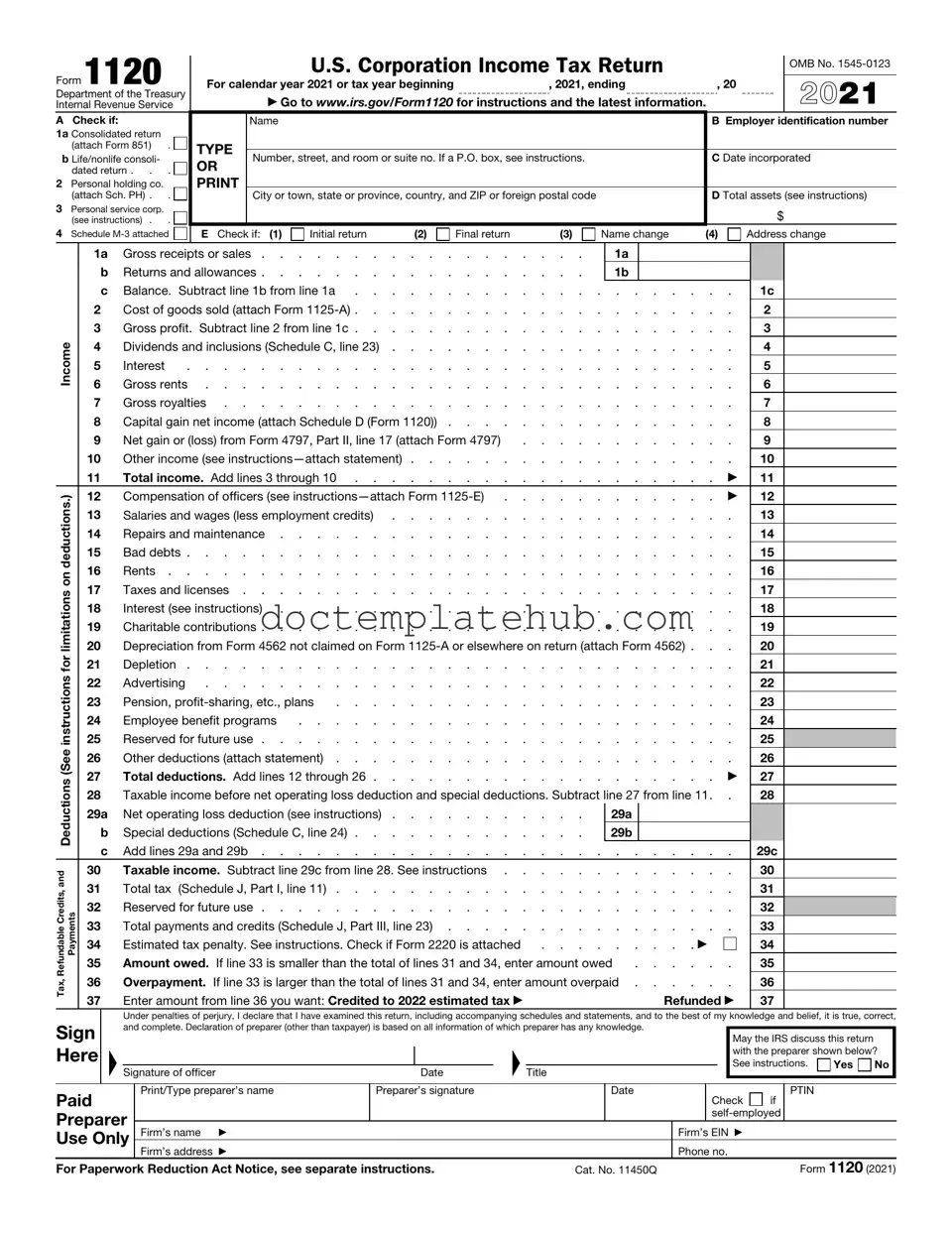

Fill Your IRS 1120 Form

The IRS 1120 form serves as a crucial document for corporations operating within the United States, facilitating the reporting of income, deductions, and tax liability. This form is primarily utilized by C corporations, which are distinct legal entities separate from their owners. Corporations must file the 1120 annually, detailing their financial activities for the tax year, including revenue generated, expenses incurred, and any applicable tax credits. The form requires accurate reporting of various income sources, such as sales revenue and dividends, while also allowing for deductions related to business expenses, such as salaries, rent, and utilities. Additionally, corporations must disclose information about their shareholders and any potential tax liabilities. Timely submission of the IRS 1120 is essential, as it not only ensures compliance with federal tax regulations but also impacts the corporation's financial standing and future tax obligations. Understanding the intricacies of this form is vital for corporate officers and accountants alike, as it directly influences the corporation's overall tax strategy and financial health.

Similar forms

The IRS Form 1065 is similar to the Form 1120 in that both are used for reporting income and expenses, but they serve different types of business entities. While Form 1120 is specifically for corporations, Form 1065 is designed for partnerships. Both forms require detailed information about the business's financial activities, including revenue, deductions, and net income. However, partnerships do not pay income tax at the entity level; instead, income is passed through to the partners, who report it on their individual tax returns. This distinction in tax treatment is a key difference between the two forms.

Another document that bears resemblance to Form 1120 is the IRS Form 1120-S, which is for S corporations. Like Form 1120, it is used to report income, deductions, and credits. However, the S corporation structure allows income to pass through to shareholders, avoiding double taxation. Both forms require similar financial information, but the tax implications differ significantly. S corporations must meet specific eligibility criteria to file Form 1120-S, which is not a requirement for traditional corporations filing Form 1120.

The IRS Form 990 is also comparable to Form 1120, but it is used by tax-exempt organizations. Both forms require organizations to disclose their financial activities, including revenue and expenses. However, Form 990 is designed to provide transparency to the public about how tax-exempt organizations operate. It includes information about governance, compliance, and public support, which is not a focus of Form 1120. While both forms aim to provide a clear picture of an organization’s financial health, their purposes and audiences differ significantly.

