Fillable Promissory Note Template for Ohio State

In the realm of financial transactions, the Ohio Promissory Note form stands out as a crucial document for individuals and businesses alike. This form serves as a written promise to repay a specified amount of money, detailing essential elements such as the principal amount, interest rate, repayment schedule, and any collateral securing the loan. By clearly outlining the terms of the agreement, it provides both the lender and borrower with a framework that protects their interests. Additionally, the form may include provisions regarding late fees, default consequences, and the governing law, ensuring that both parties understand their rights and obligations. The simplicity of the Ohio Promissory Note allows for ease of use, making it accessible for those unfamiliar with complex financial documents. However, its importance cannot be overstated, as it serves not only as a legal instrument but also as a record of the financial relationship between the parties involved. Understanding the nuances of this form is vital for anyone looking to engage in lending or borrowing within the state of Ohio.

Similar forms

The Ohio Promissory Note shares similarities with a Loan Agreement, which outlines the terms and conditions of a loan between a borrower and a lender. Both documents specify the amount borrowed, interest rates, repayment schedules, and default consequences. While the Promissory Note serves as a simple acknowledgment of debt, the Loan Agreement provides a more comprehensive framework, detailing the obligations of both parties and often including additional clauses regarding collateral or covenants.

The New York Power of Attorney form is a legal document that allows one person to grant another person the authority to make decisions on their behalf. This could range from financial decisions to health care directives. It's crucial for individuals who want to ensure their affairs are handled according to their wishes, even if they're unable to make those decisions themselves. For more information, you can visit smarttemplates.net.

A similar document is the Mortgage Agreement, which is used when a borrower secures a loan with real property as collateral. Like a Promissory Note, a Mortgage Agreement outlines the loan amount and repayment terms. However, it also includes specific provisions regarding the property itself, such as the rights of the lender in the event of default. This document is crucial for protecting the lender's interest in the property, making it more complex than a standard Promissory Note.

The Credit Agreement is another document akin to the Ohio Promissory Note. This agreement typically governs the terms of a revolving line of credit, detailing how much credit is available, the interest rates, and the repayment terms. While a Promissory Note is often a standalone document focused on a single loan, a Credit Agreement may encompass multiple transactions and provide a broader scope for ongoing borrowing relationships between the lender and borrower.

An Installment Agreement is also similar to a Promissory Note, as it details the repayment of a debt in regular installments over time. Both documents specify the principal amount and interest rates. However, an Installment Agreement may include additional terms related to the schedule of payments and penalties for late payments, making it more detailed in terms of the repayment process compared to a basic Promissory Note.

Lastly, a Personal Guarantee can be compared to the Ohio Promissory Note in that it provides a commitment from an individual to repay a debt if the primary borrower defaults. While a Promissory Note is a formal acknowledgment of debt, a Personal Guarantee adds a layer of security for the lender by holding an individual personally accountable. This document often accompanies a Promissory Note when the borrower is a business entity, ensuring that a responsible party is available to fulfill the debt obligations.

Other Common State-specific Promissory Note Templates

Promissory Note Form California - Borrowers should keep a copy of the note for their records.

For those looking to obtain a copy of the crucial CDC U.S. Standard Certificate of Live Birth form, it is important to recognize its significance in officially recording the birth of a child. This standardized document captures vital information about the newborn, such as the date of birth and parental details, across different states. To avoid any ambiguities and ensure you have the correct form, you can visit https://documentonline.org/blank-cdc-u-s-standard-certificate-of-live-birth/ for further guidance and access to the necessary resources.

Promissory Note Georgia - A signed promissory note can serve as evidence in a court of law if disputes arise.

Promissory Note Template Arizona - Understanding the nuances of a promissory note can benefit borrowers and lenders alike.

More About Ohio Promissory Note

What is an Ohio Promissory Note?

