Fill Your P 45 It Form

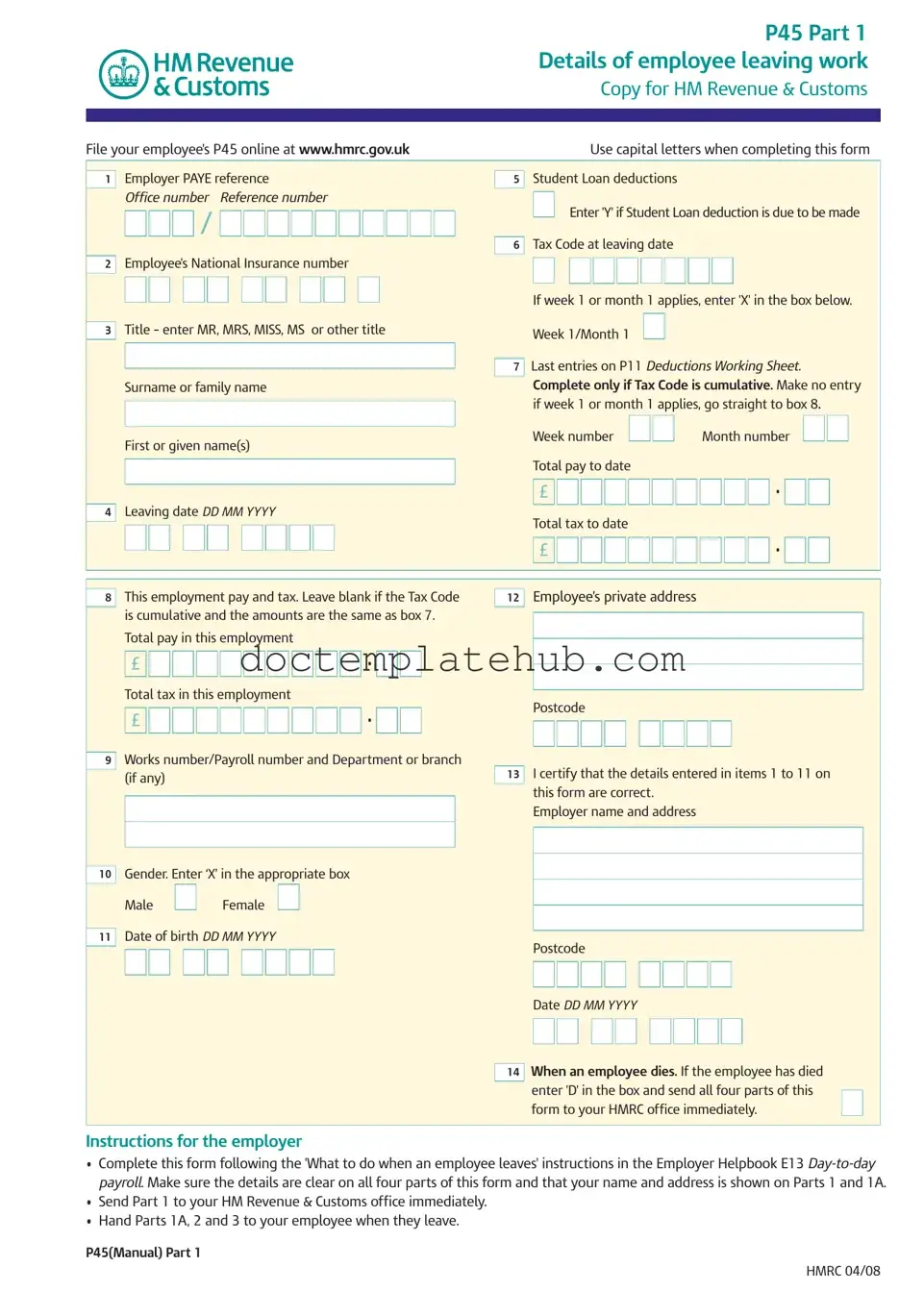

The P45 form is a crucial document in the employment lifecycle, serving as an official record when an employee leaves a job. It consists of three parts, each designated for different purposes: Part 1 is submitted to HM Revenue & Customs (HMRC), while Parts 1A, 2, and 3 are retained by the employee and their new employer. This form captures essential details such as the employee's National Insurance number, tax code, and total pay and tax deductions to date. When completing the P45, employers must ensure accuracy, as it contains vital information that affects the employee's tax obligations and entitlements. Additionally, the form includes specific sections for student loan deductions, if applicable, and instructions for the employee regarding the next steps after leaving the job. It is important for both employees and employers to understand the significance of the P45, as it not only facilitates a smooth transition to new employment but also ensures compliance with tax regulations.

Similar forms

The P45 form is a key document for employees leaving a job, but it shares similarities with several other important forms. One such form is the W-2. This document is issued by employers at the end of the tax year and summarizes an employee's earnings and tax withholdings. Like the P45, the W-2 serves as a record for tax purposes, helping employees report their income accurately when filing their tax returns. Both forms are essential for ensuring that individuals fulfill their tax obligations and receive any potential refunds.

Another closely related document is the P60. This form is provided to employees at the end of the tax year and outlines the total pay and deductions for the year. Similar to the P45, the P60 is crucial for tax reporting, but it covers the entire year rather than just the period of employment. Employees can use the P60 to confirm their tax status and ensure they have paid the correct amount of tax throughout the year.

The P50 form also has relevance when discussing the P45. This form is used to claim a tax refund when an individual stops working and has overpaid tax. While the P45 details the final pay and tax deductions from a specific job, the P50 focuses on the refund process for individuals who may not be employed. Both forms are part of the broader system that helps individuals manage their tax affairs efficiently.

