Fillable Transfer-on-Death Deed Template for Ohio State

In the realm of estate planning, the Ohio Transfer-on-Death Deed (TOD) form stands out as a powerful tool that allows property owners to seamlessly transfer their real estate to designated beneficiaries upon their passing, all while bypassing the often cumbersome probate process. This deed not only provides peace of mind by ensuring that your property is passed on according to your wishes, but it also offers flexibility; you can revoke or alter the deed at any time during your lifetime. The form requires clear identification of the property and the beneficiaries, ensuring that there is no ambiguity regarding ownership after death. Furthermore, it must be executed in accordance with Ohio law, which includes signing the document in the presence of a notary public. By utilizing the TOD deed, property owners can maintain control over their assets during their lifetime while simplifying the transfer process for their loved ones, making it an essential consideration for anyone looking to plan for the future.

Similar forms

The Ohio Transfer-on-Death Deed (TODD) form is similar to a Last Will and Testament. Both documents allow individuals to specify how their assets will be distributed after their death. However, a key difference lies in the timing of the transfer. A Last Will and Testament takes effect only after the individual passes away and typically requires probate, a legal process that can be lengthy and costly. In contrast, the TODD allows for a direct transfer of property to beneficiaries without going through probate, making the process more straightforward and efficient for heirs.

Another document that shares similarities with the Ohio Transfer-on-Death Deed is the Revocable Living Trust. Like the TODD, a Revocable Living Trust allows for the seamless transfer of assets upon death. The trust holds the property during the individual’s lifetime, and upon their passing, the assets can be distributed to beneficiaries without the need for probate. However, creating a trust often involves more complexity and legal oversight than a simple TODD, making it a more involved option for estate planning.

The Durable Power of Attorney (DPOA) also bears resemblance to the Transfer-on-Death Deed. While the TODD focuses on the transfer of real estate upon death, the DPOA allows a designated individual to manage financial and legal matters on someone’s behalf while they are still alive. This document ensures that decisions can be made when the individual is unable to do so. Although both documents empower individuals to control their assets, the DPOA is active during the person’s lifetime, whereas the TODD comes into play only after death.

In navigating estate planning, one may also find valuable resources regarding various documents and their purposes at TopTemplates.info, which provides insights that can help individuals understand the importance of having clear and organized legal frameworks within their personal affairs.

Lastly, the Joint Tenancy with Right of Survivorship is another document that parallels the Ohio Transfer-on-Death Deed. This arrangement allows two or more individuals to hold title to a property together. When one owner passes away, their share automatically transfers to the surviving owner(s) without the need for probate. Like the TODD, this method simplifies the transfer process, but it requires that all owners are on the title together from the start. In contrast, the TODD can be executed unilaterally, providing more flexibility for individuals who wish to designate beneficiaries without involving co-owners.

Other Common State-specific Transfer-on-Death Deed Templates

Tod in California - You can modify or revoke the deed at any time while you are alive.

Understanding the New York Power of Attorney form is essential, as it empowers individuals to delegate important decision-making authority to a trusted person in various situations; for more information, you can visit smarttemplates.net.

Texas Transfer on Death Deed Form 2023 - This deed offers an alternative to complicated trusts or wills for those seeking a straightforward transfer process.

What Are the Disadvantages of a Transfer on Death Deed? - It is a useful estate planning tool for individuals wanting to provide for family members after death.

Free Printable Transfer on Death Deed Form Florida - A Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit their property upon the owner's death.

More About Ohio Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Ohio to transfer their real estate to designated beneficiaries upon their death. This deed enables the property to bypass probate, simplifying the transfer process and allowing beneficiaries to inherit the property directly without court intervention.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Ohio can use a Transfer-on-Death Deed. This includes homeowners and property owners who wish to designate one or more beneficiaries to receive their property after they pass away. However, it is important that the property is solely owned by the person creating the deed.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must fill out the appropriate form, which includes details about the property and the beneficiaries. After completing the form, you must sign it in the presence of a notary public. Finally, the deed must be recorded with the county recorder’s office where the property is located to be legally effective.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed or a revocation document, sign it, and record it with the county recorder’s office. It’s important to ensure that any changes are properly documented to avoid confusion later.

What happens if I do not name a beneficiary in the Transfer-on-Death Deed?

If you do not name a beneficiary in the Transfer-on-Death Deed, the property will not be transferred upon your death. Instead, it will become part of your estate and will be subject to probate. This can lead to delays and additional costs for your heirs.

Are there any limitations on who I can name as a beneficiary?

Generally, you can name any individual or individuals as beneficiaries in a Transfer-on-Death Deed. However, you cannot name an entity, such as a corporation or a trust, as a beneficiary. Additionally, if a beneficiary predeceases you, their share may pass to their heirs unless otherwise specified in the deed.

Will a Transfer-on-Death Deed affect my property taxes?

A Transfer-on-Death Deed does not affect your property taxes while you are alive. You will continue to be responsible for paying property taxes as the owner. However, once the property transfers to the beneficiary after your death, the tax liability will then shift to them.

Is legal assistance recommended when creating a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting with an attorney is advisable. An attorney can help ensure that the deed is correctly completed and recorded, and can provide guidance on any potential implications for your estate planning. This can help prevent issues for your beneficiaries in the future.

Dos and Don'ts

When filling out the Ohio Transfer-on-Death Deed form, it's essential to approach the task with care. This document allows property owners to transfer their real estate to beneficiaries upon their death, bypassing probate. Here are five important guidelines to follow and avoid during this process:

- Do ensure that you have the correct legal description of the property. This description should be clear and precise to avoid any confusion later.

