Official Owner Financing Contract Form

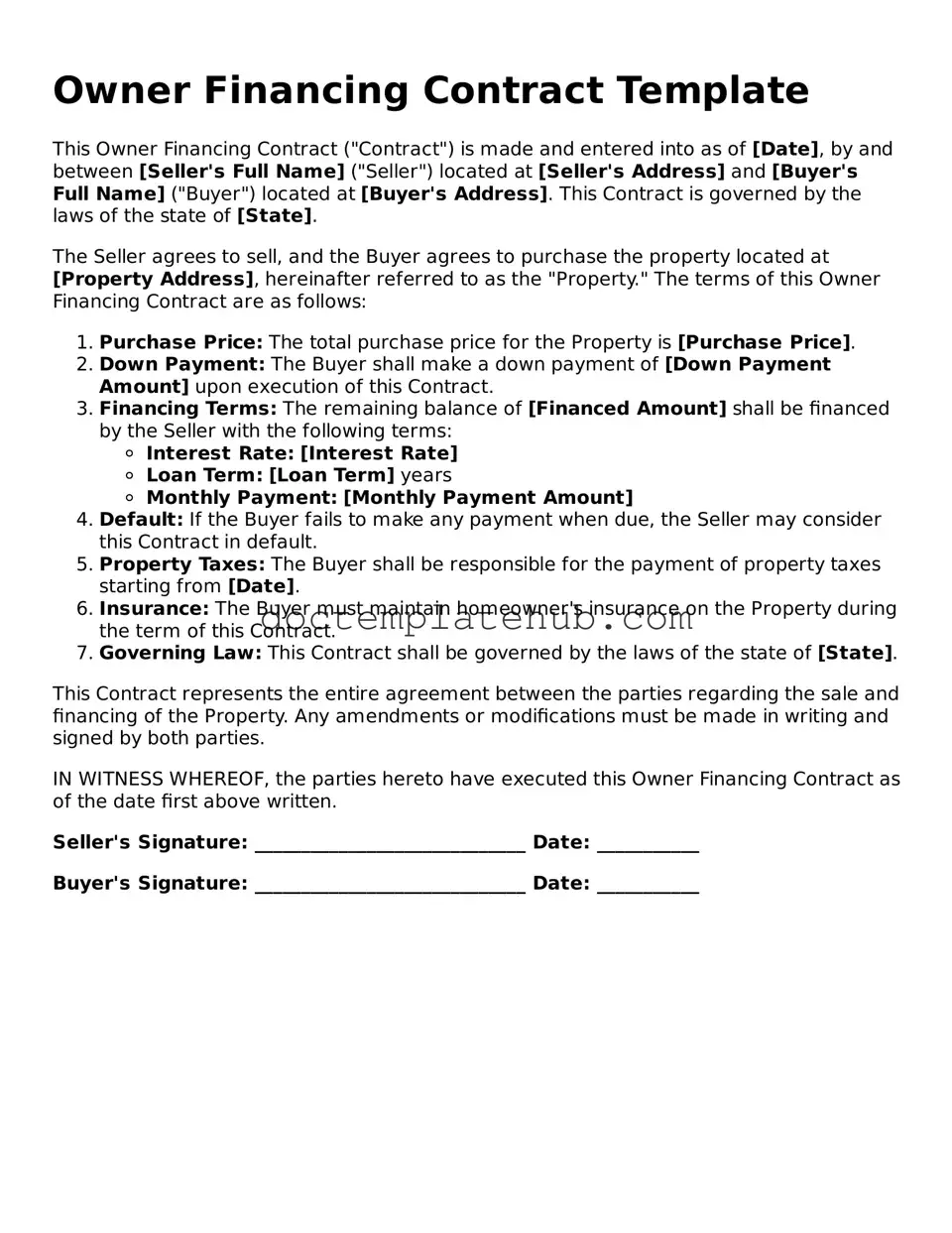

When exploring alternative methods of purchasing a home, owner financing emerges as a compelling option for both buyers and sellers. This arrangement allows the seller to act as the lender, providing the buyer with a loan to purchase the property directly. An Owner Financing Contract form is essential in this process, as it outlines the terms and conditions of the agreement, ensuring clarity and protection for both parties involved. Key components of this form typically include the purchase price, interest rate, repayment schedule, and any contingencies or clauses that may apply. Additionally, it may detail the responsibilities of both the buyer and seller, such as property maintenance and insurance requirements. By clearly defining these aspects, the Owner Financing Contract helps to mitigate misunderstandings and disputes, fostering a smoother transaction. Understanding the intricacies of this form can empower individuals to navigate the world of owner financing with confidence.

Similar forms

The Owner Financing Contract form bears similarities to a Lease Purchase Agreement. Both documents facilitate a pathway for a buyer to acquire property while allowing for payments over time. In a Lease Purchase Agreement, the buyer typically leases the property for a specified period with the option to purchase at the end of the lease term. This arrangement allows the buyer to live in the property while building equity and preparing for the eventual purchase, akin to the structure of owner financing where payments are made directly to the seller.

Another document comparable to the Owner Financing Contract is the Purchase Agreement. This foundational document outlines the terms of sale between a buyer and seller. While a Purchase Agreement often involves traditional financing through banks or lenders, it can also be adapted to include owner financing terms. Both documents require clear terms regarding payment amounts, timelines, and responsibilities, ensuring that both parties understand their obligations.

