Fill Your Profit And Loss Form

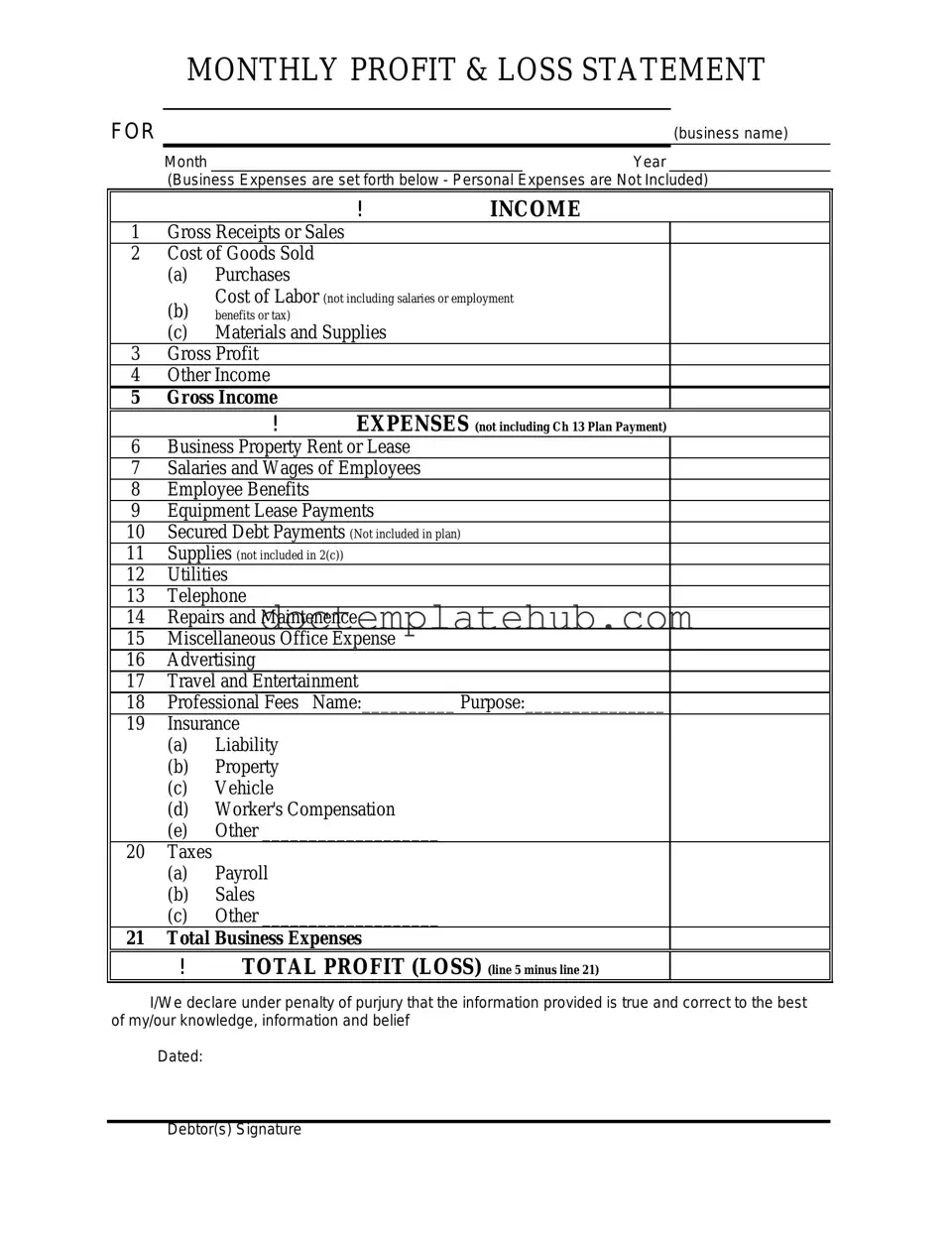

The Profit and Loss form, often referred to as the income statement, serves as a crucial financial document for businesses of all sizes. It provides a clear snapshot of a company's revenues, costs, and expenses over a specific period, typically a month, quarter, or year. This form allows business owners and stakeholders to assess the company’s profitability and operational efficiency. Key components include total revenue, which reflects all income generated from sales, and various expenses, which can be categorized into operating and non-operating costs. By subtracting total expenses from total revenue, the form reveals the net profit or loss, offering insights into financial health. Understanding this form is essential for making informed decisions about budgeting, forecasting, and overall business strategy.

Similar forms

The Profit and Loss (P&L) statement, also known as the income statement, is a crucial financial document that outlines a company's revenues, costs, and expenses over a specific period. One document similar to the P&L is the balance sheet. While the P&L focuses on a company's performance over time, the balance sheet provides a snapshot of its financial position at a single point in time. Both documents are essential for understanding a business's overall financial health but serve different purposes in financial analysis.

The cash flow statement is another document that parallels the P&L. This statement details the cash inflows and outflows of a business during a specific period. While the P&L shows profitability, the cash flow statement reveals how cash is generated and used, highlighting the liquidity of the business. Together, they provide a comprehensive view of a company’s financial operations.

The statement of retained earnings is also similar to the P&L. This document outlines changes in equity from profits or losses retained in the business rather than distributed as dividends. The P&L feeds into the statement of retained earnings by providing the net income figure, which is crucial for determining how much profit is retained in the business over time.

The budget variance report shares similarities with the P&L as well. This report compares actual financial performance against budgeted figures. Like the P&L, it highlights income and expenses but focuses on deviations from planned performance. This comparison helps management identify areas of concern and adjust future budgets accordingly.

