Fill Your IRS Schedule C 1040 Form

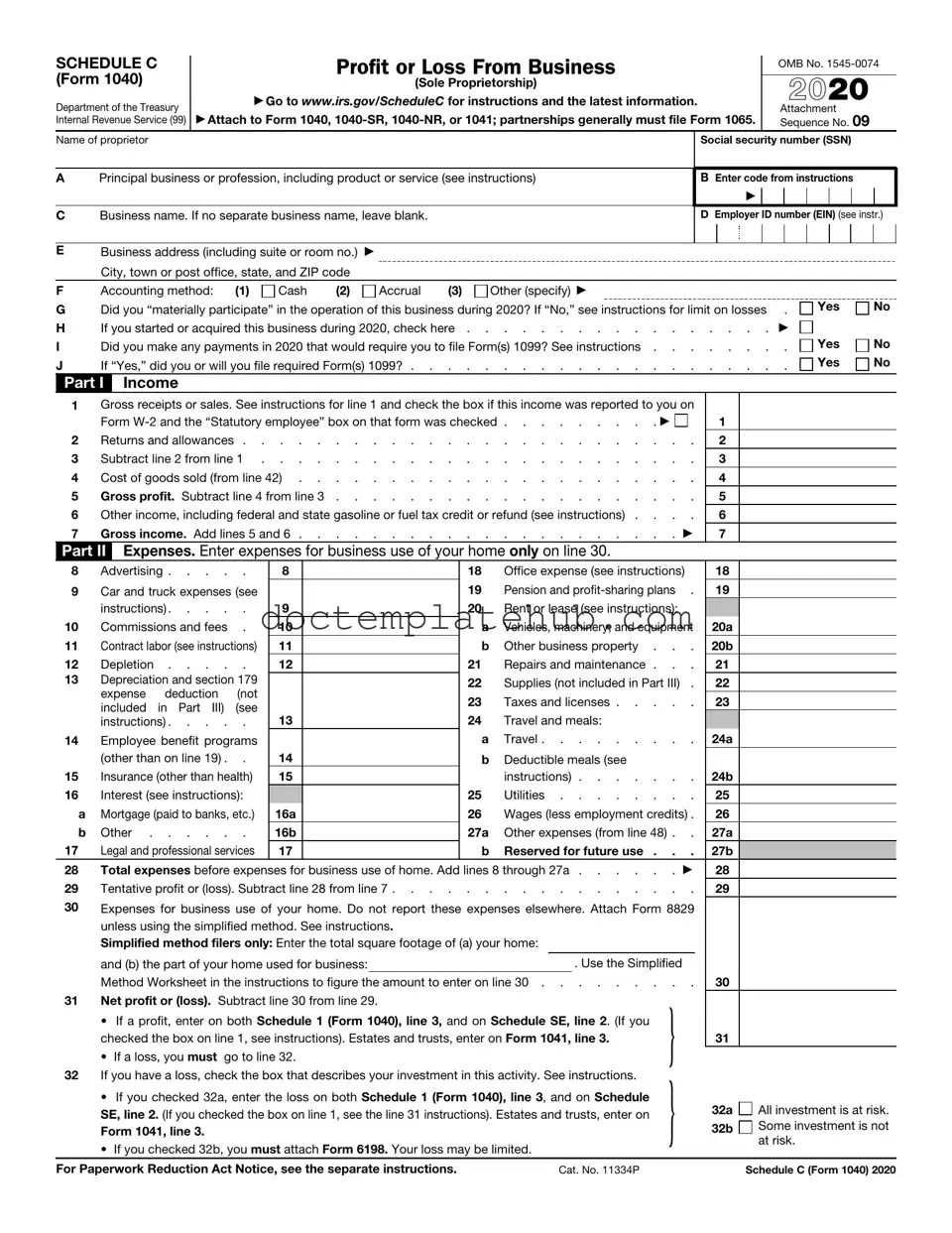

The IRS Schedule C (Form 1040) serves as a crucial tool for self-employed individuals and sole proprietors to report their business income and expenses. This form enables taxpayers to detail their earnings from various business activities, providing a clear picture of their financial performance over the year. By outlining both revenue and allowable deductions, Schedule C helps determine the net profit or loss from the business, which is then transferred to the individual’s Form 1040. Key components of the form include sections for reporting gross receipts, cost of goods sold, and various operating expenses such as advertising, utilities, and depreciation. Additionally, the form includes a space for detailing vehicle expenses, home office deductions, and other specific costs related to the business. Completing Schedule C accurately is essential, as it not only affects tax liability but also plays a role in establishing eligibility for certain credits and deductions. Understanding the intricacies of this form can empower self-employed individuals to maximize their tax benefits while ensuring compliance with IRS regulations.

Similar forms

The IRS Schedule C (Form 1040) is often compared to the IRS Form 1065, which is used for partnerships. Both forms serve the purpose of reporting income and expenses, but they cater to different types of business structures. While Schedule C is specifically for sole proprietors, Form 1065 is designed for partnerships to report their income, deductions, and credits. Each partner's share of income or loss is then passed through to their individual tax returns. This shared approach allows for a collaborative reporting of financial performance, making it essential for partnerships to accurately reflect their business activities.

Another document that resembles Schedule C is the IRS Form 1120, which is the corporate tax return. This form is utilized by corporations to report their income, gains, losses, and deductions. Like Schedule C, Form 1120 requires detailed information about revenue and expenses. However, the primary difference lies in the business structure; Schedule C is for sole proprietorships, while Form 1120 is for corporations. Both forms aim to provide a comprehensive overview of the business's financial health, but they cater to different legal entities and tax obligations.

