Fill Your Netspend Dispute Form

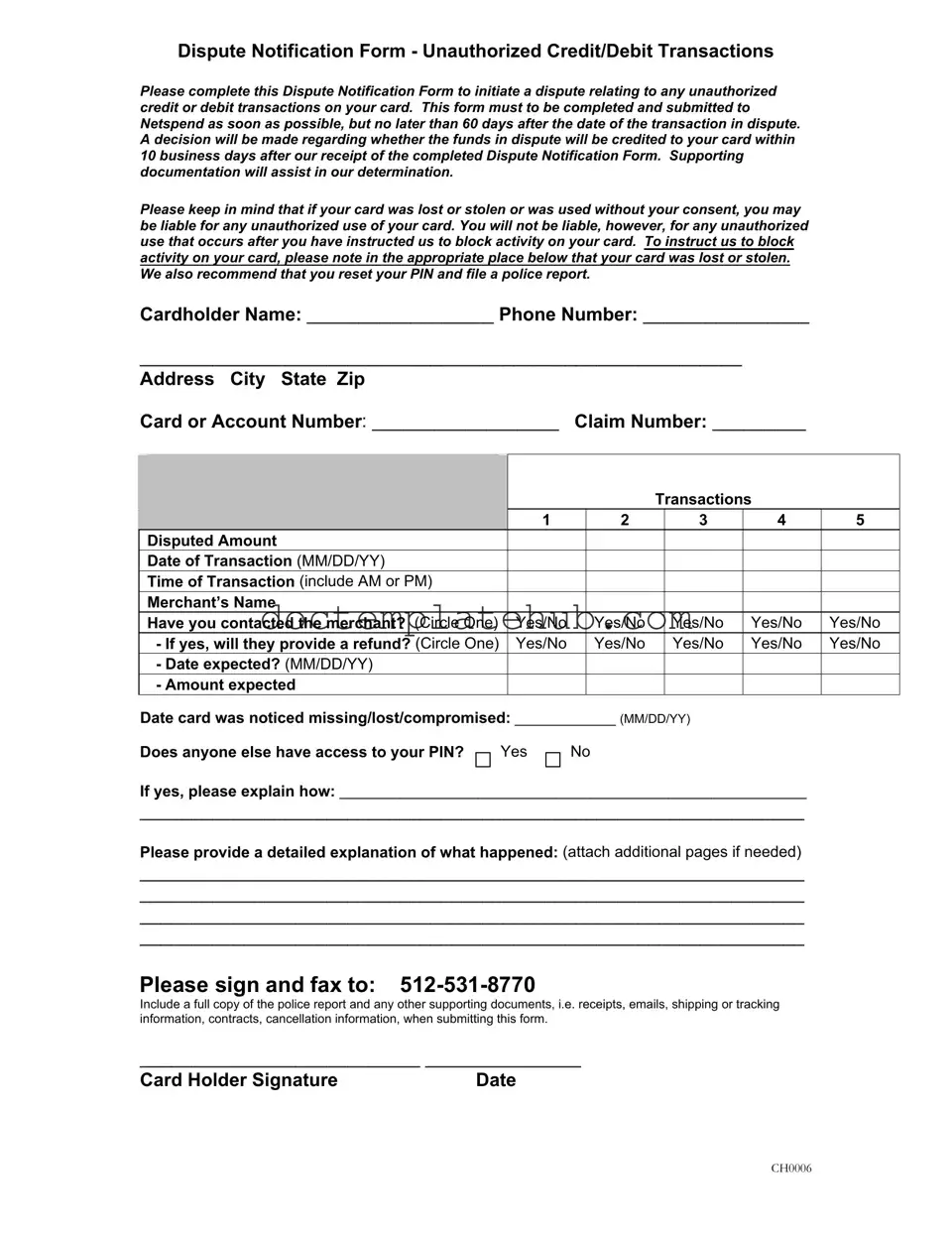

When dealing with unauthorized transactions on your Netspend card, timely action is crucial. The Netspend Dispute Notification Form serves as a vital tool for cardholders seeking to contest any credit or debit transactions they did not authorize. Completing this form initiates the dispute process, allowing you to provide essential details about the transactions in question. It's important to submit the form within 60 days of the disputed transaction to ensure a prompt review. Once received, Netspend commits to making a decision regarding your claim within 10 business days. To strengthen your case, including supporting documentation, such as receipts or police reports, is highly recommended. If your card has been lost or stolen, it’s imperative to indicate this on the form, as it may affect your liability for unauthorized charges. Furthermore, resetting your PIN and reporting the incident to the authorities can provide additional protection. The form requires basic personal information, details about the disputed transactions, and a signature to finalize the submission. Taking these steps can help safeguard your finances and ensure that you receive the support you need in resolving these disputes.

Similar forms

The Netspend Dispute Notification Form shares similarities with the Chargeback Request Form commonly used by credit card companies. Both documents serve the purpose of disputing unauthorized transactions. They require cardholders to provide specific details about the disputed transaction, including the date, amount, and merchant involved. Additionally, both forms emphasize the importance of submitting the request promptly, typically within a specified time frame, to ensure a timely resolution. Supporting documentation is also encouraged to strengthen the case, highlighting the need for thoroughness in the dispute process.

Another document akin to the Netspend Dispute Notification Form is the Fraud Report Form, which is used to report instances of identity theft or fraudulent activity. Like the dispute form, it requires personal information and details regarding the fraudulent transactions. Both forms seek to gather comprehensive information from the cardholder to facilitate a swift investigation. They also underscore the importance of prompt reporting to mitigate potential losses, reinforcing the proactive approach required from consumers facing unauthorized transactions.

The Unauthorized Transaction Report is yet another document that resembles the Netspend Dispute Notification Form. This report focuses specifically on transactions that the cardholder did not authorize. Similar to the Netspend form, it requires detailed information about each transaction in question and often asks for additional evidence to support the claim. Both documents aim to protect consumers by ensuring that unauthorized transactions are addressed quickly and effectively, thus minimizing financial harm.

