Fill Your Louisiana act of donation Form

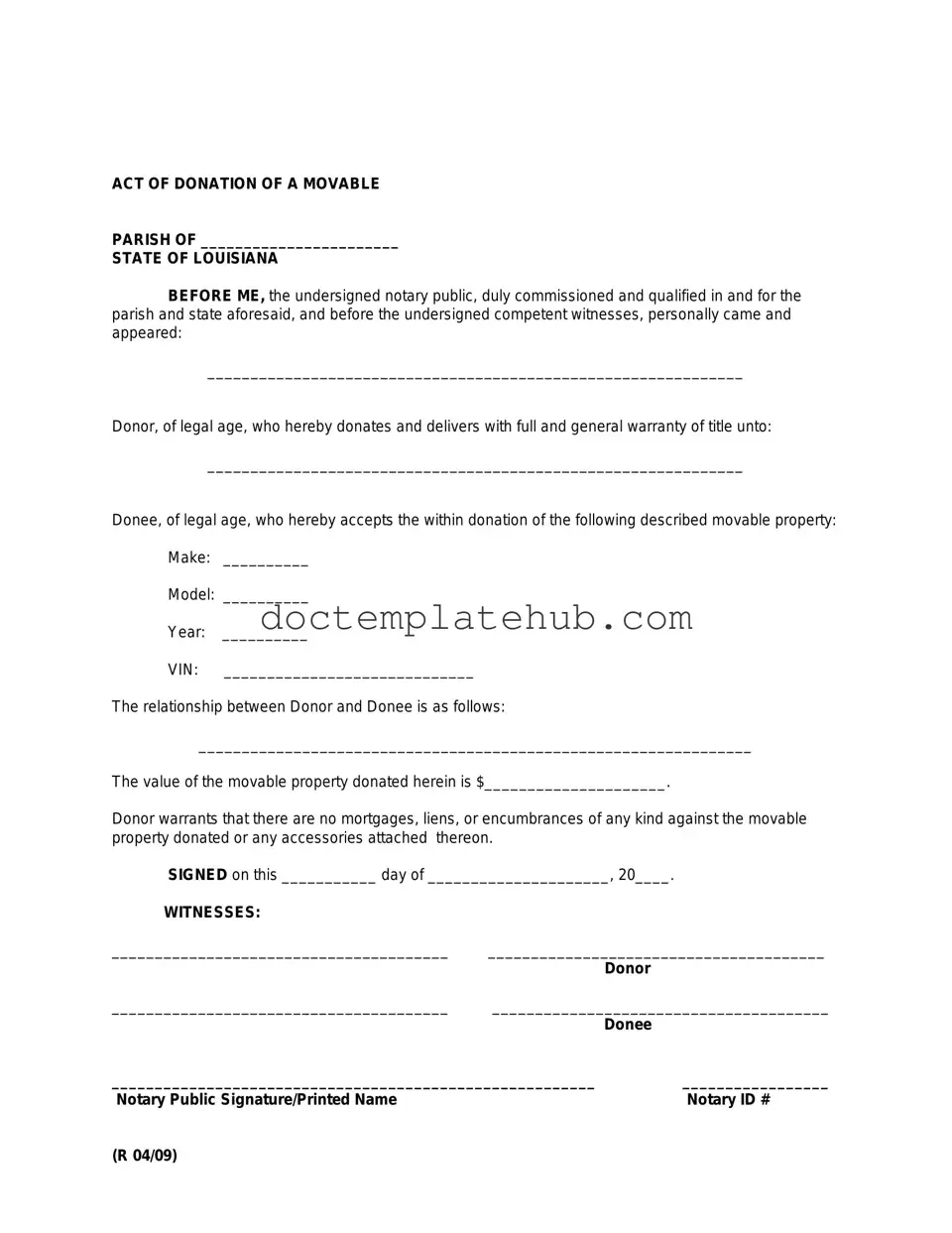

The Louisiana Act of Donation form serves as a crucial legal document for individuals wishing to transfer ownership of property or assets to another party without any exchange of monetary compensation. This form is particularly significant in the context of estate planning, allowing donors to gift property during their lifetime while potentially avoiding probate complications later on. The document typically requires detailed information about the donor and the recipient, including names, addresses, and descriptions of the property being donated. Additionally, it often includes stipulations regarding the nature of the donation, whether it is revocable or irrevocable, and any conditions that may apply. By completing this form, individuals can ensure that their intentions regarding the transfer of property are clearly documented and legally recognized, which can help prevent disputes and misunderstandings in the future. Understanding the components and implications of the Louisiana Act of Donation form is essential for anyone considering making a gift of property, as it provides a structured way to formalize such intentions and protect the rights of all parties involved.

Similar forms

The Louisiana act of donation form is quite similar to a quitclaim deed. A quitclaim deed is a legal document used to transfer ownership of real property from one party to another without any warranties or guarantees. Like the act of donation, it allows for the straightforward transfer of property rights, often used among family members or friends. Both documents serve to clarify the intention of the parties involved and ensure that the transfer is recognized by law.

Another document akin to the act of donation is a gift deed. A gift deed specifically outlines the transfer of property as a gift, without any exchange of money or consideration. Similar to the act of donation, it requires the donor's intent to give the property to the recipient. Both documents must be executed with proper formalities to be legally binding, ensuring that the recipient has clear ownership of the property.

The warranty deed shares similarities with the act of donation as well. A warranty deed provides a guarantee that the property is free from any claims or encumbrances. While the act of donation does not necessarily provide such guarantees, both documents serve to transfer ownership. They also require the parties to sign the documents, which validates the transfer and protects the interests of the recipient.

