Fill Your Intent To Lien Florida Form

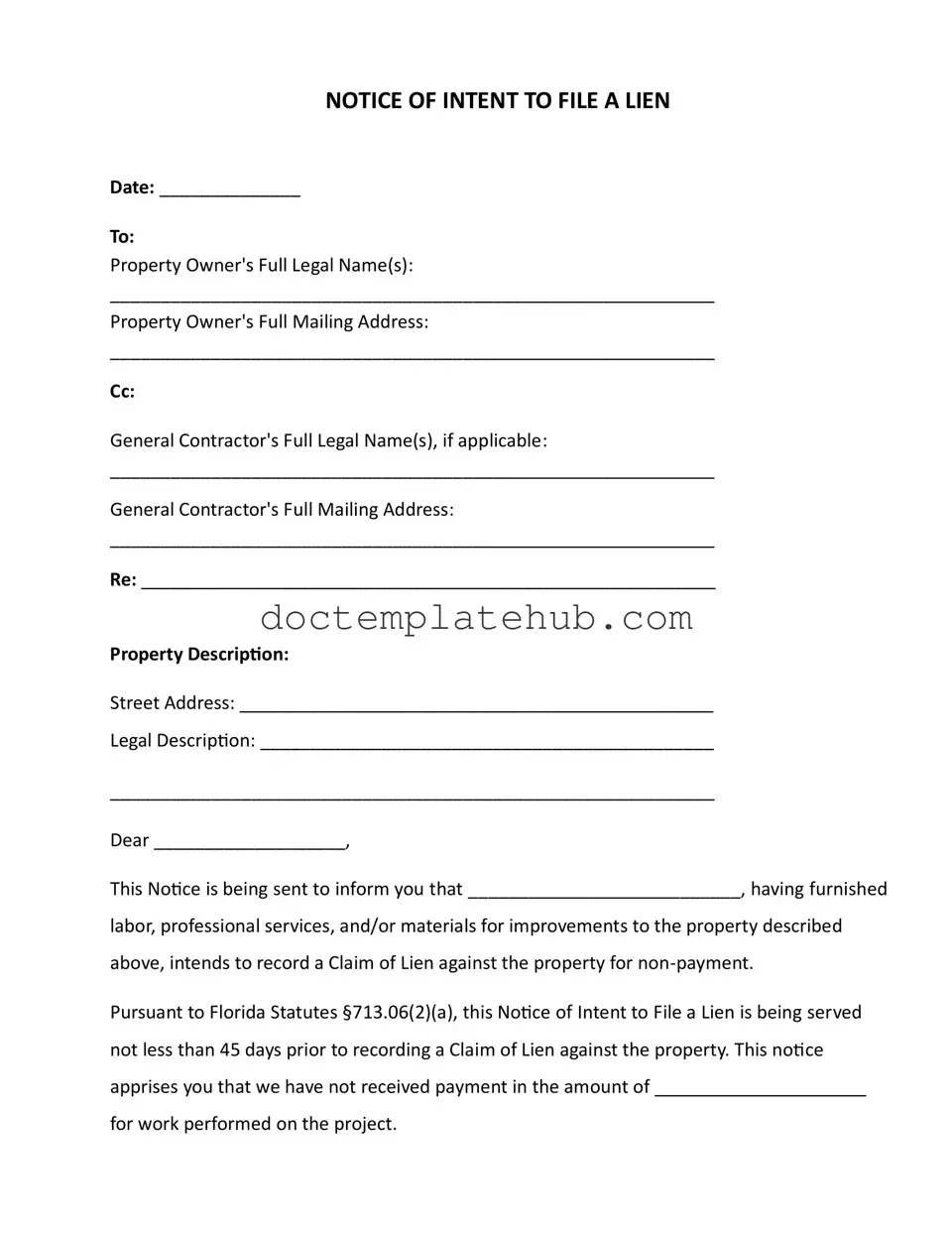

The Intent to Lien Florida form serves as a crucial document for contractors and suppliers who have not received payment for their services or materials provided to a property. This form acts as a formal notice to the property owner, alerting them of the intention to file a lien if payment is not made within a specified timeframe. It includes essential details such as the date of the notice, the names and addresses of the property owner and, if applicable, the general contractor. The form outlines the specific property involved, including both its street address and legal description. By sending this notice, the contractor or supplier notifies the property owner of the unpaid amount and emphasizes the importance of resolving the issue promptly. According to Florida law, this notice must be served at least 45 days before a lien can be recorded, providing the owner with a chance to respond. If payment is not received within 30 days, the contractor may proceed with filing a lien, which could lead to foreclosure proceedings and additional costs for the property owner. This proactive communication aims to encourage timely payment and avoid further legal action.

Similar forms

The Notice of Non-Payment is similar to the Intent to Lien Florida form in that it serves as a preliminary notification to property owners regarding unpaid debts. This document outlines the specific amount owed and provides a timeline for payment before further legal action may be taken. Like the Intent to Lien, it emphasizes the importance of resolving payment issues to avoid potential liens on the property.

The Demand for Payment letter functions similarly by formally requesting payment for services rendered or materials provided. This document typically includes details about the debt, such as the amount owed and the due date. It aims to prompt the recipient to address the outstanding balance before more serious steps, like filing a lien, are taken.

