Fillable Articles of Incorporation Template for Ohio State

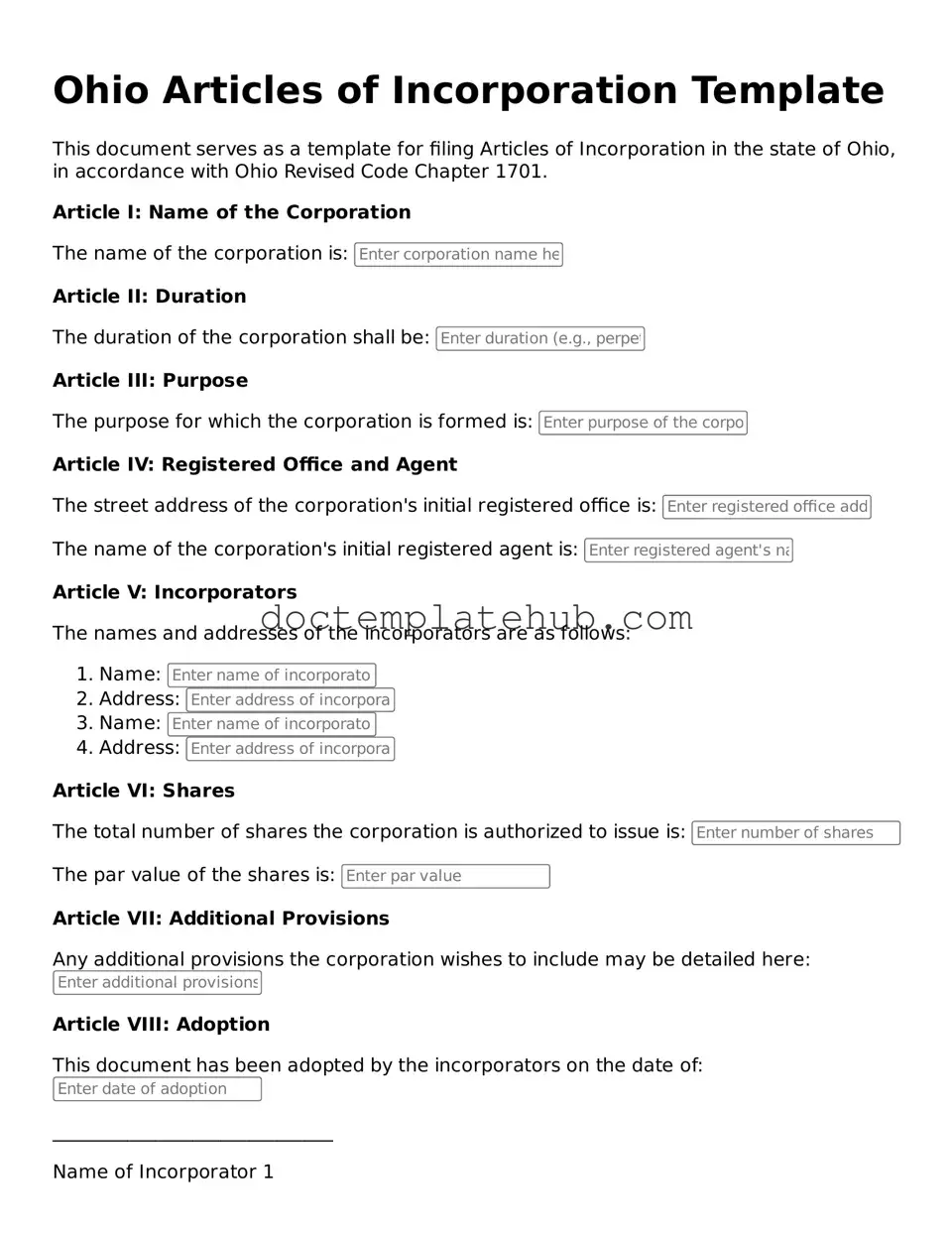

When starting a business in Ohio, one of the first steps you’ll need to take is filing the Articles of Incorporation. This essential document lays the groundwork for your corporation and provides important information about your business. It typically includes the name of your corporation, the purpose of its existence, and the address of its principal office. You will also need to designate a registered agent, who will be responsible for receiving legal documents on behalf of your corporation. Additionally, the form requires details about the number of shares your corporation is authorized to issue, which is crucial for establishing ownership and investment opportunities. Completing the Articles of Incorporation correctly is vital, as it ensures compliance with state laws and helps protect your personal assets. Understanding these key elements will make the process smoother and set your business on the right path from the very beginning.

Similar forms

The Articles of Incorporation for Ohio serve as a foundational document for the establishment of a corporation. Similar to the Articles of Incorporation, the Certificate of Incorporation in Delaware also initiates the formation of a corporation. Both documents require essential information such as the corporation's name, registered agent, and purpose. They serve to provide legal recognition and protection to the entity, ensuring compliance with state regulations.

The Bylaws of a corporation are another document that shares similarities with the Articles of Incorporation. While the Articles establish the corporation's existence, the Bylaws outline the operational rules and governance structure. Both documents are critical for the functioning of the corporation, but the Bylaws focus more on internal management rather than external recognition.

The Operating Agreement for limited liability companies (LLCs) is akin to the Articles of Incorporation in that it formalizes the entity's structure. This agreement lays out the management framework and operational procedures for the LLC. Both documents are essential for legal standing and define the roles and responsibilities of the members involved.

The Partnership Agreement is another document that resembles the Articles of Incorporation in terms of establishing a business entity. This agreement outlines the terms of the partnership, including profit-sharing, responsibilities, and decision-making processes. Like the Articles, it serves to formalize the relationship among partners and provide a legal framework for operations.

