Fillable Prenuptial Agreement Template for Ohio State

In the state of Ohio, a prenuptial agreement serves as a crucial tool for couples planning to marry, allowing them to outline their financial rights and responsibilities before tying the knot. This legal document can address a variety of important aspects, including the division of assets, management of debts, and provisions for spousal support in the event of a divorce. By clearly delineating each party's expectations and obligations, a prenuptial agreement can help mitigate potential conflicts and misunderstandings in the future. Furthermore, Ohio law requires that both parties fully disclose their financial situations when creating this agreement, ensuring transparency and fairness. The process of drafting and signing the prenuptial agreement is not merely a formality; it is an opportunity for couples to engage in open discussions about their financial goals and priorities. Understanding the nuances of the Ohio Prenuptial Agreement form is essential for anyone considering marriage, as it lays the groundwork for a more secure and harmonious partnership.

Similar forms

A cohabitation agreement shares similarities with a prenuptial agreement in that both documents are designed to outline the financial and personal responsibilities of partners. Typically used by couples who choose to live together without marrying, a cohabitation agreement can address issues such as property ownership, debt management, and even the division of assets in the event of a breakup. Like a prenuptial agreement, it requires full disclosure of assets and debts, ensuring that both parties are on the same page regarding their financial situation. This mutual understanding can help prevent disputes and foster a more harmonious living arrangement.

A postnuptial agreement is another document akin to a prenuptial agreement. While a prenuptial agreement is established before marriage, a postnuptial agreement is created after the couple has tied the knot. This document serves similar purposes, such as defining asset distribution and financial responsibilities in the event of divorce or separation. Couples may choose to enter into a postnuptial agreement to clarify financial matters that have arisen during their marriage, ensuring that both parties feel secure and informed about their financial futures.

A separation agreement, while different in context, shares the fundamental goal of a prenuptial agreement: to outline financial and personal arrangements. This document is often created when a couple decides to live apart but is not yet divorced. It addresses similar issues, such as the division of property, spousal support, and child custody arrangements. By establishing these terms in writing, a separation agreement can provide both parties with a sense of security and stability during a tumultuous time.

A will is another document that, while primarily focused on the distribution of assets after death, can have overlapping themes with a prenuptial agreement. Both documents require individuals to consider their assets and how they wish to manage them. A will outlines who will inherit property and assets, while a prenuptial agreement specifies how those assets will be divided in the event of divorce. Both documents necessitate careful thought and communication about financial matters, reinforcing the importance of transparency in relationships.

A trust agreement can also be likened to a prenuptial agreement in terms of asset management. While a prenuptial agreement deals with asset division in the event of divorce, a trust agreement focuses on how assets are managed and distributed during an individual's lifetime and after their death. Trusts can be established to protect assets for beneficiaries, similar to how prenuptial agreements protect each party's financial interests. Both documents require a clear understanding of the parties' intentions and financial situations.

A financial disclosure statement is closely related to a prenuptial agreement, as it requires both parties to fully disclose their financial situations before entering into a marriage. This document serves as a foundation for a prenuptial agreement, ensuring that both individuals understand each other’s assets, debts, and income. The transparency fostered by a financial disclosure statement is crucial for building trust and preventing future disputes, much like the goals of a prenuptial agreement.

In situations where a medical leave is necessary due to illness or injury, individuals may require official documentation, such as a Doctors Excuse Note, to justify their absence. This note serves as a critical element in both workplace and educational environments, ensuring that necessary accommodations are provided. For those seeking a template or example of such documentation, the following resource may be helpful: documentonline.org/blank-doctors-excuse-note.

Finally, a business partnership agreement can be compared to a prenuptial agreement in that both documents establish the terms of a partnership. In a business partnership agreement, the roles, responsibilities, and profit-sharing arrangements are clearly defined among partners. Similarly, a prenuptial agreement outlines the financial responsibilities and asset division between spouses. Both documents aim to prevent misunderstandings and conflicts by providing a clear structure for the relationship, whether personal or professional.

Other Common State-specific Prenuptial Agreement Templates

California Premarital Contract - Drafting a prenuptial agreement may prompt helpful conversations about financial goals and priorities in the relationship.