A power of attorney can also be compared to the act of donation. While a power of attorney grants someone the authority to act on another's behalf, it can sometimes be used to facilitate the donation of property. Both documents involve the transfer of rights, but the power of attorney allows for a broader range of actions beyond just property donation. This makes it a versatile tool in managing one’s assets.

The New York Room Rental Agreement form is an essential legal document that outlines the terms and conditions between a landlord and a tenant for the rental of a specific room within a dwelling. This agreement ensures both parties understand their rights and obligations, promoting a smooth and clear rental experience. For further details on how to properly fill out this agreement, you can visit smarttemplates.net, which offers resources and templates to aid in the renting process.

Similar to the act of donation is a living trust. A living trust allows individuals to transfer their assets into a trust during their lifetime, which can then be distributed to beneficiaries upon their death. Both documents involve the intent to transfer property but differ in their complexity and the legal protections they offer. Living trusts can provide more comprehensive management of assets, while the act of donation focuses specifically on the transfer of property.

The bill of sale is another document that bears resemblance to the act of donation. A bill of sale is used to transfer ownership of personal property, like vehicles or equipment. Like the act of donation, it serves to document the intent of the seller to transfer ownership to the buyer. Both documents provide a clear record of the transaction, ensuring that the new owner can assert their rights over the property.

In some cases, a promissory note can be compared to the act of donation, especially when the donation involves a promise of future payment or consideration. While a promissory note is primarily a financial document, it can be used in conjunction with a donation to outline any obligations of the donor. Both documents require clarity in the terms agreed upon by the parties involved, ensuring that expectations are met.

Lastly, a contract for deed is similar to the act of donation in that it allows for the transfer of property while retaining some rights for the seller. In a contract for deed, the buyer makes payments to the seller over time while the seller retains legal title until the final payment is made. Both documents establish a clear understanding of the transfer of property and the obligations of the parties, though they differ in their approach to ownership and payment structure.

Other PDF Templates

How to Ship Freight - Shippers may choose to cover excess liability for their shipments.

The New York Notary Acknowledgement is a vital document that helps establish trust in various transactions, ensuring that the signatures are not only genuine but also willingly provided. For those who are navigating the complexities of legal documents, understanding how to effectively use this form is crucial. You can find further details in the essential guide to understanding Notary Acknowledgement requirements here.

How to File a Mechanics Lien - Claimants are responsible for providing accurate and complete information when filling out the form.

More About Louisiana act of donation

What is the Louisiana Act of Donation form?

The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another without the exchange of money. This form is commonly used for gifts of real estate, personal property, or other assets. It formalizes the donation and ensures that the transfer complies with state laws, providing clarity and protection for both the donor and the recipient.

Who can use the Louisiana Act of Donation form?

Any individual who wishes to donate property can use this form. This includes parents donating property to their children, friends giving gifts to one another, or even organizations making charitable donations. However, the donor must have legal ownership of the property being donated and must be of sound mind when completing the form.

What information is required on the form?

The form requires specific information, including the names and addresses of both the donor and the recipient, a description of the property being donated, and the date of the donation. It may also require the donor's signature and, in some cases, the signature of witnesses or a notary public to validate the transaction.

Is the Louisiana Act of Donation form legally binding?

Yes, once properly completed and executed, the Louisiana Act of Donation form is legally binding. It serves as evidence of the donor's intent to give the property to the recipient. However, it is essential to ensure that all legal requirements are met to avoid any disputes in the future.

Are there any tax implications associated with donations?

Yes, there may be tax implications for both the donor and the recipient. The donor may need to report the gift on their tax return if it exceeds the annual exclusion limit set by the IRS. The recipient may also face tax responsibilities depending on the value of the property received. Consulting with a tax professional is advisable to understand the specific implications related to a donation.

Can the Louisiana Act of Donation form be revoked?

In general, a donor can revoke a donation before it is completed, meaning the property has not yet been transferred. Once the form is executed and the property is transferred, revocation becomes more complicated. Legal advice may be necessary to navigate the process of revoking a donation after it has been finalized.

Where should the completed form be filed?

After completing the Louisiana Act of Donation form, it is advisable to file it with the appropriate local government office, such as the parish clerk of court or the office of property records. This filing helps ensure that the donation is officially recorded and can prevent future disputes regarding ownership.

Dos and Don'ts

When filling out the Louisiana act of donation form, it is essential to approach the process with care. Here are ten important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Don't leave any sections blank unless instructed to do so.

- Do provide accurate and complete information about the donor and the recipient.

- Don't use abbreviations or shorthand that may confuse the reader.

- Do sign and date the form in the appropriate sections.

- Don't forget to have the form notarized if required.

- Do keep a copy of the completed form for your records.

- Don't submit the form without double-checking for errors.

- Do consult with a legal professional if you have any questions.

- Don't rush through the process; take your time to ensure everything is correct.

Louisiana act of donation - Usage Steps

After obtaining the Louisiana Act of Donation form, you will need to complete it accurately to ensure that the donation is legally recognized. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name and address of the donor, the person making the donation.

- Next, fill in the name and address of the recipient, the person receiving the donation.

- Clearly describe the property being donated. Include details such as the type of property and any relevant identification numbers.

- Indicate if the donation is made with any conditions or restrictions. If so, specify those conditions clearly.

- Both the donor and the recipient must sign and date the form. Make sure signatures are legible.

- If there are witnesses required, have them sign in the designated area.

- Finally, make copies of the completed form for both the donor and the recipient for their records.