Official Loan Agreement Form

When individuals or businesses seek financial assistance, a Loan Agreement form serves as a vital tool in establishing the terms and conditions of the borrowing arrangement. This document typically outlines the principal amount being borrowed, the interest rate applicable, and the repayment schedule, ensuring that both parties have a clear understanding of their obligations. Additionally, it often includes clauses addressing collateral, which may be required to secure the loan, and stipulations for default, detailing the consequences should the borrower fail to meet their repayment commitments. Furthermore, the form may specify any fees associated with the loan, such as origination fees or late payment penalties, providing transparency in the financial transaction. By clearly documenting these elements, the Loan Agreement not only protects the lender's interests but also empowers the borrower with a comprehensive understanding of their financial responsibilities, fostering a sense of trust and clarity in the lending relationship.

Similar forms

A Promissory Note is a document that outlines a borrower's promise to repay a loan. Similar to a Loan Agreement, it details the amount borrowed, the interest rate, and the repayment schedule. However, a Promissory Note is often simpler and may not include all the terms and conditions found in a Loan Agreement. It serves as a straightforward acknowledgment of debt, making it easier for both parties to understand their obligations.

A Mortgage Agreement is another document closely related to a Loan Agreement, particularly in real estate transactions. This document secures the loan with the property itself. If the borrower fails to repay the loan, the lender can take possession of the property. While a Loan Agreement outlines the terms of the loan, a Mortgage Agreement specifically addresses the collateral involved, providing additional security for the lender.

A Credit Agreement is often used by businesses and individuals seeking larger loans or lines of credit. Like a Loan Agreement, it details the terms of borrowing, including the amount, interest rates, and repayment terms. However, Credit Agreements can be more complex, as they may involve multiple parties and varying terms for different types of credit. They are tailored to meet the specific needs of borrowers and lenders, making them more versatile than standard Loan Agreements.

An Installment Agreement is similar to a Loan Agreement in that it involves borrowing money and repaying it over time. However, this document is typically used for installment loans, where payments are made in fixed amounts over a set period. Installment Agreements clearly outline the payment schedule, interest rates, and total repayment amount, making it easier for borrowers to budget their finances.

A Lease Agreement is often compared to a Loan Agreement, especially in situations where property is rented or leased. Both documents establish terms for the use of an asset, whether it’s money or property. A Lease Agreement specifies the rental amount, duration, and responsibilities of both the landlord and tenant, similar to how a Loan Agreement lays out the terms between a borrower and lender.

An Employment Contract can also share similarities with a Loan Agreement, particularly when it involves salary advances or loans provided by an employer. Both documents detail the terms of repayment, although Employment Contracts primarily focus on the relationship between employer and employee. They outline obligations, compensation, and other employment terms, while also addressing any financial agreements related to loans or advances.

State-specific Guides for Loan Agreement Forms

Loan Agreement Document Types

Common Forms

What Is Schedule C - Displays net profit or loss for a business.

Affidavit of Death of Joint Tenant California - It is essential for managing property that was held in joint tenancy in California.

More About Loan Agreement

What is a Loan Agreement form?

