Fill Your IRS 1040 Form

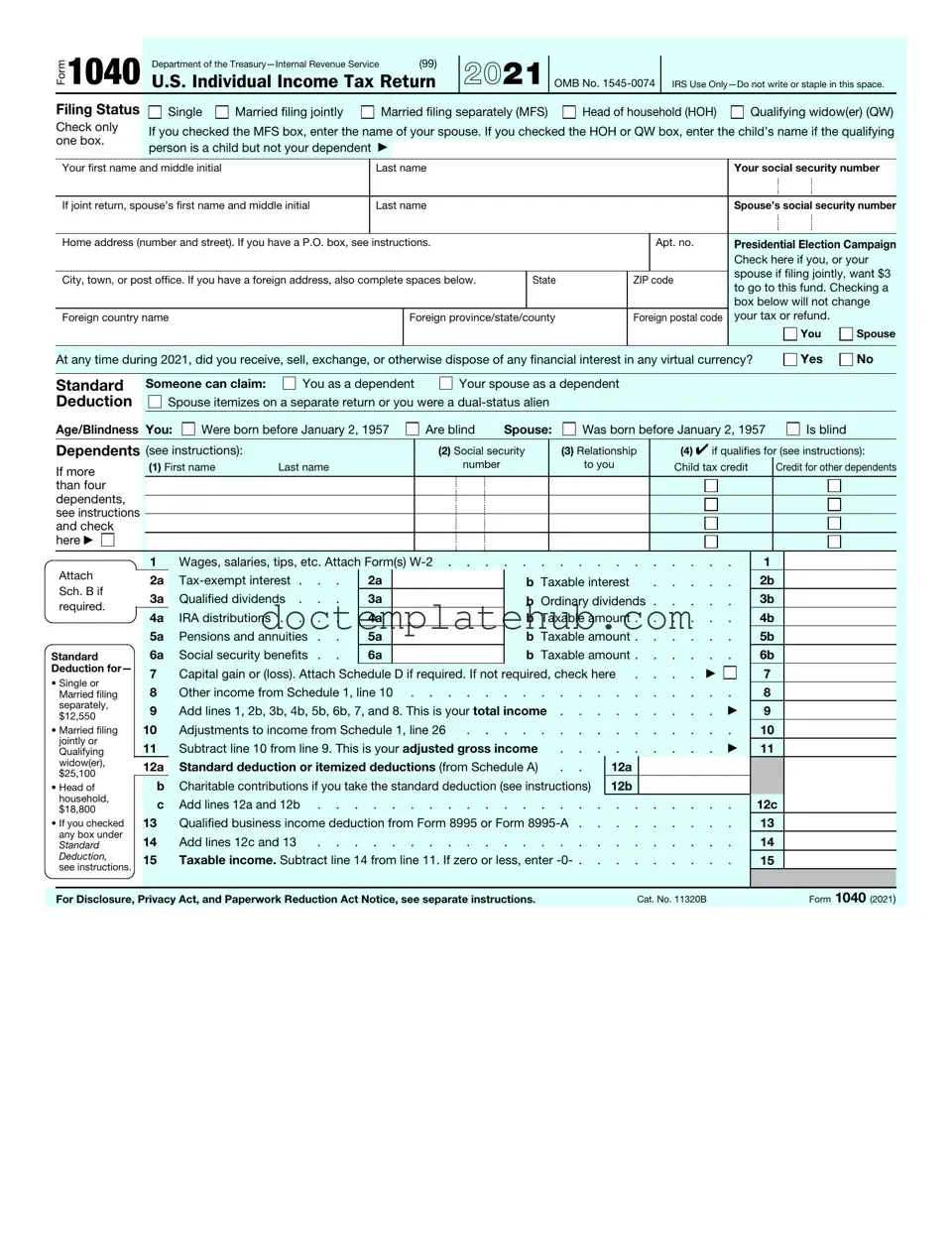

The IRS 1040 form serves as a crucial document for individuals filing their annual income tax returns in the United States. This form captures essential financial information, allowing taxpayers to report their income, claim deductions, and determine their tax liability. It includes sections for various types of income, such as wages, dividends, and self-employment earnings, ensuring a comprehensive overview of an individual's financial situation. Additionally, taxpayers can take advantage of credits and deductions, which can significantly reduce their taxable income. The form also accommodates different filing statuses, such as single, married filing jointly, or head of household, each impacting tax calculations. Understanding the 1040 form is vital for anyone looking to navigate the complexities of the tax system efficiently, as it lays the groundwork for ensuring compliance with federal tax laws while maximizing potential refunds or minimizing owed amounts.