The IRS Schedule C also shares similarities with Form 1040, specifically the main 1040 tax return. Schedule C is an attachment to Form 1040 for reporting income from self-employment. While Form 1040 captures an individual’s overall income, including wages, interest, and dividends, Schedule C focuses solely on the income generated from a business. This integration allows individuals to combine their various income sources into one tax return, simplifying the filing process for self-employed individuals.

For those navigating property transfers, understanding the implications of a Quitclaim Deed is essential, particularly in scenarios like family transactions. Acquainting yourself with this legal document can greatly aid in ensuring a smooth process. For more information, visit the comprehensive guide to Quitclaim Deed forms.

Lastly, Schedule C can be likened to the IRS Form 4835, which is used by individuals who earn income from renting out land or property. Both forms require the reporting of income and expenses related to business activities. However, while Schedule C is for general business income, Form 4835 specifically addresses income from farming or rental activities. This distinction highlights the different types of income generation, yet both forms require detailed documentation of expenses to ensure accurate tax reporting.

Other PDF Templates

Da 7666 - This form supports the updating of military duty information.

When preparing to submit the USCIS I-134 form, it is essential to understand the financial commitment that accompanies this pledge. Sponsors must be prepared to provide substantial proof of their ability to support the visitor, ensuring that they will not rely on public funds during their time in the United States. For more detailed guidance on completing the form effectively, you can visit smarttemplates.net, which offers helpful resources and templates tailored for this purpose.

Letter Authorizing Child to Travel - This form can help schools maintain an organized approach to student involvement in events.

Different Types of Background Checks - Identity verification is crucial for processing your background check efficiently.

More About IRS Schedule C 1040

What is IRS Schedule C?

IRS Schedule C is a tax form used by sole proprietors to report income and expenses from their business activities. It is part of the individual income tax return, Form 1040. If you run a business as a sole proprietor, you must file this form to calculate your net profit or loss, which is then reported on your Form 1040. This form helps the IRS understand how much money you made and what expenses you incurred in running your business.

Who needs to file Schedule C?