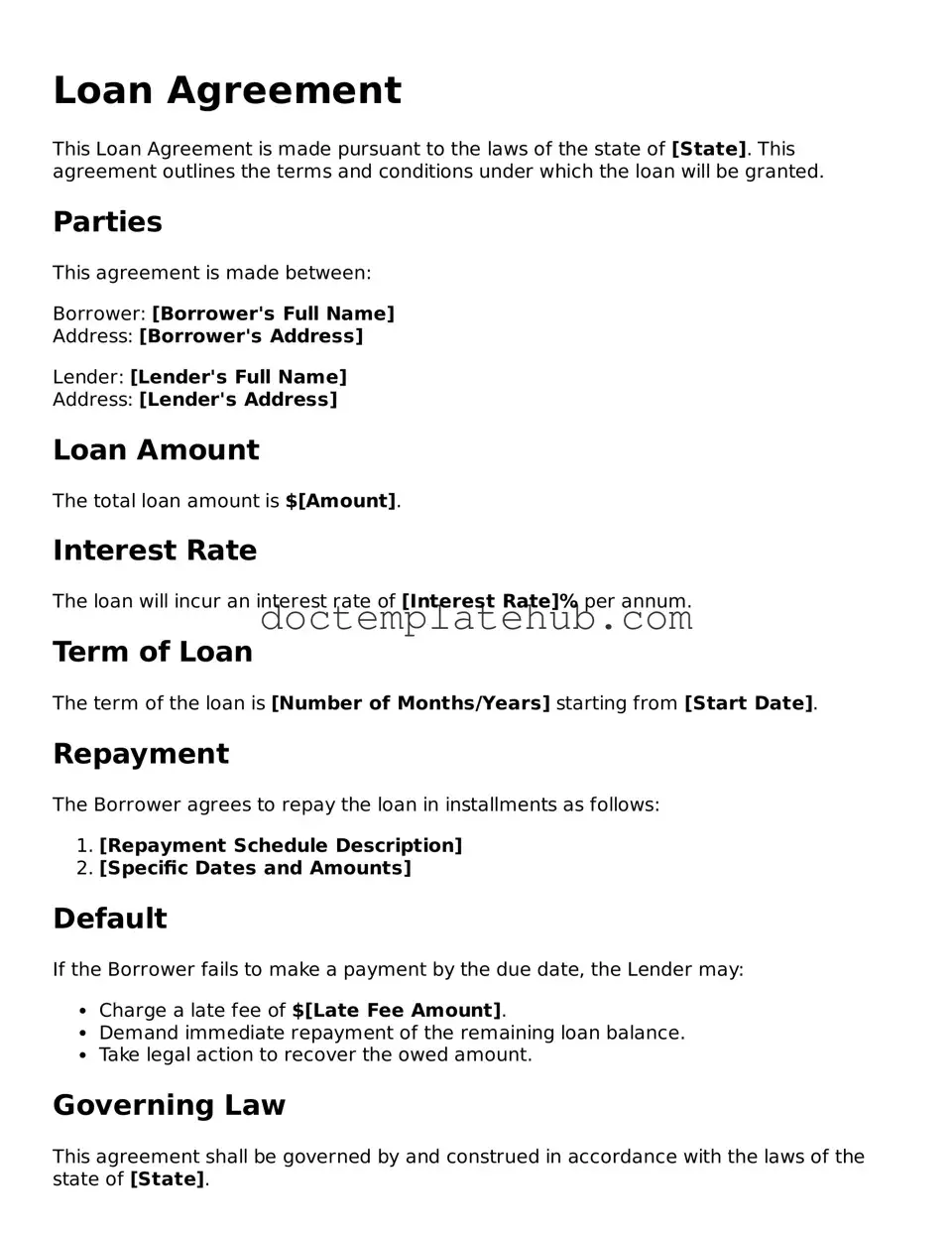

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. This document serves to protect both parties by clearly defining their rights and obligations.

Who needs a Loan Agreement?

Anyone who is lending or borrowing money should consider using a Loan Agreement. This includes individuals, businesses, and organizations. Whether it's a personal loan between friends or a business loan, having a formal agreement helps prevent misunderstandings and disputes later on.

What are the key components of a Loan Agreement?

A comprehensive Loan Agreement typically includes the following elements: the names and addresses of the lender and borrower, the loan amount, interest rate, repayment terms, due dates, any collateral, and provisions for default. Each section is crucial for ensuring clarity and accountability.

Is a Loan Agreement legally binding?

Yes, a properly drafted Loan Agreement is legally binding. Once both parties sign the document, they are obligated to adhere to its terms. If either party fails to comply, the other party may have legal recourse to enforce the agreement or seek damages.

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified, but both parties must agree to the changes. It’s advisable to document any modifications in writing and have both parties sign the revised agreement. This helps maintain clarity and ensures that all parties are aware of the new terms.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options, depending on the terms outlined in the Loan Agreement. This may include charging late fees, initiating collection efforts, or taking legal action to recover the owed amount. The specifics will depend on the agreement and applicable laws.

Do I need a lawyer to create a Loan Agreement?

While it’s not strictly necessary to hire a lawyer, it can be beneficial, especially for larger loans or complex situations. A legal professional can help ensure that the agreement complies with state laws and adequately protects your interests. For simpler loans, templates are often available that can be customized.

How do I ensure my Loan Agreement is enforceable?

To ensure enforceability, make sure the Loan Agreement is clear, comprehensive, and signed by both parties. Include all necessary details, such as the loan amount, interest rate, and repayment terms. It’s also a good idea to have the agreement notarized, which adds an extra layer of authenticity.

Dos and Don'ts

When filling out a Loan Agreement form, attention to detail is crucial. Here are ten important do's and don'ts to keep in mind:

- Do read the entire agreement carefully before signing.

- Do provide accurate and complete information.

- Do double-check the loan amount and interest rate.

- Do ensure you understand the repayment terms.

- Do ask questions if any part of the agreement is unclear.

- Don't rush through the form without reviewing it.

- Don't leave any sections blank unless instructed.

- Don't ignore the consequences of defaulting on the loan.

- Don't sign the agreement without reading it thoroughly.

- Don't forget to keep a copy of the signed agreement for your records.

Loan Agreement - Usage Steps

Filling out a Loan Agreement form is an important step in securing a loan. Once you have the form ready, you will need to provide accurate information to ensure a smooth process. Follow these steps to complete the form correctly.

- Start with your personal information. Enter your full name, address, and contact details in the designated fields.

- Provide the loan amount you are requesting. Clearly state the total amount you wish to borrow.

- Specify the purpose of the loan. Indicate why you need the funds, such as for home improvement, education, or debt consolidation.

- Fill in the repayment terms. Include the duration of the loan and the interest rate if applicable.

- Review any additional terms and conditions. Make sure to read through any specific requirements or clauses included in the form.

- Sign and date the form. Your signature confirms that you agree to the terms outlined in the agreement.

- Submit the completed form to the lender. Ensure you keep a copy for your records.