Fillable Deed in Lieu of Foreclosure Template for Ohio State

In the challenging landscape of real estate, homeowners facing financial difficulties often seek alternatives to foreclosure, and the Ohio Deed in Lieu of Foreclosure form emerges as a viable option. This legal document allows a homeowner to voluntarily transfer the ownership of their property back to the lender, thereby avoiding the lengthy and often stressful foreclosure process. By completing this form, individuals can mitigate the negative impact on their credit score and potentially resolve their mortgage obligations more amicably. The process typically involves a thorough review by the lender, who must agree to accept the deed in exchange for releasing the homeowner from the mortgage debt. Additionally, homeowners must ensure that the property is free of other liens, as this can complicate the transaction. Understanding the nuances of this form is essential for anyone considering this route, as it can lead to a smoother transition and a fresh start for those burdened by financial strain.

Similar forms

The Ohio Deed in Lieu of Foreclosure is similar to a mortgage release. A mortgage release is a document that officially frees a borrower from their mortgage obligation when the loan is paid off. In both cases, the borrower relinquishes their interest in the property, but a mortgage release typically occurs after the loan is satisfied, while a deed in lieu is often used to avoid foreclosure proceedings when the borrower can no longer make payments. Both documents aim to simplify the process of transferring property ownership back to the lender.

Another document that shares similarities is a short sale agreement. In a short sale, the lender agrees to accept less than the full amount owed on the mortgage when the property is sold. Like a deed in lieu of foreclosure, a short sale allows the borrower to avoid the lengthy and damaging process of foreclosure. Both options require the lender's approval and aim to mitigate losses for both parties involved, but a short sale involves selling the property, while a deed in lieu transfers ownership directly to the lender.

A quitclaim deed is also comparable to a deed in lieu of foreclosure. This document transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. In a deed in lieu, the borrower transfers their interest to the lender, often to clear debts and avoid foreclosure. While a quitclaim deed can be used in various situations, the intent behind both documents is to simplify the transfer of property ownership, although a quitclaim deed does not necessarily involve a mortgage obligation.

Understanding the importance of a Transfer-on-Death Deed strategy can help property owners secure their assets for beneficiaries while avoiding lengthy legal processes upon passing. This form allows for a straightforward transfer of real estate, ensuring peace of mind for the owner and their loved ones.

Similarly, a warranty deed can be likened to a deed in lieu of foreclosure. A warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. While a warranty deed is often used in standard property sales, a deed in lieu serves a specific purpose in the context of foreclosure. Both documents facilitate the transfer of property ownership, but a warranty deed assures the buyer of a clear title, while a deed in lieu typically signifies a distressed sale situation.

A foreclosure notice is another document that relates closely to a deed in lieu of foreclosure. A foreclosure notice is a legal document that informs a borrower that their lender intends to foreclose on the property due to missed payments. While a deed in lieu is a proactive measure taken by a borrower to avoid foreclosure, both documents represent critical points in the foreclosure process. They serve as indicators of financial distress and the potential loss of property, yet a deed in lieu offers a way to resolve the situation more amicably.

Power of attorney can also be compared to a deed in lieu of foreclosure. A power of attorney grants someone the authority to act on another person's behalf in legal matters, including property transactions. In situations where a borrower is unable to manage their affairs due to financial hardship, they may execute a deed in lieu, allowing the lender to take ownership without going through foreclosure. Both documents involve the transfer of authority and ownership, but a power of attorney does not necessarily imply financial distress.

Another related document is a loan modification agreement. This agreement alters the terms of an existing loan to make it more manageable for the borrower. While a deed in lieu of foreclosure is a last resort for borrowers unable to keep up with payments, a loan modification seeks to prevent foreclosure by adjusting the loan terms. Both documents reflect attempts to address financial difficulties, but a loan modification keeps the borrower in their home, whereas a deed in lieu results in the transfer of ownership to the lender.

In addition, a foreclosure deed is relevant in this context. A foreclosure deed is executed when a property is sold at a foreclosure auction. It officially transfers ownership from the borrower to the new owner, typically the lender or a third party. A deed in lieu of foreclosure serves as an alternative to this process, allowing the borrower to voluntarily transfer the property back to the lender without the need for an auction. Both documents finalize the transfer of ownership but do so under different circumstances.

