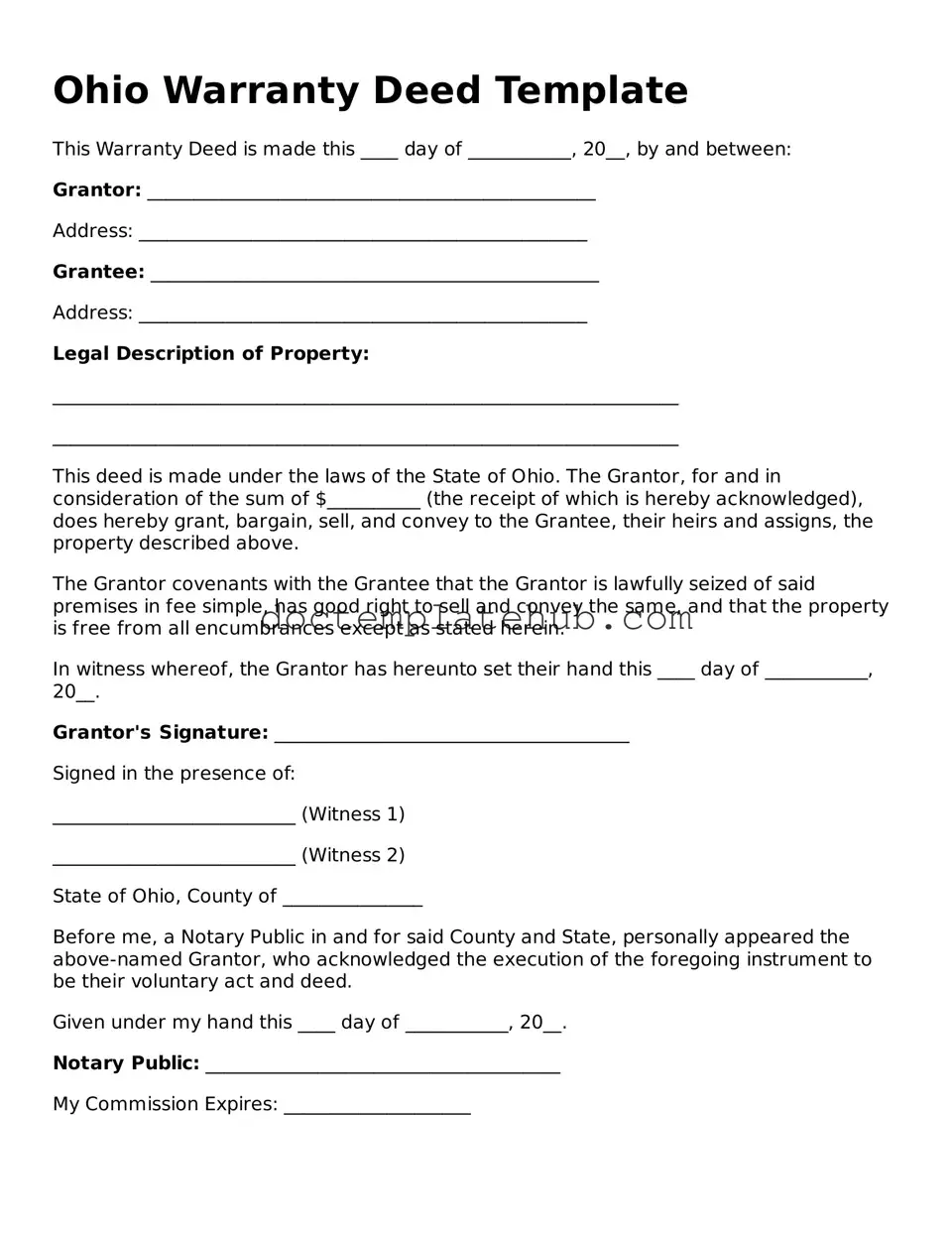

Fillable Deed Template for Ohio State

In Ohio, the deed form serves as a crucial legal instrument for the transfer of real property ownership. This document outlines the rights and obligations of both the grantor, the individual or entity transferring the property, and the grantee, the recipient of the property. It includes essential details such as the names of the parties involved, a clear description of the property being conveyed, and the legal consideration, which is often the purchase price or other forms of compensation. Additionally, the deed must be signed by the grantor and may require notarization to ensure its validity. Various types of deeds exist in Ohio, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and providing varying levels of protection for the grantee. Understanding the nuances of the Ohio deed form is vital for anyone involved in real estate transactions, as it not only facilitates the transfer of property but also establishes legal rights and responsibilities that can have long-term implications.

Similar forms

The Warranty Deed is similar to the Ohio Deed form in that it guarantees the property title is clear of any claims or liens. When a seller uses a Warranty Deed, they promise the buyer that they own the property outright and have the right to sell it. This document provides a strong level of protection for the buyer, ensuring that they can take ownership without worrying about previous owners' debts or disputes.

The Quitclaim Deed differs from the Ohio Deed form primarily in the level of protection it offers. A Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. This means that if the seller has a questionable title, the buyer assumes the risk. While this document is often used between family members or in divorce settlements, it lacks the assurances found in the Ohio Deed form.

The Special Warranty Deed is another document that shares similarities with the Ohio Deed form. It provides a limited warranty, only covering the period during which the seller owned the property. This means the seller guarantees that no issues arose during their ownership. However, unlike the Ohio Deed form, it does not protect against problems that may have existed before the seller's ownership.

