Fill Your IRS 433-F Form

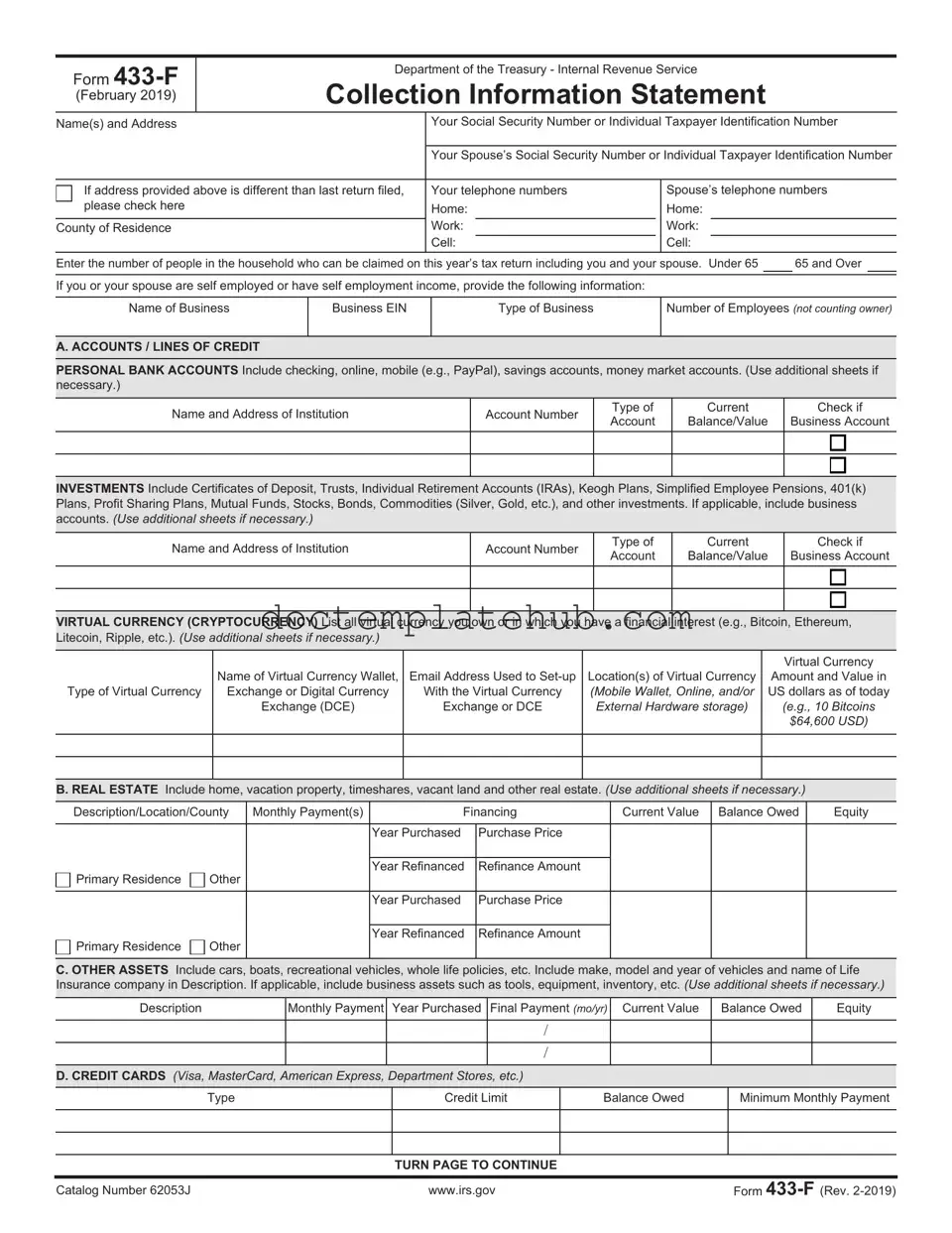

The IRS 433-F form plays a crucial role in the tax resolution process for individuals and businesses facing financial difficulties. This form serves as a financial statement, providing the Internal Revenue Service with a comprehensive overview of a taxpayer's financial situation. It includes detailed information about income, expenses, assets, and liabilities, which helps the IRS assess a taxpayer's ability to pay their tax obligations. By accurately completing the 433-F, taxpayers can facilitate negotiations for payment plans, offers in compromise, or other tax relief options. Moreover, the form is often used during audits or when taxpayers seek to resolve outstanding tax debts. Understanding the nuances of the IRS 433-F form is essential for anyone navigating the complexities of tax liabilities, as it can significantly impact the outcome of financial negotiations with the IRS.

Similar forms

The IRS Form 433-A is similar to Form 433-F in that both are used for collecting financial information from taxpayers. Form 433-A is typically used by individuals who are self-employed or have more complex financial situations. It requires detailed information about income, expenses, assets, and liabilities. Like Form 433-F, it helps the IRS evaluate a taxpayer's ability to pay their tax debt. The key difference lies in the level of detail required, with Form 433-A demanding a more thorough disclosure of financial circumstances.

