Fill Your Payroll Check Form

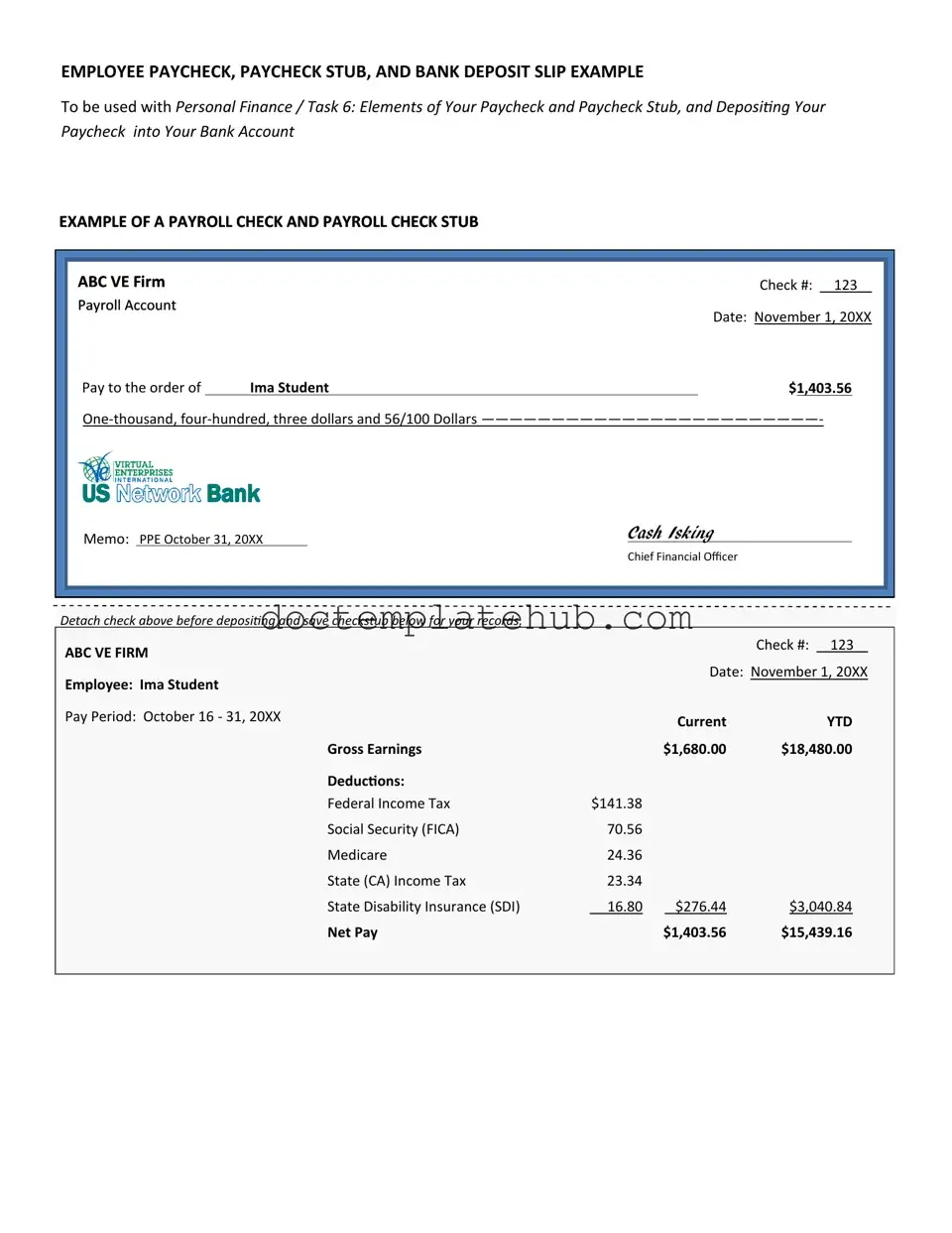

The Payroll Check form serves as a vital document in the payroll process, encapsulating essential information regarding employee compensation. It typically includes the employee's name, identification number, and the pay period for which the check is issued. Additionally, the form details the gross pay, deductions, and net pay, providing a clear breakdown of how the final amount was calculated. Employers often use this form to ensure compliance with labor laws and tax regulations, making it a crucial tool for both financial record-keeping and employee transparency. Furthermore, the Payroll Check form may also incorporate fields for employer information, check number, and payment date, facilitating accurate tracking and management of payroll transactions. Understanding the components and significance of this form can aid both employers and employees in navigating the complexities of payroll processing.

Similar forms

The Payroll Check form is similar to the Pay Stub, which provides employees with a detailed breakdown of their earnings for a specific pay period. Pay stubs typically include information such as gross pay, deductions, and net pay. This document serves as a record for employees to understand how their pay is calculated and what deductions have been made, helping them keep track of their finances and tax obligations.

