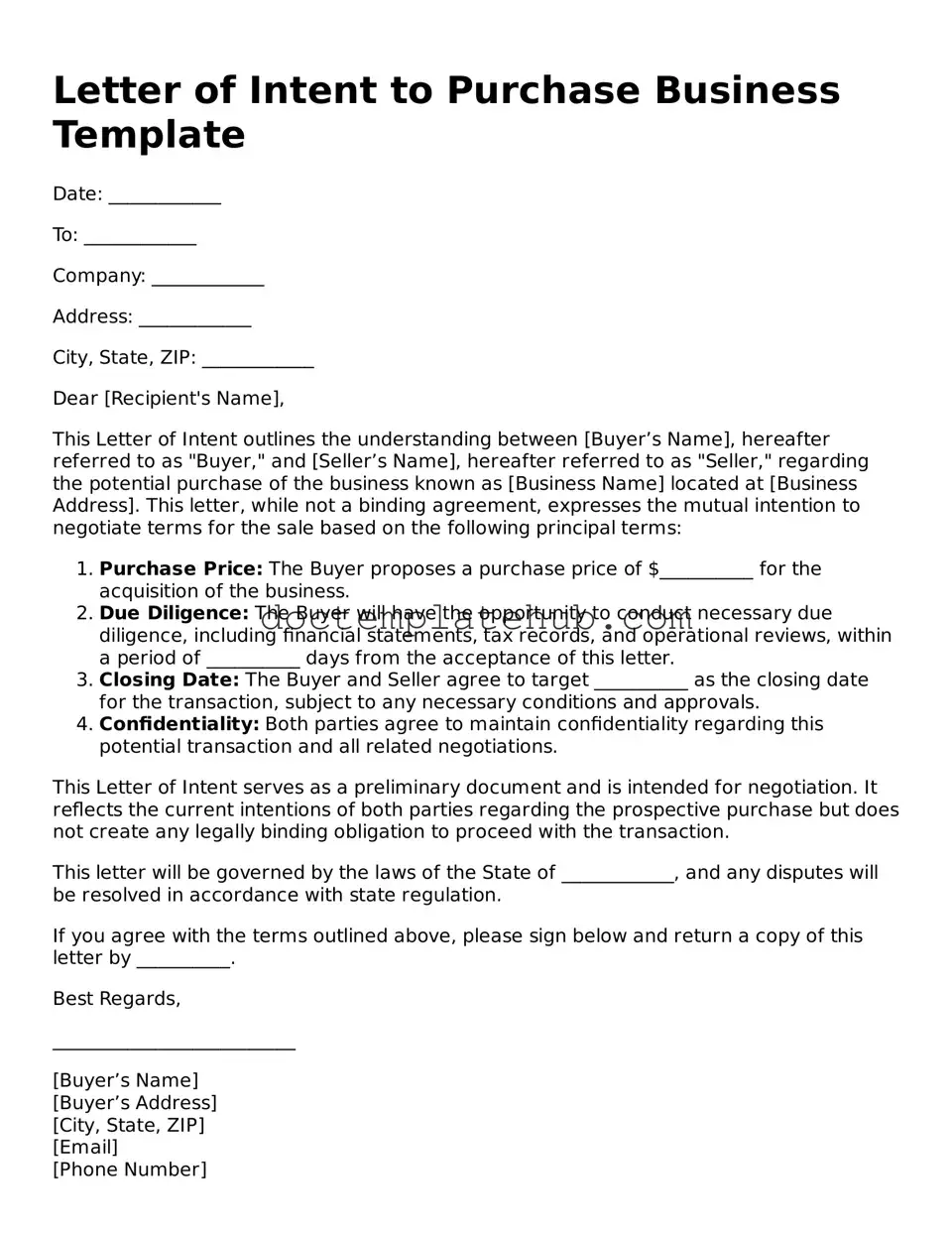

Official Letter of Intent to Purchase Business Form

When considering the acquisition of a business, the Letter of Intent to Purchase Business serves as a crucial first step in the negotiation process. This document outlines the key terms and conditions that both parties agree upon before moving forward with a formal purchase agreement. It typically includes essential details such as the purchase price, payment structure, and any contingencies that must be met for the sale to proceed. Additionally, it often addresses the timeline for due diligence, which allows the buyer to thoroughly assess the business's financial health and operational status. By establishing a clear framework for the transaction, the letter helps to minimize misunderstandings and sets the stage for a smoother negotiation process. While this form is not legally binding in most cases, it demonstrates the intent of the parties involved and can lay the groundwork for a successful business transfer. Understanding the nuances of this document can empower both buyers and sellers to navigate the complexities of business transactions with greater confidence.

Similar forms

The Letter of Intent (LOI) to Purchase Business is often compared to a Memorandum of Understanding (MOU). Both documents serve as preliminary agreements outlining the intentions of the parties involved. An MOU typically details the terms and conditions of a potential deal, much like an LOI, but it may also include a broader scope of collaboration beyond just the purchase. While an LOI is more focused on the purchase transaction, an MOU can address multiple aspects of a partnership or agreement, making it a versatile tool for negotiation.

A Purchase Agreement is another document similar to the LOI. This legally binding contract is executed after negotiations are complete and outlines the final terms of the sale. While the LOI expresses the intent to buy, the Purchase Agreement solidifies the deal with specific details, such as the purchase price, payment terms, and closing date. The LOI can serve as a precursor to the Purchase Agreement, setting the stage for the final negotiations.

