Official Mortgage Lien Release Form

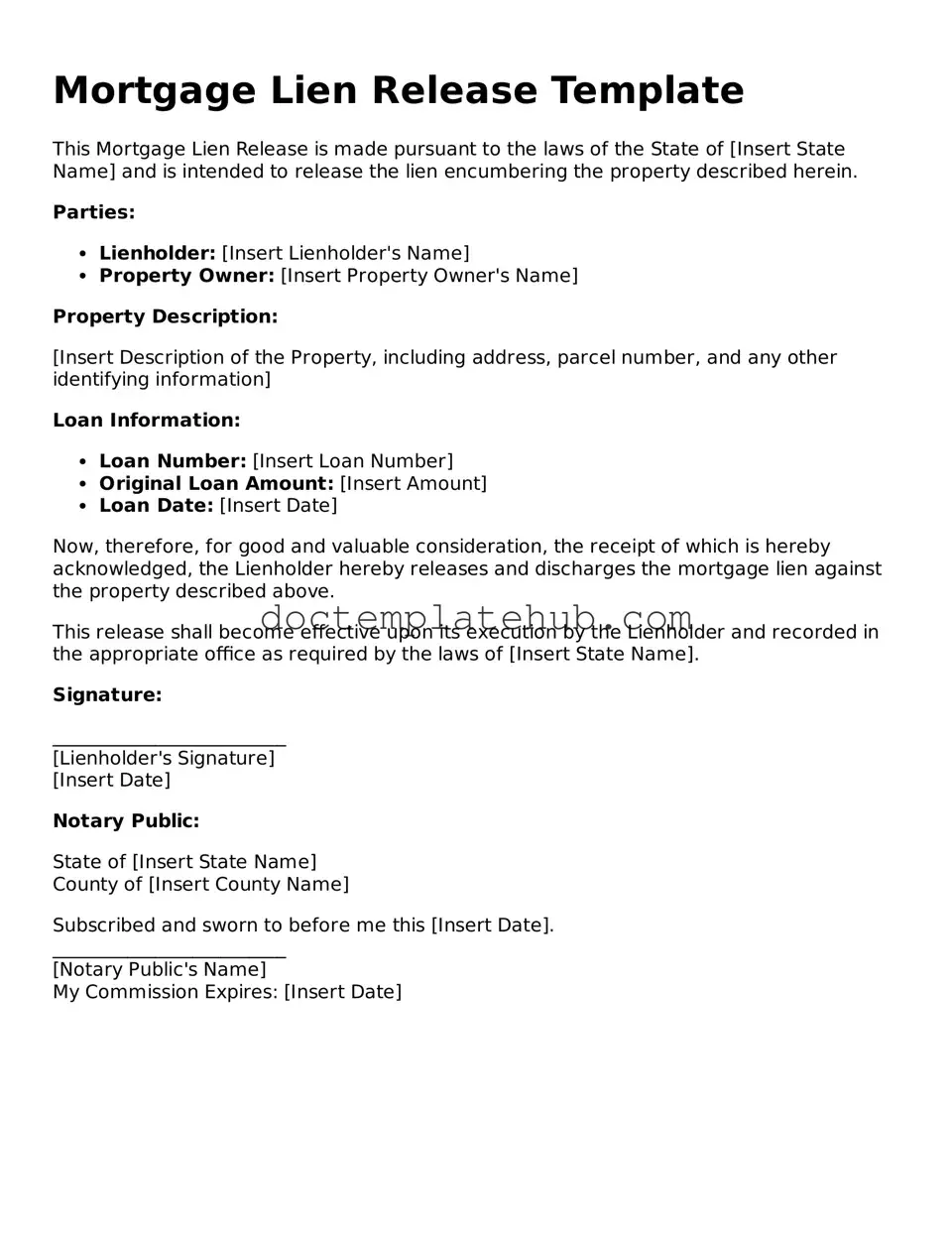

The Mortgage Lien Release form plays a crucial role in the process of clearing a mortgage lien from a property title. When a borrower has successfully paid off their mortgage, this form serves as the official document that confirms the lender's release of their claim to the property. It includes essential details such as the names of the borrower and lender, the property address, and the loan information. Additionally, the form must be signed by the lender, often requiring notarization to ensure its authenticity. Once completed, it is typically filed with the appropriate county recorder's office to make the release public. This action not only protects the borrower's rights but also helps to facilitate future transactions involving the property. Understanding the significance of this form is vital for homeowners, as it marks the transition from debt to ownership free of liens.

Similar forms

The Mortgage Satisfaction form is similar to the Mortgage Lien Release form in that both documents serve to formally acknowledge the completion of a mortgage obligation. When a borrower pays off their mortgage, the lender issues a Mortgage Satisfaction form to confirm that the debt has been satisfied. This document is important for the borrower, as it provides proof that they own their property free and clear of any mortgage claims.

Additionally, understanding the significance of a comprehensive Vehicle Accident Damage Release is essential for parties involved in auto accidents. This form not only formalizes the settlement agreement but also serves to protect both parties by clearly outlining their rights and responsibilities following an incident.

The Deed of Reconveyance is another document that resembles the Mortgage Lien Release. This document is used in states that employ a deed of trust instead of a mortgage. When the borrower pays off the loan, the lender issues the Deed of Reconveyance, which transfers the property title back to the borrower. Like the Mortgage Lien Release, it signifies that the borrower has fulfilled their financial obligation and has full ownership of the property.