By utilizing a Texas Durable Power of Attorney form, you can ensure that your selected representative is legally able to handle essential financial and legal decisions on your behalf, even during times of incapacity. This document not only helps in preventing future complications but also provides peace of mind knowing that your financial interests are in trusted hands. For more details on creating this essential document, visit smarttemplates.net.

Georgia Premarital Contract - With a prenuptial agreement, couples can reduce conflict related to finances in the future.

Texas Premarital Contract - By formalizing financial arrangements, couples can reduce emotional stress and conflict in a potential divorce situation.

More About Ohio Prenuptial Agreement

What is a prenuptial agreement in Ohio?

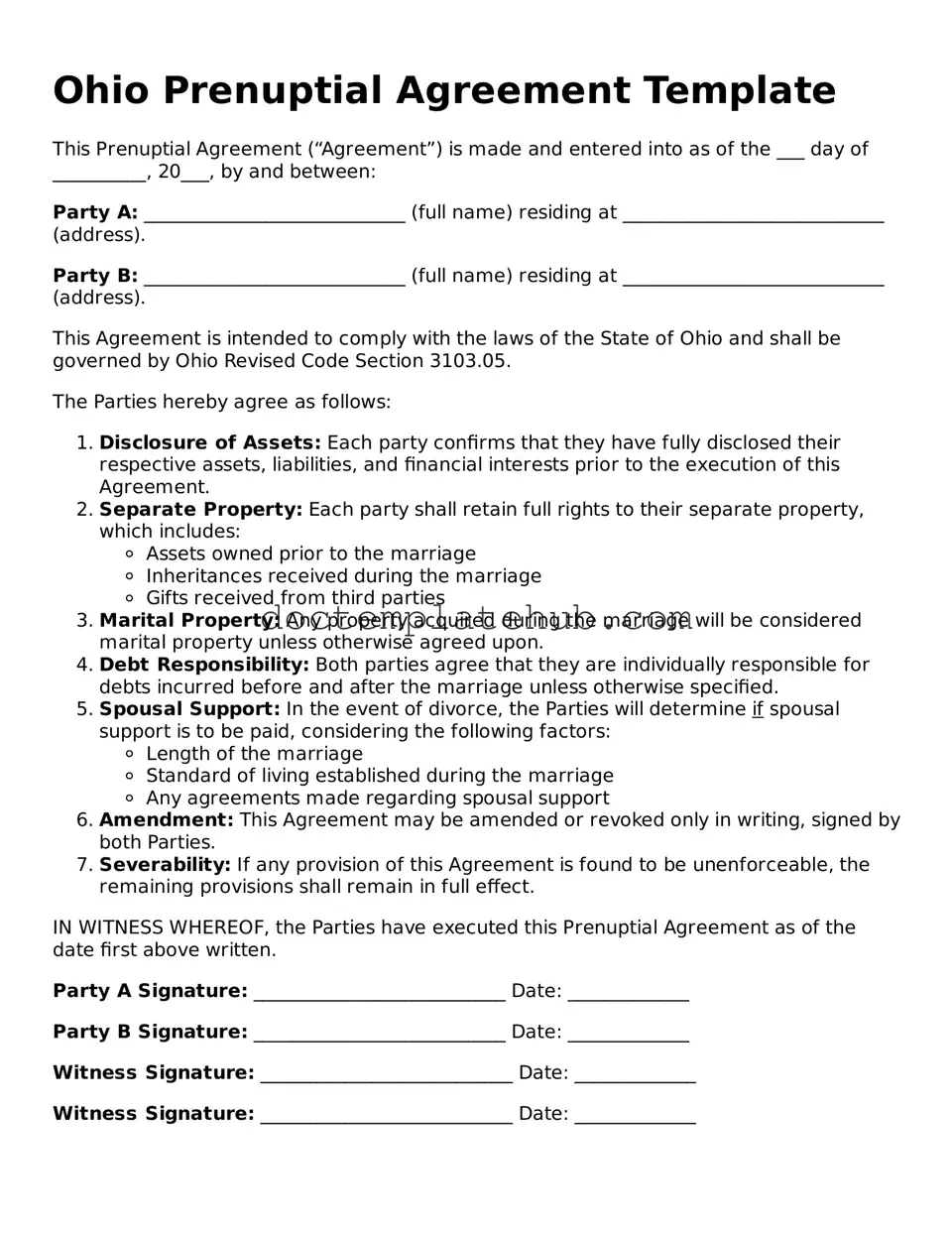

A prenuptial agreement, often referred to as a "prenup," is a legal document created by two individuals before they marry. This agreement outlines the distribution of assets and responsibilities in the event of a divorce or separation. In Ohio, a prenup can cover various topics, including property rights, spousal support, and the handling of debts. It serves to protect each party's interests and can help minimize conflicts should the marriage end. While not required by law, having a prenup can provide peace of mind and clarity for both partners.

