Fillable Durable Power of Attorney Template for Ohio State

The Ohio Durable Power of Attorney form is a vital legal document that empowers individuals to designate another person, often referred to as an agent or attorney-in-fact, to make decisions on their behalf when they are unable to do so. This form is particularly important for managing financial matters, healthcare decisions, and other personal affairs. It remains effective even if the individual becomes incapacitated, which is a key feature distinguishing it from a standard power of attorney. The document allows for a broad range of authority, enabling the agent to handle tasks such as paying bills, managing investments, and making medical decisions, depending on the specific powers granted. Furthermore, the Ohio Durable Power of Attorney form can be customized to reflect the principal's unique needs and preferences, ensuring that the agent's powers align with the individual's wishes. Understanding the nuances of this form is essential for anyone considering establishing a durable power of attorney, as it not only safeguards their interests but also provides peace of mind for both the principal and their loved ones.

Similar forms

The Ohio Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, referred to as the agent or attorney-in-fact, to make decisions on their behalf. However, the key difference lies in the durability aspect. A General Power of Attorney becomes ineffective if the principal becomes incapacitated, while a Durable Power of Attorney remains valid even if the principal is unable to make decisions due to illness or injury. This ensures that the agent can continue to act in the best interests of the principal during times of incapacity.

Another document comparable to the Ohio Durable Power of Attorney is the Healthcare Power of Attorney. This form specifically grants an agent the authority to make medical decisions for the principal when they are unable to do so themselves. While both documents involve the appointment of an agent, the Healthcare Power of Attorney is focused solely on health-related matters. It is crucial for individuals to have both documents in place to ensure comprehensive coverage for both financial and healthcare decisions, particularly in situations where they may be incapacitated.

The Living Will is another document that aligns closely with the Durable Power of Attorney, particularly in the context of healthcare. A Living Will outlines an individual’s preferences regarding medical treatment and end-of-life care, specifying what types of interventions they would or would not want. While the Durable Power of Attorney allows an agent to make decisions based on the principal’s best interests, the Living Will provides clear directives. Together, these documents ensure that an individual’s wishes are respected during critical health situations.

Understanding the significance of legal documents is essential for effective planning in various aspects of life, including emotional well-being. The Emotional Support Animal Letter serves as an important resource for individuals requiring support through their animal companions. For more information on this valuable document, you can visit documentonline.org/blank-emotional-support-animal-letter/.

Lastly, the Revocation of Power of Attorney is relevant when discussing the Durable Power of Attorney. This document allows a principal to formally cancel or revoke a previously granted power of attorney. While the Durable Power of Attorney provides ongoing authority to an agent, the Revocation of Power of Attorney serves as a safeguard, allowing individuals to regain control over their decisions. It is essential for individuals to understand how to properly revoke a power of attorney if they wish to change their agent or withdraw the authority they have granted.

Other Common State-specific Durable Power of Attorney Templates

Power of Attorney Georgia Pdf - It empowers a loved one to act in your best interests in various situations.

Power of Attorney Florida - The right agent can navigate complex legal matters on your behalf.

For those looking to execute this transfer with ease, resources such as smarttemplates.net can provide helpful templates and guidance on completing a Texas Quitclaim Deed form effectively.

How to Get a Power of Attorney in Arizona - This legal arrangement can help your family avoid conflict by laying out your intentions clearly in advance.

More About Ohio Durable Power of Attorney

What is a Durable Power of Attorney in Ohio?

A Durable Power of Attorney (DPOA) in Ohio is a legal document that allows you to appoint someone to make decisions on your behalf if you become incapacitated. Unlike a regular power of attorney, which becomes void if you are unable to make decisions, a durable power of attorney remains effective even if you lose the ability to communicate or make decisions for yourself.

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose almost anyone to be your agent, as long as they are at least 18 years old and capable of making decisions. This could be a family member, friend, or even a professional, such as an attorney or financial advisor. It’s essential to select someone you trust, as they will have significant authority over your financial and healthcare decisions.

What powers can I grant my agent?

