Official LLC Share Purchase Agreement Form

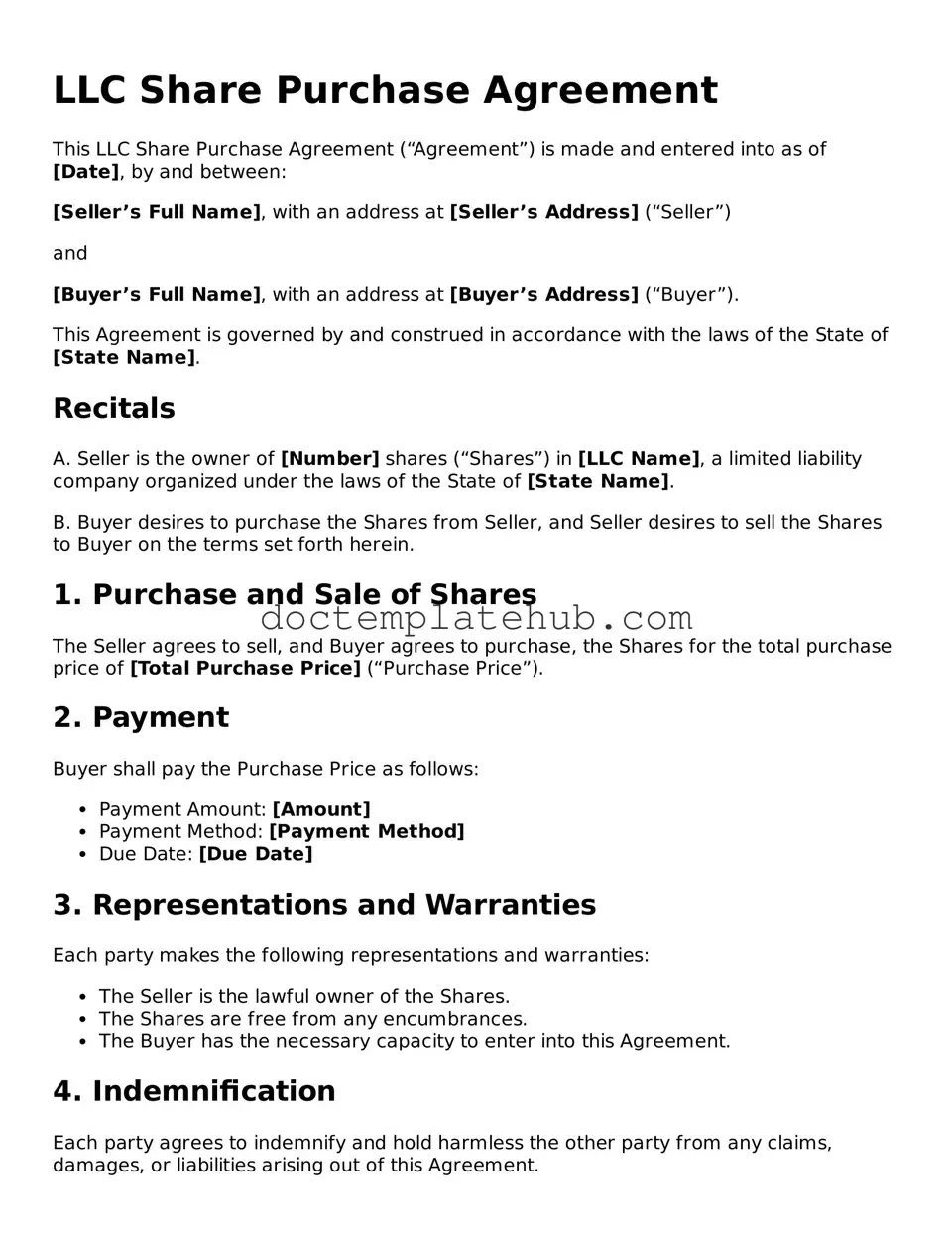

The LLC Share Purchase Agreement form is a crucial document for anyone involved in the buying or selling of shares in a limited liability company. This agreement outlines the terms and conditions under which shares are transferred between parties. It typically includes important details such as the purchase price, payment terms, and the number of shares being sold. Additionally, it addresses representations and warranties made by both the seller and the buyer, ensuring that both parties understand their rights and obligations. The form also often contains provisions for confidentiality, indemnification, and dispute resolution, which help protect the interests of both parties throughout the transaction. By clearly defining these elements, the LLC Share Purchase Agreement serves as a foundational tool for facilitating smooth and legally sound share transfers.

Similar forms

The LLC Operating Agreement is a foundational document for any limited liability company. It outlines the management structure, member roles, and operational procedures. Like the LLC Share Purchase Agreement, it serves to clarify the rights and responsibilities of the parties involved. Both documents are essential for preventing disputes and ensuring that all members understand their obligations. While the Share Purchase Agreement focuses on the transfer of ownership, the Operating Agreement provides a broader framework for the company's governance.

The Stock Purchase Agreement is another document that shares similarities with the LLC Share Purchase Agreement. This agreement is typically used for corporations and governs the sale of stock between buyers and sellers. Both documents address the terms of the sale, including price, payment methods, and any conditions that must be met. They also protect the interests of both parties by detailing representations and warranties. In essence, both agreements aim to facilitate a smooth transfer of ownership while minimizing potential conflicts.

