made to independent contractors. Accuracy is key to ensure that all information is correct and complete. Follow these steps carefully to ensure a smooth experience.

- Gather Necessary Information: Collect all relevant details such as the contractor’s name, address, and Social Security number.

- Enter Contractor Information: Fill in the contractor's name, address, and contact information in the designated fields.

- Input Payment Details: Specify the payment date and the amount being paid. Include any relevant invoice numbers if applicable.

- Record Hours Worked: If applicable, indicate the number of hours worked by the contractor during the pay period.

- Calculate Deductions: If there are any deductions (such as taxes or fees), list them clearly. Ensure that the total deductions are accurate.

- Summarize Total Payment: After deductions, calculate the total amount the contractor will receive. This should be clearly stated on the form.

- Review for Accuracy: Double-check all entries for any errors or omissions before finalizing the form.

- Provide a Copy: Once completed, provide a copy of the pay stub to the contractor for their records.