Fill Your Mortgage Statement Form

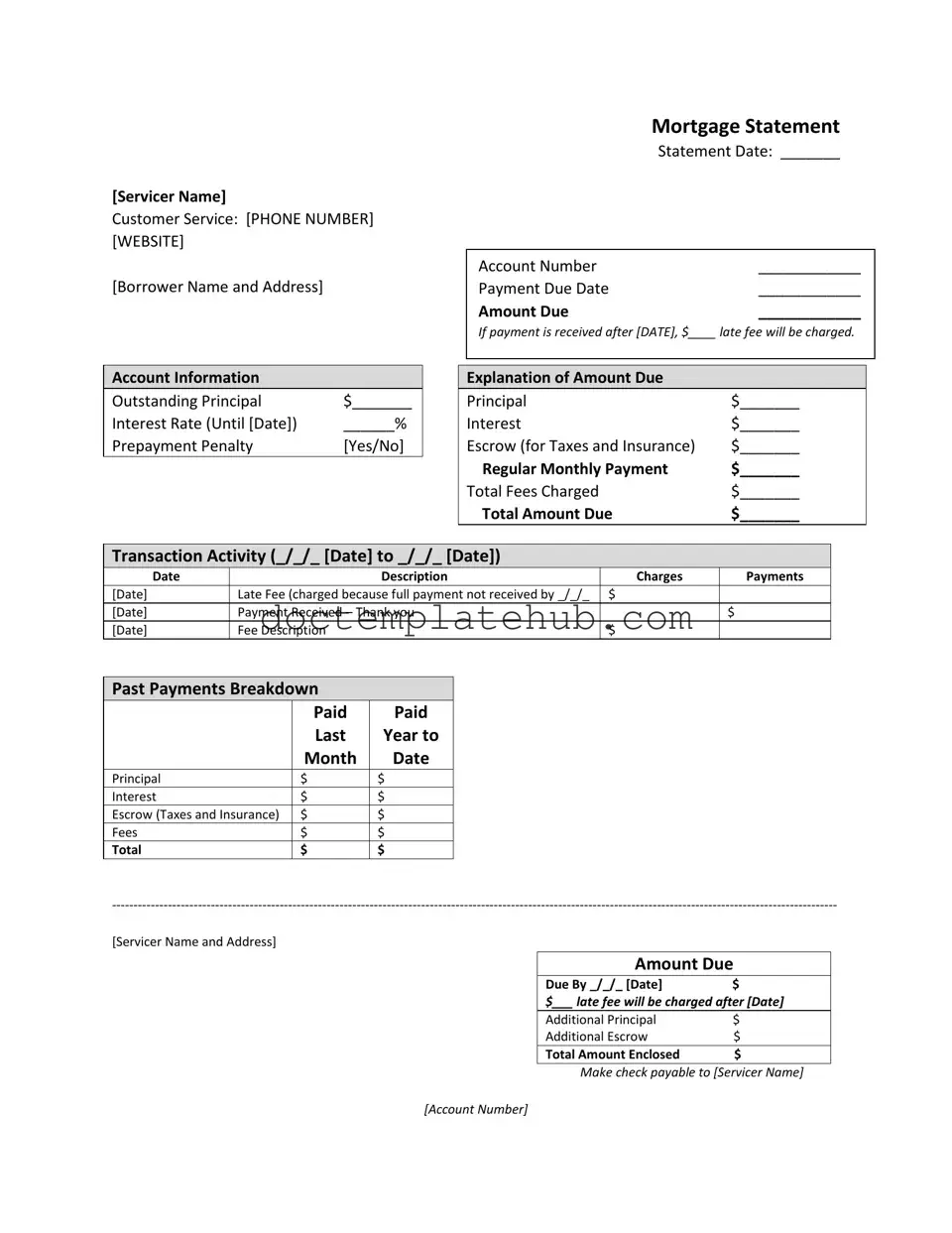

The Mortgage Statement form serves as a crucial document for borrowers, providing a detailed overview of their mortgage account. It typically includes essential information such as the servicer's contact details, the borrower's name and address, and the statement date. Key dates, including the payment due date and the amount due, are prominently displayed, along with any applicable late fees if payments are not received on time. The form outlines the account's financial status, detailing the outstanding principal, interest rate, and any prepayment penalties. A breakdown of the amount due is provided, which includes principal, interest, and escrow for taxes and insurance, culminating in the total amount owed. Additionally, the form records transaction activity over a specified period, listing charges, payments, and any late fees incurred. It also features a past payments breakdown, allowing borrowers to track their payment history. Important messages regarding partial payments and delinquency are included to inform borrowers of the implications of their payment behavior. For those experiencing financial difficulties, resources for mortgage counseling or assistance are available, ensuring that borrowers have access to necessary support.

Similar forms

The first document similar to a Mortgage Statement is a Credit Card Statement. Both documents serve to inform the borrower about their financial obligations. A Credit Card Statement details the outstanding balance, minimum payment due, and due date, much like a Mortgage Statement provides information on the amount due for the mortgage. Each statement also includes transaction history, helping the borrower track payments and charges over a specific period. This transparency is crucial for effective financial management, allowing borrowers to understand their financial standing and make informed decisions.

Another comparable document is a Utility Bill. Utility Bills outline the amount owed for services rendered, including electricity, water, or gas. Similar to a Mortgage Statement, they specify the due date and any late fees that may apply if payment is not made on time. Both documents often provide a breakdown of charges, which helps consumers understand what they are paying for. Just as a Mortgage Statement breaks down principal, interest, and escrow, a Utility Bill may detail consumption charges, taxes, and fees, making it easier for individuals to budget their monthly expenses.