The powers you grant can be broad or limited, depending on your preferences. Common powers include managing bank accounts, selling property, and making healthcare decisions. You can specify exactly what your agent can and cannot do, ensuring that your wishes are respected.

Does a Durable Power of Attorney need to be notarized?

Yes, in Ohio, a Durable Power of Attorney must be signed in the presence of a notary public to be legally valid. This notarization helps verify your identity and ensures that the document was executed voluntarily. Additionally, having witnesses can provide extra assurance, although it is not a requirement.

Can I revoke my Durable Power of Attorney?

Absolutely. As long as you are competent, you can revoke your Durable Power of Attorney at any time. This can be done by creating a new power of attorney that explicitly states the previous one is revoked or by providing a written notice to your agent and any relevant institutions. It’s wise to inform your agent and any institutions that may have relied on the old document.

What happens if I become incapacitated and don’t have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney in place, your loved ones may need to go through a court process to obtain guardianship. This process can be lengthy, costly, and emotionally taxing. By having a DPOA, you can avoid this situation and ensure that your preferences are followed.

Can I include healthcare decisions in my Durable Power of Attorney?

Yes, you can include healthcare decisions in your Durable Power of Attorney. However, it’s often recommended to have a separate document, known as a Healthcare Power of Attorney or an Advance Directive, specifically for medical decisions. This helps clarify your wishes regarding medical treatment and end-of-life care.

Is it necessary to have a lawyer to create a Durable Power of Attorney?

While it’s not legally required to have a lawyer draft your Durable Power of Attorney, consulting one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. They can also provide guidance on the implications of the powers you are granting.

How often should I review my Durable Power of Attorney?

It’s a good practice to review your Durable Power of Attorney regularly, especially after significant life events such as marriage, divorce, or the birth of a child. Changes in your financial situation or health may also warrant a review. Keeping your DPOA up to date ensures that it aligns with your current wishes and circumstances.

What should I do with my Durable Power of Attorney once it is completed?

Once your Durable Power of Attorney is completed and notarized, keep the original document in a safe place, such as a safe deposit box or with your attorney. Provide copies to your agent, any healthcare providers, and financial institutions that may need it. Make sure your loved ones know where to find it in case it is needed.

Dos and Don'ts

When completing the Ohio Durable Power of Attorney form, there are important guidelines to follow. Adhering to these can help ensure that the document is valid and meets the intended purpose.

- Do ensure you understand the powers you are granting. It is crucial to know what authority you are giving to your agent.

- Do sign the document in the presence of a notary public. Notarization adds a layer of authenticity and helps prevent disputes.

- Do keep a copy of the completed form. Having a copy allows you to reference the document in the future and informs others of your decisions.

- Do communicate your wishes clearly to your agent. Open dialogue can help ensure your agent understands your preferences and intentions.

- Don't leave any sections blank. Incomplete forms may lead to confusion or legal challenges later.

- Don't choose an agent without considering their qualifications. Select someone trustworthy and capable of handling the responsibilities you are assigning.

- Don't forget to review the form periodically. Changes in your circumstances may require updates to the document.

- Don't assume that verbal agreements are sufficient. A Durable Power of Attorney must be in writing to be legally binding.

