Official Prenuptial Agreement Form

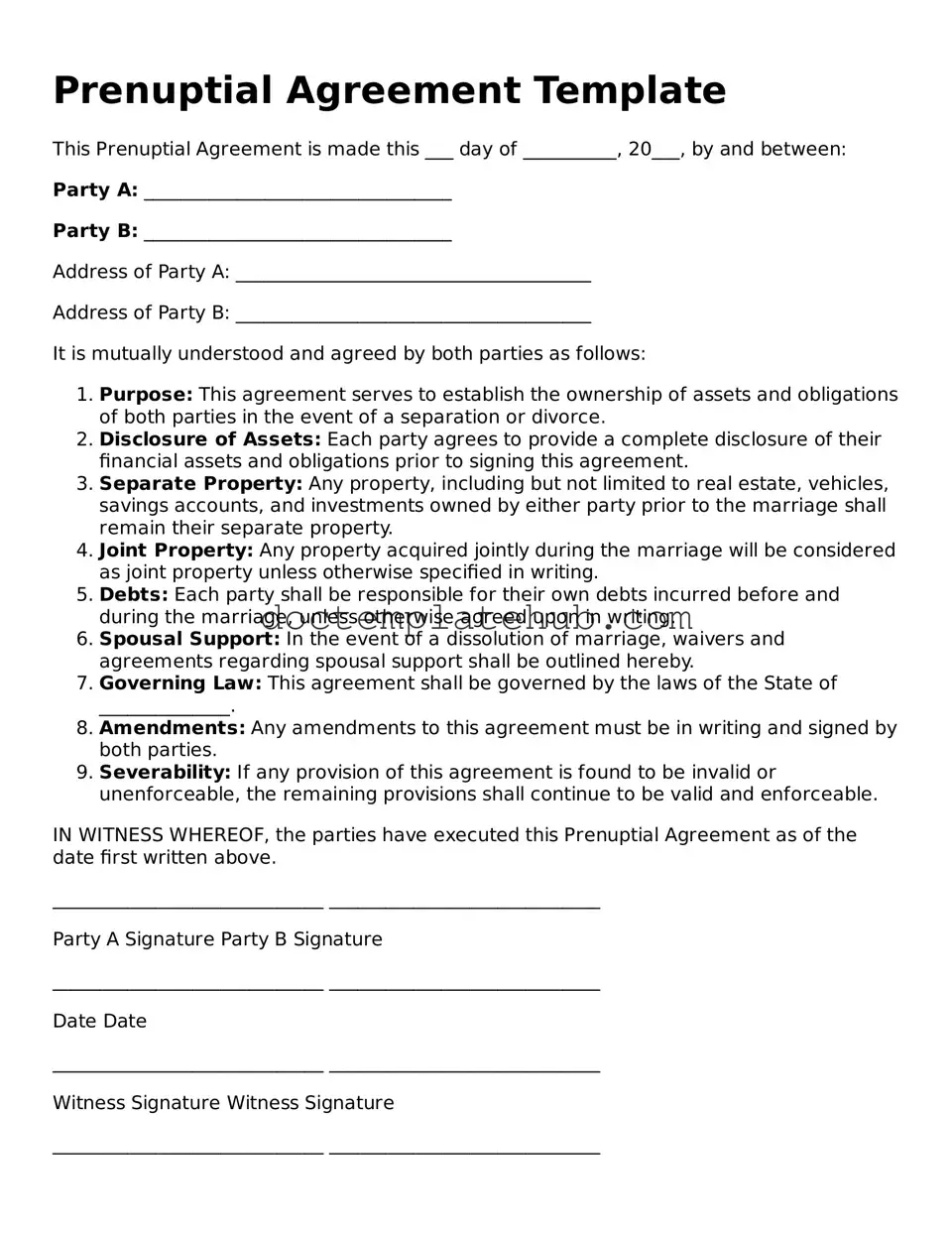

A prenuptial agreement is a crucial tool for couples planning to marry, as it lays the groundwork for financial clarity and protection. This legally binding document outlines the distribution of assets and liabilities in the event of a divorce or separation. It can address various aspects, including property ownership, debt responsibilities, and spousal support. By discussing these topics before marriage, couples can reduce potential conflicts later on. The form typically requires both parties to disclose their financial situations, ensuring transparency and fairness. Additionally, it must be signed voluntarily by both individuals, often with independent legal counsel, to ensure that each party understands their rights and obligations. A well-crafted prenuptial agreement not only safeguards individual interests but also fosters open communication about finances, helping to build a strong foundation for the marriage.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it outlines the financial and personal responsibilities of two individuals living together. This document is often used by couples who choose to cohabitate without marrying. Like a prenuptial agreement, it can address property division, debt responsibility, and other important matters should the relationship end. Both documents aim to protect the interests of each party and provide clarity regarding their rights and obligations.

A Postnuptial Agreement serves a similar purpose to a prenuptial agreement, but it is executed after the couple is married. This document can address the same issues as a prenuptial agreement, such as asset division and financial responsibilities. Couples might choose a postnuptial agreement to reflect changes in their financial situation or to clarify their intentions after marriage. Both agreements require mutual consent and understanding to be enforceable.

A Separation Agreement is another document akin to a prenuptial agreement. It is created when a couple decides to live apart but remains legally married. This document outlines the terms of their separation, including child custody, support, and property division. While a prenuptial agreement is established before marriage, a separation agreement is often the result of a decision to part ways, serving to protect the interests of both parties during the separation process.

An Estate Plan can also be compared to a prenuptial agreement, as both documents deal with the distribution of assets. An estate plan includes wills, trusts, and other directives that dictate how a person's assets will be managed and distributed after their death. Like a prenuptial agreement, an estate plan can help prevent disputes among heirs and ensure that an individual's wishes are honored. Both documents require careful consideration of assets and intentions.