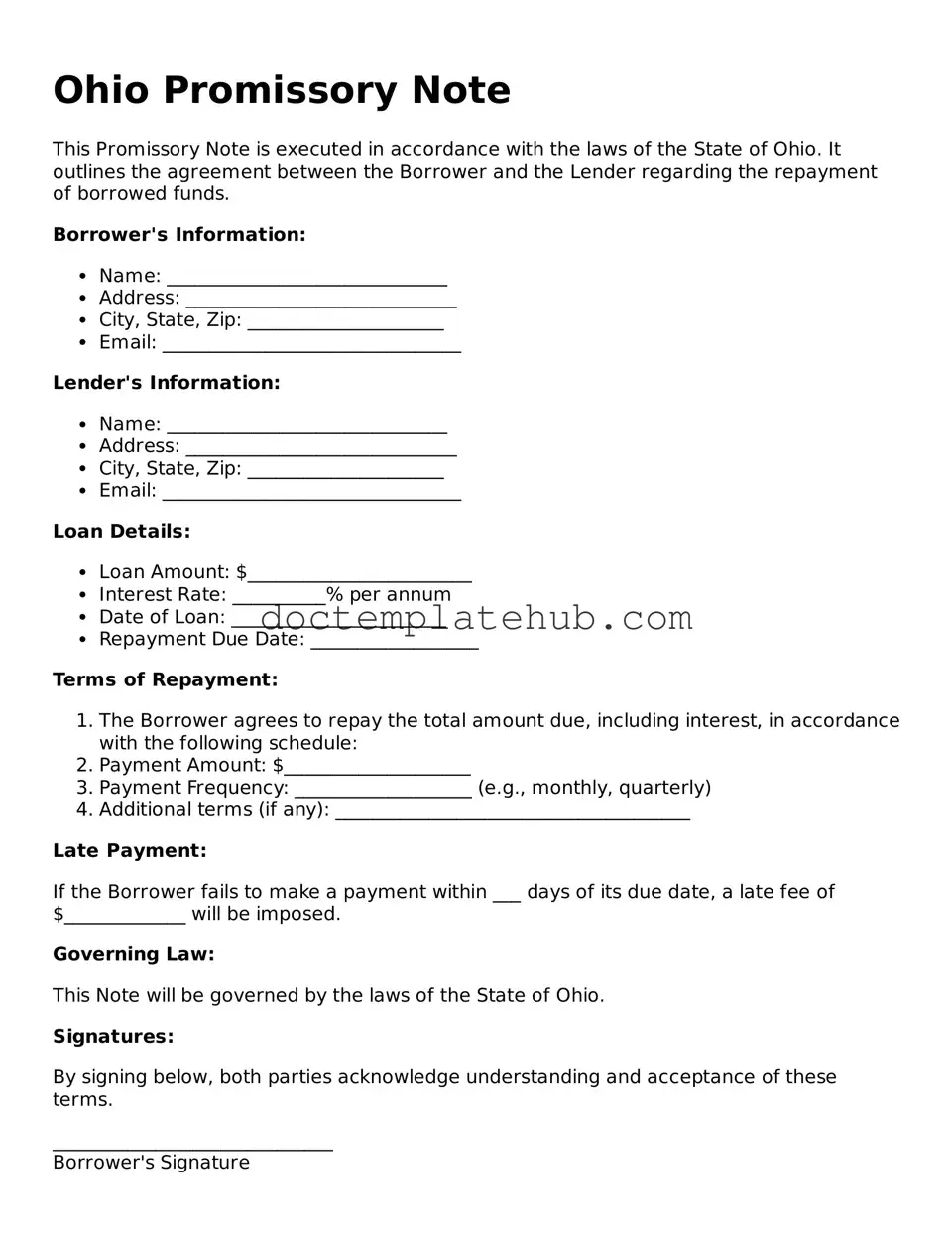

An Ohio Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. It typically includes details such as the loan amount, interest rate, repayment schedule, and any consequences for defaulting on the loan.

Who can use a Promissory Note in Ohio?

Any individual or business can use a Promissory Note in Ohio. It is commonly used in personal loans, business loans, and real estate transactions. Both lenders and borrowers should understand the terms before signing the document to ensure clarity and enforceability.

What are the key components of an Ohio Promissory Note?

A typical Ohio Promissory Note includes the following components: the names and addresses of the parties involved, the principal amount of the loan, the interest rate, the repayment schedule, and any penalties for late payments or default. It may also include provisions for prepayment and the governing law.

Is a Promissory Note legally binding in Ohio?

Yes, a Promissory Note is legally binding in Ohio as long as it meets the necessary legal requirements. Both parties must agree to the terms, and the document must be signed by the borrower. It is advisable to have a witness or notarization to strengthen its enforceability.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended note to avoid disputes later.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing collection efforts. The specific consequences should be outlined in the Promissory Note itself, including any late fees or penalties.

Do I need a lawyer to create an Ohio Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is advisable to seek legal counsel to ensure that the document meets all legal requirements and adequately protects your interests. A lawyer can help clarify terms and address any specific concerns related to the transaction.

Dos and Don'ts

When filling out the Ohio Promissory Note form, it is essential to adhere to specific guidelines to ensure the document is valid and enforceable. Below are important dos and don'ts to consider:

- Do clearly state the names of all parties involved in the agreement.

- Do specify the amount of money being borrowed.

- Do include the interest rate, if applicable.

- Do outline the repayment schedule, detailing when payments are due.

- Do sign and date the document in the presence of a witness, if required.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to keep a copy of the signed document for your records.

- Don't overlook the need for legal advice if unsure about any terms.

Ohio Promissory Note - Usage Steps

Filling out the Ohio Promissory Note form is a straightforward process. After completing the form, ensure you keep a copy for your records. This document will serve as a formal agreement between the borrower and lender regarding the loan terms.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the borrower.

- Enter the full name and address of the lender.

- Specify the principal amount being borrowed.

- Indicate the interest rate, if applicable.

- Detail the repayment terms, including the payment schedule and due dates.

- Include any late fees or penalties for missed payments.

- Sign the document where indicated. The borrower must sign, and it’s advisable for the lender to sign as well.

- Consider having the document notarized for added legal protection.