An Offer to Purchase is closely related to the LOI as well. This document is a formal proposal made by a buyer to a seller, indicating the buyer's desire to acquire the business. Like the LOI, it outlines key terms such as price and conditions. However, an Offer to Purchase is typically more detailed and may include contingencies that must be met for the sale to proceed. The LOI, on the other hand, may be less formal and more focused on expressing interest.

A Non-Disclosure Agreement (NDA) often accompanies the LOI during business transactions. While the LOI outlines the intent to purchase, the NDA protects sensitive information shared between the parties. This document ensures that any proprietary information disclosed during negotiations remains confidential. The NDA is essential for maintaining trust and safeguarding business interests, especially when sensitive data is involved.

The Term Sheet is another document that bears similarities to the LOI. A Term Sheet outlines the basic terms and conditions of a deal, serving as a summary for further negotiation. Like the LOI, it is not legally binding but provides a framework for the discussions to follow. The Term Sheet may include aspects like valuation, payment structure, and timelines, helping both parties align their expectations before formalizing the agreement.

A Letter of Intent to Lease can also be compared to the LOI for purchasing a business. While the LOI focuses on the acquisition of a business, the Letter of Intent to Lease outlines the intentions of the parties regarding the leasing of property. Both documents express a desire to move forward with a transaction, but the leasing letter specifically addresses terms related to rental agreements, such as lease duration and rental rates, rather than the purchase of an entire business.

The California Homeschool Letter of Intent form is a crucial document for parents or guardians who choose to educate their children at home. This form serves as an official notification to the relevant school district that a child will be homeschooled, instead of attending traditional public or private schools. Ensuring this form is properly filled out and submitted is essential for compliance with California's educational statutes. For more information, you can visit https://onlinelawdocs.com/california-homeschool-letter-of-intent.

Finally, a Business Plan can be seen as a document that complements the LOI in the context of purchasing a business. While the LOI articulates intent, a Business Plan provides a comprehensive overview of how the buyer intends to operate and grow the business post-acquisition. It includes market analysis, financial projections, and strategic goals. This document can be crucial in convincing the seller of the buyer's capability and vision, thereby reinforcing the intent expressed in the LOI.

Fill out Common Types of Letter of Intent to Purchase Business Templates

Homeschool Letter of Intent Template - Some districts require this letter to allocate resources for homeschoolers.

An Investment Letter of Intent form is a preliminary agreement between an investor and a company, detailing the framework of a potential investment deal. It outlines the basic terms and conditions under which the investor agrees to invest capital into the company. For those seeking templates and guidance on drafting such documents, resources like TopTemplates.info can be invaluable. Although not legally binding in all its parts, it serves as a critical foundation for the negotiation and drafting of the final investment agreement.

More About Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to Purchase Business is a preliminary document that outlines the basic terms and conditions under which a buyer intends to purchase a business. It serves as a starting point for negotiations and demonstrates the buyer's serious interest. While it is not a binding contract, it often includes key details such as the purchase price, payment structure, and timeline for the transaction. This document can help both parties align their expectations before entering into a formal agreement.

Why is a Letter of Intent important in a business purchase?

The Letter of Intent is crucial because it sets the groundwork for the entire transaction. It clarifies the intentions of both the buyer and the seller, reducing the likelihood of misunderstandings later on. By outlining essential terms, the LOI helps facilitate due diligence, allowing both parties to assess the viability of the deal. Additionally, it can serve as a tool to secure financing, as lenders often require a clear understanding of the deal before providing funds.

What should be included in a Letter of Intent to Purchase Business?

An effective Letter of Intent should include several key components. First, it should clearly state the names of the buyer and seller, along with the business being purchased. Next, it should outline the proposed purchase price and any payment terms. It’s also important to include a timeline for the transaction, conditions that must be met before closing, and any contingencies. Finally, the LOI should address confidentiality and exclusivity provisions, ensuring that both parties maintain discretion during negotiations.

Is a Letter of Intent legally binding?

Dos and Don'ts

When filling out the Letter of Intent to Purchase Business form, it is important to follow certain guidelines to ensure clarity and completeness. Below are some recommended actions and some to avoid.

- Do: Provide accurate and detailed information about the business being purchased.

- Do: Clearly outline the terms of the purchase, including price and payment structure.

- Do: Include any contingencies that may affect the sale, such as financing or inspections.

- Do: Sign and date the document to validate it.

- Don't: Leave any sections blank; ensure all fields are completed.

- Don't: Use vague language that could lead to misunderstandings.

- Don't: Forget to review the document for errors before submission.

- Don't: Submit the form without consulting with a professional if necessary.

Letter of Intent to Purchase Business - Usage Steps

Completing the Letter of Intent to Purchase Business form is an important step in the process of acquiring a business. After filling out this form, you will be better prepared to move forward with negotiations and discussions with the current business owner. Take your time to ensure that all information is accurate and reflects your intentions clearly.

- Begin by entering the date at the top of the form. This will help establish a timeline for the agreement.

- Provide your full name and contact information. Include your address, phone number, and email address to ensure clear communication.

- Next, fill in the name of the business you intend to purchase. Be sure to include any relevant details, such as the business's address or specific location.

- Clearly state the purchase price you are proposing. It is important to be specific and realistic in this section.

- Outline the terms of the purchase. This could include payment methods, timelines, or any conditions that must be met before the sale is finalized.

- Include any contingencies that may apply. For example, you might want to specify that the purchase is contingent upon financing or satisfactory due diligence.

- Sign and date the form at the bottom. Your signature indicates your agreement with the terms outlined in the letter.

Once you have completed the form, review it carefully to ensure that all information is accurate. After confirming everything is correct, you can present the letter to the seller or their representative. This will initiate further discussions regarding the potential purchase of the business.