Lastly, a forbearance agreement can be compared to a deed in lieu of foreclosure. A forbearance agreement allows a borrower to temporarily pause or reduce mortgage payments while they work to improve their financial situation. While a deed in lieu of foreclosure signifies the end of a borrower's ability to keep their home, both documents provide options for borrowers facing financial difficulties. They represent different strategies to address mortgage challenges, with forbearance offering a chance to recover while a deed in lieu provides a way out of a failing mortgage.

Other Common State-specific Deed in Lieu of Foreclosure Templates

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - This form signals that the homeowner is willing to walk away from the property to discharge debt.

In the context of estate planning, understanding the nuances of a Power of Attorney is essential, particularly for those residing in New York. This form not only facilitates necessary decision-making but also provides peace of mind knowing that a trusted individual can act on one's behalf when needed. For further detailed guidance, one can visit smarttemplates.net.

Foreclosure Georgia - This process can often provide peace of mind during chaotic financial times.

Deed in Lieu of Foreclosure Form - Homeowners who choose this route often find it preferable to the emotional strain of a foreclosure process.

More About Ohio Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option is typically pursued when the homeowner is unable to keep up with mortgage payments and wants to mitigate the negative impact of foreclosure on their credit history.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure generally depends on the lender's policies. Homeowners facing financial hardship, such as job loss or medical expenses, may qualify. However, the property must be free of other liens, and the homeowner must demonstrate that they cannot continue making mortgage payments.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

One of the main benefits is that it can help homeowners avoid the lengthy and stressful foreclosure process. Additionally, it typically results in less damage to credit scores compared to a foreclosure. Homeowners may also be able to negotiate a smoother transition, including potential relocation assistance from the lender.

What are the drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks. Homeowners may still face tax implications, as forgiven debt can be considered taxable income. Additionally, not all lenders accept Deeds in Lieu, and the process can be complicated, requiring careful negotiation and documentation.

How does the process work?

The process typically begins with the homeowner contacting their lender to discuss their financial situation. If both parties agree to proceed, the homeowner will complete the necessary paperwork, including the Deed in Lieu of Foreclosure form. The lender will then review the documentation and may require an appraisal or inspection before finalizing the transfer.

What happens to my mortgage debt after a Deed in Lieu of Foreclosure?

In most cases, the mortgage debt is forgiven once the Deed in Lieu is executed. However, homeowners should clarify this with their lender, as some lenders may reserve the right to pursue a deficiency judgment if the property sells for less than the mortgage balance.

Can I still live in my home during the Deed in Lieu process?

Generally, once the Deed in Lieu is agreed upon and executed, the homeowner will need to vacate the property. However, some lenders may offer a grace period to allow homeowners to find alternative housing, but this is not guaranteed.

Is legal advice recommended before proceeding with a Deed in Lieu of Foreclosure?

Yes, seeking legal advice is highly recommended. An attorney can help homeowners understand their rights and obligations, negotiate with lenders, and navigate the complexities of the process. This can be especially important if there are other liens or debts involved.

How does a Deed in Lieu of Foreclosure impact my credit score?

While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it will still have a negative impact on your credit score. The extent of the impact can vary based on individual circumstances, but it’s generally seen as a significant negative mark on your credit report.

Are there alternatives to a Deed in Lieu of Foreclosure?

Yes, there are alternatives. Homeowners may consider loan modifications, short sales, or even bankruptcy, depending on their financial situation. Each option has its own set of implications, so it’s important to evaluate all available choices before making a decision.

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, it is crucial to follow specific guidelines to ensure the process is smooth and legally sound. Below is a list of recommended actions and common pitfalls to avoid.

- Do ensure all property details are accurate, including the legal description.

- Do provide complete information about the parties involved, including names and addresses.

- Do have the document notarized to validate the signatures.

- Do consult with a legal professional if you have questions about the process.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't sign the document without fully understanding its implications.

- Don't forget to keep copies of the completed form for your records.

- Don't rush through the process; take the time to review all information carefully.

Ohio Deed in Lieu of Foreclosure - Usage Steps

After you complete the Ohio Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate county recorder's office. This step is crucial to ensure that the deed is officially recorded and the transfer of ownership is recognized. Be sure to keep a copy for your records.