A Pay Stub also bears similarities to a Mortgage Statement. While a Pay Stub reflects income earned, it shares the feature of itemizing amounts owed or due. It typically includes deductions for taxes, insurance, and retirement contributions, much like a Mortgage Statement itemizes principal, interest, and escrow payments. Both documents help individuals track their financial commitments and ensure they are aware of what they owe. This clarity is essential for effective financial planning and helps individuals manage their cash flow more efficiently.

To further safeguard sensitive information in business dealings, individuals can utilize a smarttemplates.net to create a comprehensive Non-disclosure Agreement form that addresses confidentiality needs specific to their transactions, thereby preventing the unintentional release of critical data.

Lastly, a Bank Statement can be likened to a Mortgage Statement. Bank Statements summarize the transactions in a checking or savings account over a specific period, detailing deposits, withdrawals, and any fees incurred. Similarly, a Mortgage Statement provides a summary of the mortgage account, including payment history and outstanding balances. Both documents serve as important tools for monitoring financial health, allowing individuals to see where their money is going and how much they owe. This information is vital for making informed financial decisions and maintaining good standing with lenders.

Other PDF Templates

Act of Donation Louisiana Pdf - In Louisiana, a notary public often needs to witness the signing of this form.

A Quitclaim Deed is a legal document used in Alabama to transfer ownership of real estate from one party to another without any warranties. This form is often utilized in situations where the seller is not guaranteeing clear title to the property. If you're ready to transfer property ownership, you can find the necessary paperwork by visiting the Quitclaim Deed form and fill out the form by clicking the button below.

Melaleuca Cancellation Form Pdf - It's important to communicate any changes in personal circumstances.

Yugioh Deck List Pdf - Specify the event you are participating in for record-keeping.

More About Mortgage Statement

What is a Mortgage Statement?

A Mortgage Statement is a document provided by your mortgage servicer that outlines your loan details. It includes information about your outstanding balance, interest rate, payment due dates, and any fees that may apply. This statement helps you keep track of your mortgage payments and account status.

How can I contact my mortgage servicer?

You can reach your mortgage servicer's customer service by calling the phone number listed on your statement or visiting their website. They can assist you with any questions or concerns regarding your mortgage account.

What happens if I miss a payment?

If you miss a payment, a late fee will be charged, as noted on your statement. Additionally, missing payments can lead to delinquency, which may result in further fees and potentially foreclosure. It's important to stay on top of your payments to avoid these consequences.

What is the meaning of the "Amount Due" section?

The "Amount Due" section of your Mortgage Statement shows the total amount you need to pay by the due date. This includes the principal, interest, and any escrow for taxes and insurance, along with any fees. Paying this amount on time is crucial to maintaining your mortgage in good standing.

What are partial payments?

Partial payments are amounts less than your full mortgage payment. These payments are not applied to your mortgage balance but are held in a separate suspense account. Once you pay the remaining balance, those funds will then be applied to your mortgage account.

What should I do if I am experiencing financial difficulty?

If you are having trouble making your mortgage payments, it's important to reach out for help. Your Mortgage Statement may provide information about mortgage counseling or assistance programs. Don't hesitate to seek support to explore your options.

How can I understand the transaction activity on my statement?

The transaction activity section lists all the payments and charges on your account over a specified period. It shows the dates, descriptions, and amounts related to your mortgage. This helps you track your payment history and any fees that have been charged.

What is a prepayment penalty?

A prepayment penalty is a fee that may be charged if you pay off your mortgage early. This fee is noted in your Mortgage Statement. Not all mortgages have this penalty, so it's important to check your statement for details regarding your specific loan.

Dos and Don'ts

When filling out the Mortgage Statement form, it's important to be careful and thorough. Here are some guidelines to help you navigate the process effectively.

- Do read the entire form carefully before starting. Understanding what is required will save you time and prevent mistakes.

- Do provide accurate information. Double-check your account number, payment due date, and other details to ensure they are correct.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Do pay attention to deadlines. Make sure to submit your form by the specified due date to avoid late fees.

- Don't leave any sections blank unless instructed. Incomplete forms may delay processing.

- Don't ignore the importance of signatures. Ensure that all required signatures are included before submission.

- Don't forget to check for any additional messages or instructions included in the form. These may provide crucial information.

- Don't submit the form without reviewing it for errors. Simple mistakes can lead to significant issues down the line.

Mortgage Statement - Usage Steps

Filling out the Mortgage Statement form requires attention to detail. Ensure you have all necessary information at hand before you start. Follow these steps to complete the form accurately.

- Begin by entering the Servicer Name in the designated field.

- Provide the Customer Service Phone Number and Website for the mortgage servicer.

- Fill in the Borrower Name and Address section with your personal details.

- Write the Statement Date in the appropriate space.

- Enter your Account Number.

- Specify the Payment Due Date.

- Indicate the Amount Due for the current payment period.

- Note the date after which a late fee will be charged, and specify the amount of the late fee.

- Fill out the Outstanding Principal amount.

- Enter the Interest Rate and the applicable date.

- Indicate whether there is a Prepayment Penalty (Yes or No).

- Break down the Amount Due into Principal, Interest, Escrow, and Total Fees Charged.

- Calculate the Total Amount Due and fill it in.

- Document the Transaction Activity by entering the dates, descriptions, charges, and payments.

- Provide details of the Past Payments Breakdown for the last year, including amounts paid for Principal, Interest, Escrow, and Fees.

- Fill in the Amount Due and the Due By date.

- Specify any additional amounts for Additional Principal and Additional Escrow.

- Calculate the Total Amount Enclosed and write it down.

- Make the check payable to the Servicer Name and include your Account Number.

Once you have completed the form, review all entries for accuracy. Ensure that all necessary details are filled in before submitting your payment. If you have questions or need assistance, contact the customer service number provided.