Fill Your IRS 2553 Form

The IRS 2553 form plays a crucial role for small business owners looking to elect S corporation status for their entities. This form allows eligible corporations and limited liability companies (LLCs) to choose a tax structure that can lead to significant tax savings. By filing Form 2553, a business can avoid double taxation on corporate income, as profits and losses are passed directly to shareholders. To successfully complete this form, businesses must meet specific eligibility requirements, including a limit on the number of shareholders and the types of allowable shareholders. Timeliness is also essential; the form must be filed within a certain timeframe to ensure the election is effective for the desired tax year. Understanding the details of Form 2553, including its sections and the necessary information required, is vital for any business owner considering this election. Additionally, there are consequences for failing to file correctly, making it imperative to approach the process with care and attention to detail.

Similar forms

The IRS Form 8832, also known as the Entity Classification Election, is similar to Form 2553 in that it allows businesses to choose how they want to be classified for tax purposes. While Form 2553 is specifically for S corporations, Form 8832 provides a broader option for entities to elect to be treated as a corporation, partnership, or disregarded entity. Both forms require careful consideration of the tax implications and eligibility criteria, ensuring that the business structure aligns with the owners' financial goals.

Form 1065, the U.S. Return of Partnership Income, shares similarities with Form 2553 in that both forms are used by entities that want to report income and losses for tax purposes. While Form 2553 is used to elect S corporation status, Form 1065 is filed by partnerships to report their income, deductions, and credits. Both forms require detailed financial information and must be filed annually, emphasizing the importance of accurate record-keeping for tax compliance.

The IRS Form 1120, U.S. Corporation Income Tax Return, is another document that parallels Form 2553. This form is used by corporations to report their income, gains, losses, and deductions. Like Form 2553, it plays a crucial role in determining the tax obligations of a business. However, while Form 2553 is for electing S corporation status, Form 1120 is specifically for C corporations, which are taxed differently. Understanding the distinctions between these forms is vital for business owners when deciding their tax structure.

Form 941, the Employer’s Quarterly Federal Tax Return, is related to Form 2553 in that both are essential for businesses with employees. While Form 2553 is focused on electing S corporation status, Form 941 is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Both forms require timely filing and accurate reporting to maintain compliance with IRS regulations, highlighting the importance of managing payroll and tax obligations effectively.

Form 990, the Return of Organization Exempt From Income Tax, is another form that shares some characteristics with Form 2553. Nonprofit organizations use Form 990 to report their financial information to the IRS. While Form 2553 is concerned with tax elections for corporations, Form 990 ensures transparency and accountability for tax-exempt organizations. Both forms are crucial for maintaining compliance with tax laws and provide insights into the financial health of the respective entities.

Form 1065-B, the U.S. Return of Income for Electing Large Partnerships, is similar to Form 2553 in that it is used by partnerships that have elected to be treated differently for tax purposes. This form is specifically for large partnerships that choose to be taxed as a partnership rather than as a corporation. Both forms require careful planning and understanding of tax implications, as they influence how income and losses are reported and taxed.

Form 1120-S, U.S. Income Tax Return for an S Corporation, is directly related to Form 2553, as it is the form that S corporations must file annually to report their income, deductions, and credits. After electing S corporation status with Form 2553, businesses must file Form 1120-S to comply with IRS requirements. This connection underscores the importance of understanding both forms in the context of maintaining S corporation status and fulfilling tax obligations.

Lastly, Form W-2, the Wage and Tax Statement, is relevant to Form 2553 in that both documents are critical for businesses with employees. Form W-2 reports the annual wages paid to employees and the taxes withheld. While Form 2553 focuses on the election of S corporation status, Form W-2 is essential for reporting employee compensation and ensuring compliance with tax withholding requirements. Both forms are vital for maintaining proper tax records and fulfilling employer responsibilities.

Other PDF Templates

Utility Bill Template - This form assists in keeping your utility accounts up to date.

Health Insurance Marketplace Statement - This form supports transparency regarding health premium costs and any subsidies provided through the Marketplace.

More About IRS 2553

What is the IRS Form 2553?

The IRS Form 2553 is a document used by small business owners to elect to be treated as an S Corporation for tax purposes. This election allows the business to avoid double taxation, meaning that income is only taxed at the shareholder level rather than at both the corporate and individual levels. By filing this form, a business can potentially reduce its overall tax liability, making it a popular choice among eligible small businesses.

Who is eligible to file Form 2553?

To file Form 2553, a business must meet certain criteria. First, it must be a domestic corporation, meaning it is incorporated in the United States. Additionally, it must have no more than 100 shareholders, and all shareholders must be individuals, certain trusts, or estates. The corporation can only have one class of stock, and it must not be an ineligible corporation, such as certain financial institutions or insurance companies. Meeting these requirements is crucial for a successful election.

When should Form 2553 be filed?

Form 2553 should be filed within two months and 15 days after the beginning of the tax year when the S Corporation election is to take effect. For example, if a corporation wants to be treated as an S Corporation for the tax year starting on January 1, it must file the form by March 15 of that year. If the deadline is missed, the corporation may have to wait until the next tax year to make the election, unless it can demonstrate reasonable cause for the delay.

What information is required on Form 2553?

When completing Form 2553, businesses must provide basic information, including the corporation's name, address, and Employer Identification Number (EIN). Additionally, the form requires details about the shareholders, such as their names, addresses, and the number of shares they own. It also asks for the date the corporation was formed and the tax year the election will apply to. Accurate and complete information is essential for the IRS to process the election smoothly.

What happens after filing Form 2553?