The Lost or Stolen Card Report shares notable similarities with the Netspend form, particularly in the context of reporting a compromised card. When a cardholder suspects their card has been lost or stolen, they must provide relevant information to initiate a block on the card and dispute any unauthorized transactions. Both forms emphasize the urgency of reporting such incidents and require cardholders to specify the date the card was noticed missing, thereby facilitating a quick response from the financial institution.

The Account Dispute Form is another document that aligns closely with the Netspend Dispute Notification Form. This form is often used to contest various account discrepancies, not limited to unauthorized transactions. It requires the account holder to detail the nature of the dispute, similar to how the Netspend form asks for specific transaction information. Both documents aim to clarify the situation for the financial institution, enabling them to investigate and resolve the dispute efficiently.

The Consumer Complaint Form also mirrors the Netspend Dispute Notification Form in its function of addressing grievances related to financial transactions. This form allows consumers to formally document their complaints, including issues with unauthorized charges. Both documents require consumers to provide detailed accounts of their experiences, ensuring that the financial institution has a clear understanding of the problem at hand. This structured approach helps facilitate a resolution that is satisfactory to the consumer.

Understanding the significance of the Arizona Articles of Incorporation process is essential for entrepreneurs looking to establish their business. This form is vital as it formally sets up a corporation, ensuring compliance with state regulations while facilitating the legal acknowledgment of the business entity.

The Billing Error Resolution Form is similar in purpose to the Netspend Dispute Notification Form, as it is used to report errors in billing statements. Consumers must provide details about the disputed charges, including the amount and nature of the error. Both forms are designed to protect consumers from incorrect charges and ensure that financial institutions address these issues promptly. The requirement for supporting documentation is also a common thread, emphasizing the importance of substantiating claims.

Lastly, the Payment Dispute Form resembles the Netspend Dispute Notification Form in its focus on contesting specific payments made from a bank account. This form requires similar information regarding the transaction in question, including date, amount, and merchant details. Both documents serve to protect consumers by allowing them to formally dispute payments they believe were made in error or without authorization. The structured format of these forms aids in the clarity and efficiency of the dispute process.

Other PDF Templates

How to Ship Freight - Freight charges may vary based on the service options selected.