Individuals who operate a business as a sole proprietor need to file Schedule C. This includes freelancers, independent contractors, and anyone who earns money from self-employment. If your business is structured as a partnership, corporation, or limited liability company (LLC) taxed as a corporation, you would not use Schedule C. Instead, different forms would apply based on your business structure.

What information do I need to complete Schedule C?

To fill out Schedule C, you will need various pieces of information. Start by gathering details about your business income, including sales, services provided, and any other sources of revenue. Next, collect records of your business expenses, such as rent, utilities, supplies, and wages. It's also helpful to have information about your vehicle expenses if you use a car for business purposes. Accurate records will ensure that you can report your income and deductions correctly.

How do I report income on Schedule C?

Income is reported on the top section of Schedule C. You will list your gross receipts or sales, which is the total amount earned from your business before any expenses are deducted. If you had returns or allowances, those should be subtracted to arrive at your net income. Make sure to keep documentation of all income sources, as the IRS may require proof if they have questions about your reported figures.

What types of expenses can I deduct on Schedule C?

Many business expenses can be deducted on Schedule C, which can significantly reduce your taxable income. Common deductible expenses include rent, utilities, office supplies, advertising, and travel costs related to business activities. Additionally, if you use part of your home exclusively for business, you may qualify for a home office deduction. It's crucial to keep receipts and records for all expenses to substantiate your deductions.

What is the difference between net profit and net loss on Schedule C?

Net profit is the amount you earn after subtracting your total business expenses from your total income. If your expenses exceed your income, you will report a net loss. A net profit is subject to self-employment tax, while a net loss can offset other income on your tax return, potentially lowering your overall tax liability. Understanding these figures is essential for accurate tax reporting.

When is Schedule C due?

Schedule C is due on the same date as your individual income tax return, which is typically April 15 each year. If you need more time, you can file for an extension, but remember that any taxes owed must still be paid by the original due date to avoid penalties and interest. Keeping track of deadlines is vital to ensure compliance with IRS regulations.

Can I file Schedule C electronically?

Yes, you can file Schedule C electronically using various tax preparation software programs. Most of these programs guide you through the process, making it easier to enter your income and expenses. Electronic filing can expedite the processing of your tax return and may lead to quicker refunds. However, ensure that you have all your documentation ready before you start the e-filing process.

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it is essential to approach the task with care and attention to detail. Here are some important guidelines to follow, as well as some common pitfalls to avoid.

Things You Should Do:

- Gather all relevant financial records, including income and expenses, before starting the form.

- Use accurate figures to report your income, ensuring you include all sources related to your business.

- Keep detailed records of your business expenses, as this can help maximize your deductions.

Things You Shouldn't Do:

- Do not underestimate your income; this could lead to penalties or audits.

- Avoid mixing personal and business expenses, as this can complicate your tax situation.

- Do not wait until the last minute to file; giving yourself ample time can help you avoid mistakes.

By adhering to these guidelines, you can ensure a smoother process when completing your Schedule C form and help safeguard your financial integrity.

IRS Schedule C 1040 - Usage Steps

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals or sole proprietors who need to report income and expenses from their business. Follow these steps to complete the form accurately.

- Start by downloading the Schedule C form from the IRS website or obtaining a physical copy.

- At the top of the form, enter your name and Social Security number. If you have a business name, include it in the designated space.

- Indicate your business address, including the city, state, and ZIP code.

- In Part I, report your gross receipts or sales. This is the total income your business earned before any expenses.

- Next, fill out the cost of goods sold if applicable. This includes any expenses directly related to the production of goods sold by your business.

- Proceed to Part II to list your business expenses. This section includes categories like advertising, car and truck expenses, and office supplies. Be thorough and accurate.

- Calculate your total expenses and subtract this amount from your gross income to determine your net profit or loss.

- Complete Part III if you have any information regarding your vehicle use for business purposes. This may require additional details about mileage.

- Review the entire form for accuracy and completeness. Make sure all numbers add up correctly.

- Sign and date the form before submitting it along with your Form 1040.