After submitting Form 2553, the IRS will review the election. If approved, the corporation will receive a confirmation letter, and it will be treated as an S Corporation for tax purposes. It is important to keep this letter for your records. If the IRS denies the election, the corporation will continue to be taxed as a regular C Corporation. In such cases, the corporation may have the option to appeal or correct any issues that led to the denial.

Dos and Don'ts

When filling out the IRS Form 2553, which is essential for electing S corporation status, it's crucial to follow specific guidelines to ensure a smooth process. Here are some important dos and don'ts to keep in mind:

- Do double-check your business name and address to ensure accuracy.

- Do make sure all shareholders sign the form where required.

- Do file the form within the appropriate timeframe, typically within 75 days of the beginning of the tax year.

- Do include the correct tax year for which you are making the election.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't forget to provide a valid Employer Identification Number (EIN) for your business.

- Don't overlook the requirement for all shareholders to be eligible S corporation shareholders.

- Don't submit the form without reviewing it for any errors or omissions.

IRS 2553 - Usage Steps

After obtaining the IRS 2553 form, you'll need to fill it out carefully to ensure that your election is processed smoothly. Follow these steps to complete the form accurately.

- Download the IRS 2553 form from the IRS website or obtain a physical copy.

- Begin with your business name. Fill in the legal name of your corporation in the designated space.

- Provide the address of your corporation. This should be the principal place of business.

- Enter the Employer Identification Number (EIN) if you have one. If not, you can apply for one separately.

- Fill in the date of incorporation. This is the date your corporation was legally formed.

- Indicate the tax year your corporation will follow. Most corporations use the calendar year, but you can choose a different fiscal year if necessary.

- List the names and addresses of all shareholders. Ensure that each shareholder's percentage of ownership is accurately represented.

- Sign and date the form. An authorized officer of the corporation must sign it to validate the election.

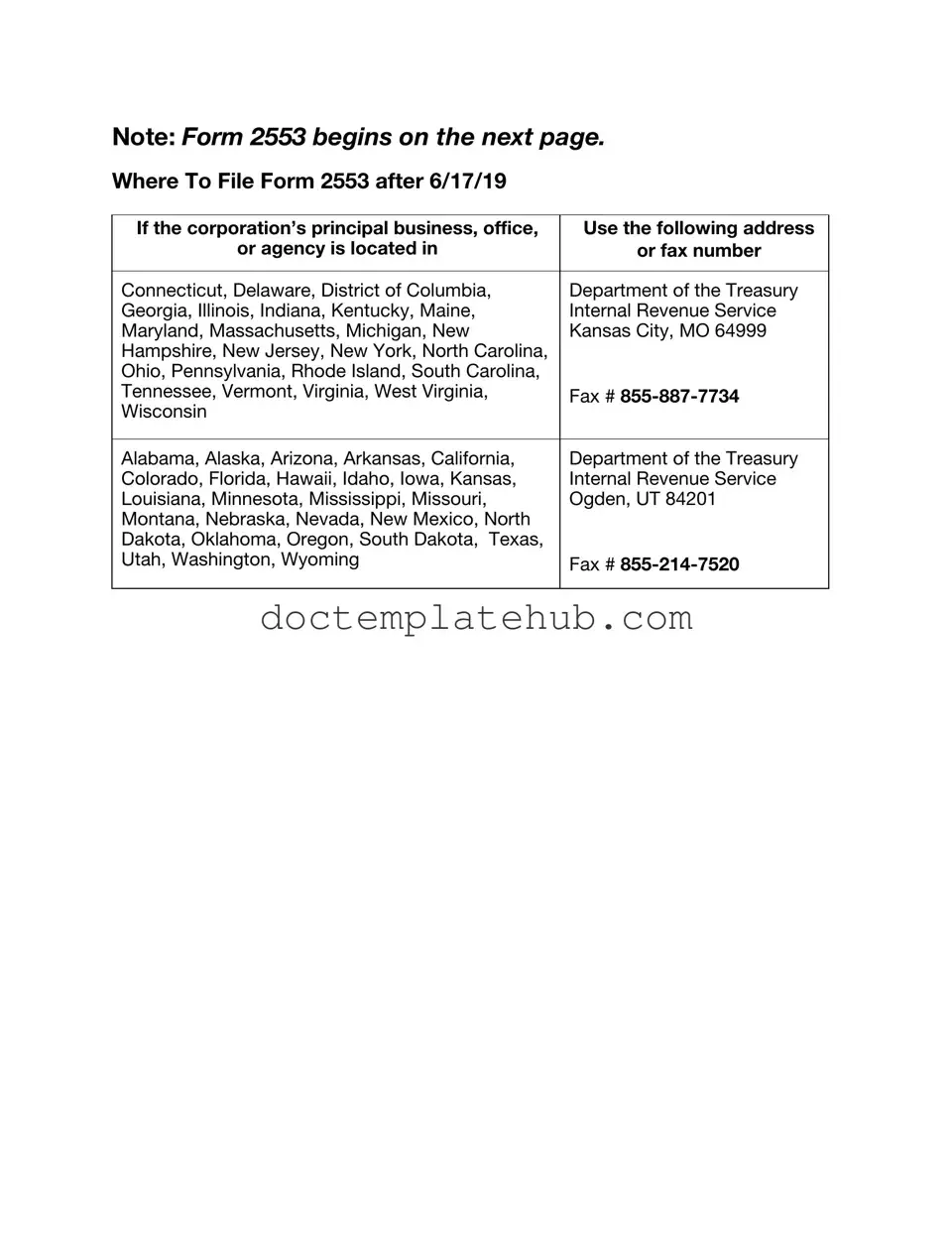

- Submit the completed form to the IRS. Make sure to send it to the correct address, which can be found in the form instructions.

Once the form is submitted, the IRS will review your election. Keep an eye on any correspondence from them to ensure that everything is processed correctly.