The Bargain and Sale Deed resembles the Ohio Deed form in that it transfers property ownership but does not provide any warranties. The seller conveys the property "as is," meaning the buyer accepts any existing issues. This document can be useful in certain situations, but buyers should be cautious as it offers less protection compared to the Ohio Deed form.

The Texas Quitclaim Deed form is another important document in the realm of property transfers, akin to various deed types. It allows individuals to relinquish any interest they may have in a property, similar to the way the Ohio Deed operates. The Quitclaim Deed is frequently utilized within familial contexts or transactions where there is mutual trust between the parties involved. While it transfers ownership rights efficiently, it does not guarantee that the title is clear or free from encumbrances, introducing a level of risk to the buyer. For more details on this form, visit smarttemplates.net/.

The Grant Deed is similar to the Ohio Deed form in that it conveys ownership and includes some implied warranties. It assures the buyer that the seller has not sold the property to anyone else and that there are no undisclosed liens. While it provides some level of protection, it does not offer the same comprehensive guarantees as the Ohio Deed form.

The Trustee's Deed is used when a property is transferred by a trustee, often in a trust or estate situation. It shares similarities with the Ohio Deed form in that it transfers ownership but may not provide the same level of assurances regarding the title. The trustee acts on behalf of the trust, and while they typically have the authority to convey the property, buyers should still conduct due diligence.

Finally, the Life Estate Deed allows a property owner to transfer ownership while retaining the right to live in the property for the rest of their life. This document is similar to the Ohio Deed form in that it legally transfers property, but it includes specific terms regarding the life tenant's rights. It can be an effective estate planning tool, but it requires careful consideration to ensure all parties understand their rights and responsibilities.

Other Common State-specific Deed Templates

Legal House Deed Document - Details the parties involved in the property transfer.

The process of filling out the CDC U.S. Standard Certificate of Live Birth form is essential for new parents, as it ensures that all necessary information about their child is accurately documented. For those seeking guidance, detailed instructions and a template can be found at https://documentonline.org/blank-cdc-u-s-standard-certificate-of-live-birth/, which provides clarity on how to properly complete this vital form.

Quit Claim Deed Ga - It is essential for both parties to review the deed for accuracy before signing.

Grant Deed California - A Deed must adhere to state-specific requirements to be effective.

More About Ohio Deed

What is an Ohio Deed form?

An Ohio Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Ohio. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and the terms of the transfer. It is essential for ensuring that the new owner has a clear title to the property and that the transfer complies with state laws.

What types of deeds are available in Ohio?

Ohio recognizes several types of deeds, each serving different purposes. The most common include the Warranty Deed, which guarantees that the seller holds clear title to the property and has the right to sell it; the Quit Claim Deed, which transfers whatever interest the seller may have without any guarantees; and the Special Warranty Deed, which offers limited warranties only for the time the seller owned the property. Understanding the differences is crucial when deciding which deed to use for your transaction.

Do I need to have the deed notarized?

Yes, in Ohio, a deed must be notarized to be valid. This means that the person signing the deed must do so in the presence of a notary public, who will then affix their signature and seal to the document. Notarization helps prevent fraud and ensures that the parties involved are who they claim to be. After notarization, the deed must be recorded with the county recorder’s office to be effective against third parties.

How do I record an Ohio Deed?

To record an Ohio Deed, you need to take the completed and notarized document to the county recorder's office in the county where the property is located. There may be a small fee for recording the deed, and you will need to provide any required information, such as the legal description of the property. Once recorded, the deed becomes part of the public record, providing legal notice of the transfer to the community.

What happens if I don’t record the deed?

If you fail to record the deed, the transfer of property ownership may not be recognized by third parties. This can lead to complications, especially if the previous owner attempts to sell the property again or if there are disputes over ownership. Recording the deed is a critical step in protecting your rights as a property owner and ensuring that your ownership is legally acknowledged.

Dos and Don'ts

When filling out the Ohio Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are nine things to keep in mind:

- Do ensure that all names are spelled correctly.

- Don't leave any required fields blank.

- Do include the correct legal description of the property.

- Don't use abbreviations that could lead to confusion.

- Do sign the deed in the presence of a notary public.

- Don't forget to date the document upon signing.

- Do check for any applicable transfer taxes.

- Don't use white-out or other correction methods on the form.

- Do keep a copy of the completed deed for your records.

By following these guidelines, you can help ensure a smooth process when submitting your Ohio Deed form.

Ohio Deed - Usage Steps

Once you have the Ohio Deed form ready, you will need to fill it out accurately to ensure a smooth transfer of property ownership. After completing the form, it will need to be signed and filed with the appropriate county office.

- Begin by entering the date at the top of the form.

- Identify the Grantor (the person transferring the property). Provide their full name and address.

- Next, identify the Grantee (the person receiving the property). Include their full name and address as well.

- Clearly describe the property being transferred. Include the legal description, which can usually be found in the current deed or tax records.

- Indicate the consideration (the value exchanged for the property). This can be a dollar amount or other forms of compensation.

- Include any relevant information about the property, such as easements or restrictions, if applicable.

- Sign the form. The Grantor must sign in front of a notary public.

- Have the notary public complete their section, which includes their signature and seal.

- Make copies of the completed deed for your records before filing.

- File the original deed with the county recorder's office in the county where the property is located.