When utilizing a Hold Harmless Agreement form in Utah, it is important to ensure that all parties understand the implications of the document. For those looking for a detailed template, resources such as smarttemplates.net can provide the necessary guidance to craft an effective agreement, thereby minimizing potential legal disputes related to injuries or damages that may arise during activities.

Texas Temporary Tag - The Texas Temporary Tag ensures you can legally drive while awaiting documentation for permanent registration.

More About Netspend Dispute

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form is designed to help cardholders report unauthorized credit or debit transactions on their cards. By completing this form, you initiate the dispute process, allowing Netspend to review the transactions in question and determine if a refund is warranted.

How soon should I submit the Dispute Notification Form?

It is important to submit the Dispute Notification Form as soon as possible. You must complete and send it to Netspend no later than 60 days after the date of the transaction you are disputing. Timely submission helps ensure that your dispute is processed efficiently.

What happens after I submit the form?

Once Netspend receives your completed Dispute Notification Form, they will review the information provided. A decision regarding the disputed funds will be made within 10 business days. If additional documentation is included, it may assist in reaching a quicker resolution.

What should I include with my Dispute Notification Form?

When submitting the form, it is beneficial to include supporting documentation. This can consist of a police report, receipts, emails, shipping or tracking information, and any other relevant documents that can help substantiate your claim.

What if my card was lost or stolen?

If your card was lost or stolen, it is crucial to indicate this on the form. By doing so, you can instruct Netspend to block any further activity on your card. Additionally, resetting your PIN and filing a police report are recommended steps to protect your account.

Will I be liable for unauthorized transactions?

You may be liable for unauthorized transactions if your card was lost or stolen and you did not report it promptly. However, you will not be held responsible for any unauthorized use that occurs after you have reported the loss and requested that Netspend block your card.

How many transactions can I dispute on one form?

You can dispute up to five transactions on a single Dispute Notification Form. Ensure that you provide all necessary details for each transaction, including the disputed amount, date, time, and merchant name.

What if I have additional information to provide?

If you need to provide more details than what fits on the form, feel free to attach additional pages. A thorough explanation of what occurred will help Netspend in their review process.

How do I submit the completed form?

After completing the form and gathering all supporting documents, sign the form and fax it to 512-531-8770. Ensure that all necessary documentation is included to facilitate the dispute process.

Dos and Don'ts

When filling out the Netspend Dispute form, follow these guidelines to ensure a smooth process.

- Do submit the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do provide accurate and complete information for each transaction you are disputing.

- Do include supporting documentation, such as receipts or emails, to strengthen your case.

- Do indicate if your card was lost or stolen to block further activity.

- Don't leave any sections blank; fill in all required fields.

- Don't forget to sign the form before submission.

- Don't submit the form without a police report if your card was lost or stolen.

- Don't wait too long to contact Netspend; timely action is crucial.

Netspend Dispute - Usage Steps

Filling out the Netspend Dispute form is an important step if you believe unauthorized transactions have occurred on your account. After you submit the form, Netspend will review your case and make a decision about crediting your account. This process typically takes about 10 business days once they receive your completed form. To ensure your dispute is handled efficiently, follow these steps carefully.

- Start by writing your Cardholder Name in the designated space.

- Provide your Phone Number for contact purposes.

- Fill in your Address, including City, State, and Zip Code.

- Enter your Card or Account Number in the appropriate field.

- If you have a Claim Number, include it in the designated area.

- List each transaction you are disputing, up to five. For each transaction, provide:

- Disputed Amount

- Date of Transaction (format: MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant (Circle Yes or No).

- If yes, state whether they will provide a refund (Circle Yes or No).

- If a refund is expected, provide the Date expected (format: MM/DD/YY).

- Include the Amount expected for the refund.

- Note the Date card was noticed missing/lost/compromised (format: MM/DD/YY).

- Indicate if anyone else has access to your PIN (Circle Yes or No). If yes, provide an explanation.

- Write a detailed explanation of what happened in the space provided. Attach additional pages if necessary.

- Sign the form and write the Date of signing.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any supporting documents, such as receipts or emails, when submitting the form.