Fillable Bill of Sale Template for Ohio State

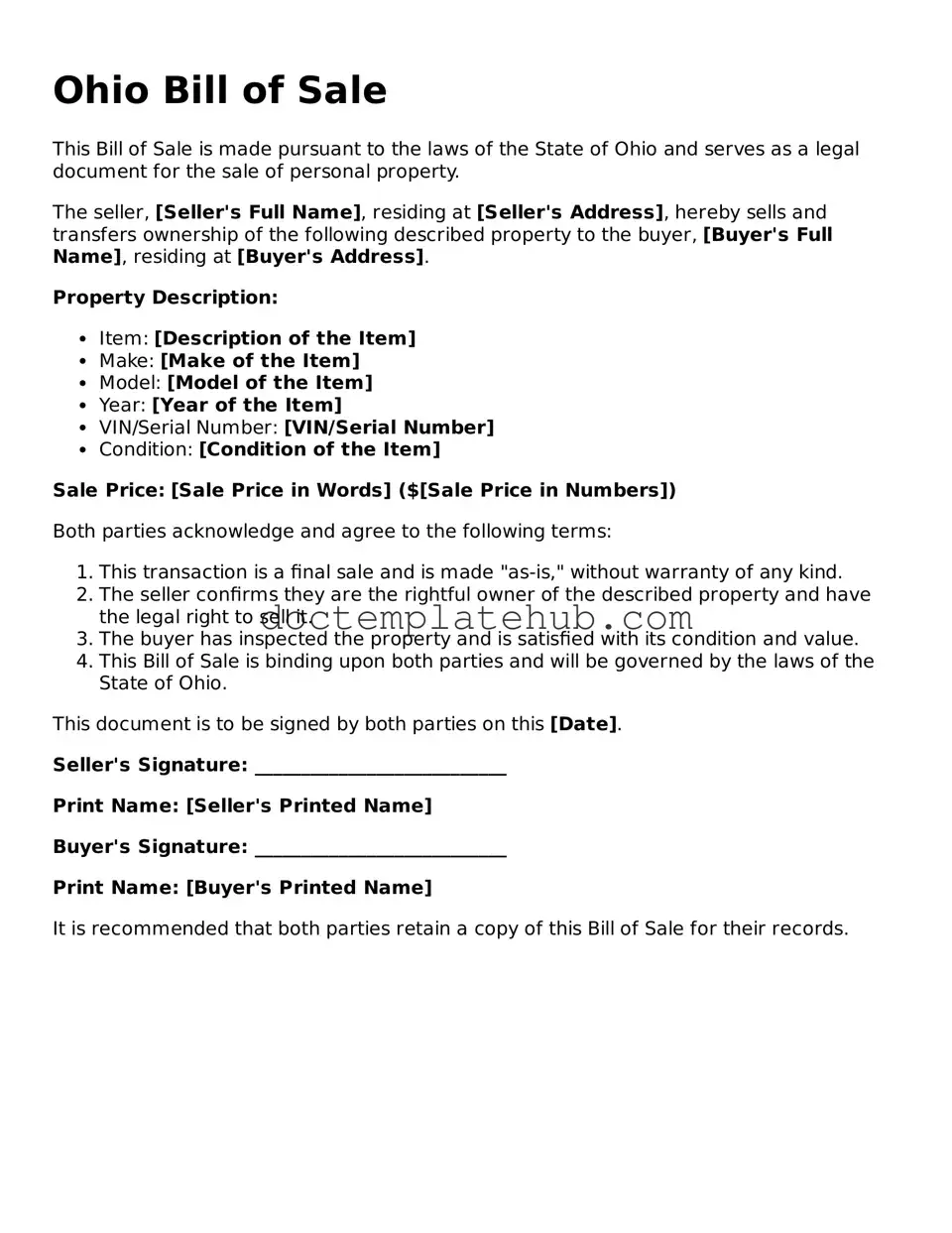

When it comes to buying or selling personal property in Ohio, a Bill of Sale form plays a crucial role in ensuring a smooth transaction. This document serves as a written record that outlines the details of the sale, including the names and addresses of both the buyer and seller, a description of the item being sold, and the purchase price. It is essential for both parties to understand their rights and responsibilities, as this form can provide legal protection should any disputes arise in the future. In Ohio, the Bill of Sale is particularly important for transactions involving vehicles, boats, and other significant assets, as it helps to establish ownership and can be required for registration purposes. Additionally, while a Bill of Sale is not always mandatory, having one can facilitate the transfer process and give both parties peace of mind. Whether you are a seasoned seller or a first-time buyer, familiarizing yourself with the components and importance of the Ohio Bill of Sale form can empower you to navigate your transaction with confidence.

Similar forms

The Ohio Bill of Sale form bears similarities to the Vehicle Title Transfer document, which is essential when ownership of a vehicle changes hands. Like the Bill of Sale, the Vehicle Title Transfer provides proof of ownership, detailing the buyer and seller's information, vehicle identification number, and sale price. Both documents serve as legal evidence in the event of disputes regarding ownership, ensuring that the transfer is recognized by state authorities. The Vehicle Title Transfer must be submitted to the Ohio Bureau of Motor Vehicles to officially record the new ownership, paralleling the Bill of Sale's role in documenting the transaction.

Another document that resembles the Ohio Bill of Sale is the Receipt for Payment. This receipt confirms that a buyer has made a payment for goods or services, similar to how a Bill of Sale indicates that a transaction has occurred. Both documents include details such as the date of the transaction, the parties involved, and a description of the item sold. While a Receipt for Payment does not transfer ownership, it serves as proof of the exchange, just as a Bill of Sale does for the transfer of ownership of property or goods.

