Fillable Operating Agreement Template for Ohio State

When starting a business in Ohio, having a clear plan is essential, and an Operating Agreement serves as a vital tool for members of a limited liability company (LLC). This document outlines the management structure and operational procedures of the LLC, ensuring that all members are on the same page. It details the ownership percentages, responsibilities, and voting rights of each member, which helps prevent misunderstandings down the road. Additionally, the Operating Agreement can address how profits and losses will be distributed, as well as the process for adding or removing members. By establishing these guidelines, the Operating Agreement not only helps maintain order but also provides legal protection for all members involved. It is a crucial step in forming an LLC that can lead to smoother operations and stronger relationships among members.

Similar forms

The Ohio Operating Agreement is similar to the LLC Membership Agreement. Both documents outline the rights and responsibilities of the members in a limited liability company (LLC). This agreement serves as a foundational document that details how the LLC will be managed, how profits and losses will be distributed, and the procedures for adding or removing members. Like the Operating Agreement, the Membership Agreement also helps prevent disputes among members by clearly defining roles and expectations.

Another document comparable to the Ohio Operating Agreement is the Partnership Agreement. This agreement is essential for partnerships, detailing the terms under which partners will operate together. It includes information about profit sharing, decision-making processes, and the responsibilities of each partner. Similar to the Operating Agreement, it aims to establish clear guidelines to avoid misunderstandings and conflicts among partners.

The Corporate Bylaws document is also akin to the Ohio Operating Agreement. Bylaws govern the internal management of a corporation, specifying how decisions are made, how meetings are conducted, and the roles of officers and directors. Just as the Operating Agreement serves to guide the operations of an LLC, Corporate Bylaws provide structure and clarity for corporations, ensuring smooth governance and compliance with laws.

For those seeking to understand the nuances of various business agreements, the EDD DE 2501 form might seem unrelated, yet it serves as a reminder of the importance of clearly defined documentation in securing essential benefits. Whether you're examining Partnership Agreements or Articles of Organization, the essence of these documents aligns with the careful consideration required in making disability claims, exemplified by the detailed instructions and eligibility requirements outlined here: https://documentonline.org/blank-edd-de-2501/.

The Shareholders Agreement shares similarities with the Ohio Operating Agreement as well. This document outlines the rights and obligations of shareholders in a corporation. It often includes provisions for the sale of shares, voting rights, and dividend distribution. Like the Operating Agreement, it aims to protect the interests of all parties involved and establish a clear framework for corporate governance.

The Joint Venture Agreement is another document that resembles the Ohio Operating Agreement. This agreement is used when two or more parties come together for a specific project or business venture. It outlines each party's contributions, responsibilities, and how profits and losses will be shared. Much like the Operating Agreement, it seeks to clarify expectations and minimize disputes during the collaboration.

The Non-Disclosure Agreement (NDA) can also be seen as related to the Ohio Operating Agreement in terms of protecting sensitive information. While the Operating Agreement focuses on the management and operational aspects of an LLC, an NDA ensures that all parties involved keep proprietary information confidential. Both documents aim to safeguard the interests of the parties involved, albeit in different contexts.

Finally, the Employment Agreement bears some resemblance to the Ohio Operating Agreement. This document outlines the terms of employment for individuals within a company, including job responsibilities, compensation, and benefits. While the Operating Agreement governs the relationship between members of an LLC, the Employment Agreement clarifies the relationship between the employer and employee, ensuring that both parties understand their rights and obligations.

Other Common State-specific Operating Agreement Templates

What Does an Operating Agreement Look Like for an Llc - The Operating Agreement is essential for establishing clear stakeholder expectations.

Operating Agreement Florida - This document can establish how distributions to members are made.

When establishing an LLC in Texas, it is essential to use an Operating Agreement form, which not only defines the company's structural framework but also clarifies the responsibilities of its members, thereby preventing misunderstandings. Resources like smarttemplates.net can be invaluable for accessing templates that simplify the drafting process, ensuring that all necessary components are included.

Operating Agreement Llc Arizona Template - This document can highlight the importance of compliance with state laws and regulations.

More About Ohio Operating Agreement

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Ohio. It serves as an internal contract among the members of the LLC, detailing their rights, responsibilities, and the distribution of profits and losses. While not legally required in Ohio, having an Operating Agreement is highly recommended as it helps prevent disputes and clarifies the operational framework of the business.

Why is an Operating Agreement important for an LLC in Ohio?

The Operating Agreement plays a crucial role in defining how the LLC operates. It establishes guidelines for decision-making, outlines the roles of members, and specifies how profits and losses are shared. By having this document in place, members can avoid misunderstandings and legal disputes. Additionally, an Operating Agreement can provide credibility to the LLC, especially when dealing with banks, investors, or potential partners.

Who should draft the Ohio Operating Agreement?

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. The process for making changes should be clearly outlined in the original document. Typically, amendments require the consent of all or a majority of the members, depending on what the Operating Agreement specifies. Keeping the Operating Agreement up to date is essential as it reflects any changes in membership, management structure, or operational procedures.

Is an Operating Agreement filed with the state of Ohio?

No, an Operating Agreement is not filed with the state of Ohio. It is an internal document that remains with the members of the LLC. However, it is advisable to keep it in a safe place and ensure that all members have access to it. This document may be requested by banks or legal entities during transactions or disputes, making it important to maintain its accuracy and relevance.

Dos and Don'ts

When filling out the Ohio Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are seven things to consider:

- Do ensure that all members' names and addresses are clearly listed.