Furthermore, when engaging in property transactions, it's essential to utilize resources such as the https://documentonline.org/blank-texas-real-estate-purchase-agreement to ensure that all terms and conditions are clearly outlined, providing both buyers and sellers with a thorough understanding of their obligations.

The Promissory Note is closely related to the Owner Financing Contract as it serves as a written promise by the buyer to repay the loan amount to the seller. This document details the loan terms, including interest rates and payment schedules. In essence, while the Owner Financing Contract outlines the overall agreement between the parties, the Promissory Note specifies the financial commitment made by the buyer, making both documents essential in owner financing scenarios.

A Mortgage Agreement also shares characteristics with the Owner Financing Contract. Both documents involve the transfer of property rights and the establishment of a financial obligation. However, a Mortgage Agreement typically involves a lender and borrower relationship, where the lender holds a lien on the property until the loan is paid off. In contrast, the Owner Financing Contract allows the seller to act as the lender, simplifying the process and removing the need for a third-party institution.

Finally, a Deed of Trust can be likened to the Owner Financing Contract in that it secures the loan made by the seller to the buyer. This document involves three parties: the borrower (buyer), the lender (seller), and a trustee. The Deed of Trust grants the trustee the authority to hold the title until the loan is repaid. This arrangement protects the seller's interests similarly to how an Owner Financing Contract secures the seller's right to receive payments while allowing the buyer to take possession of the property.

Fill out Common Types of Owner Financing Contract Templates

Purchase Agreement Addendum - Provides a means to establish timelines for property evaluations or assessments.

The New York Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions under which a piece of real estate will be sold and purchased. It details everything from the price to the responsibilities of both the buyer and the seller. Understanding this form is essential for anyone looking to navigate the complexities of buying or selling property in New York, and a useful resource for this is the NY PDF Forms.

Real Estate Agent Termination Letter - May assist in gathering necessary documentation for tax purposes.

More About Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a buyer and a seller where the seller provides financing to the buyer to purchase a property. Instead of the buyer obtaining a traditional mortgage from a bank or lender, the seller allows the buyer to make payments directly to them over a specified period. This arrangement can benefit both parties, especially when traditional financing options are not available or desirable.

What are the benefits of using an Owner Financing Contract?

One major benefit is flexibility. Sellers can negotiate terms that work for them, while buyers may find it easier to qualify for financing. Additionally, sellers can potentially receive a higher sale price or a quicker sale. Buyers often enjoy lower closing costs and may avoid some of the strict requirements set by banks.

What terms should be included in an Owner Financing Contract?

Key terms should include the purchase price, down payment amount, interest rate, repayment schedule, and duration of the loan. It's also important to outline any penalties for late payments, responsibilities for property taxes and insurance, and what happens if the buyer defaults on the loan. Clear terms help prevent misunderstandings later on.

Is a down payment required in an Owner Financing Contract?

While a down payment is not always mandatory, it is often recommended. A down payment can show the seller that the buyer is committed to the purchase. It also reduces the amount financed, which can lead to lower monthly payments. The specific amount can vary based on negotiations between the buyer and seller.

Can an Owner Financing Contract be used for any type of property?

Yes, Owner Financing Contracts can be used for various types of properties, including residential homes, commercial buildings, and vacant land. However, the willingness of the seller to offer financing may depend on the type of property and market conditions. It's essential for both parties to understand the property’s value and the risks involved.

What happens if the buyer defaults on the loan?

If the buyer defaults, the seller typically has the right to foreclose on the property, just like a bank would in a traditional mortgage scenario. This means the seller can reclaim the property and may keep any payments made up to that point. Clear default terms should be outlined in the contract to protect both parties.

Is it necessary to involve a lawyer in an Owner Financing Contract?

While it is not legally required, involving a lawyer is highly advisable. A lawyer can help ensure that the contract complies with local laws and regulations. They can also assist in drafting clear terms to protect both parties’ interests. Having legal guidance can help prevent potential disputes in the future.

Dos and Don'ts

When filling out the Owner Financing Contract form, it's important to be thorough and accurate. Here are some essential dos and don'ts to keep in mind:

- Do read the entire contract carefully before filling it out.

- Do provide accurate information for all parties involved.

- Do include all terms of the financing agreement clearly.

- Do keep a copy of the completed contract for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't rush through the process; take your time to ensure accuracy.

- Don't sign the contract until you fully understand all terms and conditions.

Owner Financing Contract - Usage Steps

Completing the Owner Financing Contract form is an important step in securing a financing arrangement directly between a buyer and a seller. The following steps will guide you through the process of filling out this form accurately.

- Begin by entering the date at the top of the form. This is the date when the agreement is being made.

- Fill in the names of both the seller and the buyer. Make sure to include full legal names to avoid any confusion.

- Provide the property address. This should be the complete address of the property involved in the transaction.

- Specify the purchase price of the property. This is the total amount that the buyer will pay for the property.

- Detail the down payment amount. This is the initial payment made by the buyer before financing begins.

- Indicate the interest rate for the financing. This is the percentage that will be applied to the remaining balance over time.

- Outline the repayment terms. Include the length of the loan and the payment schedule (monthly, quarterly, etc.).

- Provide any additional terms or conditions that both parties have agreed upon. This could include clauses about late payments or property maintenance.

- Sign and date the form. Both the buyer and seller must sign to make the agreement official.

Once the form is filled out, it is essential to keep copies for both parties. This ensures that everyone has a record of the agreement. Make sure to review the completed form carefully before finalizing it.