Official Personal Guarantee Form

When entering into a business agreement, understanding the Personal Guarantee form is essential for both parties involved. This form is a commitment made by an individual to take personal responsibility for the debts or obligations of a business. By signing this document, the guarantor agrees to pay back any debts if the business fails to do so. This can provide lenders with added security and may help businesses secure financing more easily. It's important to note that a Personal Guarantee can be unconditional or limited, depending on the terms outlined in the agreement. Additionally, the form typically includes details about the obligations being guaranteed, the duration of the guarantee, and any specific conditions that may apply. Understanding these aspects can help individuals make informed decisions and protect their personal assets while supporting their business endeavors.

Similar forms

A Personal Guarantee form is often compared to a Co-Signer Agreement. Both documents involve a third party agreeing to take on financial responsibility if the primary borrower defaults. In a Co-Signer Agreement, the co-signer's credit is also at stake, which can impact their financial standing. This mutual risk encourages the primary borrower to fulfill their obligations, knowing that someone else is equally invested in the repayment process.

Another document similar to a Personal Guarantee is a Lease Guaranty. This is commonly used in rental agreements, where a guarantor agrees to cover rent payments if the tenant fails to do so. Just like a Personal Guarantee, a Lease Guaranty provides landlords with an added layer of security, ensuring that they will receive their payments even if the tenant encounters financial difficulties.

A Loan Guarantee is also akin to a Personal Guarantee. In this scenario, a third party assures the lender that they will repay the loan if the borrower defaults. This document is often used in business financing, where lenders seek additional assurance before extending credit. Both forms are designed to mitigate risk for lenders and encourage responsible borrowing.

Next, we have a Surety Bond, which shares similarities with a Personal Guarantee. A surety bond involves a third party (the surety) who guarantees the performance of a contract or payment of a debt. In both cases, the third party assumes responsibility if the primary party fails to meet their obligations, providing reassurance to the other party involved.

A Corporate Guarantee can also be likened to a Personal Guarantee. In this case, a corporation agrees to back the debts of a subsidiary or another entity. This document serves to bolster the financial credibility of the borrowing entity, similar to how a Personal Guarantee supports an individual’s loan application by leveraging the guarantor's financial strength.

The Indemnity Agreement is another document that bears resemblance to a Personal Guarantee. In an Indemnity Agreement, one party agrees to compensate another for any losses incurred. While the primary purpose differs slightly, both documents involve one party stepping in to assume responsibility for another's obligations, providing a safety net in case of default.

For those looking to understand the formalities involved in real estate transactions, the key aspects of the Real Estate Purchase Agreement form are critical to grasp. This document plays a vital role in setting out the parameters agreed upon by both buyer and seller, ensuring clarity and mutual understanding throughout the sale process.

A Security Agreement can also be compared to a Personal Guarantee. In a Security Agreement, collateral is pledged to secure a loan. While the Personal Guarantee relies on the guarantor's promise to pay, a Security Agreement provides tangible assets that the lender can claim if the borrower defaults. Both serve to protect the lender's interests but through different mechanisms.

Another related document is a Credit Enhancement Agreement. This type of agreement involves a party improving the creditworthiness of a borrower by providing additional assurances. Like a Personal Guarantee, it aims to increase the likelihood of loan approval and favorable terms, benefiting both the lender and the borrower.

Lastly, the Affidavit of Support is similar in spirit to a Personal Guarantee. Typically used in immigration contexts, this document involves an individual promising to financially support another person. While the stakes and contexts differ, both documents reflect a commitment to assume financial responsibility, ensuring that obligations are met for the benefit of all parties involved.

Fill out Common Types of Personal Guarantee Templates

Real Estate Agent Termination Letter - Useful in instances where financing fails or other contingencies arise.

Purchase Agreement Addendum - Allows for the adjustment of contingencies related to inspections or appraisals.

The New York Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions under which a piece of real estate will be sold and purchased. It details everything from the price to the responsibilities of both the buyer and the seller. Understanding this form is essential for anyone looking to navigate the complexities of buying or selling property in New York. For more information, you can refer to the NY PDF Forms that provide templates and resources to assist you.

Private Mortgage Contract - The contract should be clear about any potential additional fees or costs.

More About Personal Guarantee

What is a Personal Guarantee form?

A Personal Guarantee form is a legal document where an individual agrees to be personally responsible for the debts or obligations of a business. This means that if the business fails to pay its debts, the individual’s personal assets could be at risk. It’s commonly used by lenders to ensure they have a way to recover funds if the business defaults.

Who typically needs to sign a Personal Guarantee?

Usually, owners or key stakeholders of a business are asked to sign a Personal Guarantee. This often includes sole proprietors, partners, or anyone who has significant control over the business's finances. Lenders want assurance that someone with a vested interest in the business will back the obligations personally.

What are the risks of signing a Personal Guarantee?

By signing a Personal Guarantee, you put your personal assets on the line. If the business cannot meet its financial obligations, creditors can pursue your personal assets, like your home or savings. It’s crucial to understand the extent of your liability before signing this document.

Can a Personal Guarantee be revoked?

Generally, a Personal Guarantee cannot be revoked unilaterally. Once signed, it remains in effect until the obligation is fulfilled or the lender agrees to release you from it. If you want to be released, you’ll need to negotiate with the lender, which may involve meeting specific conditions.

How does a Personal Guarantee affect my credit?