The Lease Agreement is yet another document that shares characteristics with the Ohio Bill of Sale. While a Bill of Sale transfers ownership, a Lease Agreement outlines the terms under which one party can use another party’s property for a specified period. Both documents require the identification of the parties involved and a description of the item or property in question. They also serve as legal contracts, protecting the rights of both parties and detailing the responsibilities and obligations associated with the transaction.

In the realm of personal property transactions, the Gift Deed is similar to the Ohio Bill of Sale, albeit with a key difference. A Gift Deed is used to transfer ownership of property without any exchange of money, while a Bill of Sale typically involves a sale price. Both documents require the identification of the giver and receiver, as well as a clear description of the property being transferred. They both serve as legal proof of the transaction, ensuring that the transfer is recognized by relevant authorities.

The Affidavit of Ownership is another document that parallels the Ohio Bill of Sale. This affidavit is often used when an individual needs to assert their ownership of property, particularly when there is no formal documentation available. Similar to a Bill of Sale, it includes details about the property and the owner, providing a sworn statement that can help establish legal ownership. Both documents can be critical in resolving disputes about ownership and can be used in legal proceedings if necessary.

Additionally, the Power of Attorney can be compared to the Ohio Bill of Sale in terms of transferring rights. A Power of Attorney allows one person to act on behalf of another in legal matters, including the sale of property. While the Bill of Sale is focused on the transfer of ownership, the Power of Attorney can authorize someone to execute a Bill of Sale on behalf of the owner. Both documents must be executed with care to ensure that the intent of the parties is clearly stated and legally binding.

Lastly, the Warranty Deed shares similarities with the Ohio Bill of Sale, particularly in real estate transactions. A Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. Like a Bill of Sale, it includes details about the buyer and seller, as well as a description of the property. Both documents serve to protect the interests of the parties involved, ensuring that the transaction is legitimate and that the buyer receives ownership free of encumbrances.

Other Common State-specific Bill of Sale Templates

Bill of Sale Dmv Pdf - A Bill of Sale is a simple but powerful tool for ensuring clarity and transparency in property transactions.

Do You Need a Bill of Sale in Florida - It serves as a receipt for the buyer and proof of sale for the seller.

Az Car Bill of Sale - The details on a Bill of Sale can vary widely based on the type of item being sold and individual state requirements.

Ga Trailer Bill of Sale - Buyers can use a Bill of Sale to confirm that the item has no outstanding loans or claims against it.

More About Ohio Bill of Sale

What is a Bill of Sale in Ohio?

A Bill of Sale in Ohio is a legal document that records the transfer of ownership of personal property from one person to another. It serves as proof of the transaction and includes details about the item being sold, the buyer, and the seller.

When do I need a Bill of Sale?

You need a Bill of Sale when you sell or purchase items like vehicles, boats, or other valuable personal property. It is especially important for high-value items or when the buyer and seller do not know each other well.

What information should be included in the Ohio Bill of Sale?

The Ohio Bill of Sale should include the names and addresses of both the buyer and seller, a description of the item being sold (including serial numbers if applicable), the sale price, and the date of the transaction. Signatures of both parties are also necessary.

Is a Bill of Sale required for vehicle sales in Ohio?

Yes, a Bill of Sale is required for vehicle sales in Ohio. It helps in the registration process and provides proof of ownership. The Ohio Bureau of Motor Vehicles (BMV) may require this document when transferring the title.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. However, it is important to ensure that all required information is included and that it complies with Ohio laws. Templates are available online, or you can consult with a legal professional for guidance.

Do I need to have the Bill of Sale notarized?

In Ohio, notarization of a Bill of Sale is not required by law. However, having it notarized can add an extra layer of protection and may be beneficial if there are disputes in the future.

What if the item being sold is a vehicle?

If the item is a vehicle, the Bill of Sale should include specific details like the vehicle identification number (VIN), make, model, year, and odometer reading at the time of sale. This information is crucial for the title transfer process.

What happens if I lose my Bill of Sale?

If you lose your Bill of Sale, it can be difficult to prove ownership of the item. It is advisable to keep a copy in a safe place. If necessary, you may be able to create a new Bill of Sale, but both parties must agree and sign it again.

Is a Bill of Sale legally binding?

Yes, a Bill of Sale is a legally binding document once both parties have signed it. It can be used in court to prove ownership and the terms of the sale if disputes arise.

Where can I find an Ohio Bill of Sale form?

You can find an Ohio Bill of Sale form online through various legal websites, or you may obtain one from a local office supply store. Additionally, some legal aid organizations may provide free templates.

Dos and Don'ts

When filling out the Ohio Bill of Sale form, it’s important to ensure accuracy and clarity. Here are some guidelines to help you navigate the process effectively:

- Do provide accurate information about the buyer and seller.

- Do include a complete description of the item being sold, including make, model, and VIN if applicable.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use abbreviations or shorthand that may confuse the information.

- Don't forget to check for spelling errors, as they can lead to complications later.

- Don't rush through the process; take your time to ensure everything is correct.

Ohio Bill of Sale - Usage Steps

Once you have the Ohio Bill of Sale form in front of you, it's time to fill it out carefully. Make sure you have all necessary information at hand, such as details about the buyer, seller, and the item being sold. Follow these steps to complete the form accurately.

- Gather Information: Collect the names, addresses, and contact information of both the buyer and seller.

- Describe the Item: Clearly outline the item being sold. Include details like make, model, year, and any identification numbers (like a VIN for vehicles).

- Enter Sale Price: Specify the agreed-upon sale price for the item. Make sure this is clear and accurate.

- Date of Sale: Write the date when the sale is taking place. This is important for record-keeping.

- Signatures: Both the buyer and seller need to sign the form. Ensure both parties sign and date it to validate the transaction.

- Keep Copies: Make copies of the completed Bill of Sale for both the buyer and seller for their records.