Ohio Durable Power of Attorney - Usage Steps

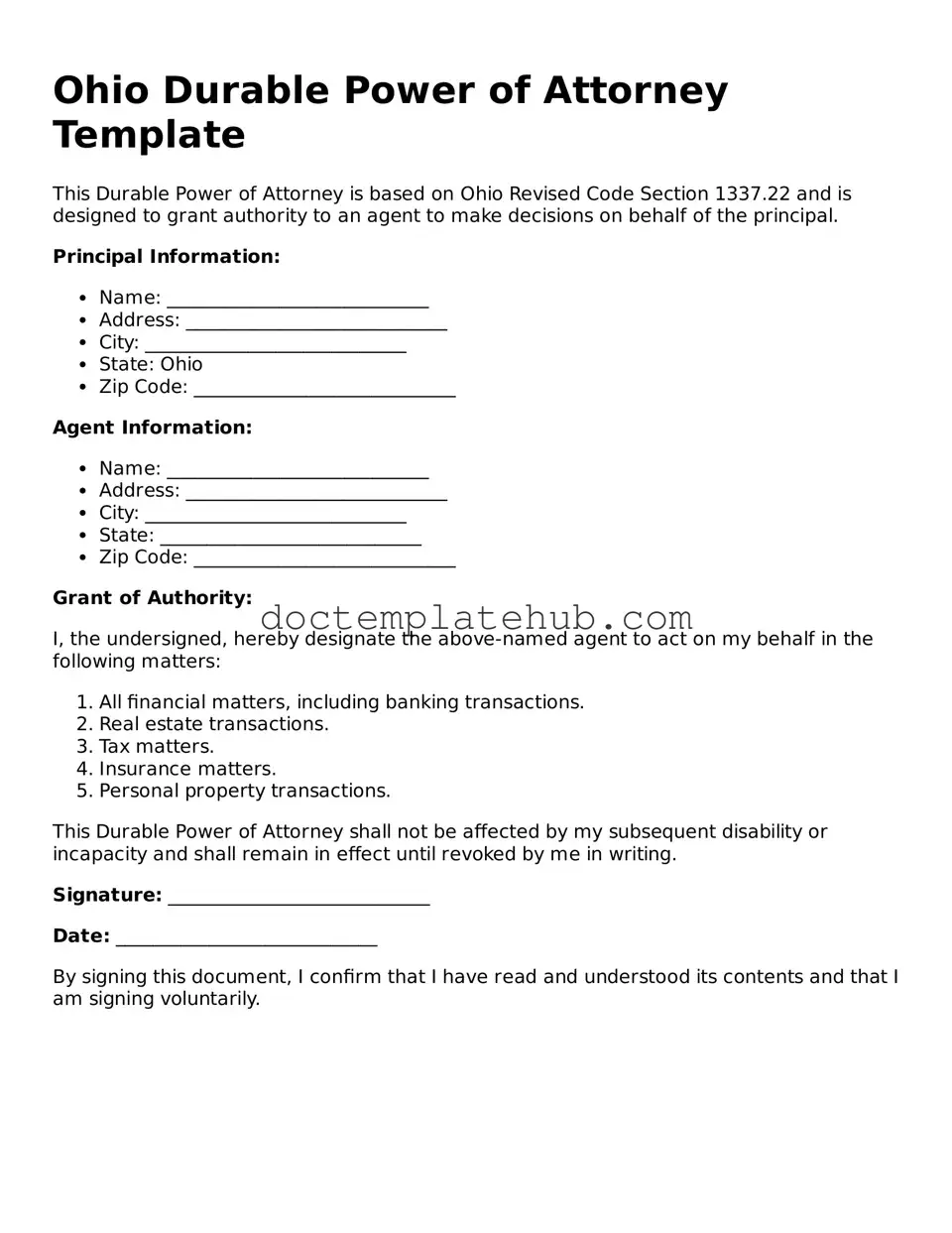

Filling out the Ohio Durable Power of Attorney form is a straightforward process that requires careful attention to detail. Completing this document allows you to designate someone to make decisions on your behalf in specific situations. Follow these steps to ensure the form is filled out correctly.

- Obtain the Ohio Durable Power of Attorney form. You can find it online or request a copy from an attorney.

- Begin by entering your full name and address at the top of the form. This identifies you as the principal.

- Next, designate your agent by providing their full name and address. This person will have the authority to act on your behalf.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific areas, such as financial or medical decisions.

- Include any special instructions you want your agent to follow. This can clarify your wishes and guide their actions.

- Sign and date the form in the designated area. Your signature must match the name you provided at the top of the form.

- Have the form witnessed by two individuals who are not related to you or your agent. They must sign and date the form as well.

- If required, consider having the document notarized. This adds an extra layer of validation.

After completing these steps, keep a copy of the form for your records and provide a copy to your agent. This ensures that they have the necessary documentation to act on your behalf when needed.