Fill Your IRS W-9 Form

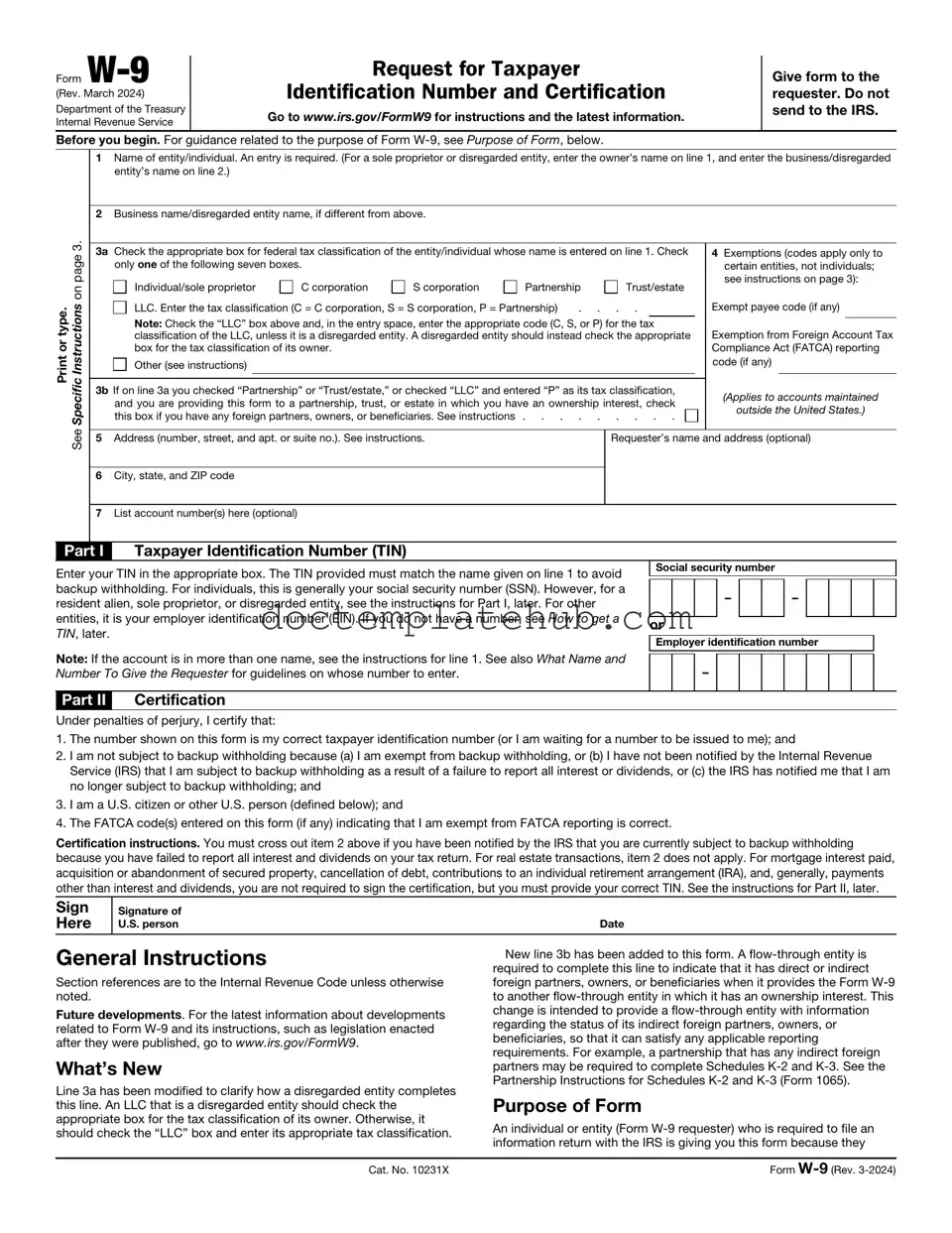

The IRS W-9 form is an essential document for individuals and businesses alike, playing a critical role in the world of taxation. When someone needs to report income paid to a contractor or freelancer, the W-9 comes into play. It collects vital information, including the taxpayer's name, business name (if applicable), address, and taxpayer identification number (TIN). This form serves as a request for the taxpayer's information, ensuring that the payer can accurately report payments to the IRS. Additionally, the W-9 helps determine whether the payee is an individual, corporation, or another type of entity, which can affect tax obligations. By providing accurate information on the W-9, taxpayers can help avoid issues with the IRS and ensure compliance with federal tax regulations. Understanding the importance of this form is crucial for anyone engaging in freelance work or independent contracting, as it lays the groundwork for proper income reporting and tax filing.

Similar forms

The IRS W-4 form is commonly used by employees to inform their employers about their tax withholding preferences. Like the W-9, it is a form that collects personal information, such as name and Social Security number. However, while the W-9 is used primarily for independent contractors and vendors to provide their taxpayer identification information, the W-4 focuses on determining how much federal income tax should be withheld from an employee's paycheck. Both forms are essential for ensuring accurate tax reporting and compliance with IRS regulations.

The 1099 form series is another set of documents that shares similarities with the W-9. Specifically, the 1099-MISC and 1099-NEC forms are used to report payments made to non-employees, such as freelancers or independent contractors. When a business pays an individual or entity that is not an employee, it often requires a completed W-9 to obtain the necessary taxpayer information. The information provided on the W-9 is then used to accurately fill out the corresponding 1099 form at the end of the tax year, ensuring that both the payer and payee fulfill their tax obligations.

The IRS Form 1040 is the standard individual income tax return form. While it serves a different purpose than the W-9, both documents are integral to the tax process. The W-9 provides the necessary information for businesses to report payments made to individuals, which may ultimately be included in the individual’s 1040 when they file their annual taxes. The data collected through the W-9 can impact the amounts reported on the 1040, making it a critical component of accurate tax reporting.