A Will, specifically, is similar to a prenuptial agreement in that it addresses the distribution of assets upon death. A will specifies who will inherit property and possessions, much like a prenuptial agreement outlines asset division during a divorce. Both documents provide a framework for managing assets and can help avoid conflicts among surviving family members. They require clear communication of intentions to be effective.

A Trust Agreement shares similarities with a prenuptial agreement in terms of asset management. A trust allows a person to place their assets in a legal entity for the benefit of specific individuals. This can protect assets from creditors and ensure they are distributed according to the grantor's wishes. Like a prenuptial agreement, a trust agreement requires careful planning and consideration of how assets will be handled over time.

A Business Partnership Agreement is akin to a prenuptial agreement when couples own a business together. This document outlines the roles, responsibilities, and profit-sharing arrangements between partners. It can also address what happens to the business in the event of a partner's departure or death. Just as a prenuptial agreement clarifies financial matters in a marriage, a partnership agreement does the same in a business context.

The importance of legal agreements extends beyond personal relationships to various fields, including business transactions and health care considerations, where protective measures are crucial. A well-crafted agreement can safeguard parties against unforeseen liabilities, echoing the principles found in documents such as a Hold Harmless Agreement form, which can effectively mitigate risks involved in certain activities. For those looking for specific templates or guidance on such agreements, resources like smarttemplates.net can provide valuable assistance.

An Investment Agreement can also be compared to a prenuptial agreement. This document outlines the terms under which individuals invest together, detailing contributions, profit-sharing, and exit strategies. Both agreements aim to protect the interests of each party involved, ensuring that all parties understand their rights and obligations. Clear communication and mutual agreement are essential in both cases to avoid future disputes.

Common Forms

California Immunization Record Form - Decision-making about a child’s health can be guided by this thorough immunization history.

For those seeking clarity in the transaction process, the use of a "state-specific boat bill of sale" form is crucial, as it helps ensure proper documentation of ownership transfer for boats. You can find a suitable template at https://vesselbillofsale.com/boat-bill-of-sale-form/.