The Certificate of Formation, used in various states, is similar to the Articles of Incorporation in that it officially creates a business entity. This document typically includes the name of the business, the registered agent, and the purpose of the entity. Both documents are filed with the state to achieve legal recognition and protection.

The Statement of Information, often required in states like California, parallels the Articles of Incorporation as it provides essential information about a corporation. This document must be filed periodically and includes details such as the names and addresses of directors and officers. Both documents help maintain transparency and compliance with state laws.

The Assumed Name Certificate, also known as a DBA (Doing Business As) registration, is similar in that it allows a business to operate under a name different from its legal name. While the Articles of Incorporation establish the legal entity, the Assumed Name Certificate provides a way for that entity to engage with the public under a more recognizable name.

When establishing a corporation, it's also important to consider various legal agreements that could protect the organization, including the Hold Harmless Agreement, which is essential for minimizing liability in different scenarios. For more information on this type of agreement, you can visit smarttemplates.net.

The Nonprofit Articles of Incorporation serve a similar purpose for nonprofit organizations. They establish the legal existence of the nonprofit and include information about its mission and governance. Both types of Articles provide a framework for operation and compliance with state regulations, although the focus for nonprofits is on charitable purposes.

The Franchise Agreement, while different in function, shares a commonality with the Articles of Incorporation in that it formalizes a business relationship. This agreement outlines the terms under which a franchisee operates under the franchisor's brand. Both documents create legal obligations and define the rights and responsibilities of the parties involved.

Finally, the Business License Application can be seen as similar to the Articles of Incorporation in that it is a necessary step for legal operation. This application grants permission to conduct business within a specific jurisdiction. While the Articles establish the entity, the Business License Application ensures compliance with local regulations and ordinances.

Other Common State-specific Articles of Incorporation Templates

Biz Online - It distinguishes between different classes of stock, if applicable.

Filing the necessary Articles of Incorporation form is vital for any business looking to establish a strong corporate presence in Arizona. This document serves as the foundation for your corporation, defining its fundamental characteristics and legal framework.

Texas Llc Annual Fees - Incorporation can offer tax benefits, which are noted in the Articles.

Georgia Secretary of State Forms - Details on how decisions will be made within the corporation may be included.

More About Ohio Articles of Incorporation

What are the Ohio Articles of Incorporation?

The Ohio Articles of Incorporation is a legal document that establishes a corporation in the state of Ohio. It outlines essential information about the corporation, such as its name, purpose, and structure. Filing this document is a crucial step in forming a corporation, as it grants the entity legal recognition and protection under state law.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Ohio must file the Articles of Incorporation. This includes businesses of all sizes, from small startups to large enterprises. Nonprofit organizations also need to file this document to gain legal status.

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key pieces of information. This includes the corporation's name, the purpose of the corporation, the address of the principal office, the number of shares the corporation is authorized to issue, and the names and addresses of the initial directors. Additional provisions can also be included if desired.

How do I file the Articles of Incorporation in Ohio?

Filing can be done online or by mail. To file online, visit the Ohio Secretary of State's website and complete the necessary forms. If you prefer to file by mail, you can download the form, fill it out, and send it to the Secretary of State's office with the required filing fee. Ensure that all information is accurate to avoid delays.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Ohio varies depending on the type of corporation being formed. Typically, the fee ranges from $99 to $125. It's essential to check the current fee schedule on the Ohio Secretary of State's website to ensure you have the correct amount when filing.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, online filings are processed faster, often within a few business days. Mail filings may take longer, sometimes up to several weeks. To expedite the process, ensure that all required information is complete and accurate before submission.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. If there are changes to the corporation’s name, purpose, or structure, an amendment form must be filed with the Ohio Secretary of State. There may be a fee associated with this amendment, so it’s important to check the current regulations.

Do I need legal assistance to file the Articles of Incorporation?

While it's not mandatory to have legal assistance, consulting with a legal professional can be beneficial. They can help ensure that all information is accurate and compliant with Ohio laws. This can prevent potential issues down the line, saving time and resources.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation is officially formed. You will receive a certificate of incorporation from the state. Following this, you must comply with ongoing requirements, such as obtaining any necessary licenses and permits, holding regular meetings, and filing annual reports.

Dos and Don'ts

When filling out the Ohio Articles of Incorporation form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things to do and avoid:

- Do provide accurate information about your business name and address.

- Do include the purpose of your corporation clearly and concisely.

- Do ensure that the names and addresses of the initial directors are complete.

- Do review the form for any spelling or grammatical errors before submission.

- Do check the required filing fee and include payment with your application.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't use a name for your corporation that is already in use by another entity.

- Don't forget to sign and date the form before submission.

- Don't submit the form without making a copy for your records.

Ohio Articles of Incorporation - Usage Steps

After completing the Ohio Articles of Incorporation form, you will need to submit it to the Ohio Secretary of State's office along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.

- Obtain the Ohio Articles of Incorporation form from the Ohio Secretary of State's website or office.

- Fill in the name of the corporation. Ensure the name is unique and includes an appropriate designation, such as "Corporation" or "Inc."

- Provide the purpose of the corporation. This should be a brief statement outlining the business activities.

- Enter the address of the corporation’s principal office. This should be a physical address, not a P.O. Box.

- List the name and address of the statutory agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the number of shares the corporation is authorized to issue. Specify any classes of shares if applicable.

- Include the names and addresses of the incorporators. These individuals are responsible for setting up the corporation.

- Sign and date the form. Ensure that all incorporators sign if there are multiple.

- Review the completed form for accuracy and completeness before submission.

- Submit the form along with the required filing fee to the Ohio Secretary of State's office. This can typically be done online or by mail.