- Do specify the purpose of the business in detail.

- Do outline the management structure, including roles and responsibilities.

- Do review the agreement for any errors before submission.

- Don't leave any sections blank; fill out every required field.

- Don't use vague language; be as specific as possible.

- Don't forget to include the date of the agreement and signatures from all members.

Ohio Operating Agreement - Usage Steps

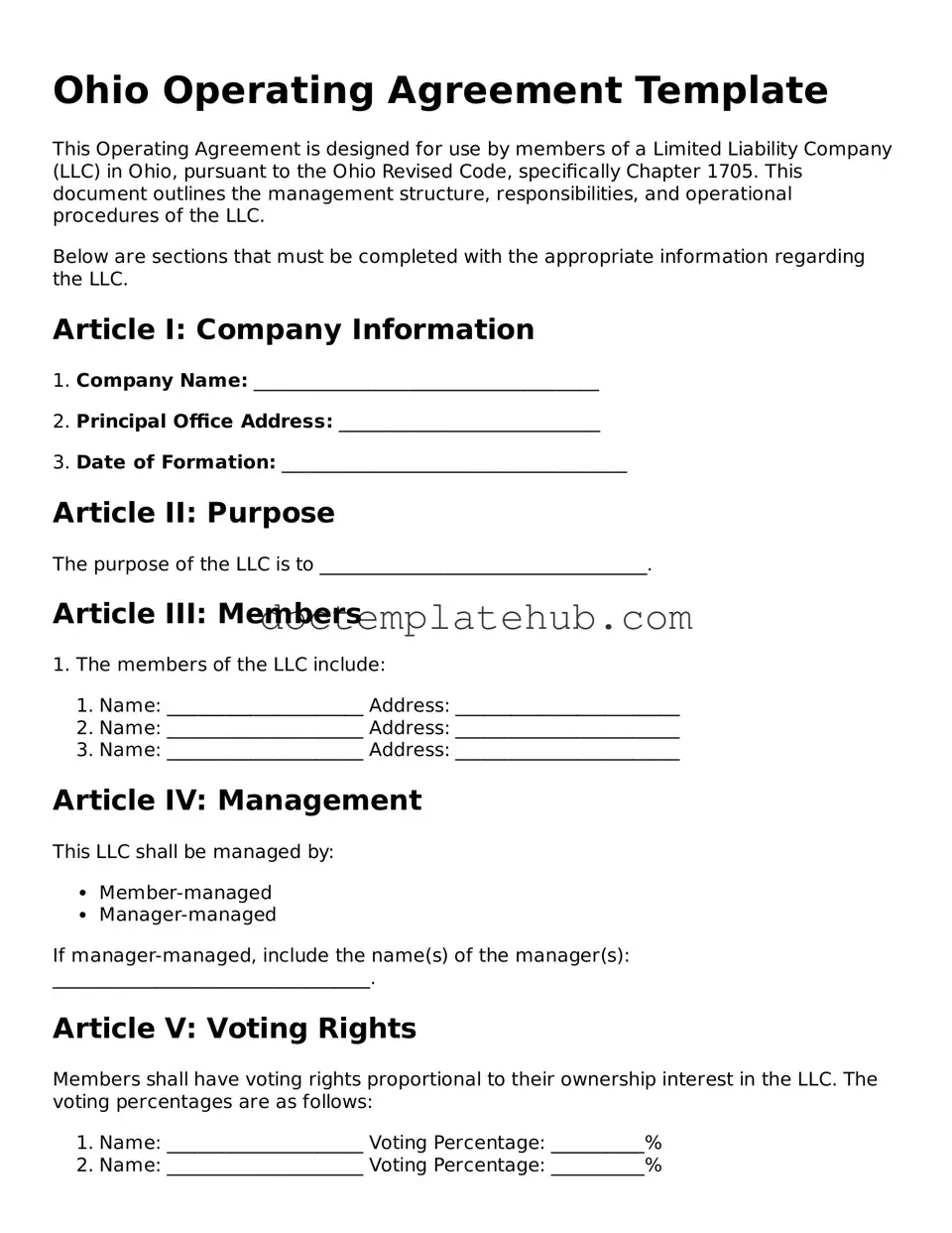

Completing the Ohio Operating Agreement form is an essential step for those forming a Limited Liability Company (LLC) in Ohio. This document outlines the management structure and operating procedures of your LLC. Follow these steps carefully to ensure that you fill out the form correctly.

- Begin with the title of the document. Write “Operating Agreement” at the top of the form.

- Provide the name of your LLC. Make sure it matches the name registered with the Ohio Secretary of State.

- Enter the principal office address. This should be the primary location where the business operates.

- List the names and addresses of all members involved in the LLC. Include their ownership percentages if applicable.

- Specify the purpose of the LLC. Clearly state what business activities the LLC will engage in.

- Detail the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Outline the voting rights of members. Specify how decisions will be made and what constitutes a quorum.

- Include provisions for profit and loss distribution. Clearly define how profits and losses will be shared among members.

- Address the procedure for adding or removing members. Include any conditions or processes that must be followed.

- Provide information about the dissolution of the LLC. Outline the steps that will be taken if the business needs to close.

- Finally, have all members sign and date the document. This step is crucial for the agreement to be valid.

Once the form is completed, it is advisable to keep a copy for your records. You may also consider consulting with a legal professional to ensure that your Operating Agreement meets all necessary requirements and accurately reflects the intentions of the members.