Next, the P85 form comes into play, particularly for those leaving the UK to work abroad. Similar to the P45, the P85 helps the tax authorities track an individual's income and tax status when they leave the country. Both forms serve to inform HMRC about changes in employment status, ensuring that individuals are taxed correctly based on their circumstances.

A Michigan Hold Harmless Agreement is a legal document that transfers risk from one party to another, ensuring that the entity being protected is not held liable for certain damages or injuries. This form is essential in various transactions or activities that involve a level of risk, and for those seeking specific templates, resources such as smarttemplates.net can provide valuable assistance.

The Jobseeker's Allowance (JSA) claim form is another document that shares a purpose with the P45. When an employee leaves a job and applies for JSA, they may need to provide their P45 as proof of previous employment and earnings. This connection highlights how the P45 facilitates the transition from employment to seeking new opportunities, ensuring that individuals have access to support during periods of unemployment.

Additionally, the Self-Assessment Tax Return form is relevant when discussing the P45. If an employee has multiple sources of income or has left a job, they may need to complete a self-assessment to report their earnings accurately. The P45 provides essential information about the income and tax paid from the previous job, making it easier for individuals to fill out their tax returns correctly.

Lastly, the PAYE (Pay As You Earn) coding notice is similar in that it informs employees about their tax code and how much tax will be deducted from their pay. While the P45 provides a summary of what has happened during employment, the PAYE coding notice helps employees understand their ongoing tax obligations. Both documents play a vital role in the tax system, helping ensure that individuals are taxed fairly based on their earnings.

Other PDF Templates

Bdsm Checklist - Clarify roles before engaging.

The California Trailer Bill of Sale form serves as a legal document that records the sale and transfer of ownership of a trailer in California. This form is essential for both buyers and sellers, as it helps ensure a smooth transaction and provides proof of ownership. For more detailed information, you can visit documentonline.org/blank-california-trailer-bill-of-sale/, as understanding its components can simplify the buying or selling process significantly.

Rental Application Form Wa - You are encouraged to follow up on your application if you do not hear back within a reasonable timeframe.

More About P 45 It

What is a P45 form?

