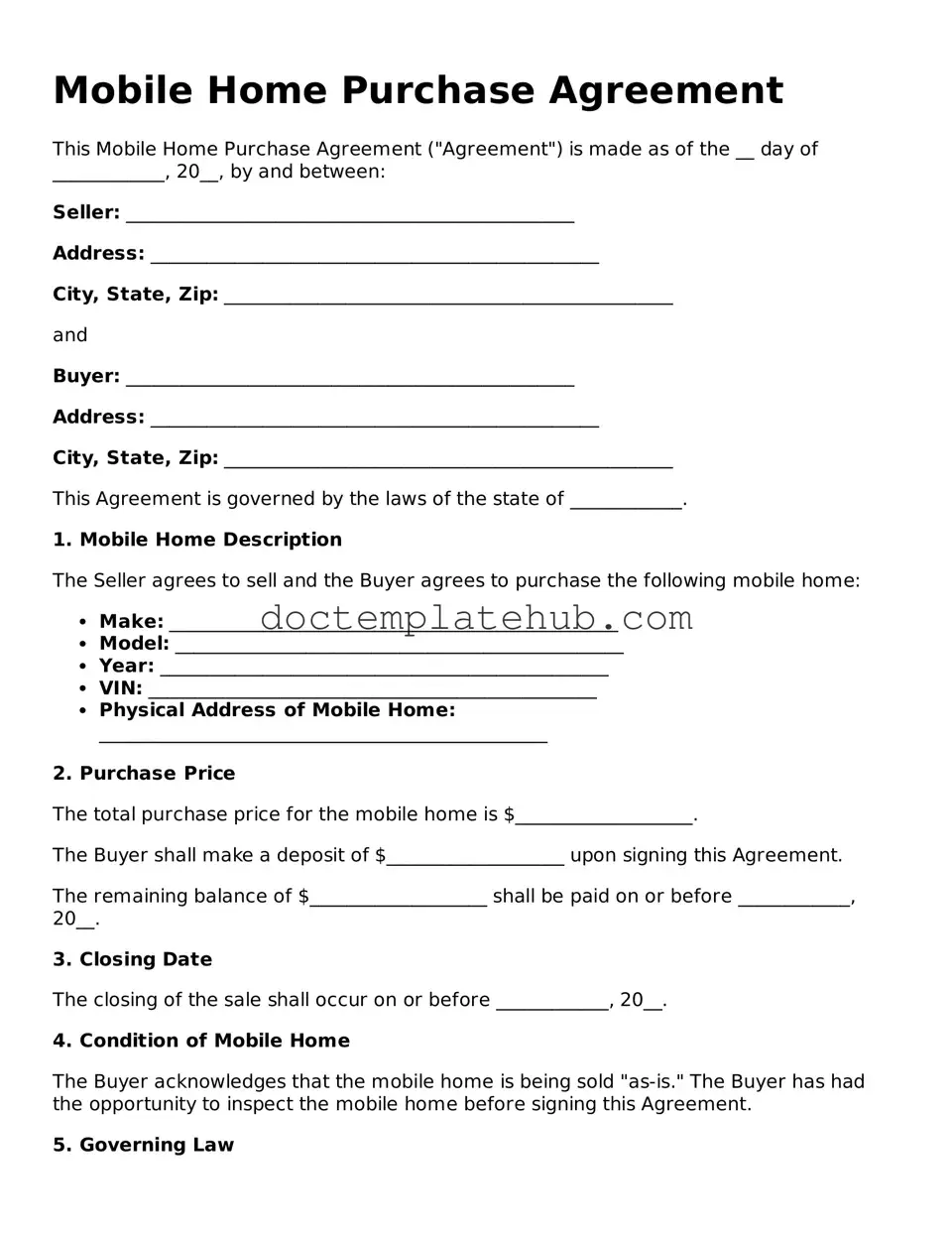

Official Mobile Home Purchase Agreement Form

The Mobile Home Purchase Agreement form serves as a crucial document in the process of buying or selling a mobile home. This agreement outlines the terms and conditions agreed upon by both the buyer and the seller, ensuring clarity and protection for both parties. Key aspects include the purchase price, payment terms, and any contingencies that may apply. It also details the responsibilities of each party regarding inspections, repairs, and the transfer of ownership. Additionally, the agreement may specify whether the mobile home is being sold with or without the land it occupies, which can significantly affect the transaction's dynamics. By clearly laying out these elements, the Mobile Home Purchase Agreement helps to minimize misunderstandings and disputes, fostering a smoother transaction process. Understanding this form is essential for anyone involved in the mobile home market, as it lays the groundwork for a successful sale or purchase.

Similar forms

The Mobile Home Purchase Agreement is similar to a Residential Purchase Agreement. Both documents serve as contracts between a buyer and a seller for the transfer of property ownership. They outline the terms of the sale, including purchase price, contingencies, and timelines for closing. In both agreements, the buyer typically has the right to conduct inspections and the seller must disclose any known issues with the property. The primary difference lies in the type of property being sold; the Residential Purchase Agreement pertains to traditional homes, while the Mobile Home Purchase Agreement specifically addresses mobile or manufactured homes.

Another document that shares similarities is the Lease Agreement. While a Mobile Home Purchase Agreement is focused on ownership transfer, a Lease Agreement outlines the terms under which a tenant can occupy a property. Both documents detail responsibilities, such as maintenance and payment terms. However, the Lease Agreement is temporary, allowing the tenant to use the property for a specified period, whereas the Mobile Home Purchase Agreement results in permanent ownership transfer upon completion.

