Official Lady Bird Deed Form

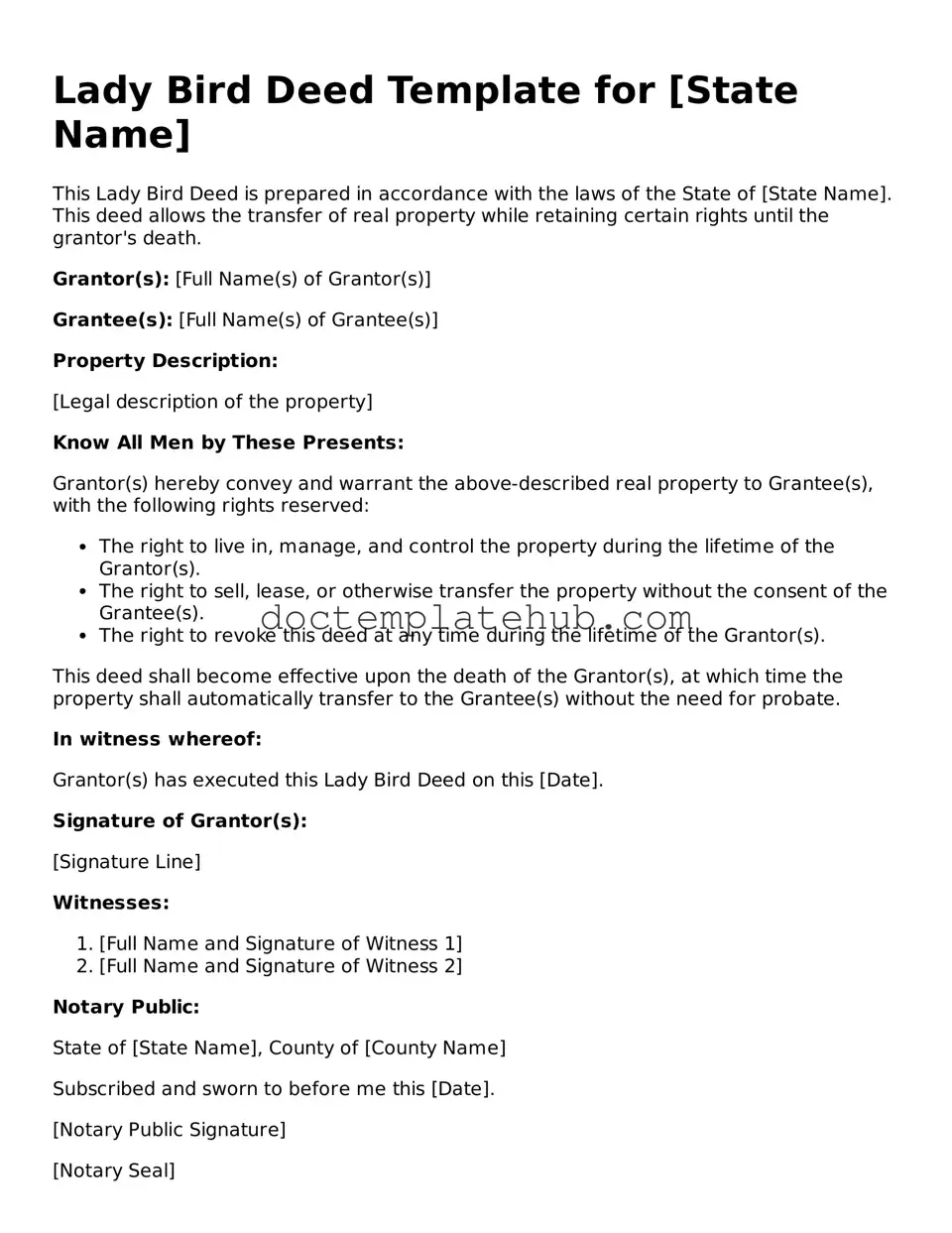

The Lady Bird Deed is a powerful estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique form is often used to avoid probate, simplifying the process for heirs when the property owner passes away. One of its key features is that it enables the original owner to live in and use the property without any restrictions, even after the transfer is executed. This means that the owner can sell, lease, or mortgage the property without needing consent from the beneficiaries. Additionally, the Lady Bird Deed can provide certain tax benefits, as it may help in avoiding capital gains taxes for heirs. By understanding its advantages and requirements, individuals can make informed decisions about their estate planning strategies, ensuring their wishes are honored while providing peace of mind for their loved ones.

Similar forms

The Lady Bird Deed, also known as an enhanced life estate deed, shares similarities with a traditional life estate deed. Both documents allow a property owner to retain the right to live in and use the property during their lifetime. However, while a traditional life estate deed requires the property to pass to a designated beneficiary upon the owner’s death, a Lady Bird Deed provides more flexibility. The owner can sell, mortgage, or change the beneficiary without needing permission from the remainderman, which is not the case with a traditional life estate.