To ensure that you understand your rights and obligations as a landlord or tenant, it's essential to familiarize yourself with important documents like the Florida Notice to Quit form. This legal notice, which prompts tenants to address lease violations, can be downloaded for your reference; download the document now to stay informed and prepared.

Form 1040, the individual income tax return, shares some similarities with Form 1120 in that both require the reporting of income and deductions. However, Form 1040 is for individuals, while Form 1120 is for corporations. Individuals report their personal income and expenses, while corporations report on their business activities. The structure of both forms is designed to capture the financial activities relevant to their respective entities, yet the tax treatment and obligations differ greatly between individuals and corporations.

Lastly, the IRS Form 941 is another document that has some parallels with Form 1120. Form 941 is used by employers to report payroll taxes, including income tax withheld and Social Security and Medicare taxes. Both forms require detailed financial reporting, but they serve different purposes. Form 941 focuses on employment-related taxes, while Form 1120 is concerned with corporate income. Understanding the distinctions between these forms is crucial for compliance and accurate reporting, as each serves a unique role in the tax system.

Other PDF Templates

Irs Transcripts - The total payments section summarizes all amounts applied or paid toward the tax balance throughout the year.

Understanding the nuances of shipping documentation is essential, especially when dealing with a Straight Bill Of Lading form, which is a crucial document in the shipping industry, serving as a contract between a shipper and a carrier for the transport of goods. It specifies the details of the cargo, its destination, and the terms of transportation. This form, importantly, is non-negotiable, meaning it requires delivery only to the named consignee. For more resources on filling out these forms, you can visit https://smarttemplates.net/.

Florida Real Estate Forms - This document ensures that both landlords and tenants understand their rights and obligations during the lease term.

More About IRS 1120

What is the IRS Form 1120?

The IRS Form 1120 is the U.S. Corporation Income Tax Return. Corporations use this form to report their income, gains, losses, deductions, and credits. It is essential for determining the tax liability of a corporation for a given tax year.

Who needs to file Form 1120?

