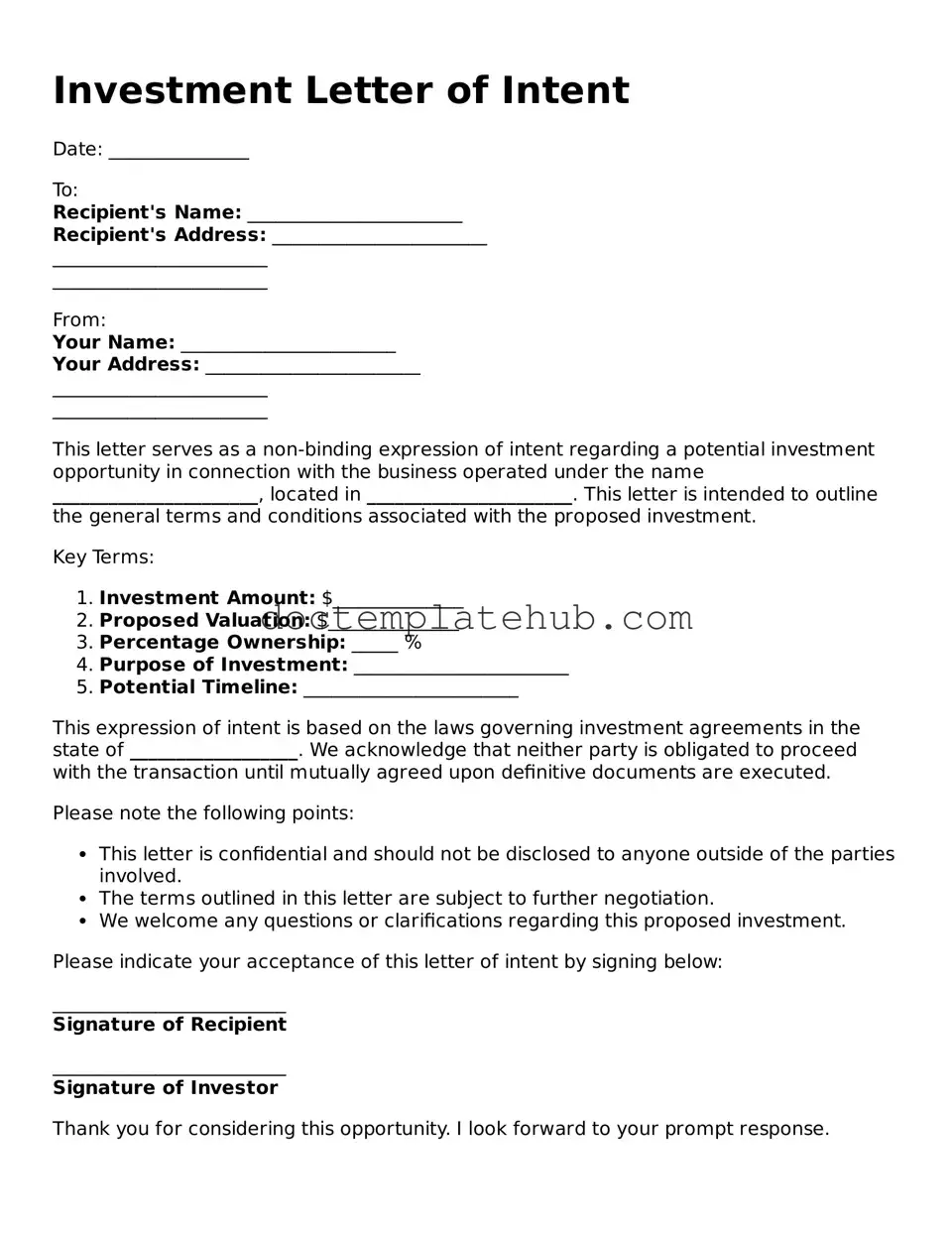

Official Investment Letter of Intent Form

The Investment Letter of Intent (LOI) serves as a crucial document in the realm of investment transactions, outlining the preliminary terms and conditions agreed upon by the parties involved. This form typically includes essential details such as the amount of investment, the structure of the deal, and any contingencies that may affect the final agreement. By clearly articulating the intentions of both the investor and the recipient, the LOI establishes a foundation for negotiations and helps to mitigate misunderstandings. Additionally, it often encompasses timelines for due diligence and closing, as well as any exclusivity provisions that may prevent competing offers during the negotiation period. While the LOI is not legally binding in most cases, it plays a vital role in signaling commitment and seriousness, paving the way for more detailed agreements to follow. Understanding the nuances of this form is essential for both investors and businesses seeking funding, as it sets the stage for successful partnerships and investment opportunities.