The IRS Form SS-4 is used to apply for an Employer Identification Number (EIN). While the W-9 is focused on individual taxpayer information, the SS-4 is geared towards businesses and entities seeking to establish their tax identification. Both forms require similar identifying information, such as the name and address of the taxpayer. The W-9 is often utilized by businesses that have already obtained their EIN to provide information to those who will report payments to them.

The IRS Form 4506-T allows taxpayers to request a transcript of their tax return. This document is similar to the W-9 in that it requires the taxpayer's identification information, including Social Security number. While the W-9 is used to provide information for payment reporting, the 4506-T is used to obtain a record of past tax filings. Both forms facilitate communication with the IRS, ensuring that individuals and businesses can access necessary information for tax compliance.

The IRS Form 8821 is a tax information authorization form. It allows a designated individual to receive or inspect your tax information. Similar to the W-9, it requires the taxpayer's personal information, such as their name and Social Security number. Both forms are essential for establishing proper channels of communication with the IRS, allowing individuals to authorize others to handle their tax matters while ensuring that their personal data is protected.

The IRS Form 1065 is the return of partnership income. While it serves a different function than the W-9, both documents are vital for tax reporting purposes. Partnerships often require a W-9 from their partners to report income accurately on the 1065. The information collected through the W-9 helps ensure that each partner's share of income is reported correctly, reflecting their contributions and earnings within the partnership.

The IRS Form 1098 is used to report mortgage interest paid by an individual. Similar to the W-9, it requires personal information to ensure that the correct taxpayer is associated with the reported payments. Both forms play a role in the overall tax reporting landscape, with the W-9 providing necessary identification for those receiving payments and the 1098 detailing specific deductions that can affect an individual's tax return.

The IRS Form 941 is used by employers to report payroll taxes. While it primarily focuses on employees, it shares a connection with the W-9 in that both forms require accurate taxpayer identification. Employers must ensure that they have the correct information on file for their employees, much like they do for independent contractors through the W-9. Both forms are essential for maintaining compliance with federal tax obligations.