Understanding the intricacies of property transfer documents is essential for effective estate planning. For those seeking better insights into various forms like the Straight Bill Of Lading or other related templates, resources such as smarttemplates.net can be invaluable in navigating the complexities of these legal forms.

A revocable living trust is another document that has characteristics similar to a Lady Bird Deed. Both instruments allow for the transfer of property outside of probate, which can simplify the process for heirs. A revocable living trust can hold various types of assets and can be altered or revoked at any time by the grantor. This flexibility contrasts with the more limited control offered by a traditional life estate deed, making the revocable living trust a more comprehensive estate planning tool.

Fill out Common Types of Lady Bird Deed Templates

What Is a Deed in Lieu - Borrowers should approach this process with caution and preparedness.

When it comes to ensuring a clear transaction, having the right documentation is crucial. For those looking for a reliable template, our site offers an informative guide on the comprehensive boat bill of sale form that outlines all necessary details for a successful sale. For more information, visit the boat bill of sale form.

Deed of Gift Template - This form outlines the intent of the donor to give a gift to the recipient.

More About Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their property to beneficiaries while retaining the right to use and control the property during their lifetime. This type of deed provides significant advantages, such as avoiding probate and allowing the original owner to sell or mortgage the property without the beneficiaries' consent. It is particularly useful for individuals looking to pass on their property without the complications of a traditional transfer upon death.

How does a Lady Bird Deed work?

When a property owner executes a Lady Bird Deed, they maintain a life estate in the property, meaning they can live in or use the property as they wish. Upon the owner's death, the property automatically transfers to the named beneficiaries without going through probate. This seamless transition helps ensure that the property remains within the family or is passed on according to the owner's wishes, all while avoiding the lengthy and often costly probate process.

What are the benefits of using a Lady Bird Deed?

One of the primary benefits of a Lady Bird Deed is its ability to bypass probate. This can save time and money for the beneficiaries. Additionally, the original owner retains full control over the property, allowing them to sell or modify it as needed without needing consent from the beneficiaries. This flexibility can be crucial for individuals who may need to make financial decisions regarding their property later in life. Furthermore, a Lady Bird Deed can protect the property from creditors in certain situations, providing an additional layer of security for the owner's estate.

Are there any drawbacks to a Lady Bird Deed?

While a Lady Bird Deed offers many advantages, there are some potential drawbacks to consider. For instance, if the property owner requires Medicaid assistance, the property may still be counted as an asset, which could affect eligibility. Additionally, the deed does not protect against estate taxes, which might still apply upon the owner's death. Finally, if the beneficiaries are not prepared to manage the property after the owner's passing, this could lead to disputes or complications. It is essential to weigh these factors and consult with a legal expert before proceeding with a Lady Bird Deed.

Dos and Don'ts

When it comes to filling out a Lady Bird Deed form, attention to detail is crucial. This legal document allows property owners to transfer their property to their heirs while retaining certain rights during their lifetime. Here are some important dos and don’ts to keep in mind:

- Do ensure that you have the correct legal description of the property.

- Do clearly identify all parties involved, including the grantor and grantee.

- Do review the form for accuracy before signing.

- Do consider consulting with a legal professional for guidance.

- Do keep a copy of the completed deed for your records.

- Don’t rush through the process; mistakes can lead to complications.

- Don’t forget to include any necessary witnesses or notarization requirements.

- Don’t leave out any details about the property or the beneficiaries.

- Don’t assume that the form is the same in every state; check local laws.

- Don’t neglect to file the deed with the appropriate county office.

By following these guidelines, you can help ensure that your Lady Bird Deed is filled out correctly and serves its intended purpose. Proper execution is vital to avoid any future disputes or misunderstandings regarding property ownership.

Lady Bird Deed - Usage Steps

Completing a Lady Bird Deed form requires careful attention to detail to ensure that all necessary information is accurately provided. Once the form is filled out, it will need to be signed and notarized before it can be recorded with the appropriate county office.

- Begin by obtaining the Lady Bird Deed form. This can often be found online or through a legal office.

- At the top of the form, fill in the name of the property owner, also known as the grantor. Ensure that the name matches the name on the property deed.

- Next, provide the address of the property being transferred. This should include the street address, city, state, and zip code.

- Identify the beneficiaries who will receive the property. List their full names and relationship to the grantor.

- In the designated section, indicate whether the property will remain in the grantor's control during their lifetime. This is a crucial aspect of the deed.

- Include any specific instructions regarding the transfer of the property after the grantor's death, if applicable. Be clear and concise in this section.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- After notarization, make copies of the signed deed for your records.

- Finally, file the original deed with the county clerk or recorder's office where the property is located. This step is essential for the deed to take effect.