How do I create a prenuptial agreement in Ohio?

Creating a prenuptial agreement in Ohio involves several steps. First, both parties should openly discuss their financial situations and expectations for the marriage. It is advisable to consult with separate legal counsel to ensure that each person's interests are adequately represented. Once both parties agree on the terms, the prenup should be drafted, ideally with the assistance of an attorney. After drafting, both parties must sign the document in the presence of a notary public to ensure its validity. It is crucial that the agreement is fair and does not include any illegal provisions to be enforceable in court.

Are there any requirements for a prenuptial agreement to be valid in Ohio?

Yes, certain requirements must be met for a prenuptial agreement to be considered valid in Ohio. Both parties must enter into the agreement voluntarily, without any form of coercion or duress. Full disclosure of assets and debts is essential; both parties should have a clear understanding of each other's financial situations. The terms of the agreement must be fair and reasonable at the time of signing. Additionally, the agreement should be in writing and signed by both parties in front of a notary public. If these conditions are met, the prenup is likely to be enforceable in court.

Can a prenuptial agreement be modified or revoked in Ohio?

Yes, a prenuptial agreement can be modified or revoked in Ohio, but this process must be done in writing. Both parties must agree to any changes, and the revised agreement should be signed and notarized just like the original. If one party wishes to revoke the agreement entirely, both parties must consent to this change. It is important to document any modifications or revocations to avoid confusion or disputes in the future. Keeping open communication about financial matters and any changes in circumstances can help ensure that the agreement remains relevant and fair.

What happens if we don’t have a prenuptial agreement?

If a couple does not have a prenuptial agreement in Ohio, the state's laws will dictate how assets and debts are divided in the event of a divorce. Ohio follows equitable distribution laws, meaning that marital property will be divided fairly, but not necessarily equally. This can lead to disputes over what is considered marital property versus separate property. Without a prenup, both parties may have less control over the outcome of asset distribution and spousal support. Having a prenuptial agreement can provide clarity and protection, making it a valuable consideration for couples planning to marry.

Dos and Don'ts

When preparing to fill out the Ohio Prenuptial Agreement form, it’s essential to approach the task thoughtfully. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do discuss your intentions openly with your partner before starting the form.

- Do consult with a legal professional who specializes in family law to guide you through the process.

- Do be honest about your financial situation, including assets and debts.

- Do ensure both parties have independent legal representation to avoid conflicts of interest.

- Don’t rush through the form; take your time to understand each section.

- Don’t hide any financial information from your partner, as this can lead to disputes later.

- Don’t forget to revisit the agreement periodically, especially if your financial situation changes.

By following these guidelines, you can create a solid foundation for your prenuptial agreement that respects both parties' interests and fosters a healthy relationship moving forward.

Ohio Prenuptial Agreement - Usage Steps

Filling out the Ohio Prenuptial Agreement form is a straightforward process. By following these steps, you can ensure that all necessary information is accurately provided, which can help protect both parties’ interests.

- Begin by obtaining the Ohio Prenuptial Agreement form. You can find it online or through legal resources.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill in the names of both parties at the top of the form. Ensure that the names are spelled correctly and match official identification.

- Provide the date of the intended marriage. This date should be accurate and reflect when you plan to marry.

- List all assets owned by each party. Be thorough and include properties, bank accounts, investments, and any other significant assets.

- Detail any debts that each party has. This includes loans, credit card debts, and any other financial obligations.

- Include any provisions regarding spousal support or alimony. Specify if either party will waive the right to spousal support.

- Sign and date the form. Both parties must do this in the presence of a notary public to validate the agreement.

- Make copies of the signed agreement for both parties. Keep these copies in a safe place.

After completing the form, consider consulting with a legal expert to review the agreement. This ensures that it meets all legal requirements and addresses your specific needs.