Different Types of Background Checks - Information collected here will not affect your employment decision.

More About Prenuptial Agreement

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a "prenup," is a legal contract entered into by two individuals prior to marriage. This document outlines the distribution of assets and responsibilities in the event of divorce or separation. It can address various issues, including property division, debt allocation, and spousal support. The primary purpose of a prenup is to protect individual assets and clarify financial expectations, fostering transparency between partners before they commit to marriage.

Who should consider a prenuptial agreement?

Individuals in various circumstances may benefit from a prenuptial agreement. Those with significant assets, such as real estate, investments, or businesses, often find a prenup particularly useful. Additionally, individuals entering a second marriage, those with children from previous relationships, or partners with substantial income disparities may wish to establish clear financial guidelines. Ultimately, anyone who seeks to safeguard their financial interests and promote open communication about finances may consider a prenup.

What should be included in a prenuptial agreement?

A comprehensive prenuptial agreement typically includes several key components. First, it should outline the assets and debts of each party, detailing what will be considered separate or marital property. Second, it may specify how property will be divided in the event of divorce, including any spousal support or alimony provisions. Additionally, the agreement can address financial responsibilities during the marriage, such as joint accounts or expenses. Importantly, both parties should fully disclose their financial situations to ensure fairness and transparency.

Can a prenuptial agreement be modified after marriage?

Yes, a prenuptial agreement can be modified after marriage, but this typically requires both parties to agree to the changes. To ensure enforceability, it is advisable to document any modifications in writing and have them signed by both spouses. Additionally, some couples may choose to create a postnuptial agreement, which serves a similar purpose as a prenup but is established after the marriage has taken place. It is important to consult legal professionals when making any changes to ensure that the agreement remains valid and enforceable.

Is a prenuptial agreement legally binding?

A prenuptial agreement can be legally binding if it meets certain criteria. For the agreement to be enforceable, it must be in writing and signed by both parties. Additionally, both individuals should enter into the agreement voluntarily and without coercion. Full financial disclosure is essential, as is the opportunity for both parties to seek independent legal advice. If these conditions are met, a prenup is generally upheld in court, although specific enforceability can vary by state. Legal advice is recommended to navigate these complexities effectively.

Dos and Don'ts

When filling out a Prenuptial Agreement form, it's important to approach the process thoughtfully. Here are some things to keep in mind:

- Do communicate openly with your partner about your intentions and expectations.

- Do consult with a qualified attorney to ensure that the agreement is legally sound.

- Do be honest about your financial situation, including assets and debts.

- Do consider including provisions for future changes, such as children or changes in income.

- Don't rush the process. Take your time to understand the implications of the agreement.

- Don't hide any assets or debts from your partner. Full disclosure is essential.

- Don't use the agreement as a way to control or manipulate your partner.

Following these guidelines can help ensure that your Prenuptial Agreement is fair and effective for both parties.

Prenuptial Agreement - Usage Steps

Filling out a Prenuptial Agreement form is an important step for couples looking to clarify their financial rights and responsibilities before marriage. This document can help ensure that both parties are on the same page regarding their assets and any potential future financial matters. Below are the steps to guide you through the process of completing this form.

- Gather Necessary Information: Collect details about your assets, liabilities, income, and any other financial information relevant to the agreement.

- Identify Both Parties: Clearly state the full names and addresses of both individuals entering the agreement.

- Outline Separate and Joint Property: Specify which assets each person will retain as separate property and which will be considered joint property.

- Discuss Financial Responsibilities: Include any agreements about how expenses will be managed during the marriage, such as bills, debts, and savings.

- Consider Future Changes: Address how the agreement may be modified in the future, should circumstances change, such as the birth of children or changes in income.

- Include Signatures: Ensure both parties sign the document in the presence of a notary public to validate the agreement.

- Make Copies: After signing, make copies of the completed agreement for both parties to keep for their records.