Any corporation operating in the United States must file Form 1120. This includes C corporations, which are taxed separately from their owners. S corporations, however, file a different form (1120S) and do not pay federal income tax at the corporate level.

When is Form 1120 due?

Form 1120 is typically due on the 15th day of the fourth month after the end of the corporation’s tax year. For most corporations that follow the calendar year, this means the form is due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

What information is required on Form 1120?

Form 1120 requires detailed information about the corporation’s income, deductions, and credits. This includes revenue from sales, cost of goods sold, operating expenses, and any other income or deductions. Additionally, the corporation must provide its name, address, and Employer Identification Number (EIN).

Can a corporation get an extension to file Form 1120?

Yes, a corporation can request a six-month extension to file Form 1120 by submitting Form 7004. However, this extension only applies to the filing of the form, not the payment of any taxes owed. Payment must still be made by the original due date to avoid penalties and interest.

What happens if a corporation fails to file Form 1120?

If a corporation fails to file Form 1120 on time, it may face penalties. The IRS typically imposes a penalty based on the amount of unpaid tax. Additionally, failure to file can lead to interest charges on any taxes owed. It is important to file on time to avoid these consequences.

Can Form 1120 be filed electronically?

Yes, Form 1120 can be filed electronically. The IRS encourages electronic filing as it is faster and more efficient. Corporations can use IRS-approved e-file providers to submit their returns electronically. This method also allows for quicker processing and confirmation of receipt.

What if a corporation needs to amend Form 1120?

If a corporation needs to amend a previously filed Form 1120, it should file Form 1120-X, Amended U.S. Corporation Income Tax Return. This form allows the corporation to correct any errors or make changes to its original return. It is important to provide clear explanations for the amendments made.

Where can a corporation find help with Form 1120?

Corporations can find assistance with Form 1120 through the IRS website, where they can access instructions and resources. Additionally, tax professionals, accountants, or tax preparers can provide guidance and help ensure that the form is completed accurately.

What records should a corporation keep related to Form 1120?

Corporations should maintain detailed records of all income, expenses, and deductions reported on Form 1120. This includes receipts, invoices, bank statements, and any other documentation that supports the information provided on the tax return. Keeping these records for at least three years is advisable in case of an audit.

Dos and Don'ts

When filling out the IRS 1120 form, it's important to be thorough and accurate. Here are some key do's and don'ts to keep in mind:

- Do ensure all information is accurate and complete. Double-check your numbers and details.

- Do file your form on time to avoid penalties. Keep track of deadlines.

- Do include all necessary schedules and attachments. Missing documents can delay processing.

- Do consult a tax professional if you're unsure about any part of the form. Getting help can save you time and stress.

- Don't rush through the form. Take your time to avoid mistakes.

- Don't ignore instructions. Follow the guidelines provided by the IRS carefully.

- Don't forget to sign and date the form. An unsigned form is considered incomplete.

- Don't hesitate to ask questions. If something is unclear, seek clarification before submitting.

IRS 1120 - Usage Steps

Filling out the IRS Form 1120 is an important step for corporations to report their income, deductions, and tax liability. Once you gather all necessary information and documents, you can begin completing the form. Follow these steps to ensure accurate and complete submission.

- Begin with the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Provide the date of incorporation and the total assets at the end of the year.

- Complete the income section by reporting gross receipts or sales, returns, and allowances.

- List other income sources, such as dividends and interest income, in the appropriate section.

- Calculate the total income by adding all income sources together.

- Move to the deductions section and list all allowable business expenses, such as salaries, rent, and utilities.

- Sum up all deductions to find the total deductions amount.

- Subtract total deductions from total income to determine taxable income.

- Complete the tax computation section, applying the appropriate tax rate to the taxable income.

- Include any credits or payments that apply to your corporation, such as estimated tax payments.

- Calculate the total tax due or the amount to be refunded.

- Sign and date the form. Ensure that an authorized person from the corporation signs it.

- Submit the completed form to the IRS by the deadline, either electronically or by mail.