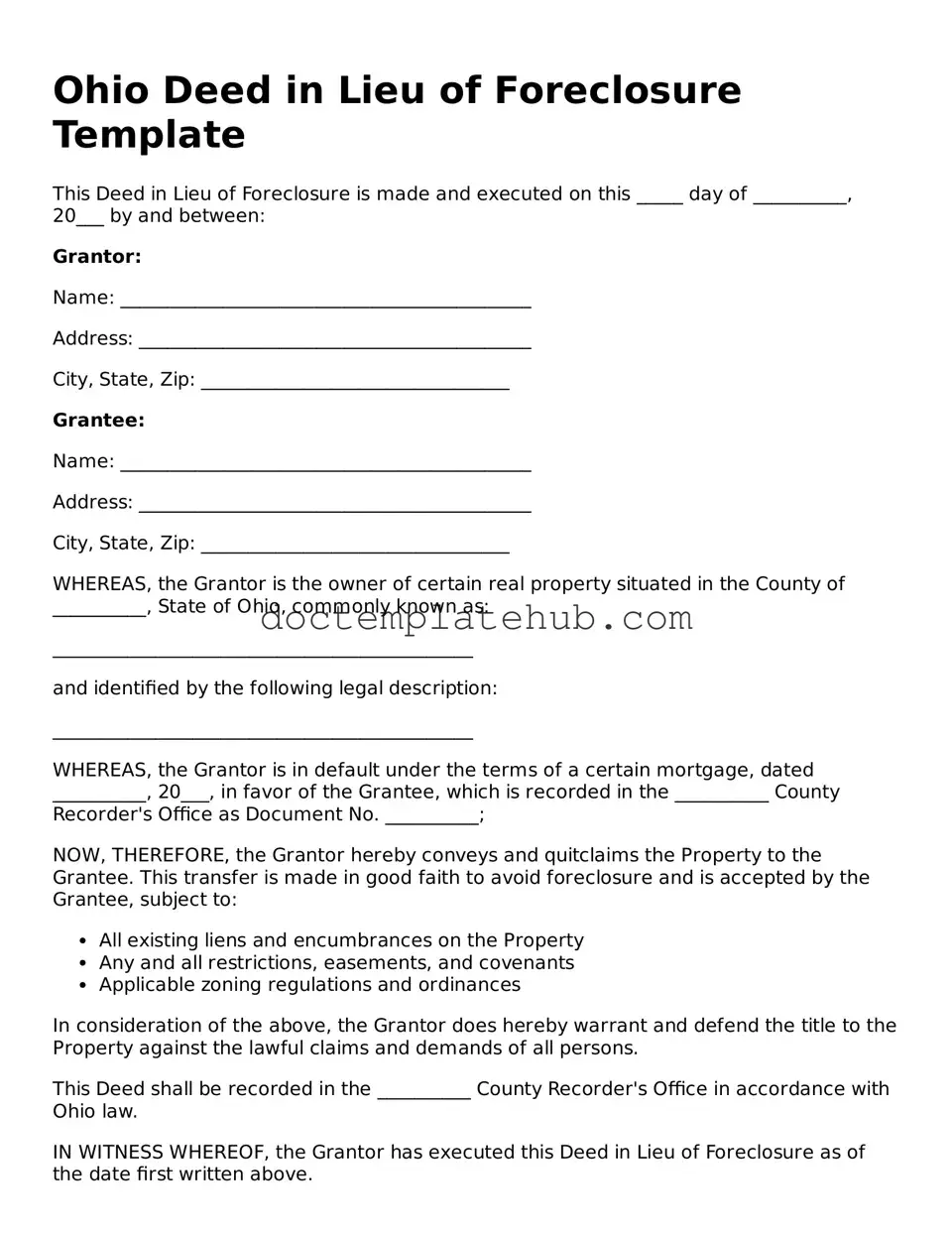

- Obtain the Ohio Deed in Lieu of Foreclosure form. You can find it online or at your local county recorder's office.

- Fill in the current owner's name and address at the top of the form. Ensure this matches the name on the property title.

- Provide the property address. Include the street address, city, and zip code.

- Identify the legal description of the property. This information can usually be found on your property tax bill or previous deed.

- Indicate the name and address of the new owner, typically the lender or bank.

- Sign and date the form. Make sure all signatures are in ink and dated appropriately.

- Have the form notarized. A notary public will need to witness your signature to validate the document.

- Submit the completed form to your local county recorder's office for recording.