Finally, the IRS Form 1095-A is used to report health insurance coverage obtained through the Health Insurance Marketplace. Similar to the W-9, it collects personal information to ensure accurate reporting. While the W-9 is used for payment reporting, the 1095-A provides crucial information for individuals to claim health care tax credits. Both forms are integral to the broader tax system, ensuring that taxpayers can accurately report their financial situations and obligations.

Other PDF Templates

Security Guard Example Incident Report Writing - This report underlines the essential nature of the security officer's role on-site.

Correction Deed California - This affidavit is crucial for maintaining transparency in legal document preparation.

Electrical Panel Schedule Template - The panel schedule assists in safety inspections.

More About IRS W-9

What is the purpose of the IRS W-9 form?

The IRS W-9 form is used to provide your taxpayer identification information to a person or entity that will pay you income. This could be an employer, a client, or any other payer. By completing the W-9, you confirm your name, address, and taxpayer identification number (TIN), which is usually your Social Security Number (SSN) or Employer Identification Number (EIN). This information helps the payer report payments to the IRS accurately.

Who needs to fill out a W-9 form?

Typically, independent contractors, freelancers, and vendors who receive payments for services rendered need to complete a W-9 form. If you are a U.S. citizen or resident alien and you receive income that requires reporting, you will likely be asked to provide a W-9. Businesses that pay you $600 or more in a calendar year will request this form to report the payments to the IRS.

How do I fill out a W-9 form?

Filling out a W-9 form is straightforward. Start by entering your name as it appears on your tax return. If you have a business name, include that in the appropriate section. Next, provide your business entity type, if applicable. After that, fill in your address, and then enter your TIN. Lastly, sign and date the form. Ensure that all information is accurate to avoid issues with tax reporting.

What should I do if my information changes?

If your name, address, or taxpayer identification number changes, you should complete a new W-9 form and submit it to the requester. Keeping your information up to date is essential for accurate tax reporting. If you fail to provide updated information, it could lead to tax complications for both you and the payer.

Is the W-9 form submitted to the IRS?

No, the W-9 form is not submitted directly to the IRS. Instead, it is provided to the person or business requesting it. They will use the information from your W-9 to prepare their own tax documents, such as the 1099 form, which they will submit to the IRS. Keep a copy of your completed W-9 for your records, as it may be needed for future reference.

Dos and Don'ts

When filling out the IRS W-9 form, it is important to approach the task with care. This form is essential for providing your taxpayer information to the person or entity requesting it. Here are some key dos and don'ts to keep in mind:

- Do ensure that your name matches the name on your tax return. This helps avoid any discrepancies.

- Do provide your correct taxpayer identification number (TIN), whether it is your Social Security Number (SSN) or Employer Identification Number (EIN).

- Do check the box that applies to your tax status, such as individual, corporation, or partnership.

- Do sign and date the form to confirm that the information provided is accurate.

- Don't leave any required fields blank. Incomplete forms can lead to processing delays.

- Don't use outdated versions of the form. Always ensure you are using the most current version available from the IRS website.

By following these guidelines, you can help ensure that your W-9 form is completed accurately and efficiently. This will facilitate smooth communication with the requesting party and help avoid potential tax issues in the future.

IRS W-9 - Usage Steps

After obtaining the IRS W-9 form, it is essential to complete it accurately to ensure proper tax reporting. Once filled out, the form should be submitted to the requesting party, typically a business or organization that needs your taxpayer information for reporting purposes.

- Download the IRS W-9 form from the official IRS website or obtain a physical copy.

- At the top of the form, provide your name as it appears on your tax return.

- If applicable, enter your business name or disregarded entity name in the second line.

- In the next section, select the appropriate federal tax classification by checking the corresponding box (individual, corporation, partnership, etc.).

- Fill in your address, including street, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate this in the appropriate section.

- Sign and date the form at the bottom, certifying that the information provided is accurate.