Similar forms

The Investment Letter of Intent (LOI) shares similarities with a Memorandum of Understanding (MOU). Both documents outline the preliminary agreements between parties before finalizing a contract. An MOU typically reflects a mutual understanding of goals and intentions, similar to how an LOI expresses the intent to invest and the basic terms surrounding that investment. While an LOI is often more formal and may include specific terms, an MOU is generally less binding and focuses on establishing a cooperative framework.

An Offer Letter is another document that parallels the Investment LOI. An Offer Letter is used to present terms and conditions for a potential agreement, often in employment or real estate contexts. Like the Investment LOI, it outlines key terms such as price, timelines, and conditions. However, the Offer Letter is more specific to a single transaction or employment opportunity, while the Investment LOI may cover broader terms related to a financial investment.

Fill out Common Types of Investment Letter of Intent Templates

Letter of Intent Sample for Business - A Letter of Intent can stipulate how disputes will be resolved during negotiations.

Intent to Purchase - Maintaining professionalism in the letter can foster a positive negotiating atmosphere.

More About Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between parties interested in making an investment. It typically includes key terms, conditions, and intentions of the parties involved. While it is not a legally binding contract, it serves as a starting point for further negotiations.

Who should use an Investment Letter of Intent?

This form is useful for individuals or entities looking to make an investment in a business or project. It can be used by investors, entrepreneurs, or companies seeking funding. The LOI helps clarify intentions before formal agreements are drafted.

What information is typically included in the form?

The Investment Letter of Intent usually includes details such as the amount of the investment, the purpose of the investment, the timeline for the investment, and any conditions that need to be met. It may also outline the rights and responsibilities of each party.

Is the Investment Letter of Intent legally binding?

Generally, an Investment Letter of Intent is not legally binding. It serves as a framework for negotiation and does not create enforceable obligations. However, some sections may be binding if explicitly stated, such as confidentiality agreements or exclusivity clauses.

How does an Investment Letter of Intent benefit both parties?

This document benefits both parties by providing a clear outline of expectations. It helps prevent misunderstandings and ensures that both sides are on the same page before moving forward. It can also save time and resources during the negotiation process.

Can the terms in the Investment Letter of Intent be changed?

Yes, the terms in the Investment Letter of Intent can be negotiated and changed. Since it is a preliminary document, both parties can discuss and modify the terms until they reach a mutual agreement. This flexibility is one of its key advantages.

What should I do after signing the Investment Letter of Intent?

After signing the LOI, the next step is usually to draft a more detailed and binding agreement. This might include a purchase agreement or investment contract. It’s important to work with legal professionals to ensure all terms are accurately captured and legally enforceable.

Where can I find a template for an Investment Letter of Intent?

You can find templates for an Investment Letter of Intent online or through legal document preparation services. It’s important to choose a template that fits your specific needs and to customize it to reflect the unique aspects of your investment situation.

Dos and Don'ts

When it comes to filling out the Investment Letter of Intent form, attention to detail is crucial. Here are five important do's and don'ts to keep in mind:

- Do read the instructions carefully before starting. Understanding what is required can save you time and frustration.

- Don't rush through the form. Taking your time ensures accuracy and completeness.

- Do provide clear and concise information. Clarity helps the reviewers understand your intent and makes a positive impression.

- Don't use vague language. Being specific about your investment goals and expectations is essential.

- Do double-check for any errors before submission. A quick review can catch mistakes that might otherwise go unnoticed.

By following these guidelines, you can enhance the quality of your submission and increase the likelihood of a favorable outcome.

Investment Letter of Intent - Usage Steps

After obtaining the Investment Letter of Intent form, you will need to provide specific information to complete it accurately. This form is crucial for expressing your intent to invest and outlines the terms and conditions of the investment. Follow the steps below to ensure that you fill it out correctly.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your contact information, including your phone number and email address.

- Fill in the date on which you are completing the form.

- Specify the amount you intend to invest in the appropriate section.

- Clearly state the purpose of the investment in the next field.

- If applicable, indicate any specific terms or conditions you wish to include.

- Sign the form at the bottom to confirm your intent.

- Finally, date your signature to complete the form.

Once you have filled out the form, review all the information for accuracy. Ensure that your contact details are correct, as this will facilitate communication regarding your investment. After confirming everything is in order, submit the form as instructed.