A Notice of Default is another document that shares similarities with the Intent to Lien. This notice is often used in the context of mortgages or loans, indicating that a borrower has failed to meet their payment obligations. It serves as a warning that further action may be initiated if the default is not remedied within a specified timeframe.

The Mechanic's Lien is closely related, as it is the legal claim that may be filed after the Intent to Lien has been issued. This document formally asserts a contractor's right to seek payment for work performed on a property. It is essential to follow the proper procedures outlined in the Intent to Lien to ensure the Mechanic's Lien is valid.

The Notice of Claim is also comparable, as it is used to inform property owners of a potential claim against their property. This document often precedes legal action and outlines the basis for the claim, similar to how the Intent to Lien informs the owner of unpaid debts and the potential for a lien.

A Construction Lien Waiver is another document that interacts with the Intent to Lien process. While the Intent to Lien signals a potential claim, a lien waiver indicates that a contractor or supplier has received payment and relinquishes their right to file a lien for that specific work. It is crucial for property owners to obtain waivers to avoid future claims.

Understanding the intricacies of legal documents, such as a Non-disclosure Agreement (NDA) form, is essential for businesses and individuals alike. An NDA establishes a confidential relationship, ensuring that sensitive information is protected. For templates and examples, you can visit smarttemplates.net.

The Notice of Intent to Foreclose is relevant as it indicates the lender's intention to initiate foreclosure proceedings due to non-payment. This document serves as a warning to property owners that they may lose their property if debts are not addressed. It shares the same urgency as the Intent to Lien in terms of notifying the owner of potential consequences.

A Demand for Arbitration can also be seen as similar, as it is used to resolve disputes regarding payment or contract terms. This document typically requires the parties to engage in arbitration before pursuing legal action, similar to how the Intent to Lien seeks to resolve payment issues before filing a lien.

The Notice of Right to Cure is another document that serves a similar purpose. It informs property owners of their right to rectify a default before further legal actions are taken. This notice provides a specific period for the owner to address the issue, aligning with the Intent to Lien's goal of encouraging payment to avoid more severe consequences.

Lastly, the Notice of Intent to Sue is akin to the Intent to Lien in that it alerts the recipient of potential legal action due to unpaid debts. This document outlines the basis for the claim and encourages the recipient to resolve the issue before litigation occurs, mirroring the intent behind the Notice of Intent to Lien.

Other PDF Templates

Musician Band Contract Agreement - Cancellation terms detail notice periods for canceling the performance.

What Is a Progress Note in the Medical Record - Information on nutritional counseling provided.

The New York Notary Acknowledgement is a vital document for ensuring signature verification in legal processes, making it important for parties involved. To learn more about its practical applications, visit this link for a detailed overview of the Notary Acknowledgement procedure: key elements of the Notary Acknowledgement process.

Free Job Application Template - Specify the job title you are applying for to ensure proper routing.

More About Intent To Lien Florida

What is the Intent to Lien Florida form?

The Intent to Lien Florida form is a legal document that notifies property owners of a contractor or service provider's intention to file a lien against their property due to non-payment. This notice serves as a warning and is required by Florida law to be sent at least 45 days before the actual lien is recorded.

Who needs to file an Intent to Lien?

What information is required on the form?

The form requires several key pieces of information, including the date, property owner's full legal name and mailing address, general contractor's details (if applicable), a description of the property, and the amount owed for the work performed. Accurate information is essential for the notice to be valid.

What happens if the property owner does not respond?

If the property owner fails to respond within 30 days of receiving the notice, the contractor or service provider may proceed to record the lien. This could lead to legal actions, including foreclosure on the property to recover the owed amount.

Can the lien be avoided after the Intent to Lien is filed?

Is there a specific format for the Intent to Lien form?

What are the consequences of recording a lien?

How should the Intent to Lien be delivered?

What should be done if a lien is recorded?

Dos and Don'ts

When filling out the Intent To Lien Florida form, it is essential to ensure accuracy and compliance with the requirements. Here are some important do's and don'ts to keep in mind:

- Do provide the correct date at the top of the form.

- Do include the full legal name and mailing address of the property owner.

- Do accurately describe the property, including both the street address and legal description.

- Do clearly state the amount owed for the work performed.

- Don't leave any sections blank; all fields must be completed.

- Don't forget to sign and date the form before submission.

- Don't ignore the 45-day notice requirement before recording a lien.

- Don't underestimate the importance of providing a method for the property owner to contact you.

Intent To Lien Florida - Usage Steps

Filling out the Intent to Lien form in Florida requires careful attention to detail. This document serves as a formal notice to the property owner regarding an outstanding payment for services or materials provided. After completing the form, it is essential to deliver it properly to ensure legal compliance.

- Date: Write the current date at the top of the form.

- Property Owner's Information: Fill in the full legal name(s) of the property owner(s) in the designated space.

- Mailing Address: Provide the full mailing address of the property owner(s).

- General Contractor's Information: If applicable, include the full legal name(s) of the general contractor and their mailing address.

- Property Description: Clearly state the street address of the property in the specified area.

- Legal Description: Write the legal description of the property, which may require referencing public records.

- Notice Content: In the body of the letter, indicate who is sending the notice and the amount owed for the services or materials provided.

- Response Period: Mention that the property owner has 30 days to respond to avoid a lien being filed.

- Your Information: Sign the document and include your name, title, phone number, and email address at the bottom.

- Certificate of Service: Complete the certificate section by noting how the notice was served (e.g., certified mail, hand delivery) and include your name and signature.