The Promissory Note is also comparable, particularly in financing aspects. Both documents involve financial obligations. The Mobile Home Purchase Agreement may reference a Promissory Note if the buyer is financing the purchase. This note specifies the loan amount, interest rate, and repayment terms. While the Purchase Agreement focuses on the sale of the mobile home, the Promissory Note addresses the financial commitment of the buyer to repay the borrowed funds.

A Bill of Sale is another relevant document. It serves as proof of the transaction and the transfer of ownership from the seller to the buyer. Both the Mobile Home Purchase Agreement and the Bill of Sale include essential details such as the purchase price and the description of the property. However, the Bill of Sale is often executed after the Mobile Home Purchase Agreement has been fulfilled, providing a formal record of the transaction.

For anyone looking to invest, a well-structured Investment Letter of Intent is essential to navigate the complexities of real estate transactions. This preliminary agreement not only reflects a commitment to proceed but also outlines key terms and conditions, serving as a contract foundation for future negotiations. To learn more about creating such documents, visit smarttemplates.net.

Finally, a Title Transfer Document is similar in that it facilitates the transfer of ownership. This document is crucial for legally recording the change in ownership of the mobile home. Both the Mobile Home Purchase Agreement and the Title Transfer Document must be completed for the transaction to be legally binding. The Purchase Agreement outlines the terms of the sale, while the Title Transfer Document ensures that the buyer is recognized as the new owner in public records.

Common Forms

Simple Payment Plan Car Payment Contract - Identifies the lender's rights in the event of default.

The General Bill of Sale form is a legal document used to transfer ownership of personal property from one party to another. This form serves as proof of the transaction, detailing the specifics of the property and the agreement between the buyer and seller. For more information, you can visit https://topformsonline.com/general-bill-of-sale/. Understanding its components is essential for ensuring a smooth transfer process.

Direction to Pay Form Contractor - Utilizing this authorization form may lead to improved efficiency in processing your vehicle repair claim.

More About Mobile Home Purchase Agreement

What is a Mobile Home Purchase Agreement?

A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions for the sale of a mobile home. It serves to protect both the buyer and the seller by detailing the responsibilities and rights of each party involved in the transaction.

What information is typically included in the agreement?

The agreement usually includes the names of the buyer and seller, a description of the mobile home, the purchase price, payment terms, and any contingencies. It may also cover inspection rights, warranties, and the closing date.

Is the Mobile Home Purchase Agreement legally binding?

Yes, once both parties sign the Mobile Home Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to fulfill the terms outlined in the agreement, unless otherwise agreed upon in writing.

Can the agreement be modified after it is signed?

Modifications can be made, but both parties must agree to any changes. It is essential to document any amendments in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

What happens if one party does not fulfill their obligations?

If either party fails to meet their obligations as outlined in the agreement, the other party may have the right to seek legal remedies. This could include seeking damages or enforcing the terms of the contract through legal action.

Do I need a lawyer to complete a Mobile Home Purchase Agreement?

While it is not legally required to have a lawyer, consulting with one can provide valuable insights. A lawyer can help ensure that the agreement complies with state laws and adequately protects your interests.

What should I do if I have questions about the agreement?

If questions arise, it is advisable to seek clarification from a knowledgeable source. This could be a real estate agent, a lawyer, or a trusted advisor familiar with mobile home transactions.

Are there any specific state laws that affect the Mobile Home Purchase Agreement?

Yes, state laws can vary significantly regarding mobile home transactions. It is crucial to familiarize yourself with local regulations that may impact the sale, including title transfer requirements and any disclosures that must be made.

What are contingencies, and should they be included in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing approval, satisfactory inspection results, and the sale of the buyer's current home. Including contingencies can protect the buyer and ensure a smoother transaction.

How can I ensure that the Mobile Home Purchase Agreement is valid?

To ensure validity, both parties should sign the agreement, and it should include all necessary details. It is also wise to have the document reviewed by a legal professional to confirm compliance with applicable laws.

Dos and Don'ts

When filling out the Mobile Home Purchase Agreement form, it is important to approach the task with care. Below is a list of things to do and avoid to ensure a smooth process.

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information.

- Do double-check all figures and calculations.

- Do sign and date the form where required.

- Do keep a copy of the completed agreement for your records.

- Don't leave any required fields blank.

- Don't use white-out or make alterations without initialing them.

- Don't rush through the form; take your time to ensure accuracy.

- Don't forget to review the terms and conditions before signing.

By following these guidelines, individuals can help ensure that their Mobile Home Purchase Agreement is completed correctly and effectively.

Mobile Home Purchase Agreement - Usage Steps

Completing the Mobile Home Purchase Agreement form is a critical step in the buying process. It ensures that both the buyer and seller are on the same page regarding the terms of the sale. Follow these steps to accurately fill out the form.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the buyer and seller. Ensure all information is accurate and complete.

- Specify the details of the mobile home, including the make, model, year, and vehicle identification number (VIN).

- Clearly state the purchase price of the mobile home. Include any deposits or down payments that have been agreed upon.

- Outline the payment terms, including the method of payment and any financing arrangements.

- Indicate any contingencies that must be met before the sale is finalized, such as inspections or loan approvals.

- Include any additional terms that both parties have agreed upon. This might cover repairs, warranties, or other considerations.

- Both parties should sign and date the form at the bottom. Ensure that the signatures are legible.

Once the form is filled out, it is advisable to review it carefully for any errors or omissions. After confirming that all information is correct, both parties should retain a copy for their records.