If you sign a Personal Guarantee, it can impact your personal credit score. If the business defaults on its obligations, it could lead to collections or legal action against you. This can result in negative marks on your credit report, affecting your ability to secure loans or credit in the future.

What should I consider before signing a Personal Guarantee?

Before signing, evaluate your financial situation and the business's financial health. Consider how much risk you are willing to take. It’s also wise to consult with a financial advisor or legal professional to fully understand the implications and ensure you’re making an informed decision.

Dos and Don'ts

When filling out a Personal Guarantee form, attention to detail is crucial. Here’s a list of things to do and avoid:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check your personal information for typos.

- Do sign and date the form where required.

- Don't rush through the form; take your time.

- Don't leave any sections blank unless instructed.

- Don't forget to keep a copy for your records.

Following these guidelines will help ensure your Personal Guarantee form is filled out correctly and efficiently.

Personal Guarantee - Usage Steps

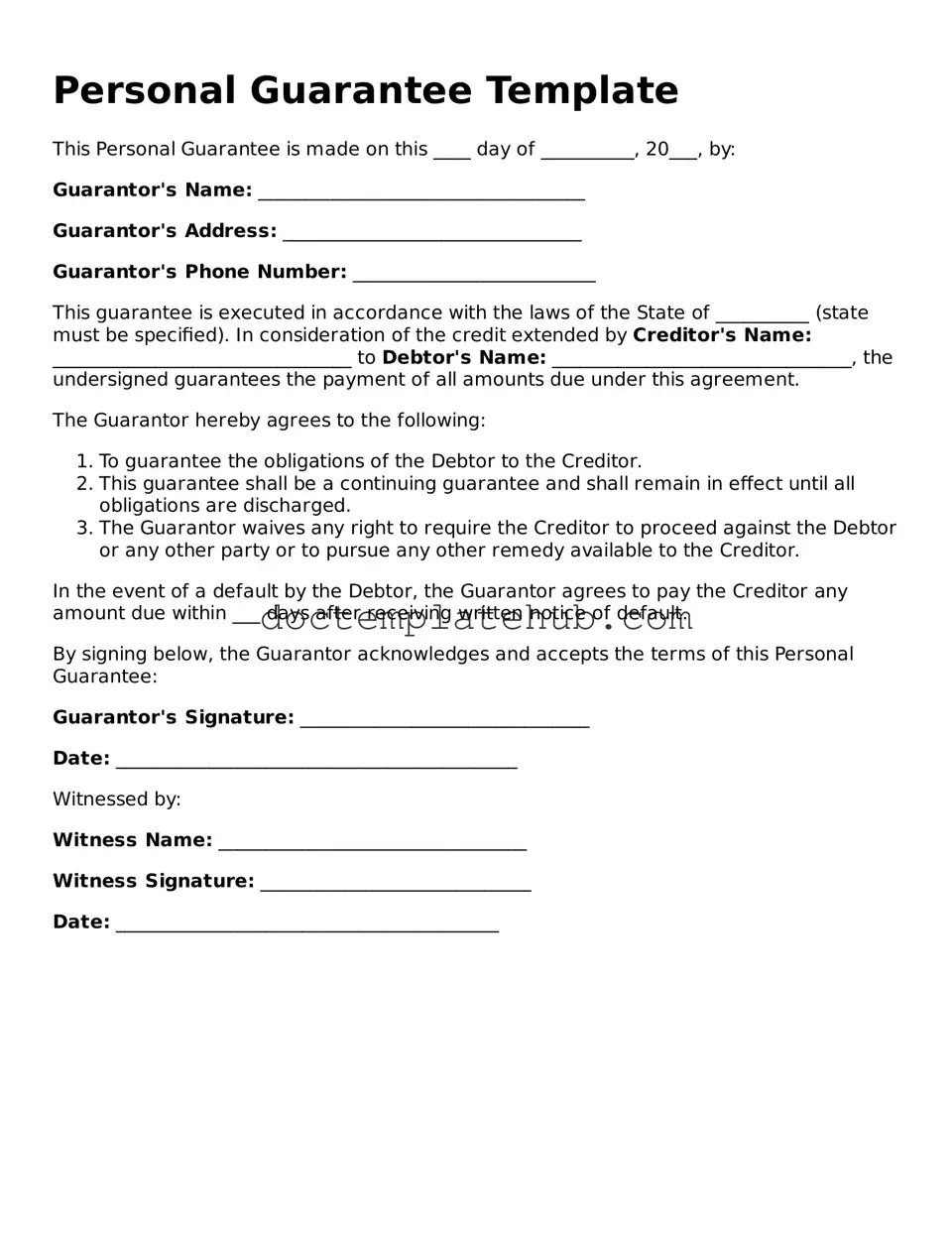

Completing the Personal Guarantee form is an important step in securing your commitment. After filling out this form, it will need to be submitted to the relevant party for review. Ensure all information is accurate and complete to avoid delays.

- Begin by entering your full legal name in the designated field.

- Provide your current residential address. Ensure it is up to date.

- Fill in your contact number, including area code.

- Enter your email address for any necessary correspondence.

- List the name of the business or entity you are guaranteeing.

- Specify the nature of your relationship to the business. This could include your role or position.

- Indicate the amount you are guaranteeing. Be precise with the figures.

- Sign and date the form at the bottom. Ensure your signature matches your legal name.

Once completed, review the form for any errors or omissions. It’s crucial to ensure everything is accurate before submission.