Form 433-B serves a similar purpose but is specifically designed for businesses. This form collects information about a business’s financial status, including income, expenses, and assets. Just like Form 433-F, it is used to assess a business's ability to pay tax debts. The distinction lies in the focus on business operations and financial data rather than personal finances, making it essential for business owners facing tax issues.

Understanding the benefits of a Transfer-on-Death Deed form in Georgia can significantly simplify the estate planning process, ensuring that property is passed on efficiently without the complexities of probate. This deed offers clarity regarding the intended beneficiary, making the transition smoother for heirs and providing assurance to property owners.

Another related document is the IRS Form 656, which is an Offer in Compromise application. While Form 433-F gathers financial information, Form 656 uses that information to propose a settlement for less than the total amount owed. Taxpayers must submit Form 433-F alongside Form 656 to demonstrate their financial situation and justify their offer. Both forms work together to facilitate negotiations between the taxpayer and the IRS regarding tax liabilities.

Form 9465 is also relevant, as it is a request for a monthly installment agreement. Similar to Form 433-F, it requires information about the taxpayer’s financial situation. However, while Form 433-F assesses overall ability to pay, Form 9465 focuses on establishing a payment plan for those who cannot pay their tax bill in full. The two forms are often used in conjunction to set up manageable repayment terms based on the taxpayer's financial capacity.

Lastly, the IRS Form 1040, the individual income tax return, shares similarities with Form 433-F in that both require personal financial information. Form 1040 details an individual’s income and deductions for the tax year, while Form 433-F provides a snapshot of financial status for the IRS to evaluate tax liabilities. Although they serve different purposes, both forms are crucial in the context of an individual’s tax responsibilities and financial obligations.

Other PDF Templates

Make a Fake Insurance Card - This document features a security watermark for authenticity.

Cash Drawer Balance Sheet - Encourages regular cash drawer checks.

Obtaining the CDC U.S. Standard Certificate of Live Birth is essential for new parents, as this official document not only provides a record of the child's birth but also facilitates access to important services. For further details on how to obtain this form, you can visit https://documentonline.org/blank-cdc-u-s-standard-certificate-of-live-birth.

What Is a Progress Note in the Medical Record - Documentation of any adverse reactions noted.

More About IRS 433-F

What is the IRS 433-F form used for?

The IRS 433-F form is primarily used to collect financial information from taxpayers who owe back taxes. This form helps the IRS assess a taxpayer's ability to pay their tax debts. By providing details about income, expenses, assets, and liabilities, taxpayers can inform the IRS of their financial situation. This information can be crucial for negotiating payment plans or settling tax debts.

Who needs to fill out the IRS 433-F form?

Taxpayers who have received a notice from the IRS regarding unpaid taxes may need to complete the IRS 433-F form. This includes individuals who are seeking to set up an installment agreement or those who want to apply for an Offer in Compromise. If you owe taxes and are unable to pay in full, filling out this form is often a necessary step in resolving your tax issues.

How do I complete the IRS 433-F form?

To complete the IRS 433-F form, gather all necessary financial documents, such as pay stubs, bank statements, and bills. The form requires you to provide information about your income, monthly expenses, assets, and liabilities. Be honest and thorough when filling it out, as inaccuracies can lead to complications with your tax situation. After completing the form, review it for accuracy before submitting it to the IRS.

Where do I send the completed IRS 433-F form?

Once you have completed the IRS 433-F form, you should send it to the address indicated in the notice you received from the IRS. If you are unsure where to send it, you can check the IRS website or contact their customer service for guidance. Make sure to keep a copy of the form for your records before sending it off.

Dos and Don'ts

When filling out the IRS 433-F form, it's important to approach the process carefully. Below are some essential dos and don'ts to keep in mind.

- Do provide accurate and complete information.

- Do double-check all entries for errors before submission.

- Do include all sources of income, even if they seem minor.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill in every applicable area.

- Don't exaggerate or understate your financial situation.

- Don't ignore deadlines; submit the form on time to avoid penalties.

- Don't hesitate to seek assistance if you have questions about the form.

By following these guidelines, you can help ensure that your submission is processed smoothly and efficiently.

IRS 433-F - Usage Steps

Filling out the IRS 433-F form is an important step in addressing your tax situation. This form helps the IRS understand your financial status. Below are the steps to complete the form accurately.

- Start by downloading the IRS 433-F form from the IRS website or obtain a physical copy.

- At the top of the form, fill in your name, Social Security number, and address.

- Provide your telephone number and email address in the appropriate fields.

- In the section for employment information, list your employer's name, address, and phone number.

- Next, detail your income. Include your salary, wages, and any other sources of income.

- List your monthly expenses. This includes housing, utilities, food, transportation, and any other necessary costs.

- Document your assets. This includes cash, bank accounts, real estate, and vehicles.

- If applicable, note any debts you owe. Include credit cards, loans, and any other financial obligations.

- Review the completed form for accuracy. Make sure all information is correct and complete.

- Sign and date the form at the bottom before submitting it to the IRS.

Once you have filled out the form, it is essential to submit it to the IRS as instructed. Keep a copy for your records. This will help you stay organized and prepared for any follow-up communication from the IRS.