Another document similar to the Payroll Check form is the Direct Deposit Authorization form. This form allows employees to authorize their employer to deposit their pay directly into their bank accounts. Like the Payroll Check form, it ensures that employees receive their earnings promptly and securely, eliminating the need for physical checks and the associated risks of loss or theft.

The W-2 form is also closely related to the Payroll Check form. This tax document summarizes an employee's annual wages and the taxes withheld from their paycheck. At the end of the year, employers provide W-2 forms to employees, which they use to file their income tax returns. Both forms are essential for understanding earnings and tax responsibilities, although the W-2 covers a longer period.

Similar to the Payroll Check form is the Time Sheet. This document records the hours worked by an employee during a specific pay period. Time Sheets help employers track attendance and hours worked, ensuring that employees are compensated accurately. Both documents are critical for payroll processing, as they rely on accurate timekeeping to determine earnings.

If you are handling the estate of a deceased person in New York, you may find the process easier with a reliable resource that outlines the necessary steps. For a comprehensive understanding of the Small Estate Affidavit, you can refer to this detailed guide on Small Estate Affidavit procedures. This document is crucial for ensuring that you comply with the legal requirements involved in settling an estate without the need for formal probate.

The Earnings Statement is another document that shares similarities with the Payroll Check form. This statement provides a summary of an employee's earnings over a specified period, often detailing different types of compensation, such as overtime and bonuses. Like the Payroll Check form, the Earnings Statement helps employees understand their total compensation and how it is calculated.

The Employee Compensation Agreement is also comparable to the Payroll Check form. This document outlines the terms of an employee's pay, including salary, bonuses, and any other compensation. It serves as a formal record of what an employee can expect to receive, much like the Payroll Check form reflects the actual payment made to the employee.

Lastly, the Tax Withholding Certificate, commonly known as Form W-4, is similar in that it affects the amount of money an employee receives on their Payroll Check. This form allows employees to indicate their tax withholding preferences, which directly influences their net pay. Understanding the relationship between the W-4 and the Payroll Check form is essential for employees to manage their take-home pay effectively.

Other PDF Templates

Free Printable Puppy Shot Record - This record includes vital information such as rabies and DHPP vaccination details.

California Short Term Disability - The DE 2501 ensures that claimants can provide necessary medical evidence with their application.

The process of filling out the USCIS I-589 form can be daunting, but resources are available to assist applicants in navigating their journey toward asylum in the United States. For those looking for guidance on completing this essential document, visiting smarttemplates.net can provide useful templates and information to facilitate the application process and enhance the chances of a successful outcome.

How to Apply for a Us Passport - Be aware of differing fees for adults and minors listed on the form.

More About Payroll Check

What is the Payroll Check form?

The Payroll Check form is a document used by employers to issue payments to their employees for work performed. This form typically includes details such as the employee's name, the amount being paid, the pay period, and any deductions that may apply. It serves as a formal record of the transaction and ensures that both the employer and employee have a clear understanding of the payment being made.

How do I fill out the Payroll Check form correctly?

To fill out the Payroll Check form, start by entering the employee's name clearly at the top. Next, specify the payment amount and ensure that it matches the agreed-upon salary or wage. Indicate the pay period for which the payment is being made, and include any necessary deductions, such as taxes or benefits. Double-check all entries for accuracy before finalizing the form to avoid any payment discrepancies.

What should I do if I notice an error on the Payroll Check form?

If you find an error on the Payroll Check form, it’s important to correct it immediately. Depending on the nature of the mistake, you may need to void the original check and issue a new one. Make sure to document the error and the correction for your records. Keeping clear records helps maintain transparency and can prevent future issues.

Are there any legal requirements for using the Payroll Check form?

Dos and Don'ts

When filling out the Payroll Check form, it is important to adhere to certain guidelines to ensure accuracy and compliance. Here is a list of things to do and avoid:

- Do: Verify all personal information, including name, address, and Social Security number, for accuracy.

- Do: Double-check the pay period dates to ensure the correct timeframe is covered.

- Do: Ensure that the payment amount is calculated correctly, taking into account hours worked and any deductions.

- Do: Sign the form where required to authorize the payment.

- Don't: Leave any fields blank; all required information must be completed.

- Don't: Use incorrect or outdated forms, as this may lead to processing delays.

- Don't: Forget to keep a copy of the completed form for your records.

- Don't: Submit the form without reviewing it for errors or inconsistencies.

Payroll Check - Usage Steps

Once you have the Payroll Check form in front of you, it’s time to fill it out accurately. This ensures that employees receive their payments without any issues. Follow these steps carefully to complete the form correctly.

- Start by entering the employee’s name in the designated field.

- Next, fill in the employee ID number to identify the individual.

- Provide the pay period dates to specify the time frame for the payment.

- Enter the gross pay amount that the employee has earned during the pay period.

- Deduct any withholdings and enter the total amount in the appropriate section.

- Calculate the net pay and write it down in the designated area.

- Finally, sign the form in the signature section to authorize the payment.