Similar forms

The IRS Form 1040 is similar to the W-2 form, which employers provide to employees. The W-2 summarizes an employee's annual wages and the taxes withheld from their paycheck. Just as the 1040 is used to report income and calculate tax liability, the W-2 serves as a key document for individuals to accurately report their earnings on their tax return. Both forms are essential for ensuring that taxpayers fulfill their obligations and receive any potential refunds.

Another document that resembles the 1040 is the 1099 form. This form is issued to independent contractors and freelancers to report income earned outside of traditional employment. Like the 1040, the 1099 requires individuals to report their income and may also include information about taxes withheld. The 1099 helps self-employed individuals accurately report their earnings and understand their tax responsibilities.

The Schedule C form is also closely related to the 1040. Used by sole proprietors, Schedule C details income and expenses from a business. It feeds directly into the 1040, allowing business owners to report their profits or losses as part of their overall income. Both forms work together to provide a comprehensive view of an individual's financial situation.

In addition to the various tax forms and agreements mentioned, individuals looking for comprehensive templates, including the Hold Harmless Agreement form, can find valuable resources at smarttemplates.net, ensuring that they have access to the necessary legal documents to mitigate risks during various transactions or activities.

The IRS Form 1098 is another document that shares similarities with the 1040. This form is used to report mortgage interest paid during the year. Homeowners can use the information from the 1098 to potentially deduct mortgage interest on their 1040. Both forms play a crucial role in tax calculations, especially for individuals who own homes and want to maximize their deductions.

Form 8889, used for Health Savings Accounts (HSAs), also has a connection to the 1040. Individuals with HSAs must report contributions and distributions on this form, which then feeds into the 1040. This relationship allows taxpayers to manage their healthcare expenses while also ensuring they comply with tax regulations related to HSAs.

The 1040 is similar to the Schedule A form, which is used for itemizing deductions. Taxpayers can choose between the standard deduction and itemizing their deductions on Schedule A. Both forms work together to determine the most beneficial tax outcome for individuals, allowing for a tailored approach to tax filing.

Form 8862 is another document that shares a relationship with the 1040. This form is used to claim the Earned Income Tax Credit (EITC) after a previous denial. It requires specific information to be submitted alongside the 1040 to ensure eligibility for the credit. The connection between these forms emphasizes the importance of accurately reporting income and tax credits.

The 1040 also relates to the Form 5405, which is used for claiming the First-Time Homebuyer Credit. This form is submitted alongside the 1040 to report the credit received when purchasing a home. Both forms highlight the financial benefits available to taxpayers and the importance of understanding eligibility requirements.

Lastly, the 1095-A form, which provides information about health insurance coverage through the Marketplace, is linked to the 1040. Taxpayers use this form to report their health coverage and potentially qualify for premium tax credits. The relationship between the 1095-A and the 1040 underscores the significance of health insurance in tax reporting and compliance.

Other PDF Templates

Seating Chart Generator Band - Involve all staff in verifying the final version of the chart.

To facilitate a smooth transaction, you can utilize a straightforward Florida mobile home bill of sale, which serves as a legal record of ownership transfer. This document not only ensures compliance with state regulations but also protects the interests of both the buyer and seller. For more information, visit this resource on Mobile Home Bill of Sale forms.

Roof Certification Form - Identify general conditions of the roof deck to summarize its overall health.

International Driver License Aaa - Direct any questions regarding the form to the appropriate AAA contact for prompt assistance.

More About IRS 1040

What is the IRS 1040 form?

The IRS 1040 form is the standard individual income tax return form used by U.S. taxpayers. It is used to report income, claim tax deductions, and calculate tax liability. Most people who earn income in the U.S. will need to file this form each year to ensure they meet their tax obligations.

Who needs to file a 1040 form?