The sales report is also akin to the P&L, as it details revenue generated from sales over a specific period. This report focuses on sales performance and can be broken down by product or service line. While the P&L encompasses all revenues and expenses, the sales report provides a more granular view of income sources, which can be crucial for strategic decision-making.

The expense report is another document that mirrors the P&L. It itemizes all expenses incurred during a specific period, offering detailed insights into where money is being spent. This report can help management identify cost-saving opportunities and improve budgeting practices. The information from the expense report feeds into the P&L, contributing to the overall understanding of profitability.

The financial forecast is similar to the P&L in that it estimates future revenues and expenses based on historical data. This document helps businesses plan for the future and set financial goals. While the P&L reflects past performance, the financial forecast aims to predict future outcomes, making both documents essential for strategic planning.

Finally, the annual report often includes a P&L statement as part of its comprehensive overview of a company's financial performance. This document is designed for stakeholders and includes not only financial statements but also management commentary and analysis. The P&L provides a clear picture of profitability within the broader context of the annual report, helping investors and other stakeholders assess the company's overall performance.

Other PDF Templates

What Does Esa Letter Look Like - This document helps bridge the gap between mental health conditions and housing rights.

Letter of No Trespass - This document formally communicates a restriction on property entry.

CBP Declaration Form 6059B - Using the CBP 6059B form properly contributes to a smooth entry process into the U.S.

More About Profit And Loss

What is a Profit and Loss form?

A Profit and Loss form, often referred to as an income statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. This form provides a clear picture of a business's profitability, indicating whether it has made a profit or incurred a loss over that time frame.

Why is the Profit and Loss form important?

The Profit and Loss form is crucial for several reasons. It helps business owners understand their financial health, assess operational efficiency, and make informed decisions regarding budgeting and forecasting. Additionally, this form is essential for investors and stakeholders, as it provides insight into the company's performance and potential for growth.

What information is included in a Profit and Loss form?

A typical Profit and Loss form includes various sections: revenues or sales, cost of goods sold (COGS), gross profit, operating expenses, and net profit or loss. Each section provides a detailed breakdown of income and expenditures, allowing for a comprehensive analysis of financial performance.

How often should a Profit and Loss form be prepared?

Frequency of preparation can vary based on the needs of the business. Many companies prepare Profit and Loss forms monthly, quarterly, or annually. Regularly updating this form allows for timely insights into financial trends and aids in effective decision-making.

What is the difference between gross profit and net profit?

Gross profit refers to the revenue remaining after deducting the cost of goods sold. It indicates how efficiently a company produces and sells its products. In contrast, net profit is the amount left after all expenses, including operating costs, taxes, and interest, have been subtracted from total revenue. Net profit provides a more comprehensive view of a company's overall profitability.

Can a Profit and Loss form show a loss?

Yes, a Profit and Loss form can indeed show a loss. If total expenses exceed total revenues during the reporting period, the result will be a net loss. This situation can occur for various reasons, including increased costs, decreased sales, or unexpected expenses, and it is essential for business owners to analyze the underlying causes.

How can a business improve its Profit and Loss results?

Improving Profit and Loss results can involve several strategies. Businesses may focus on increasing sales through marketing efforts, reducing costs by optimizing operations, or enhancing pricing strategies. Regularly reviewing the Profit and Loss form can help identify areas for improvement and track progress over time.

Is the Profit and Loss form the same as a balance sheet?

No, the Profit and Loss form is not the same as a balance sheet. While the Profit and Loss form focuses on income and expenses over a specific period, the balance sheet provides a snapshot of a company's financial position at a single point in time. The balance sheet includes assets, liabilities, and equity, offering a different perspective on financial health.

Who uses the Profit and Loss form?

The Profit and Loss form is utilized by a variety of stakeholders. Business owners and managers rely on it for internal decision-making. Investors and creditors examine it to assess the company's financial viability. Additionally, accountants and financial analysts use this form to prepare tax returns and financial forecasts.

Dos and Don'ts

When filling out a Profit and Loss form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do ensure all income sources are accurately reported.

- Do categorize expenses correctly to reflect true business costs.

- Do double-check calculations for accuracy.

- Do keep supporting documents for all reported figures.

- Don't omit any income, even if it seems minor.

- Don't mix personal expenses with business expenses.

- Don't ignore deadlines for submission to avoid penalties.

By following these guidelines, you can ensure that your Profit and Loss form is completed accurately and efficiently.

Profit And Loss - Usage Steps

Filling out the Profit and Loss form is a straightforward process that requires careful attention to detail. Once completed, this form provides a snapshot of your financial performance over a specific period. Here are the steps to guide you through filling out the form.

- Gather your financial records for the period you are reporting on. This includes income statements, receipts, and any other relevant documents.

- Begin with the section for income. List all sources of revenue, including sales, services, and any other income streams.

- Next, move to the expenses section. Document all business-related expenses, such as rent, utilities, salaries, and supplies.

- Calculate your total income by adding all revenue sources together.

- Calculate your total expenses by summing up all the costs listed.

- Subtract the total expenses from the total income. This will give you your net profit or loss for the period.

- Review all entries for accuracy. Ensure that all figures are correct and that you have included all necessary information.

- Once everything is verified, sign and date the form at the bottom.

After completing these steps, your Profit and Loss form will be ready for submission. Make sure to keep a copy for your records, as it can be useful for future financial planning and tax purposes.