The P45 form is a document issued by an employer when an employee leaves their job. It provides important information about the employee's earnings and the taxes that have been deducted during their employment. The form is divided into three parts: Part 1 for HM Revenue & Customs (HMRC), Part 1A for the employee, and Parts 2 and 3 for the new employer.

Who receives a P45?

When an employee leaves a job, they receive Part 1A of the P45. The employer keeps Part 1 for HMRC and gives Parts 2 and 3 to the new employer. It’s essential for the employee to keep Part 1A safe, as they may need it for tax returns or when applying for benefits.

What information is included on a P45?

A P45 contains several key details, including the employee's name, National Insurance number, tax code, total pay to date, total tax deducted, and the leaving date. This information helps ensure that the employee is taxed correctly in their new job or when claiming benefits.

How should I complete a P45?

When filling out a P45, use capital letters for clarity. Ensure that all required fields are completed accurately, including the employee's PAYE reference, National Insurance number, and total pay and tax amounts. If the employee's tax code is cumulative, only complete specific sections as indicated on the form.

What should an employee do with their P45?

Employees should keep Part 1A of the P45 for their records. It may be needed for tax returns or when applying for benefits. Parts 2 and 3 should be given to the new employer to avoid emergency tax codes, which could lead to overtaxing.

What if I lose my P45?

If an employee loses their P45, they should contact their previous employer to request a replacement. If that's not possible, they can still provide their new employer with their earnings and tax information from their last payslip, but this may result in a temporary emergency tax code.

Can I claim tax back using my P45?

Yes, if you have overpaid tax while employed, you can claim a refund using your P45. This typically happens when your total earnings for the year are below the personal allowance threshold. To claim, you may need to fill out a form and provide your P45 to HMRC.

What happens if an employee dies?

If an employee dies, the employer must mark the P45 form with a 'D' and send all parts of the form to HMRC immediately. This ensures that the tax affairs of the deceased are handled correctly and any necessary arrangements are made.

How does a P45 affect new employment?

A new employer uses the information from Parts 2 and 3 of the P45 to set up the employee's tax code and ensure proper tax deductions. If the new employer does not receive these parts, the employee may be taxed at a higher emergency rate until the correct information is provided.

Dos and Don'ts

When filling out the P45 IT form, it is essential to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do use capital letters when completing the form to ensure clarity.

- Do double-check the employee's National Insurance number for correctness.

- Do enter the correct leaving date in the format DD MM YYYY.

- Do ensure that the tax code is accurately recorded, especially if it is cumulative.

- Do send Part 1 to HM Revenue & Customs immediately after completion.

- Don't leave any required fields blank unless specifically instructed to do so.

- Don't alter or modify any parts of the form once it has been filled out.

P 45 It - Usage Steps

Filling out the P45 form is a straightforward process, but it’s important to ensure that all details are accurate. This form is used when an employee leaves a job, and it provides essential information for tax purposes. Follow these steps carefully to complete the form correctly.

- Gather necessary information: Collect all relevant details such as the employee's National Insurance number, leaving date, and total pay to date.

- Complete Part 1: Fill in the employer's PAYE reference, office number, and reference number in the designated boxes.

- Enter employee details: Write the employee's title, surname, and first name(s). Include the leaving date in the format DD MM YYYY.

- Fill in the financial details: Record the total pay to date and total tax to date in the appropriate boxes.

- Indicate Student Loan deductions: If applicable, enter 'Y' in the box provided for Student Loan deductions.

- Specify the tax code: Enter the tax code at the time of leaving. If week 1 or month 1 applies, mark 'X' in the box.

- Complete the address section: Fill in the employee’s private address and postcode.

- Certify the information: Sign and date the form, confirming that the details are correct.

- Send the form: Immediately send Part 1 to HM Revenue & Customs and provide Parts 1A, 2, and 3 to the employee.

Once the form is filled out and submitted, the employee should keep their copy safe for future reference. They may need it for tax purposes or when starting a new job. It's essential to handle this process accurately to ensure smooth transitions for both the employer and employee.