Generally, anyone who earns income must file a 1040 form. This includes employees, self-employed individuals, and those with investment income. Specific thresholds for income may vary, but if you owe taxes or want to claim a refund, filing is necessary. Some exceptions apply, such as certain low-income earners or individuals who meet specific criteria.

What information do I need to complete the 1040 form?

To fill out the 1040 form, you will need personal information such as your Social Security number, filing status, and details about your dependents. Additionally, you will need information about your income from various sources, such as W-2 forms from employers, 1099 forms for freelance work, and any other income documentation. It’s also helpful to have records of deductions and credits you plan to claim.

What are the deadlines for filing the 1040 form?

The typical deadline for filing the 1040 form is April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. If you need more time, you can file for an extension, which gives you until October 15th to submit your return. However, keep in mind that an extension to file does not extend the time to pay any taxes owed.

What should I do if I made a mistake on my 1040 form?

If you realize you made a mistake after submitting your 1040 form, don’t panic. You can file an amended return using Form 1040-X. This form allows you to correct errors such as incorrect income, deductions, or filing status. Make sure to follow the instructions carefully and submit the amended return as soon as possible to avoid potential penalties or interest.

Can I file my 1040 form electronically?

Yes, you can file your 1040 form electronically. The IRS encourages e-filing as it is faster and often leads to quicker refunds. Many tax preparation software programs offer e-filing options, and some taxpayers may qualify for free e-filing through the IRS Free File program. Ensure you have all your information ready before starting the e-filing process for a smooth experience.

Dos and Don'ts

Filling out the IRS 1040 form can seem daunting, but with the right approach, you can navigate it successfully. Here’s a helpful list of things you should and shouldn't do to ensure your tax return is accurate and complete.

- Do: Gather all necessary documents, such as W-2s and 1099s, before starting.

- Do: Double-check your Social Security number and personal information for accuracy.

- Do: Use the correct filing status that reflects your situation.

- Do: Report all sources of income, including side jobs or freelance work.

- Do: Take advantage of deductions and credits that you qualify for.

- Don't: Rush through the form; take your time to avoid mistakes.

- Don't: Forget to sign and date your return before submitting it.

- Don't: Ignore the instructions provided with the form; they can be very helpful.

- Don't: Leave any fields blank; if something doesn’t apply, write “N/A.”

- Don't: Assume you know everything; consider consulting a tax professional if needed.

By following these guidelines, you can simplify the process of filling out your IRS 1040 form and minimize the chances of errors. Remember, being thorough and careful pays off in the long run.

IRS 1040 - Usage Steps

Filling out the IRS 1040 form is an essential step in the annual tax process for many individuals and families. Once you have gathered all necessary documents and information, you can begin the process of reporting your income, deductions, and credits. Follow these steps to ensure you complete the form accurately.

- Gather your documents. Collect all relevant tax documents, such as W-2s, 1099s, and any records of other income.

- Begin with your personal information. At the top of the form, fill in your name, address, and Social Security number. If you are filing jointly, include your spouse's information as well.

- Indicate your filing status. Choose from options like single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report your income. In the income section, list all sources of income, including wages, interest, dividends, and any other income. Use the information from your W-2s and 1099s to fill this out accurately.

- Claim deductions. Look for the section where you can enter your standard deduction or itemized deductions. Choose the option that benefits you the most.

- Calculate your taxable income. Subtract your total deductions from your total income to find your taxable income.

- Determine your tax liability. Use the tax tables provided in the instructions to find out how much tax you owe based on your taxable income.

- Account for credits. If you qualify for any tax credits, such as the Earned Income Tax Credit or Child Tax Credit, be sure to enter those amounts here.

- Calculate your total tax. Add any other taxes owed to your tax liability to determine your total tax for the year.

- Report any payments made. Include any withholding from your paychecks and any estimated tax payments you made throughout the year.

- Determine if you owe money or will receive a refund. Subtract your total payments from your total tax to see if you owe money or if you'll get a refund.

- Sign and date the form. Don’t forget to sign and date your return. If you are filing jointly, your spouse must also sign.

- Submit your form. Decide whether to file electronically or mail a paper return. If mailing, ensure you send it to the correct address based on your state.

After completing these steps, review your form for any errors before submitting it. Keeping a copy for your records is also a good practice. Filing your taxes accurately and on time can help you avoid penalties and ensure you receive any refunds due.