- Do include the full names and addresses of all beneficiaries. Accurate information is crucial for the transfer to be valid.

- Do sign the deed in the presence of a notary public. This step is necessary to validate the document legally.

- Don't forget to record the deed with the county recorder’s office. Failing to do this means the transfer may not be recognized.

- Don't use vague language. Clarity is vital, so avoid terms that could lead to ambiguity regarding the transfer.

By adhering to these guidelines, you can help ensure that the transfer of property is executed smoothly and in accordance with Ohio law. Taking the time to do it right now can prevent complications in the future.

Ohio Transfer-on-Death Deed - Usage Steps

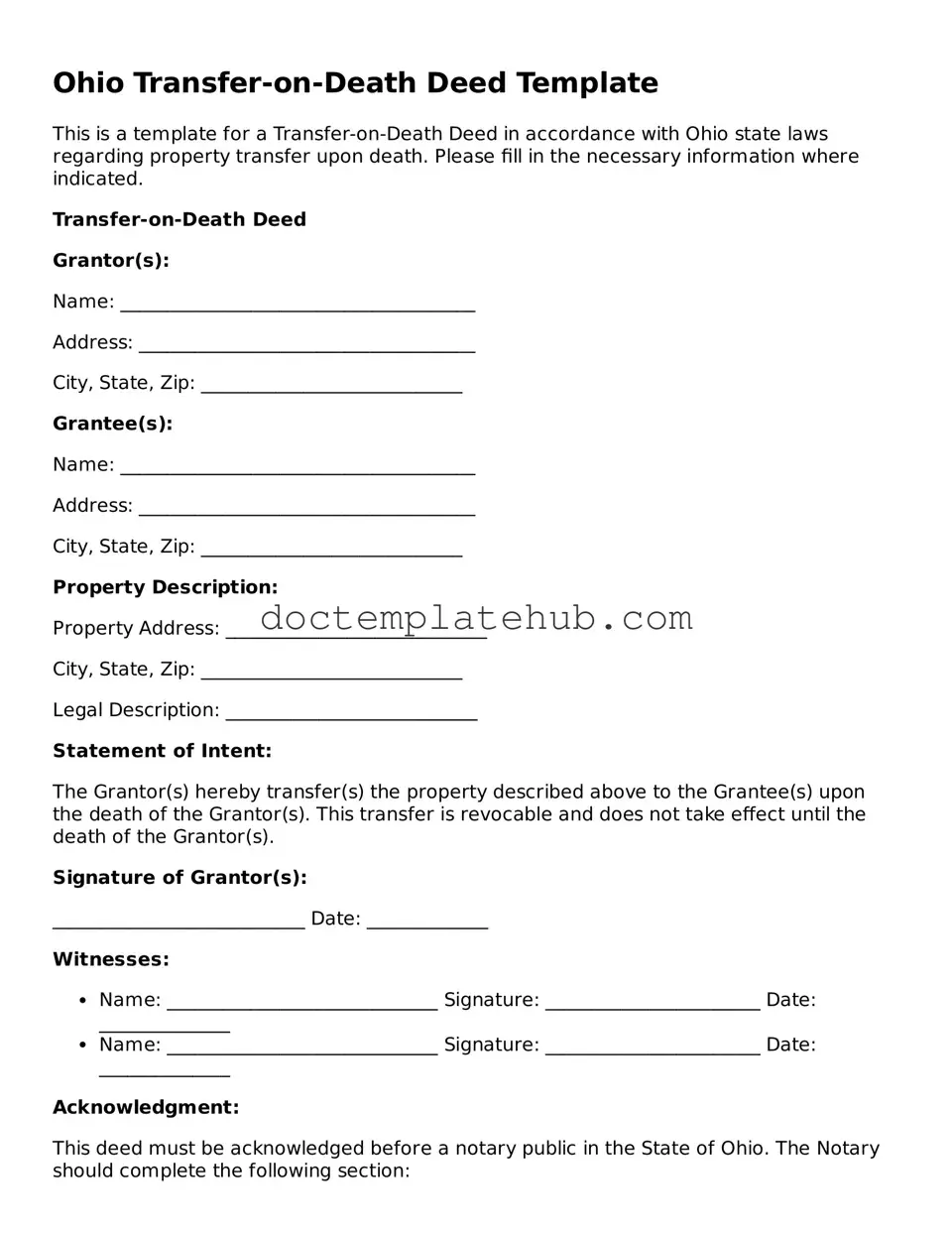

Once you have the Ohio Transfer-on-Death Deed form ready, it is important to fill it out accurately to ensure the transfer of property occurs as intended. This process requires attention to detail. Follow the steps below to complete the form correctly.

- Begin by entering the name of the current property owner(s) in the designated space. Ensure the names match exactly as they appear on the property title.

- Provide the current owner's address. This should be the primary residence of the property owner(s).

- Identify the property being transferred. Include the full legal description of the property, which can be found on the current deed or tax documents.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death. Include their addresses as well.

- Specify how the property should be divided among multiple beneficiaries, if applicable. Clearly state the percentage or fraction for each beneficiary.

- Sign the form in the presence of a notary public. This step is crucial as it validates the document.

- Have the notary public complete their section, confirming your identity and the authenticity of your signature.

- Make copies of the signed and notarized deed for your records. It is advisable to keep a copy for yourself and provide one to each beneficiary.

- File the original deed with the county recorder’s office where the property is located. There may be a filing fee, so check with the office for details.

After completing these steps, the Transfer-on-Death Deed will be properly executed. This deed should be kept in a safe place, as it will only take effect upon the death of the property owner(s).