The Satisfaction of Judgment form is similar in purpose to the Mortgage Lien Release, as it indicates that a judgment debt has been paid in full. When a debtor satisfies a judgment against them, the creditor must file this document with the court. This ensures that the debtor’s credit report reflects that the judgment is resolved, similar to how a Mortgage Lien Release clears the property title.

The UCC-3 Financing Statement Amendment can also be compared to the Mortgage Lien Release. This document is used to amend or terminate a previously filed UCC-1 Financing Statement, which secures a lender's interest in personal property. When a debt is paid off, the lender files a UCC-3 to release their claim, similar to how a lender releases a mortgage lien once the loan is repaid.

The Quitclaim Deed is another document that shares similarities with the Mortgage Lien Release. While it is primarily used to transfer ownership of property, it can also be used to clear any claims or interests in the property. If a lender holds a lien on a property and releases it, a Quitclaim Deed may be issued to confirm that the lender no longer has any interest in the property, providing clarity to the new owner.

The Certificate of Title is also akin to the Mortgage Lien Release, as it serves as proof of ownership. When a mortgage is paid off, the lender may provide a Certificate of Title to confirm that there are no outstanding claims against the property. This document is essential for the homeowner, as it establishes their clear title to the property, similar to the assurance provided by a Mortgage Lien Release.

Lastly, the Release of Lien form is closely related to the Mortgage Lien Release. This document is used to remove a lien placed on a property for unpaid debts, such as contractor fees or taxes. Once the debt is settled, the lienholder files a Release of Lien, which clears the property title. This is akin to how a Mortgage Lien Release indicates that a mortgage debt has been satisfied, ensuring the homeowner's title is free from claims.

Fill out Common Types of Mortgage Lien Release Templates

Partial Lien Release Form - Conveys important information to all parties involved regarding agreed terms.

Before participating in any activity, it is crucial to understand the implications of signing a California Release of Liability Form. This form not only outlines the responsibilities of all parties involved but also serves as a protective measure for providers against potential legal issues. For more information on how to properly utilize this document, visit OnlineLawDocs.com.

Waiver Template Free - The form allows parties to formally acknowledge the receipt of damages settlement.

Waiver Liability Form - Helps clarify that participants are aware they are engaging at their own risk.

More About Mortgage Lien Release

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a legal document that removes the lien on a property once the mortgage has been paid off. This form is essential for clearing the title of the property, allowing the owner to sell or refinance without any encumbrances from the previous mortgage lender.

Why do I need a Mortgage Lien Release?

You need a Mortgage Lien Release to ensure that the property title is clear. Once you pay off your mortgage, the lender must officially acknowledge that the debt has been satisfied. Without this release, the lien may remain on the property, complicating future transactions.

How do I obtain a Mortgage Lien Release?

What information is included in a Mortgage Lien Release?

A Mortgage Lien Release usually includes the property address, the names of the borrower and lender, the loan number, and a statement that the mortgage has been paid in full. It may also include the date of the release and the signatures of authorized representatives from the lender.

Do I need to file the Mortgage Lien Release with the county?

Yes, you should file the Mortgage Lien Release with the county recorder's office where the property is located. This step is crucial to ensure that the release is officially documented and that the lien is removed from public records.

What happens if my lender does not provide a Mortgage Lien Release?

If your lender fails to provide a Mortgage Lien Release after you have paid off your mortgage, you can take several steps. First, contact the lender to inquire about the status. If necessary, you may need to escalate the issue or seek legal advice to compel the lender to issue the release.

Can I create my own Mortgage Lien Release form?

While you can draft your own Mortgage Lien Release, it is advisable to use a template or seek assistance from a legal professional. Ensuring that the form meets all legal requirements is essential for it to be valid and accepted by the county recorder.

How long does it take to process a Mortgage Lien Release?

The processing time for a Mortgage Lien Release can vary. Once filed, it may take several days to a few weeks for the county to officially record the release. Check with your local recorder's office for specific timelines and procedures.

Dos and Don'ts

When filling out the Mortgage Lien Release form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts:

- Do double-check all personal information for accuracy.

- Do ensure that the form is signed by all necessary parties.

- Do keep a copy of the completed form for your records.

- Do submit the form to the appropriate county office for recording.

- Don't leave any required fields blank.

- Don't use incorrect names or misspellings.

- Don't forget to check the submission deadline.

- Don't submit the form without confirming all signatures are present.

Mortgage Lien Release - Usage Steps

After gathering the necessary information, you're ready to fill out the Mortgage Lien Release form. This document is essential for officially releasing a mortgage lien once the loan has been paid off. Follow these steps carefully to ensure accuracy and completeness.

- Begin by entering the name of the borrower in the designated field. This should match the name on the mortgage documents.

- Next, provide the address of the property associated with the mortgage. Ensure that the address is complete, including street number, street name, city, state, and ZIP code.

- Locate the section for the lender's information. Fill in the lender's name and contact details accurately.

- In the space provided, indicate the loan number associated with the mortgage. This number is typically found on your mortgage statement.

- Check the date of the loan payoff. Enter the date when the final payment was made, confirming that the loan is fully paid.

- Sign and date the form in the appropriate areas. Ensure that the signature matches the name of the borrower.

- If applicable, have the form notarized. This step may be required in some jurisdictions to validate the release.

- Finally, make copies of the completed form for your records before submitting it to the appropriate authority or lender.

After completing the form, submit it to the lender or the appropriate local government office. Keep a copy for your records, as it serves as proof that the mortgage lien has been released. This step is crucial for ensuring that your property title is clear of any encumbrances.