The Membership Interest Purchase Agreement also resembles the LLC Share Purchase Agreement. This document is specifically designed for the sale of membership interests in an LLC. It outlines the terms of the transaction, including purchase price and any representations made by the seller. Both agreements emphasize the importance of clarity in the transfer process and aim to protect the rights of both the buyer and the seller. They ensure that all parties are aware of their rights and obligations during the transaction.

In the realm of investment transactions, the Investment Letter of Intent plays a crucial role by establishing the initial framework for negotiations, much like the agreements discussed. It serves as a commitment by the investor to pursue an agreement under outlined terms without being legally binding on the investment itself, creating a pathway for clarity and understanding. For further information, you can visit smarttemplates.net.

The Asset Purchase Agreement is another relevant document that bears similarity to the LLC Share Purchase Agreement. While the latter focuses on ownership transfer, the Asset Purchase Agreement deals with the sale of specific assets of a business rather than its ownership structure. Both documents outline terms such as price and conditions for the sale. They also provide a framework for the transaction, ensuring that both parties understand what is being exchanged. This clarity is crucial for avoiding misunderstandings and ensuring a successful transaction.

Common Forms

How Do I Create an Operating Agreement for My Llc - It outlines the process for decision-making and voting within the LLC.

Florida Immunization Records - For permanent medical exemptions, detailed clinical reasoning must be provided by a physician.

The General Bill of Sale form is a legal document used to transfer ownership of personal property from one party to another. This form serves as proof of the transaction, detailing the specifics of the property and the agreement between the buyer and seller. For more information on this important document, you can visit https://topformsonline.com/general-bill-of-sale/, making it essential to understand its components for ensuring a smooth transfer process.

Better Business Bureau Complaint - Raise concerns about misleading information on a website.

More About LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy shares in a limited liability company (LLC) from another party. This agreement serves as a binding contract that details the rights and obligations of both the buyer and the seller. It typically includes information such as the purchase price, payment terms, and any representations or warranties made by the seller regarding the shares being sold.

Why is an LLC Share Purchase Agreement important?

This agreement is crucial for several reasons. First, it protects the interests of both parties by clearly defining the terms of the transaction. Without a formal agreement, misunderstandings and disputes may arise after the sale. Additionally, the agreement can help ensure compliance with any applicable laws or regulations governing the sale of shares in an LLC. It also provides a record of the transaction, which can be useful for future reference or in the event of legal disputes.

What key elements should be included in an LLC Share Purchase Agreement?

Several important elements should be included in an LLC Share Purchase Agreement. These include the names and addresses of the buyer and seller, a description of the shares being sold, the purchase price, and the payment terms. The agreement should also outline any conditions that must be met before the sale can be completed, such as obtaining necessary approvals from other members of the LLC. Additionally, representations and warranties regarding the shares, as well as any indemnification clauses, should be clearly stated.

How does the payment process work in an LLC Share Purchase Agreement?

The payment process is typically detailed within the agreement itself. It may specify whether the payment will be made in a lump sum or in installments. The agreement should also outline the method of payment, such as cash, check, or bank transfer. Furthermore, it may include provisions regarding what happens if the buyer fails to make a payment on time, which could involve penalties or the right of the seller to terminate the agreement.

Can an LLC Share Purchase Agreement be modified after it is signed?

Yes, an LLC Share Purchase Agreement can be modified after it is signed, but any changes must be agreed upon by both parties. Typically, modifications are made in writing and signed by both the buyer and the seller to ensure that there is a clear record of the new terms. It is essential to document any amendments to avoid confusion or disputes in the future.

What should I do if a dispute arises regarding the LLC Share Purchase Agreement?

If a dispute arises, the first step is to review the terms of the agreement to understand each party's rights and obligations. Open communication between the parties may help resolve the issue amicably. If informal discussions do not lead to a resolution, it may be necessary to seek legal advice. Depending on the terms of the agreement, mediation or arbitration might be required before pursuing litigation. Always consult with a legal professional to explore the best course of action.

Dos and Don'ts

When filling out an LLC Share Purchase Agreement form, it's crucial to approach the task with care and attention to detail. Here are five essential do's and don'ts to keep in mind:

- Do ensure that all information is accurate and up-to-date.

- Do read the entire agreement thoroughly before signing.

- Do consult with a legal professional if you have any questions.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any fields blank; every section should be completed.

By following these guidelines, you can help ensure that your LLC Share Purchase Agreement is filled out correctly and effectively protects your interests.

LLC Share Purchase Agreement - Usage Steps

Filling out the LLC Share Purchase Agreement form is a straightforward process. This document is essential for formalizing the sale of shares in a limited liability company. By completing it accurately, both the buyer and seller can ensure that their rights and responsibilities are clearly outlined.

- Begin by entering the date at the top of the form. This is the date when the agreement is being executed.

- Next, provide the names and addresses of both the buyer and the seller. Make sure to include any relevant contact information.

- Specify the number of shares being sold. Clearly state the amount to avoid any confusion.

- Indicate the purchase price for the shares. This should be a clear and agreed-upon amount.

- Include any terms or conditions related to the sale. This might involve payment methods or deadlines.

- Both parties should sign and date the agreement at the bottom. Ensure that the signatures are legible.

- Make copies of the completed agreement for both the buyer and the seller. Keep these for your records.